How to capture asset implied volatility through Uniswap V3 daily trading volume and liquidity information

How to use daily Volume and liquidity information in Uniswap V3 Pool to extract implied volatility of any asset

The tao of the meta-universe

In this article, I have shown how to extract implied volatility for any asset directly using daily trading volume and liquidity information in the Uniswap V3 pool.

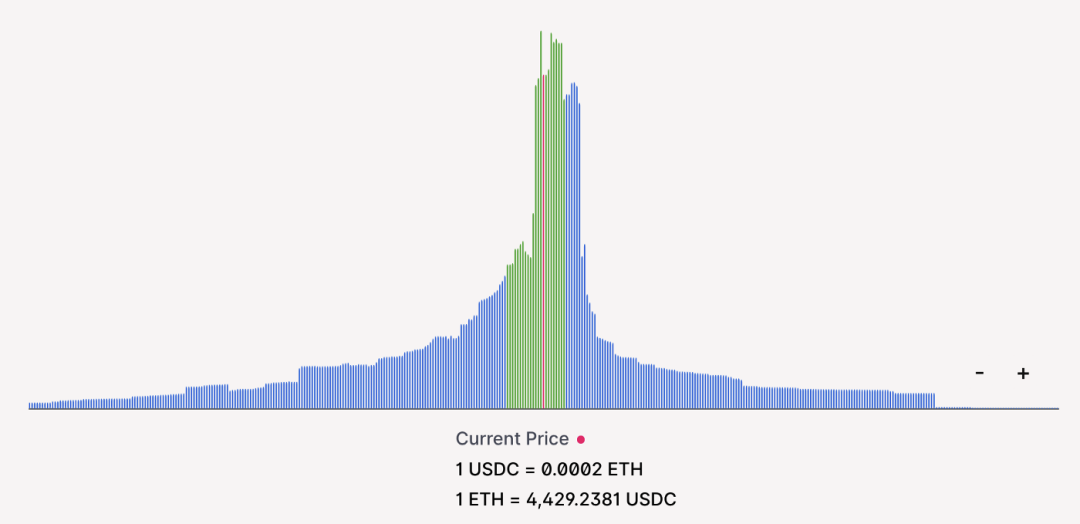

ETH-USDC-0.3% pool liquidity. The green bar shows the expected 7-day trend, calculated using an on-chain implied volatility measure.

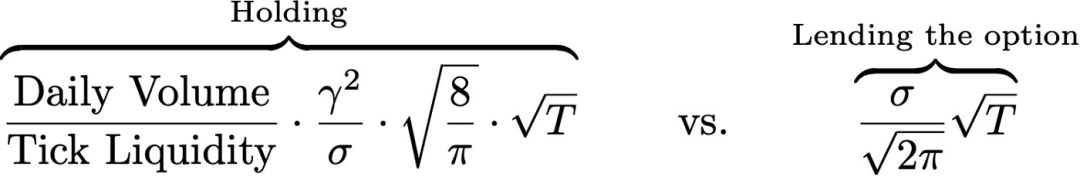

In my last article I demonstrated that lending a position in Uni V3 LP as an option can be more profitable than holding it. That is because the premium received for selling the option may exceed the amount of fees accrued on the LP token. In my analysis, I came up with the following equation:

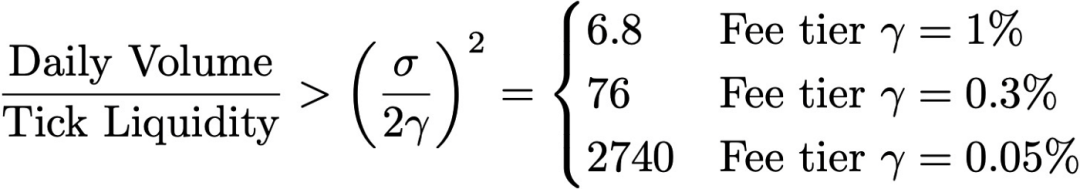

Some rearrangement resulted in the following conditions to guide whether the asset should be lent or held as an option for a fee:

However, I made an unnatural assumption in my analysis: I assumed that the on-chain volatility of the asset matched the "market" volatility of the same asset on the centralised options exchanged.

Specifically, I assume annualized volatility hovers around 100% and use this figure to extract ratios of 6.8, 76, and 2749. Recall that these ratios should tell you what the volume to liquidity ratio should be so that, assuming implied volatility is 100%, holding LP tokens is more advantageous than selling the position as an option.

I prescribe 100% annualized volatility for all assets on Uniswap. For an ETH- stablecoin pair, 100% May be accurate, but for a stablecoin pair, this would be a serious overestimate. Similarly, some highly volatile assets can have real annualized volatility of hundreds of percent.

How to solve this problem? How do we select the "right" volatility in the above expression? I'm actually a big proponent of the efficient markets hypothesis. After all, the efficient market hypothesis is one of the main reasons for using geometric Brownian motion to model asset prices in black-Scholes equations.

To put it simply:

The efficient markets hypothesis (EMH) is an assumption in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to consistently "beat the market" on a risk-adjusted basis, since market prices should only respond to new information. (Source: Wikipedia)

Therefore, given the framework, can we assume that all participants have already priced the carrying cost and expected return of LP positions, meaning that we can only assume that LP returns exactly match its option premium.

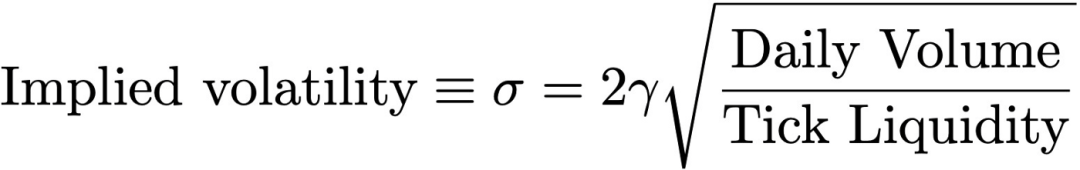

In other words, we can look at the daily trading volume and tick liquidity of any Uniswap V3 pool and calculate the implied volatility (IV) of the pool using the conditions I exported earlier:

Thus, as long as daily trading volume and tick liquidity can be extracted from on-chain activity, this equation provides a straightforward way to calculate asset IV.

1 Calculate implied volatility from Uniswap V3

How accurate is the assumption that all DeFi users are "rational"? Depending on whom you ask, it could be very low, but let's think more carefully.

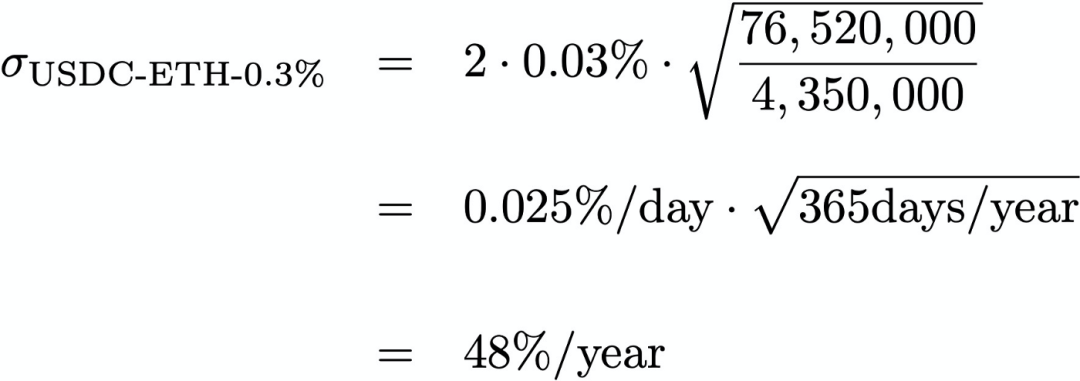

To calculate the implied volatility of the USDC-ETH-0.3% pool, we must divide the daily trading volume (76,520,000) by the square root of the amount of liquidity (4,350,000) of the current price change, then multiply by 2* 0.3% and √365days to get the annualized volatility:

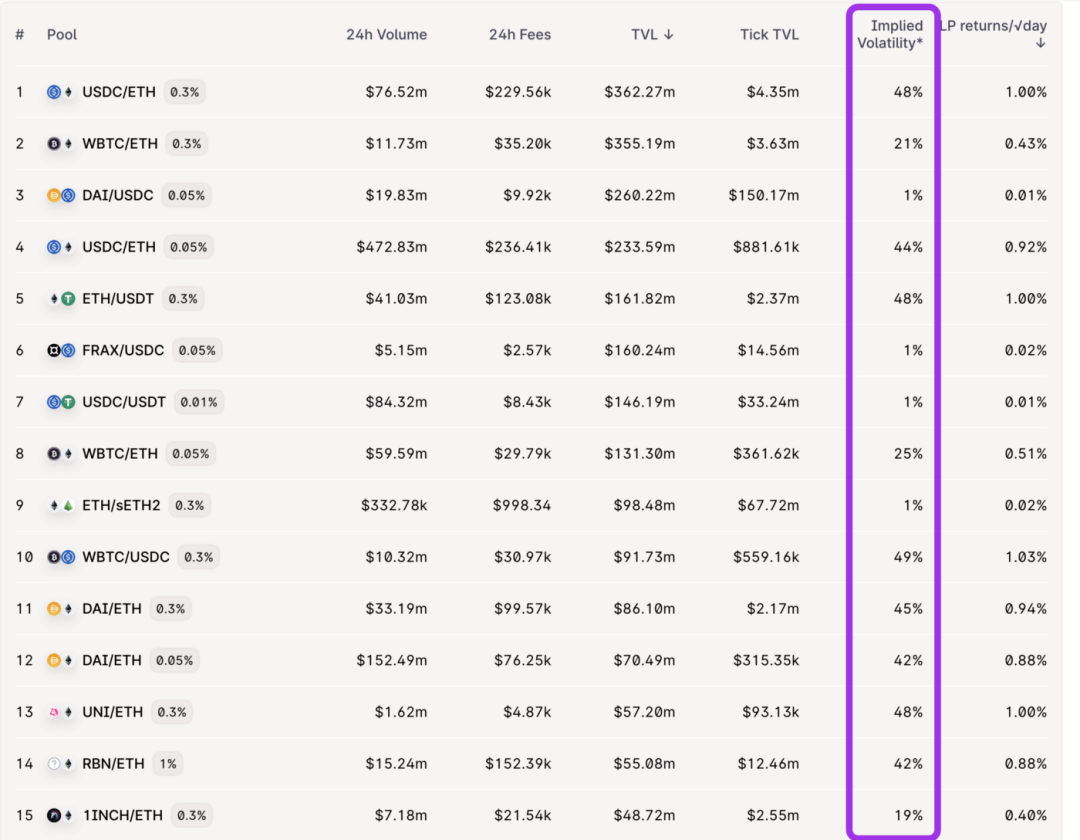

Here are TVL calculations of the same implied volatility for the top 15 pools in Uniswap V3:

Implied volatility ranges from 49% for WBTC/USDC pairs to as low as 1% for DAI/USDC and ETH/sETH2 pairs.

How good is this approximation?

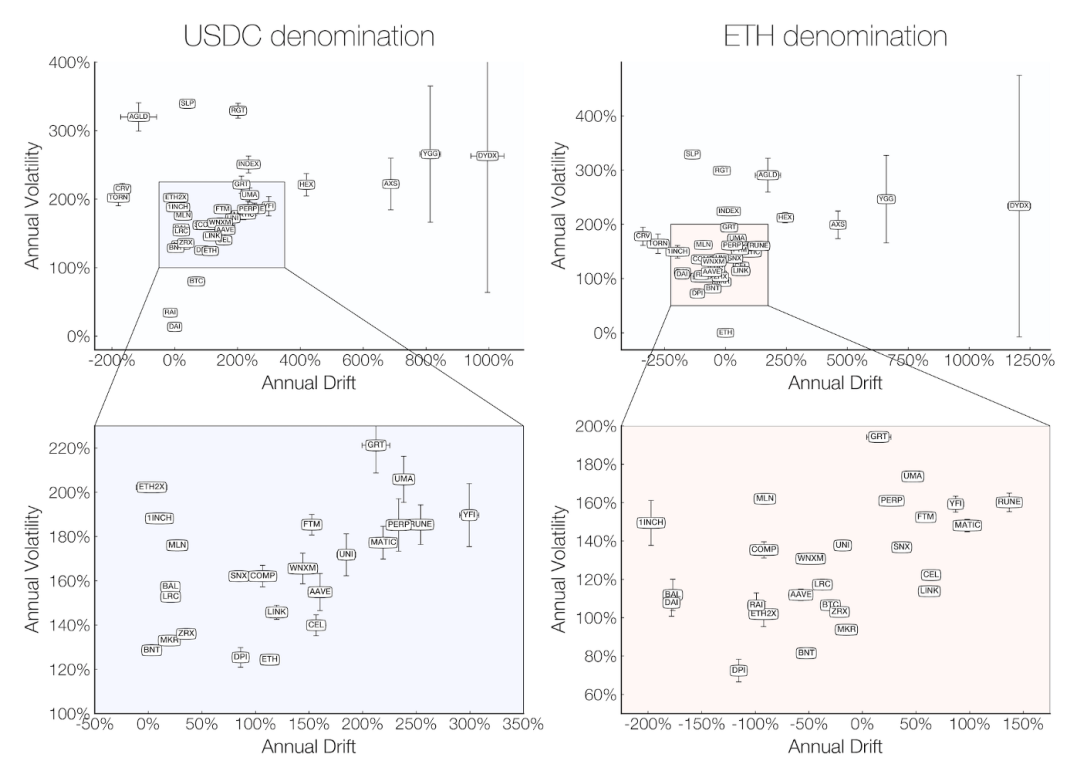

In a previous post, I pulled daily opening and closing data from Coingecko to extract actual volatility for several assets, all in USDC or ETH:

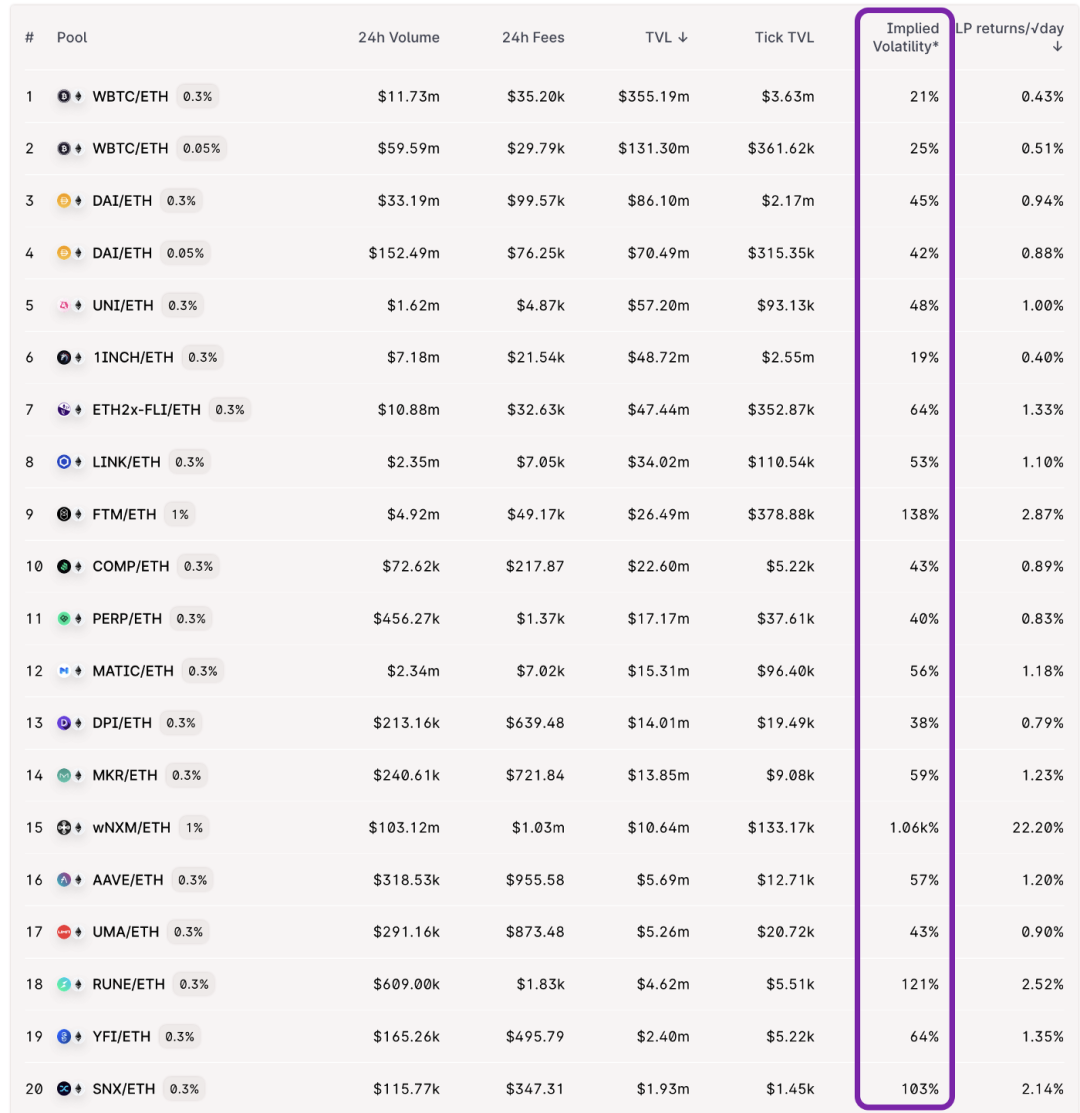

In ETH terms, the actual volatility of most assets hovers between 75% and 200%. If we compare this with IV extracted from Uniswap V3 pool, we get:

Note that for most assets, volatility is slightly lower, perhaps about 2.5 times.

I'm not sure where this difference comes from. Maybe that's because DeFi users aren't all rational, or users aren't trading as much on the chain as on centralized exchanges, or because I took this screenshot on Sunday and the volume is just lower.

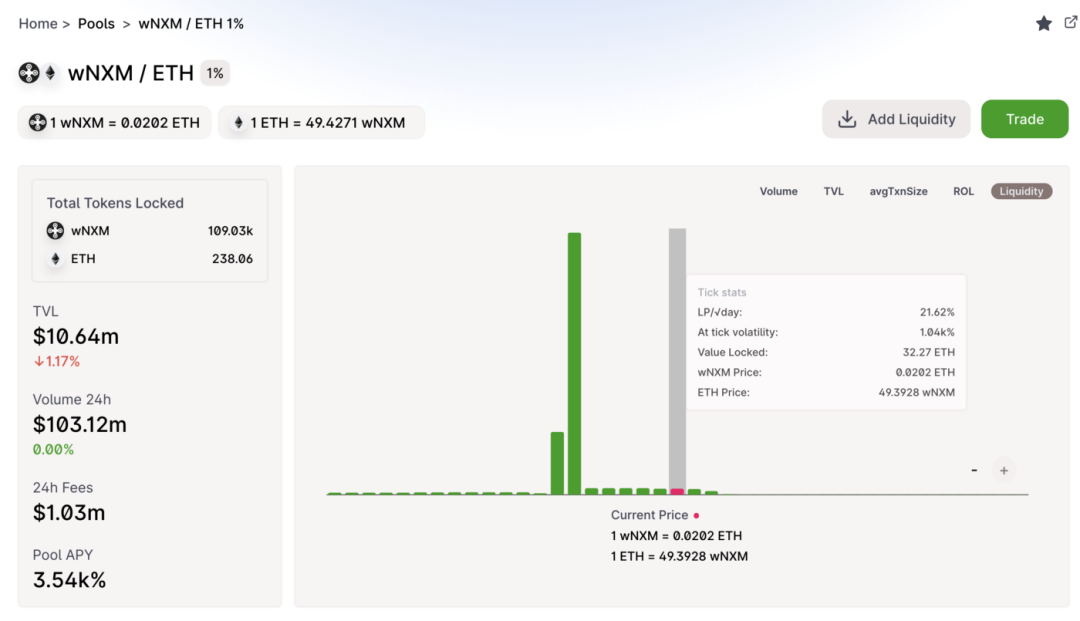

Furthermore, WNXM appears to be an outlier with an annualized volatility of over 1,000%. This may be due to the relatively low tick mobility:

Or a day of high volume ($103 million), I think the Uniswap theGraph instance reports 24-hour volume as a combination of volume and add + remove in liquid tokens. A quick snapshot of daily exchange volume is closer to about 1 million, which corresponds to a more realistic implied volatility of 32%/ y.

Use IV to help deploy liquidity effectively

Why should we care about IV? In fact, implied volatility is very useful for estimating the expected price movement of any asset:

See this post and this post for more details on choosing the best Uniswap V3 LP location. Specifically, understanding IV should also help determine where liquidity will be deployed in the Uniswap V3 pool.

For example, Eth-UNI-0.3% has locked in a total value of $57m, but only about $2m over the seven-day expected move. In other words, an average of 96% of deployed liquidity will not be touched for the next seven days.

The next step is to directly calculate the realized volatility for each trade using the on-chain data and compare it to IV using the volume + liquidity calculation.

This is a slightly more complex problem than I expected, and I've been working on it for the past few weeks. In the process, however, I made several interesting films showing the link between conversion + liquidity + fees for some highly volatile assets.

More details will be introduced later, please pay attention!

The original link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum

Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR