Trustless Bridge: Solving the Interoperability Crisis and Optimizing the Efficiency of Liquidity Utilization

Original title: "Trustless Bridge: Solving the Interoperability Crisis , optimize the utilization efficiency of working capital"

Original author: Hakeen, Marina, Evelyn, W3.Hitchhiker

With the advent of the multi-chain era, the interoperability requirements of the blockchain network are becoming more and more Starting from 2021, cross-chain bridges will show explosive growth. The cross-chain bridge can transmit "information". The information here is not only assets, but also smart contract calls, identity proofs, and state interactions. As of the end of April 2022, more than 65 cross-chain bridges have emerged in the encrypted world.

The cross-chain bridge can solve the problem of insufficient liquidity. In addition to playing an important role in asset extradition, the cross-chain bridge can also solve the problem of insufficient performance of the underlying public chain. Like the current Ethereum Layer 2, it can help transfer the transaction throughput from the first layer to the off-chain system. The whole process is realized through the bridge. Keep funds and release a layer of huge trading volume pressure. But such a bridge also has certain disadvantages. As a blockchain network independent of the main chain, most of them only focus on their own security model, so they have a certain degree of security risk.

The ideal cross-chain bridge, under the premise of ensuring a highly transparent and tamper-free cross-chain environment, can not only meet the interaction of assets and other information, but also have extremely High security guarantees to achieve higher-performance consensus on protocols, applications, transactions, etc. compatible with various public chains. According to this mode of development, the "middleware" role of the cross-chain bridge can be recognized by the market and used more frequently, and the development of the industry can also enter the era of indiscriminate cross-chain interaction.

This article will mainly start from the security of asset cross-chain bridges, classify according to who is verifying the system, and select three recently popular Trustless cross-chains Bridges, respectively, summarize their advantages and disadvantages from their respective operating principles, teams, investment and financing, and costs.

1. Classification of cross-chain bridges

Safety and speed have always been the priority of cross-chain bridges Task. Since the Layer 2 cross-chain bridges on the market are mainly built on Ethereum, if we put funds on Layer 2, then the funds are still protected by Ethereum verifiers; if we transfer the assets on Arbitrum through the cross-chain bridge When it comes to Optimism, Arbitrum and Optimism themselves are also secured by Ethereum. The validator is on Ethereum, and the strong consensus foundation of Ethereum provides extremely high security, but the bridge protocol uses a set of external validators, and the funds are no longer protected by Ethereum, but by the validators of the bridge. According to the barrel principle, it is the most vulnerable part that determines the safety.

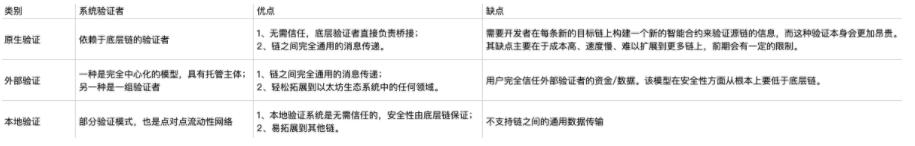

So according to who is verifying the system, we can be divided into the following three categories:

1. Native verification

It completes the verification by running the light client of the source chain in the virtual machine of the target chain.

Such as IBC, BTC Relay, Near Rainbow Bridge, Polkadot SnowBridge, LayerZero, Movr, Optics, Gravity Bridge, etc.

2. External verification

< /p>

This kind of verification method has one or a group of verifiers, and the verifier needs to monitor the specific address of the source chain. Users send assets to a specific address on the source chain to lock them, and third-party verifiers will verify the information and need to reach a consensus. When the consensus is reached, corresponding assets will be generated on the target chain.

This type of cross-chain bridge includes Synapse, Thorchain, Anyswap, PolyNetwork, WBTC, WormHole, Qredo, Ronin, etc.

There are two main types of verifiers:

< p>One is to have a managed principal. The transferred assets are kept by the custodian, which requires full trust in the custodian. This model depends entirely on the credibility of the bridge operator itself. Essentially, they can take away users' native assets and make cross-chain assets lose value. For example, if the custodian of wBTC takes all the BTC backing the value of wBTC, then wBTC will become worthless, although this probability is very small.

The other is a set of verifiers. In order to become a validator, they need to bond assets to prevent evil. Binding assets can also be divided into two categories. One is to bind the corresponding cross-chain assets. For example, in order to realize the cross-chain of BTC or ETH, the verifier needs to bind BTC or ETH. The other is the protocol that binds Token assets to itself. For example, Thorchain is bound to RUNE, and Synapse plans to bind its own TokenSYN in the future to ensure the security of its chain. In this model, bridge participants have the opportunity to steal users' funds, but due to the existence of the "game" mechanism (that is, the pledge of their own funds, accompanied by the existence of a penalty mechanism for stealing funds), they should not do so.

The local verification protocol mentioned below transforms the complex multi-party verification problem into a set of simpler two-party interactions, each party only verifies the counterparty, as long as This model works where the two parties are economically adversarial - i.e. the two parties cannot collude to obtain funds from the wider chain.

3. Local verification

Local verification is a partial verification mode and a peer-to-peer liquidity network . Each node is a "router" itself, and what the router provides is the original asset of the target chain, not the derivative asset. Additionally, routers cannot withdraw user funds through locking and dispute resolution mechanisms.

Such models include Hop, Connext, Celer, Liquality, etc. The peer-to-peer model performs relatively well in terms of security, cost, speed, and multi-chain connection expansion.

Comparison of advantages and disadvantages of each verification system

4. Summary

< br>

External verification mode to build a cross-chain bridge has the advantages of faster speed, lower cost, universal data transmission, easier multi-chain connection, better user experience, etc., but the potential disadvantage of this model is its safety. Due to the introduction of the role of external actors, the user's security is not only dependent on the security of the source chain or the target chain, but also limited by the security of the bridge. In the process of transferring assets across chains, if the bridge is not secure, the assets are at risk.

Native verification mode is a cross-chain bridge that does not require trust. It does not have the potential security trade-offs of third-party verifiers and can transmit various general data. The security of the cross-chain bridge is related to the security of the blockchain itself. The financial security of users is not affected by the bridge itself. If there is a security problem, it is also a problem with the chain itself. At the same time, there is no need to pledge assets (more efficient funds). But the model still lacks sufficient activity and multi-chain connections. Between any two chains, developers need to develop and deploy new light-client smart contracts on the source and target chains. In addition, it has the disadvantages of being slower and more expensive.

The local authentication mode uses the mobile network mode. It uses local validation and does not require global validation, so it is faster and less expensive. Relatively speaking, its capital efficiency is higher than that of the external verification model and lower than that of the native verification model. At the same time, the throughput of the peer-to-peer liquidity network is also greater. Of course, it also has shortcomings. It has limitations in information transmission and cannot achieve universal information transmission.

2. Development trend

Different models of cross-chain bridges have different trade-offs . Therefore, at different stages, according to the different needs of users for speed, cost, versatility, security, etc., different models of cross-chain bridges may achieve different effects at different stages. In the early days, the external verification mode and the local verification mode may gain faster development speed because of the empirical advantages in cost and speed. With people's emphasis on security and the development of technology, the native verification model may also develop gradually in the later stage.

As time goes by, some cross-chain bridges will gradually gain the upper hand and become the main players in the cross-chain bridge market. With the continuous in-depth development of Layer 2, cross-chain bridges will become an important part of the future multi-chain era.

3. List several cross-chain bridges

1. Hop protocol

Operation principle

roll up and roll up transfer

The ETH officially minted by Arbitrum is transferred to hETH through AMM, then the hETH on the Arbitrum chain is locked through the bridge contract, hETH is minted on another bridge, and then converted through the AMM deployed on the Op Become the officially minted ETH of Op.

No interaction with Layer 1 is required during this process.

roll up and L1 transfer

;

The user sends a redemption ETH request from the Op chain on the Hop protocol, the Hop protocol informs Bounder, Bounder confirms the advance asset, sends ETH to the user on Layer 1, the user receives it immediately, challenge At the end of the period, Bounder gets the ETH withdrawn from Layer 1.

At this time, it is necessary to interact with Layer 1. Because of the competition, Bounder needs to pay the gas fee by himself. In order to reduce the cost, he will mix multiple transactions into one. Therefore, the time required to complete the interaction is variable.

Hop protocol has three important roles:

2. Bridge contracts: Responsible for network transfer and providing liquidity.

3. Bounder: Advance payments for chains with a challenge period.

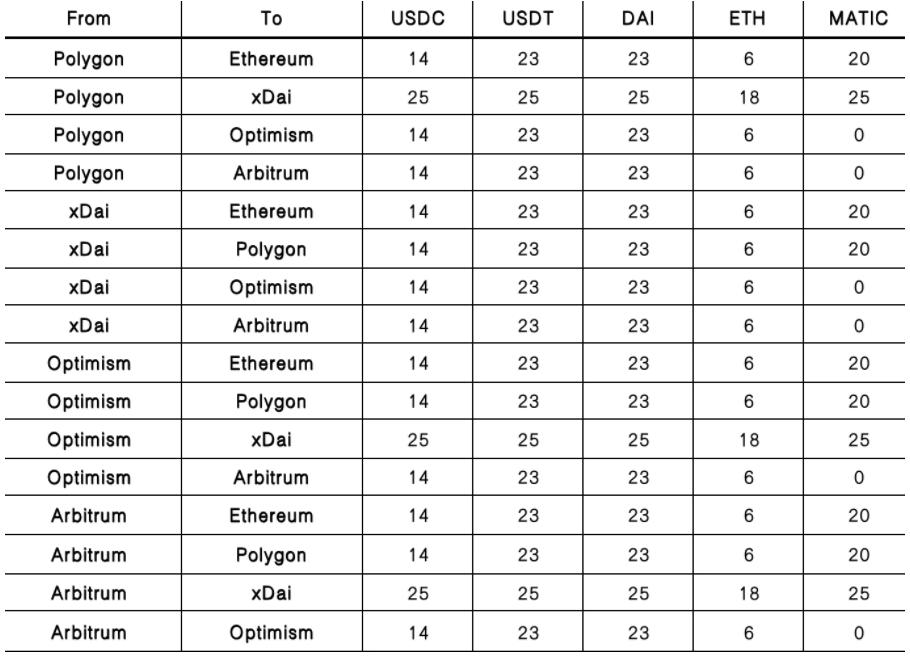

Cost

Note: The data in this table is calculated when Ethereum is $2650, and the cost changes with the change of Ethereum gas cost. Due to different measurement times and network congestion, the results fluctuate greatly and are for reference only.

Team Situation

Shane Fontaine: Ether Fang developer, co-founder of Authereum, and the organizer of the Ethereum meetup in the Los Angeles area. He was the chief cryptographic developer of CoinCircle, participated in the development of Level K, and also served as a technical consultant for UNIKOIN and Synapse Capital. A lot of smart contract code was written.

Lito Coen: Founder of Crypto Testers, also responsible for business growth at Hop Protocol. He has invested in more than ten projects in the Web3 field. Previously, he was the Business Development Manager at SatoshiPay.

Christopher Whinfrey: Co-founder of Authereum, developer of decentralized applications, formerly the founder of Level K.

Investment and financing

The financing information is unknown, Currently only disclosed investors include 1confirmation, 6th man ventures, infinite capital, etc.

2、Connext

Operation Principle

Auction: Users are paired with liquidity providers, and liquidity providers Or provide liquidity for transfers, lock your DAI on Op, and provide DAI on Arbitrum.

Preparation: At this stage, two parties lock funds for transfer - the user on the sending chain and the router on the receiving chain.

Fulfillment: During this phase, both parties unlock funds for transfer. Users provide a signature to unlock their funds on the receiving chain, and liquidity providers use the same signature to unlock funds on the sending chain.

Specific process

The sender broadcasts the transaction request to the NATS message network

The router monitors the network, quotes, and the network automatically selects a low-cost router

Sender is paired with router

sender sends asset and quotation information to the nxtp contract, and the contract broadcasts a signal that the transaction is ready

router sends transfer preparation to nxtp

sender sends information and signature required for appropriation to relayer, relayer assists in appropriation The transaction is sent to the nxtp contract of the receiver chain

The router obtains a local signature from the nxtp contract, and the router allocates funds to the address

< /p>

user obtains assets in another chain, and signs

router obtains signed messages, and obtains advanced assets from sender chain's nxtp contract

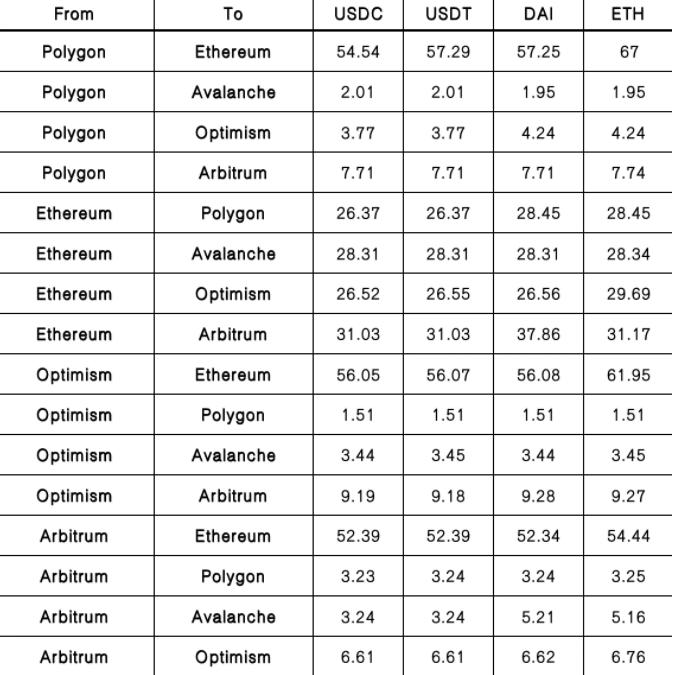

Operating Expenses

Note: The data in this table is calculated when Ethereum is $2650, and the cost will change with the gas fee of Ethereum. Due to different measurement times and network congestion, the results fluctuate greatly and are for reference only.

Team

Layne Haber: COO, UCLA, CEO of two startups.

Rahul Sethuram: Chief Technology Officer, University of California, Santa Cruz, former NASA research assistant, TESLA test engineer, Ethereum developer.

Investment and financing

The total financing is 15.7 million US dollars, and the A round of financing has been completed.

Investors include: #Hashed, Ethereum foundation, Consensys, 1kx, OK ventures, huobi ventures, coinbase ventures, polychain, jinglan wang (optimism), Sandeep Nailwal (polygon)

3, Nomad

How it works

From the Optimism Team Absorbing inspiration and experience, Nomad itself is an implementation and extension of Optimistic Interchain Communication. The security guarantee of the system is that any participant can publish all fraud proofs, and all participants have a window to react to any fraudulent behavior.

Nomad forms the base layer of a cross-chain communication network capable of sending general-purpose messages with higher generality but with a 30-minute latency.

The sending chain (home chain) generates a series of messages (document), signing Signed by a notary (updater). If the notary presents a fake copy, a penalty is broadcast and all clients know it is malicious and access to their account can be blocked.

Nomad uses optimistic proof as a prototype, sends some data proof, accepts it as valid after the timer elapses, and introduces challengers to submit fraud proofs.

Nomad spans multiple chains. The sending chain is the source of messages, and messages are committed into the merkle tree ("message tree"). The root of this tree is notarized by the updater, and is relayed to the receiving chain through the relayer in the "update". Updates are signed by the updater. They commit to the previous root and a new root. Any chain can maintain a "replica" contract that contains knowledge of the updater and the current root. Signed updates are held by replicas and accepted after a timeout.

This leaves open the possibility of an updater signing a fraudulent update. Unlike optimistic rollups, Nomad allows fraud, which is the most important change in the security model. Importantly, fraud can always be proven to the Home contract on the sending chain. Therefore, updaters must submit collateral stakes on the sending chain. Fraud can always be proven on the sending chain, and the bond can be slashed as a penalty.

Cost

Note: The data in this table is calculated when Ethereum is $2540, and the cost will change with the gas cost of Ethereum. Due to different measurement times and different network congestion conditions, the results fluctuate greatly and are for reference only.

Team

Investment and financing

The seed round of financing is 22.4 million US dollars, led by polychain capital, and other investors include the graph, celestia, amber group, mina, circle, avalanche, 1kx, polkadot, A&T capital, coinbase and other 27 investors.

Nomad and Connext Integration

Connext's The advantage lies in the realization of cross-chain and L2 Trustless sending value and calling contracts, but the disadvantage is that it does not allow fully general communication, but its delay is indeed much lower. Rely on Nomad high security, absorb Nomad trust/risk.

Leverages Connext's low-latency liquidity pools, allowing end users to complete transfers in minutes, rather than delays of more than 30 minutes. According to the official Connext report, whales and institutions will take 35 minutes longer to complete Nomad’s bridge time.

Connext and Nomad are a combination of low-latency liquidity + security. With the growth of Connext liquidity, the adoption of Nomad may gradually favor institutional capital in the future or a large amount of capital.

4. Summary

Judging from the off-site popularity, Hop bridge is still the best. The popularity caused by the integration of Connext and Nomad has gradually increased the public's attention to it.

On the whole, Nomad is more secure because of its Fraud is expensive, and Nomad is an ideal protocol for more general cross-chain operations, which are usually performed by DAOs or other organizations rather than end users, so the corresponding usage and cross-chain times are not as convenient and fast; however, with Connext Integration can make up for some of the problems.

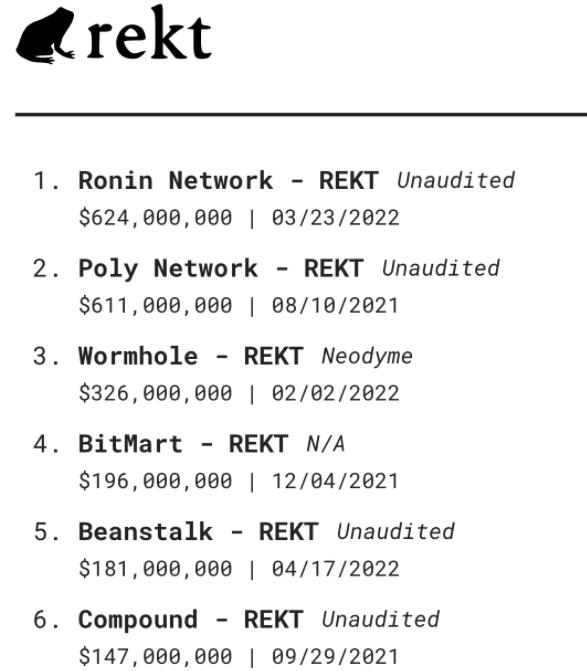

Currently the largest blockchain hacking attacks are almost all from cross-chain bridges, such as Ronin Network’s $624 million, Poly Network’s $611 million, Wormhole’s $326 million... These attacks remind us that no matter what users think , decentralization is a practical security necessity for large-value applications.

We can see the ultra-high temptation and ultra-high cost-benefit for cross-chain bridge attacks. If the cross-chain bridge wants to succeed, the first prerequisite is security. In the future, assets worth billions of dollars or tens of billions of dollars will not be able to be compensated by any institution. The ideal state for cross-chain bridges should be safe, interconnected, fast, capital-efficient, low-cost, and anti-censorship. With future technology iterations, native verification will prevail, but from the current economic and security trade-offs, Local verification is currently a better solution overall.

Of course, the cross-chain bridge should not be limited to the cross-chain of assets. Message and contract calls, data interaction, and state interaction are all application directions of the cross-chain bridge. The rigid demand for diversified cross-chains creates unlimited future potential for the entire track.

Original link< /a>

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR