Where is your token in the year-end corporate chain inventory?

原文作者:Natasha Che,Soundwise 创始人

原文编译:0x137

本文梳理自 Soundwise 创始人 Natasha Che 在个人社交媒体平台上的观点,律动 BlockBeats 对其整理翻译如下:

Over the past year, we have witnessed the unprecedented leapfrog development of the coin circle, with rapid changes in various fields that are difficult to cover by one person. The following sections analyze the current major L1 and L2 public chains one by one, and evaluate their development potential and challenges.

首先,让我们根据公链的「引力」将它们分为 4 个梯队:

·零梯队: 以太坊 OG

·第一梯队:已经展现出网络效应的 L1 和 L2,包括 Solana、Avalanche、Terra、Polygon

·第二梯队:有坚实的团队、技术、资金,但吸引力很小,这样的公链很多

·WTF 梯队:「什么鬼,这个东西这么大的市值哪里来的?」

零梯队: 以太坊

以太坊的叙事不断变化,利益相关者的期望也各不相同。有的希望通过分片一劳永逸地解决扩容问题;有的希望以太坊成为 L2 的底部结算层;有的则认为以太坊应该与比特币竞争终极「稳健货币」的头衔。所有这些都表明以太坊仍在寻找建立价值的支点。与此同时,其他 L1 正在飞速增长,现有的 L2 部署又没有足够的吸引力,而人们对即将到来的 ZK Rollup L2 的期望值过高,很难不翻车。

事实上,无论以太坊未来想要做什么——分片、L2 的安全层等,新兴的公链已经以更优雅的方式提供了相关的解决方案,例如 Avalanche 的 subnet、Near 的 appchains、Cosmos 的 zones。加密世界不会停下来等待以太坊解决自己的问题,所以我很难看到以太坊超其他越竞争方案的场景。

第一梯队

「Solunavax」成为一个推特 meme 是有原因的,这 3 条 L1 公链获得了最为广泛的采用,它们的价格增长也反映了这一点。在我看来,它们的增长曲线才刚刚开始,未来的 1 到 2 年里,它们可能仍然会是加密领域风险/回报比的最佳选择。当然,它们都有着各自不同的机遇和挑战。

Solana

Solana 是当前 L1 公链浪潮的推动者,也是唯一条坚持整体扩容、反对模组化架构的公链。后者既是一种优势,也是一种阻碍。

优势 1:目前基本没有其他在认真构建具有扩容性的单片链,这使得 Solana 能够独占这一市场,并做到跨平台的标准统一以及实现完整的可组合性,Solana 本身也有了更加纯净的价值属性。

优势 2:整体性架构意味着 SOL 是平台唯一的 Token,平台价值的累积也不会被混淆到别的地方。这与其他模组化公链相比更有利于社区的稳定性,因为这些模组化公链所累积的价值往往是在 L1 Token 及其 L2/子网络 Tokens 之间是共享的,Cosmos 就是一个典例。Solana 在几大主要 L1 中拥有最高的质押比率是有原因的,它拥有着以为强大和活跃的社区,而来自「模组化群体」的 FUD,只会给 Solana 支持者更多空间积累 Token 的机会。

阻碍:整体性架构不太灵活,阻止了 Solana 参与许多有前途的潜在应用场景的竞争,例如企业和私有链。同时模组化阵营也有更强大的头脑风暴能力:更多的人参与研究,能够相互学习,也就能更快地做出改进。

当然这些都不是看涨或看跌的理由。归根结底,一条公链的好坏与其生态中项目的好坏有着直接的关系。作为高速、低成本、可扩容的第一条 L1 公链,Solana 在生态系统和公众意识的规模上领先于其他非 ETH 竞争对手一步。在没有 EVM 兼容性为其早期生长提供扶持的前提下,Solana 当前的成就十分难能可贵。

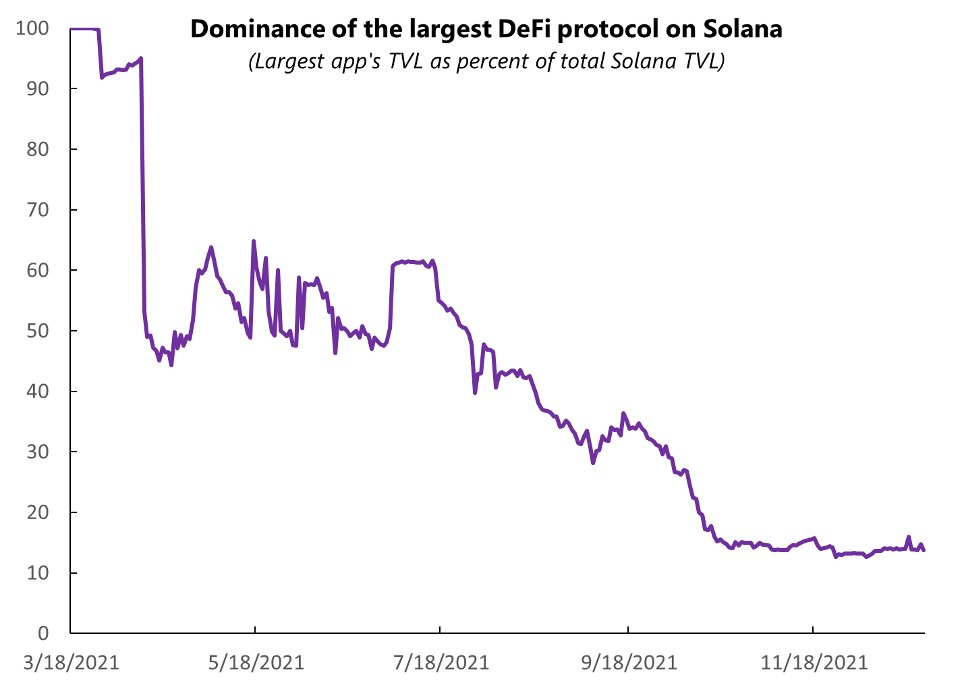

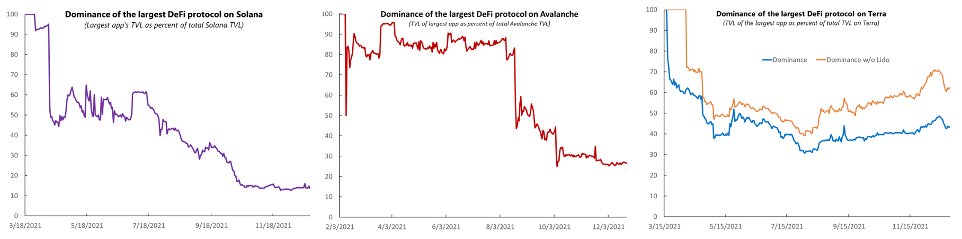

Worryingly, however, Solana Ecology does not yet have a particularly successful application, especially in the DeFi space. Despite the growth in both the number of applications and TVL, after nearly a year, Raydium, a native project that was neither creative nor executed well, still has Solana's highest TVL share (15%), especially over the past three months, when Raydium's share has barely changed. The lack of outstanding DeFi success stories is disappointing, given that platform-wide order book availability was touted as a major pillar of value in Solana's DeFi development.

明年 L1 与 L2 之间的竞争只会变得更加激烈,游戏和元宇宙产业将成为下一个主要战场。Solana 的领先优势不会在一夜之间消失,但它也需要更多成功的应用程序来保持领先地位。

Avalanche

Avalanche is the second most popular public chain in my opinion. It gained traction later than Solana, but has more room for growth in the short term. Solana's handicap is Avalanche's advantage, the subnet architecture gives it more flexibility, application scenarios, and the possibility of ecological expansion, while the EVM-compatible C chain leveragesthe Ethereum user base for short-term growth. I think Solana and Avalanche are like Android and iOS in the Web 3 world.

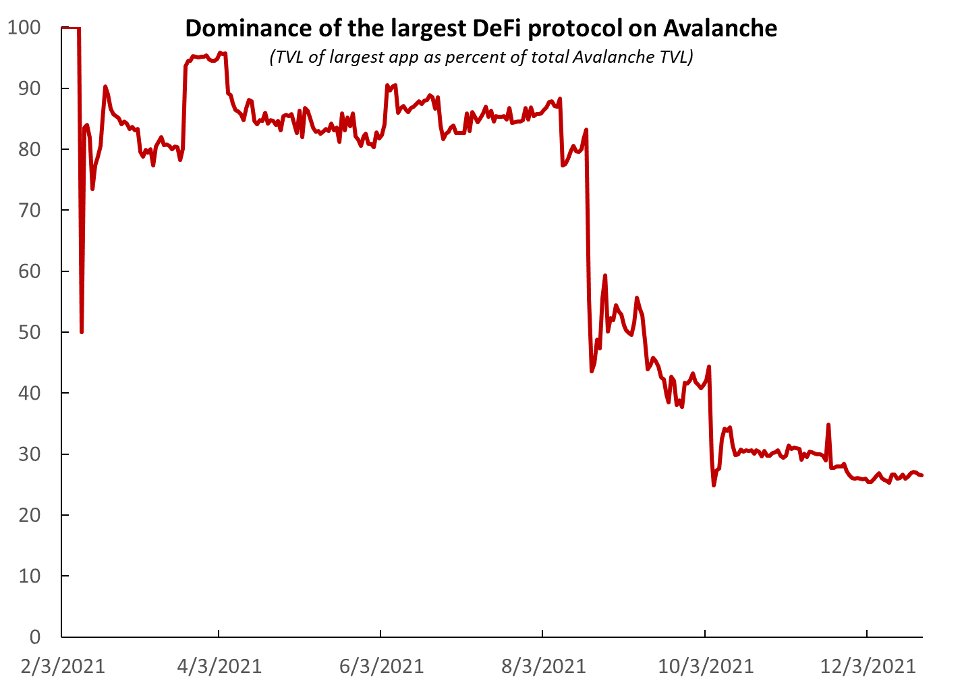

Avalanche's original, diverse ecosystem is showing every sign of healthy growth, as is its development community and subsets. Despite starting late to Solana, the DeFi space at Avalanche has produced more successful winners than Solana.

到目前为止,Avalanche 满足了我 L1 投资清单上的很多要求。它所面临的挑战,是其他那些具有类似基础设施但启动较慢的公链,例如 Near 和 Algorand,它们可能会在明年加快增长。技术本身的差异并不足以成为 L1 的护城河,因此现在不是自满的时候,Avalanche 需要利用现有的吸引力和社区继续拉拢高质量的项目。尽管如此,我认为 Avalanche 仍然是目前 Solunavax 中最具有潜力的 L1 公链。

Terra

The fundamental difference between Terra and Solana and Avalanche is that it is not so much an ecosystem as a suite of products. In contrast to the latter two robust web technologies and diversified projects, Terra's growth has been driven entirely by one or two projects, and the dominance of these projects has increased over time. Anchor alone accounts for more than 40% of Terra's total TVL, and if the pledge agreement Lido is excluded, the share of Anchor is more than 60%. It's worth noting that Terra has secured a spot in the top 10 by market cap thanks to UST staboin growth and one or two strong projects, demonstrating the power of building products for the general public, not just the small "degen" segment of the coin community.

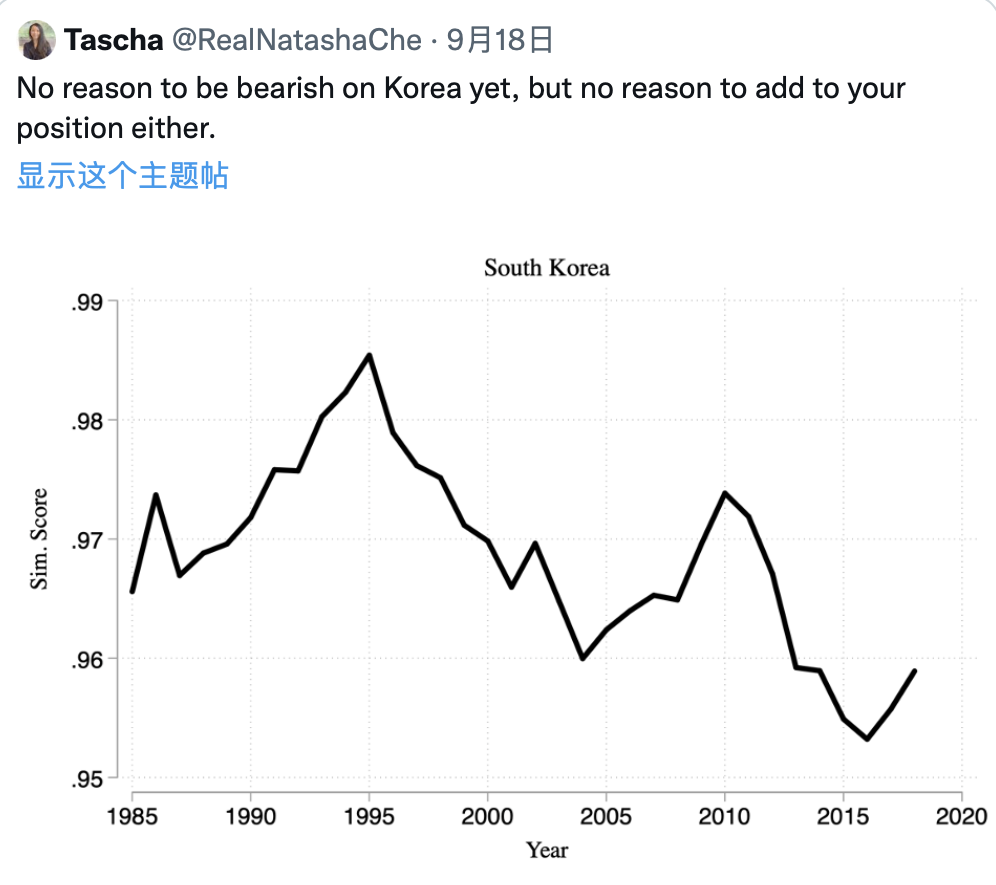

For now, however, protocols such as Anchor and Mirror can be easily replicated in Terra's ecosystem, raising questions about the defensibility of Its moat of growth momentum. The setup is strikingly similar to South Korea's economy: the country's four biggest "projects" -- Samsung, Hyundai, SK and LG -- account for nearly half of GDP. It is true that South Korea is a creative economy, but it also differs from the larger ecosystem in that risk is highly concentrated. So my view of Terra is similar to my view of Korea: a place in the portfolio, but by no means fully invested.

Polygon

增长虽然强劲,但鉴于其与 ETH 的紧密联系,大多数较大的应用程序都是从以太坊移植过来的,原生创新仍然很少。Polygon 对技术的态度就像是雇佣军,愿意把各种扩容方案直接丢进实战,以找到最好的解决方法。团队升级和转向的速度也很快,这也许能为 Polygon 在即将到来的以太坊 L2 竞争中提供一些保护。在我看来,虽然 Polygon 的潜力低于 Avalanche,但凭借强大的吸引力和未来势头,它应该在市值前 10 名中占有一席之地。

第二梯队

这些公链已经建立了自己相应的一些生态,但吸引力较低。它们当中的一部分很可能上升至第一梯队,并带来比 Solunavax 更好的风险/回报比;而其他一部分则可能会很快死亡。如果你投资这些项目,就最好密切关注它们的动态。

NEAR

One of the more interesting chains in the second tier. It got off to a slow start, but it's showing signs of accelerating, and its EVM Aurora activity is increasing. However, this momentum is relatively small, and trends in DeFi are fickle and can change direction at any time. Its Octopus network makes application-specific chains and multi-chain interactions a reality, inspiring more web developers to get involved.

如果你觉得这很像 Avalanche 的营销策略,那你没有错,NEAR 正在做所有公链都会做的事情来获得更多吸引力。不过他的持续增长仍取决于生态内部的项目质量,就目前而言下结论还为时过早。

Cosmos

有用的协议,无用的 Token。

Harmony

Harmony 到目前为止仍然只是 DeFi 王国的一个受益者,仅此而已。但 DeFi 的未来必将是多链的,就像许多伟大的公司最终都成为跨国公司一样,DeFi 会逐渐迁徙到它能找到的最大市场。除了 DeFi 之外,Haemony 从竞争中脱颖而出的道路还不是很清楚。

Algorand

Algorand 的叙事和团队都足够稳健,但他们需要做出更多的动作,零星的几个合作关系很难帮助项目快速成长,Algorand 需要拥有 1 到 2 个自己的杀手级应用程序,就像 Terra 和 Harmony 一样。

Elrond

Elrond 的营销策略十分优秀,但项目实际的吸引力相较于市值却有一些不匹配,Elrond 未来通往更广普及的道路可能是漫长而曲折的。在第二梯队的公链应该尽可能地识别和吸引其他链上已经成功的项目,就像发展中国家利用 FDI(外国直接投资)来促进其增长。

WTF 梯队

如果一条公链莫名出现在市值前 100 名,你却没有听人提到哪怕是一次,那么它就很有可能在 WTF 梯队中。不是说这些项目一定会辜负他的市值,但到目前为止,现实并没有给出有利的相应证据。如果是我,我会远离这些项目。

In short, the crypto space is changing fast, and there's always something new. Some of the public chains mentioned above have good prospects for the next 1 or 2 years, but will need to be re-evaluated after that period, and none of them are worth the loyalty of users forever. Whatever you do, don't be a fundamentalist.

The original link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR