DeFi Future after the USDC de-anchoring event, "on-chain finance" or complete decentralization?

原文标题:《 USDC 脱锚事件后的 DeFi 未来,「链上金融」or 完全去中心化? 》

Original article by Igans, substack

Frank, Foresight News

The unanchoring of USDC has raised significant concerns and questions in the market about the future development of DeFi. Since the DeFi ecosystem relies heavily on USDC, it is critical to assess potential solutions for the future.

I think we have two paths open to the DeFi community: redefining DeFi as "on-chain finance" or embracing decentralization in its entirety.

I. Rename DeFi "on-chain Finance"

DeFi relies on centralized components like stablecoins, prognostics, and Web2 infrastructure, making it vulnerable to potential government crackdowns.

The USDC itself was considered the safest collateral, so much so that Compound v2 locked the value of the USDC directly at $1.

Now we realize that trust in the USDC ultimately depends on trust in the traditional financial banking system and the government. If the government really wanted to shut down (most of) DeFi, they could.

Currently, DeFi is meant to be decentralized and trusted at every level, so even a centralized component can affect the security of the entire protocol.

So by renaming DeFi "on-chain finance," the industry can recognize centralization while maintaining key advantages such as self-regulation, increased liquidity, composability, and a single source of data (irreversible transactions).

The benefits of "on-chain finance" will become increasingly clear:

Increased liquidity (widening buyer's market);

Enhanced composability (new financial products);

Single data source (reduces reconciliation costs);

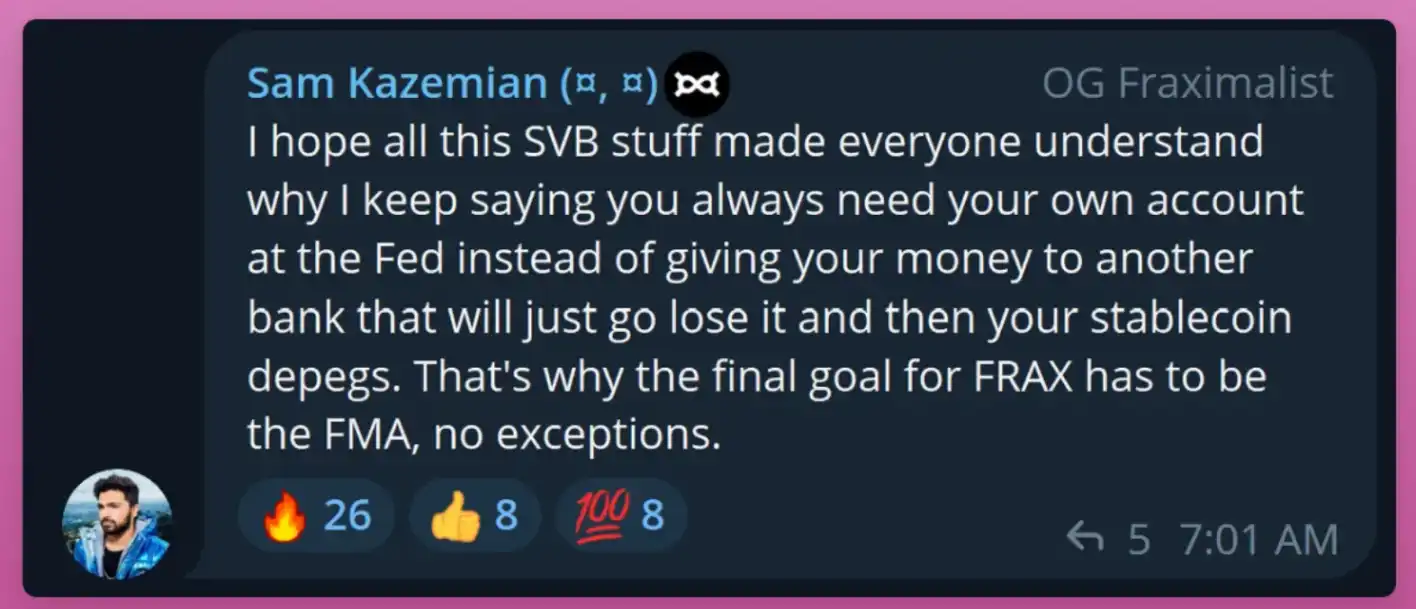

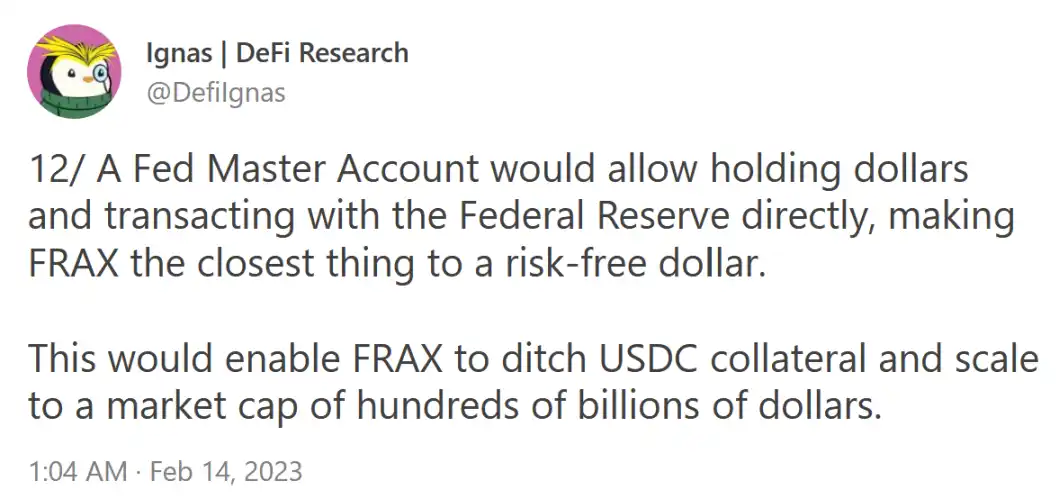

Examples like FRAX show that projects can move in the direction of "on-chain finance" without fully embracing decentralization:

Frax Finance's goal is to get as close to the Federal Reserve as possible by applying for a Federal Reserve Master account (which, Foresight News notes, allows US dollars to be held and traded directly with the Fed), thereby freeing itself from the limitations of using USdcs as collateral and the risk of bank failure. And expanded its market value to hundreds of billions of dollars, making FRAX the closest thing to a risk-free dollar.

This means that even with some centralized components, projects such as FRAX can still benefit from DeFi infrastructure.

This is because DeFi ecosystems can maximize trust-free environments and thus minimize the need for human intervention.

Take Uniswap for example: Its code is designed to be immutable, which allows assets like FRAX to be traded on the chain without any scrutiny.

However, it is important to note that Uniswap's user interface is still centralized and therefore susceptible to regulatory pressures.

This highlights that. DeFi projects must strike a delicate balance between providing the benefits of decentralisation and dealing with the complexity of regulatory compliance.

As a result, all elements and protocols of DeFi may never be fully decentralized or censor-resistant, so treating tokens like USDC as risk assets and DeFi as "on-chain finance" can help resolve this confusion and ethical dilemma.

Second, embrace complete decentralization

The second option is for the DeFi community to remove the centralized elements and become decentralized like Bitcoin.

This would involve replacing USdcs with censor-resistant collateral such as Bitcoin or Ethereum, and projects such as Liquity's LUSD, Maker's DAI and Tornado Cash are typical examples of efforts in this direction.

LUSD on Liquity

Liquity's LUSD is a typical project taking a more decentralized approach.

During the USDC debacle, LUSD demonstrated its value as a safe-haven asset, providing stability amid market turmoil, much like the Swiss franc in the current traditional financial system.

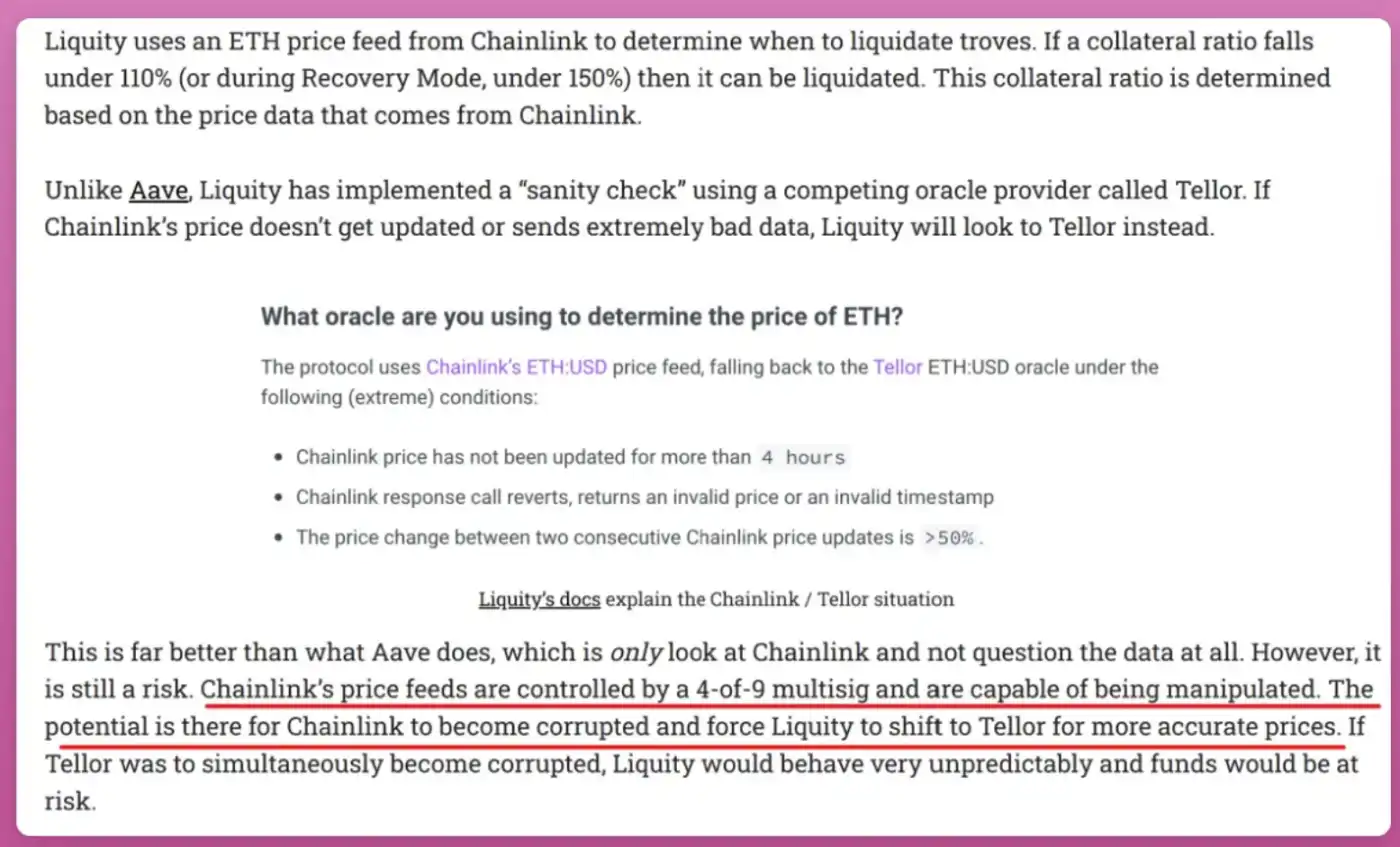

However, it is important to recognize that even LUSD, with its decentralized nature, relies on price prognosticators, which can be manipulated in extreme circumstances

This highlights the ongoing challenge and complexity of the DeFi project in pursuing full decentralization while ensuring security and reliability for its users.

Maker's DAI

MakerDAO's vision for DAI is to build it as a fully decentralized and just global currency.

To achieve this, Maker intends to phase out the use of seizable collateral such as the USDC in order to ensure greater flexibility and a more secure footing for the currency, which would require it to abandon its anchoring dollar exchange rate regime if necessary.

Recent alarm bells have been ringing in the DeFi ecosystem due to its heavy reliance on USDC, prompting MakerDAO to accelerate this mission.

Tornado Cash

Tornado Cash proves that full decentralization is possible, albeit at a high cost.

Tornado Cash has been a successful privacy tool for obfuscating transaction data between sender and receiver, and has reached a total lock-in value (TVL) of $247 million.

Unfortunately, this level of decentralization was costly for the project's developer, who eventually faced jail for alleged money laundering.

The high cost of decentralization

The case of Tornado Cash raises key questions for the DeFi ecosystem:

Are founders willing to take the risks associated with complete decentralization?

Will users want to interact with a fully decentralized application if it puts their wallet at risk of being blacklisted?

While not every DeFi DApp will be considered a threat by regulators, the possibility of regulatory intervention remains a permanent problem for the industry. In fact, the recent stablecoin crackdown is pushing DeFi toward decentralization.

As the DeFi field continues to grow, striking a balance between decentralization and compliance is critical for the long-term success and sustainability of these programs.

"D" in DAO

Imagine, for example, if the US government asked for DAI to be blacklisted.

How will Decentralized Autonomous Organizations (DAOs), such as Curve, which allows the creation of permissive liquidity pools, respond to this requirement, Aave?

Faced with this dilemma, will the Curve DAO choose to block DAI at the smart contract level or risk being blacklisted itself?

Finding a balance in the DeFi space of full decentralization is not easy, and projects must carefully balance their commitment to decentralization with the need to address potential regulatory challenges and maintain sustainable ecosystems.

DeFi's two-way future

In fact, there is a third option for the entire DeFi ecosystem.

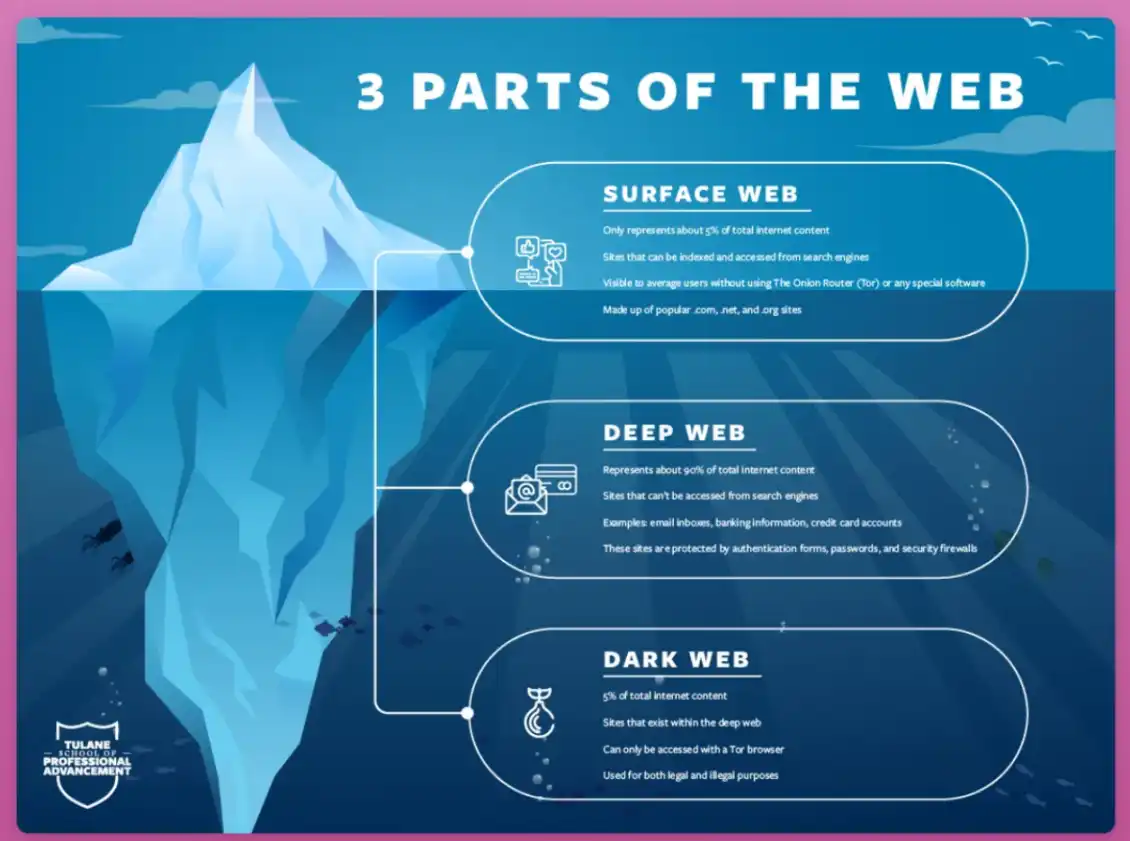

DeFi is likely to move in two directions at once, as the Internet does now: While most users access the Internet through regulated services, privacy-seeking individuals can use the dark web to enhance anonymity.

DeFi protocols may have varying degrees of decentralization and regulatory compliance.

例如,Uniswap 接口可能会被审查,阻止对特定 Token 的访问,但是社区可以创建自己的用户界面,因为代码是不可变和非歧视性的。

The future of finance

The recent USDC debacle was a wake-up call to the DeFi community, as the risk stems from traditional financial banks, and this incident has made it clear that DeFi is not as decentralized as we once thought.

But the term "DeFi" is entrenched and unlikely to be easily replaced.

Nonetheless, DAOs must stop perpetuating the illusion of complete decentralization and start acknowledging the reality of the situation.

In fact, although we continue to use the term "DeFi", we should realize that it more accurately represents the concept of "on-chain finance", which includes both decentralized and centralized elements.

Only by accepting this understanding can the DeFi community work towards a more resilient and transparent ecosystem.

Original link

欢迎加入律动 BlockBeats 官方社群:

Telegram 订阅群:https://t.me/theblockbeats

Telegram 交流群:https://t.me/BlockBeats_App

Twitter 官方账号:https://twitter.com/BlockBeatsAsia

Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

API/RSS

API/RSS

Social

Social

Summarized by AI

Summarized by AI