CB Insights: 39 charts Overview of investment and financing trends in the blockchain industry in Q2 2022

Original title: State of Venture Q2'22 Report

Source: CB Insights

Bai Ze Research Institute

2022 Q2 Crypto VC status

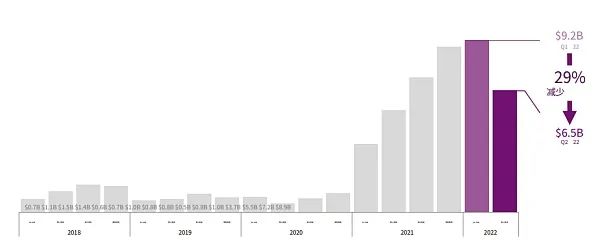

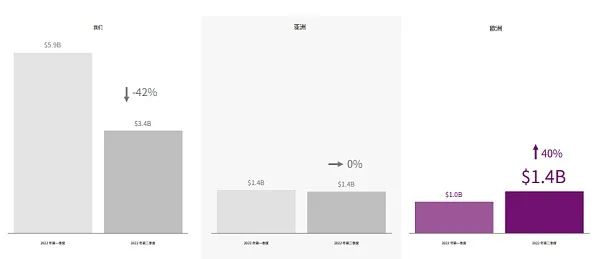

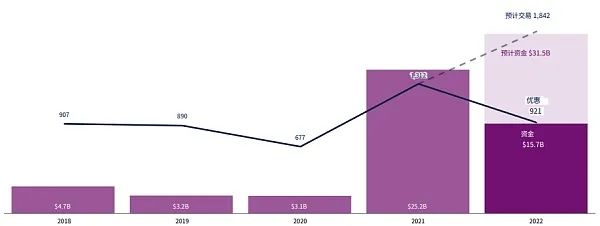

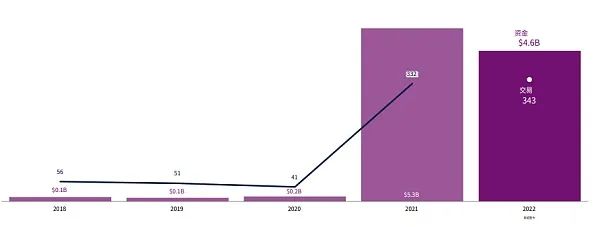

Crypto investment funds are down globally. Blockchain venture investment fell to $6.5 billion, the first sequential decline in 2 years. Investors have scaled back their investments in cryptocurrencies due to macroeconomic pressures and concerns over cryptocurrency valuations and stablecoins.

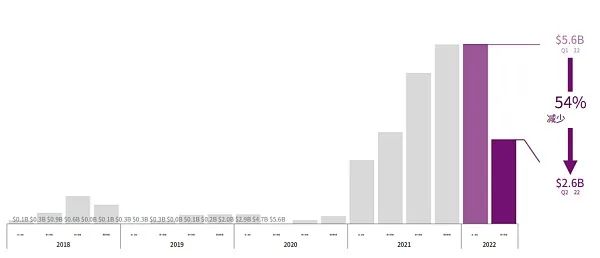

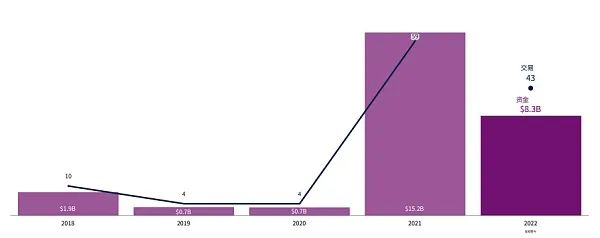

Billions of dollars of huge financing reduction. The total number of mega rounds of $100 million or more fell to $2.6 billion, less than half of the previous quarter's total, and the number of mega rounds (16) also fell. This suggests that investors are more cautious due to the "cold winter" in the cryptocurrency market and recent price volatility.

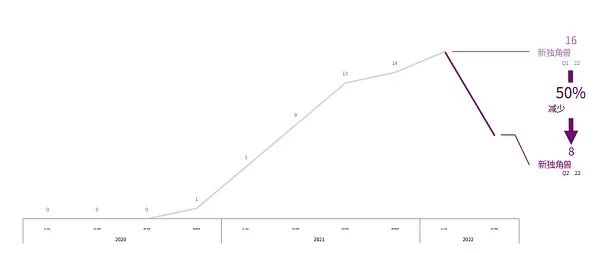

Birth of Crypto unicorns halved. Eight Crypto unicorns were born in the quarter, half of last quarter's record high of 16. The most valuable of these was Seychelles based cryptocurrency exchange KuCoin, valued at $10 billion, while half of the new unicorns were Web3 startups.

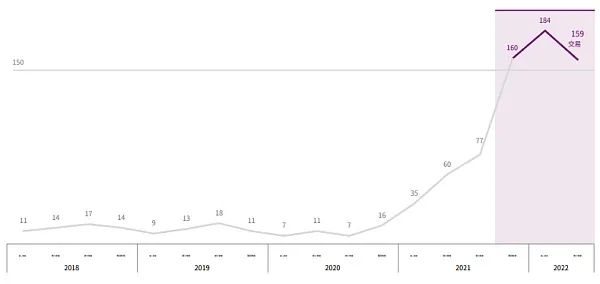

The future of NFTS, games, and the metaverse may be tougher. Although the NFT, games and metaverse categories saw a month-on-month decline in project funding, they still attracted more than 150 investments. However, projects in these categories may face a tougher road ahead. NFT transactions are down, and gaming and metaverse will face stiff competition from Big tech.

2022 Q2 Crypto VC pattern

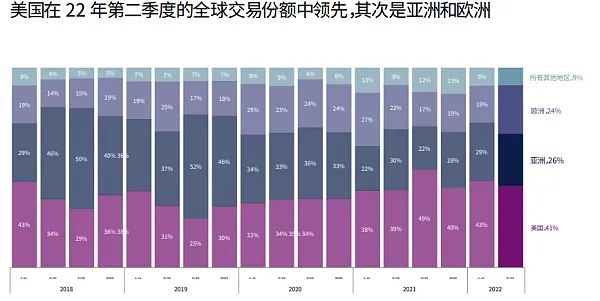

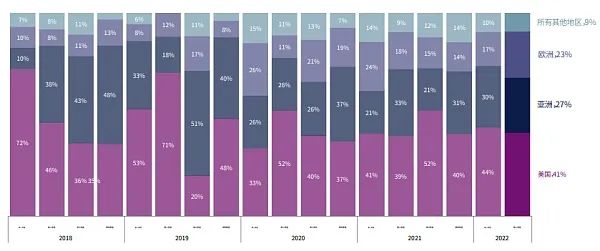

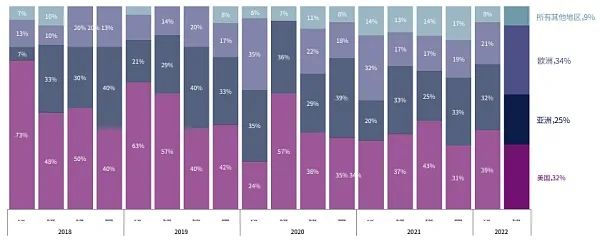

Crypto investment growth in Europe. Europe is the only region where Crypto ventures are growing in size. It tied with Asia with $1.4 billion invested in the second quarter of 2022, but lagged behind the U.S. with $3.4 billion. Six of the top 10 Crypto investments in Europe belong to Web3 (e.g. NEAR Protocol, Msquared) and three belong to institutional managed cryptocurrency solutions (e.g. Elwood Technologies, Coinhouse).

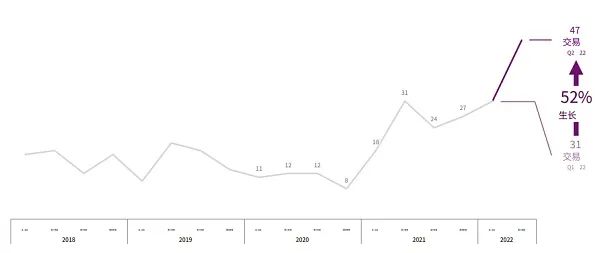

Blockchain infrastructure growth. Blockchain infrastructure was the only category to receive more investment during the quarter, hitting a new high of 47 deals, with the largest deal being a NEAR Agreement Series C funding round totaling $350 million.

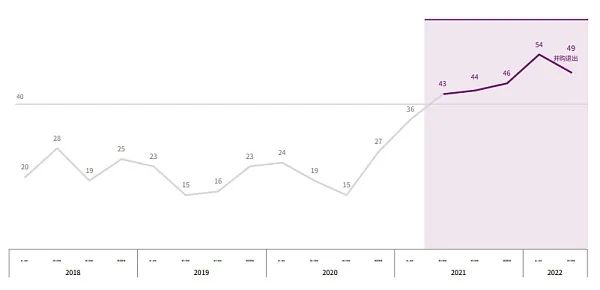

More than 40 Crypto companies withdrew from mergers and acquisitions (M& A exits), A record. With several prominent CeFi (centralised financial platforms) filing for bankruptcy, giants such as Binance and FTX are trying to buy these companies at a discount. In addition, other companies, such as Bolt, Robinhood, and eBay, also acquired at least one Crypto or NFT company during the quarter.

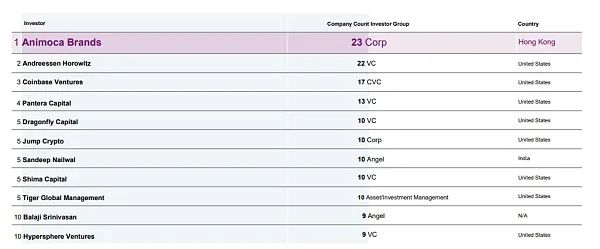

Animoca Brands is the top investor. Animoca Brands remained the most active investor (for the third quarter in a row), although the number of investments also declined quarter-on-quarter. In addition, the number of investments the 10 most active investors (including A16Z and Coinbase) participated in fell 24% during the quarter.

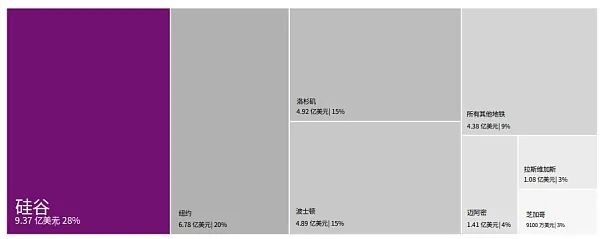

Silicon Valley has overtaken New York to become the dominant force in Crypto investment in the US. Silicon Valley was the No. 1 location for Crypto fundraising in the U.S. this quarter, with a total investment of $937 million, with the largest investments coming from institutional Crypto trading platform FalconX ($150 million) and NFT market Magic Eden ($130 million). Silicon Valley overtook New York ($678 million) in the quarter, which had held the lead for eight consecutive quarters.

Overall data interpretation

Global Crypto funding has fallen for the first time in two years.

The total amount of large capital raisings of $100 million or more decreased.

The number of new Crypto unicorns halved this quarter.

The NFT, Gaming, and metaverse categories have attracted more than 150 investments for three consecutive quarters.

Crypto investment funds from Europe have grown significantly.

Investment in blockchain infrastructure is at a record high.

Crypto M&A exits reached a record high of 49 in the quarter.

Animoca Brands was the largest investor for the third quarter in a row.

Silicon Valley became the No. 1 location for Crypto investments in the U.S. this quarter, overtaking New York.

Crypto investment trends

Global Crypto fundraising could hit an all-time high in 2022.

The US led Crypto investments in the quarter, followed by the Asian region and Europe.

VCs remained the leader in Crypto investments this quarter.

With 43 investments in half a year, 2022 is likely to be a record year for mega rounds of funding in excess of $100 million.

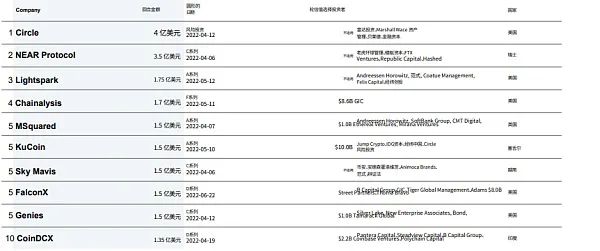

Top 'unicorn' funding rounds for Q2 2022:

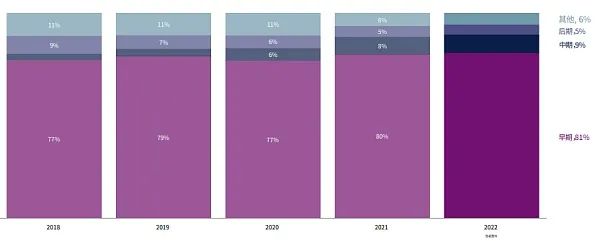

Early stage investments in Crypto projects/companies still dominate.

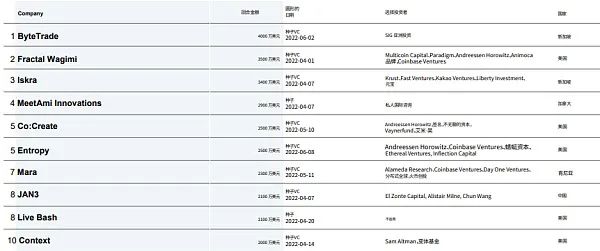

Top "unicorn" seed rounds for Q2 2022:

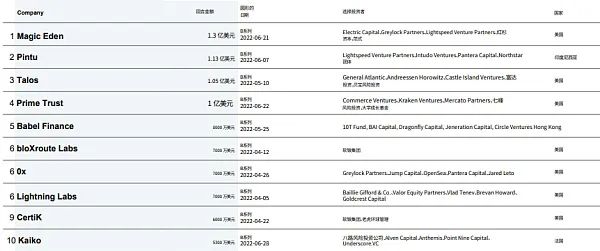

Top "unicorn" Series A funding in Q2 2022:

Top "unicorn" Series B rounds in Q2 2022:

Top "unicorn" Series C funding in Q2 2022:

Crypto unicorns

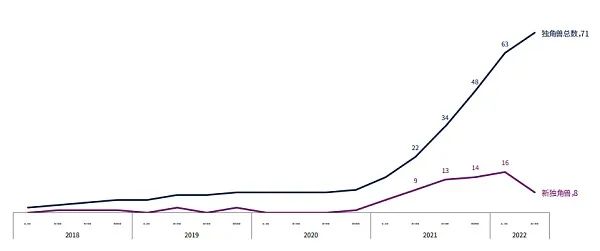

The number of new unicorns halved in the second quarter of 2022, bringing the total to 71.

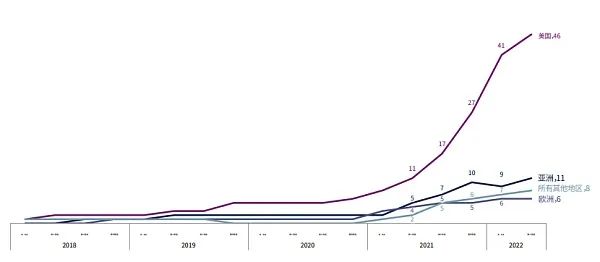

The United States is home to 46 unicorns, or 65 percent of the total, including five new unicorns.

The US has by far the most unicorns, followed by Asia.

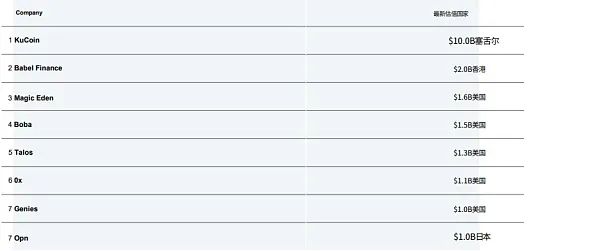

Top 'new unicorns' for Q2 2022:

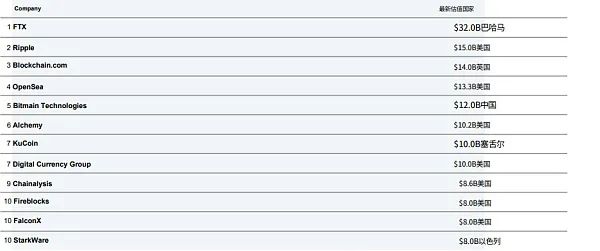

Highest valued 'unicorns' in the second quarter of 2022:

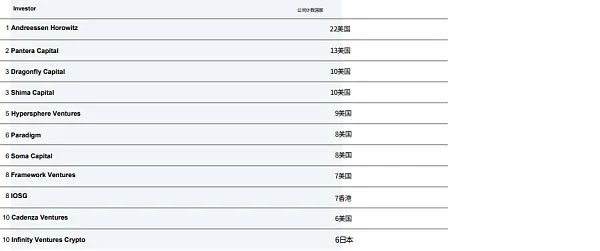

Top VC's in Q2 2022 by number of investments:

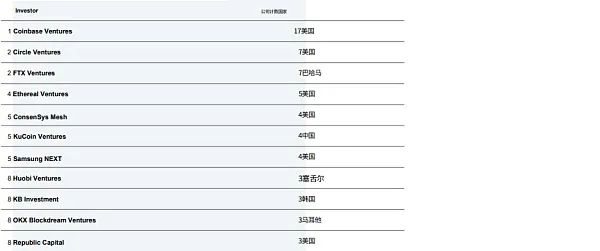

Top CVC (Crypto Industry VC) by number of investments in Q2 2022:

Web3 Track investment data

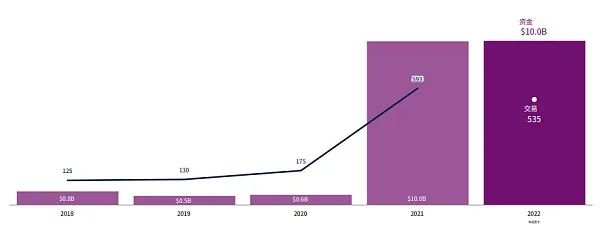

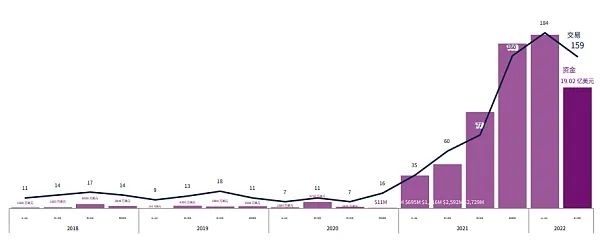

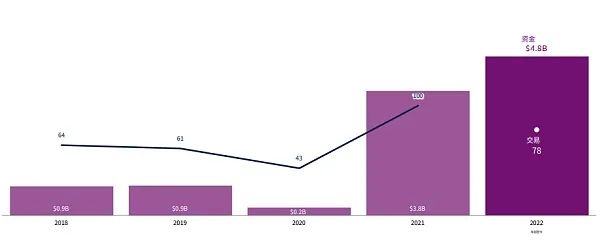

The amount of money invested in Web3 startups in the first half of 2022 is already the same as the total for all of 2021.

After six consecutive quarters of growth, the Web3 category saw a decline in both funding and investment deals in the second quarter of 2022.

The United States leads in Web3 global investment share, followed by Asia.

Top "Web3" financings for Q2 2022:

NFT, gaming and meta-universe track investment data

The year-to-date number of investments in the three categories of NFT, games and metaverse has already surpassed the total for all of 2021.

But the amount of money invested in these three categories has declined.

Top "NFTS, Games, and Metaverse" funding in Q2 2022:

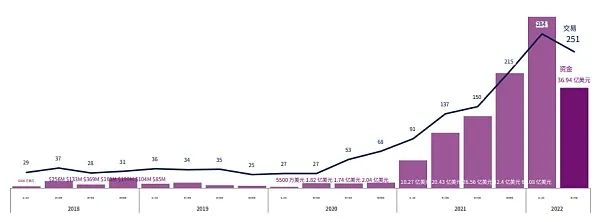

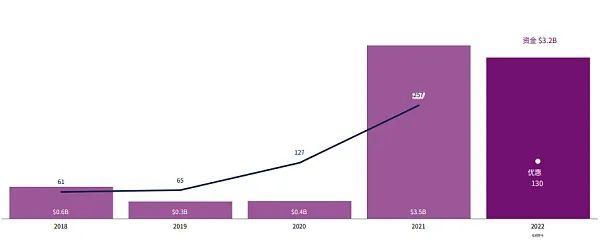

DeFi Track investment data

The amount of money invested in DeFi is expected to hit a record high:

The European region leads the DeFi share of global investment, overtaking the US.

Top 'DeFi' financings in Q2 2022:

Blockchain infrastructure track investment data

Investment in blockchain infrastructure has already exceeded the total for the whole of 2021.

Investment in blockchain infrastructure grew strongly in Asia and Europe during the quarter.

Top "blockchain infrastructure" financings in Q2 2022:

The original link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities