Can you leverage against NFT? Check out the NFT Perpetual Contract track from nftperp

Article:0xLaughing, rhythm BlockBeats

introduction

For a long time, the NFT market has been committed to solving the problem of "insufficient liquidity". Starting from the valuation and pricing of NFT, matchmaking methods and other aspects, many excellent products and innovative mechanisms continue to emerge to promote the sustainable development of NFT financialization.A healthy financial market requires market participants to be able to play both bearish and bearish roles at any time in order to hedge trading risks, increase profit opportunities, and diversify trading strategies. However, currently, NFT traders can only execute the strategy of buying low and selling high on NFT spot for profit. The trading mode is very simple. NFT traders have the demand of long/short NFT with leverage. In response to these questions, people are looking for answers to NFT derivatives trading from traditional financial markets and DeFi markets.

The traditional financial futures market used to have an inherent limitation, that is, it has a settlement date and limited leverage trading capacity, can not adapt to this 724 hours trading crypto market. As a result, BitMEX launched perpetual contracts on May 13, 2016, using an innovative money rate to regulate spot and contract prices as closely as possible, unlocking the opportunity to use up to a hundredfold leverage to make long/short bets. Its arrival has forever changed cryptocurrencies and the world of finance.

In fact, a number of NFTFi innovations were inspired by DeFi: for example, the first NFT AMM project, sudoswap, referenced uniswap v3 AMM's centralized liquidity scheme, and the point-to-pool Lending Protocol Leader referenced Aave.

With perpetuals in the DeFi market as a reference point, nftperp, a platform for perpetuals that can leverage long/short NFT, has emerged.

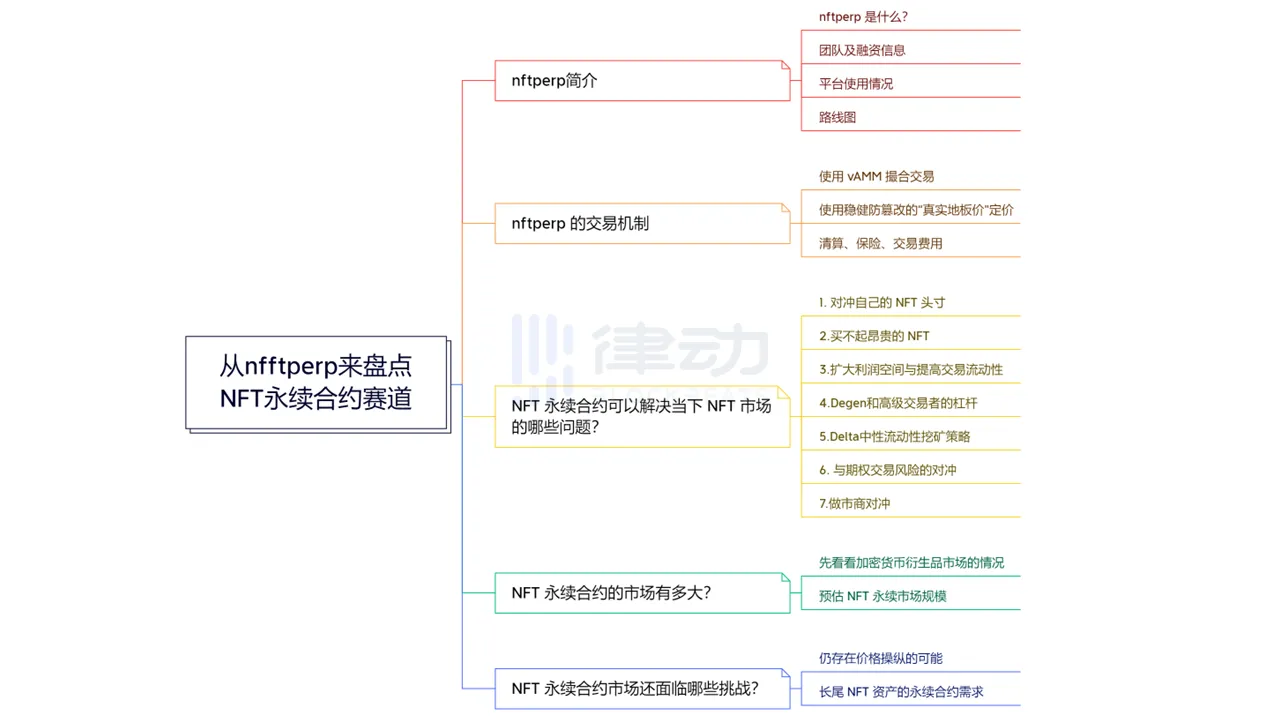

Introduction to nftperp

What is nftperp?

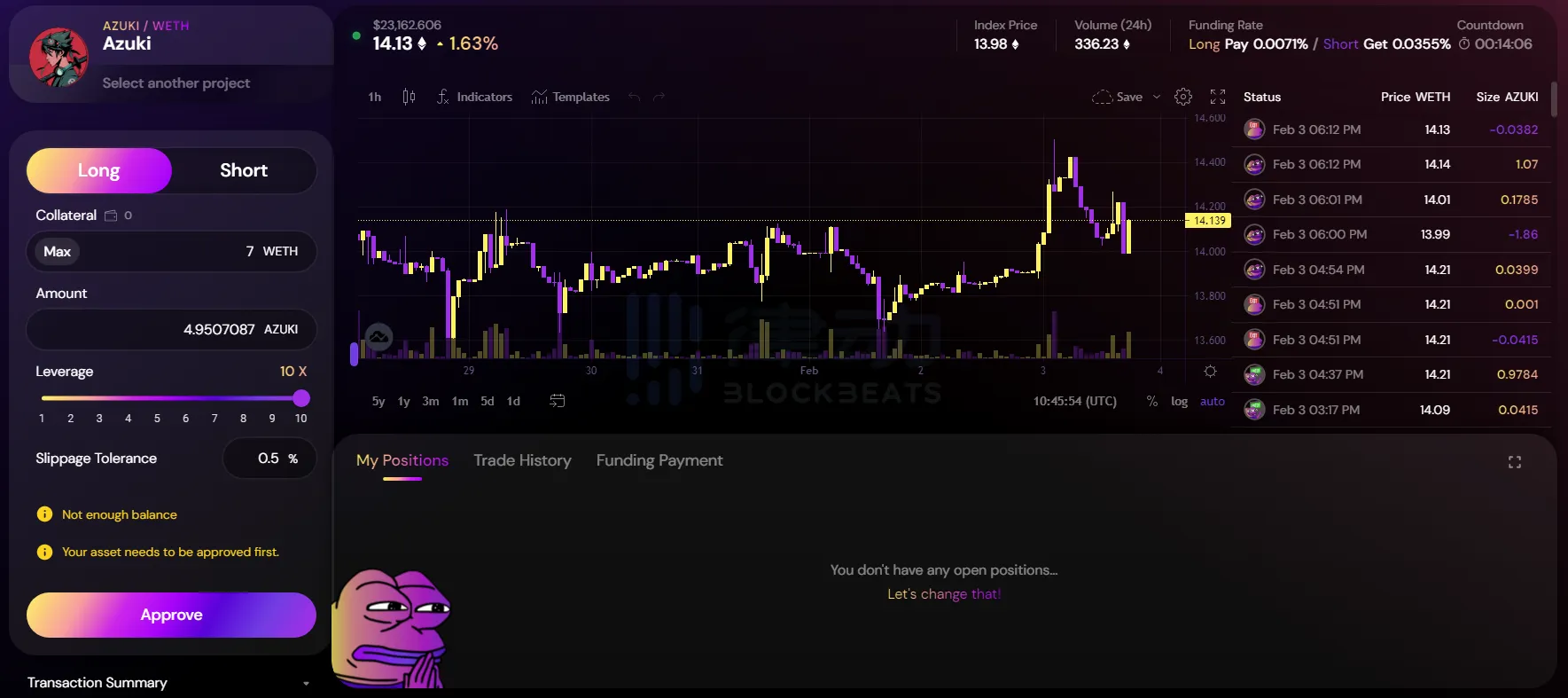

nftperp is a decentralized exchange for perpetual contracts for NFT:

• Based on Arbitrum

• Users can use ETH as collateral to carry out perpetual contract trading for blue chip NFT projects such as BAYC and CryptoPunk with up to 10 times leverage

• The protocol uses the NFT Price evaluation Protocol Upshot to integrate Chainlink Prognostic machine feeds real-time NFT price data on the chain based on the floor price of blue chip NFT

• No real liquidity provider is required and no order book is used, instead the vAMM (virtual automated Market Maker) mechanism pioneered by Perpetual Protocol is improved to match NFT perpetual contract trading

Team and financing information

Little information has been released about the team, except that the founder isJoseph Liu. There are also several investment analysts and researchersMckenna,Nick Chong,Ben RoyandBen LakoffAs a team advisor.

On November 25, nftperp, a trading platform for NFT perpetual contractsannounceRaised a $1.7 million seed round at a $17 million valuation, The round was funded by Dialectic, Maven 11, Flow Ventures, DCV Capital, Gagra Ventures, AscendEX Ventures, Perridon Ventures, Caballeros Capital, Cogitent Ventures, Nothing Research, Apollo Capital, Tykhe Block Ventures, OP Crypto and other institutions participated in the investment.

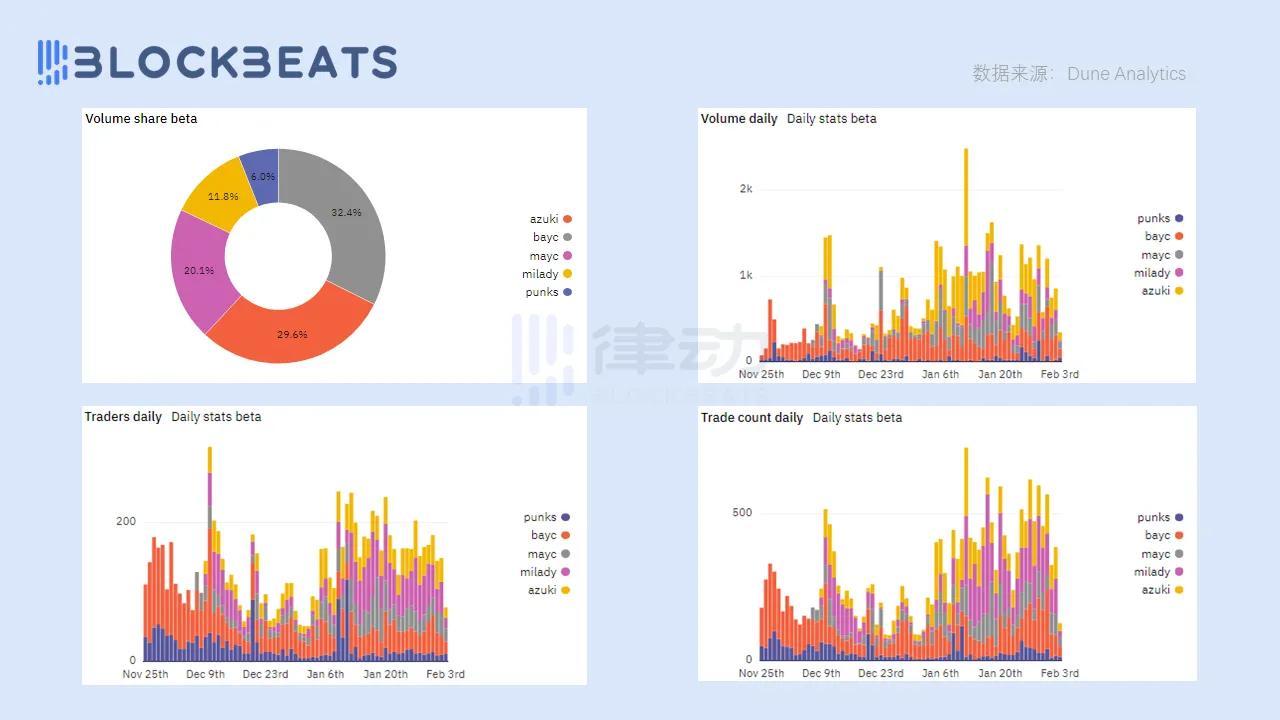

Platform usage

On November 25, 2022 nftperp launched the beta mainnet, according to Dune AnalyticsdataBy the time of publication:

• Cumulative trading volume exceeded $70 million

• 1,381 users made a total of 21,150 transactions

• Currently, the platform only supports perpetual contract trading for BAYC, Azuki, MAYC, CryptoPunks and Milady series

• The most traded NFT series is Bored Ape Yacht Club with 32.4% share, followed by Azuki with 29.6%

Road map

According to the officialRoad mapAccording to the report, plans beyond 2023 include:

• V1 goes online on the public main network

• Mafia Nuts on sale

• L2 solution reassessment

• nftperp token distribution

• NFT index derivatives

• Permissionless markets

• Structured product launches and more

Trading mechanism of nftperp

Use vAMM to broker deals

The original static vAMM

In 2018, Perpetual Protocol, a decentralized perpetual trading platform, launched vAMM (Virtual Automated Market Makers) mechanism.

Like ordinary AMM, vAMM also adopts x * y = k for automatic price discovery. The difference is that vAMM does not require a real liquidity provider. Users will create virtual assets after depositing real assets as collateral in the smart contract vault. Then trade and quote in the liquidity pool according to x * y = k, which also provides the function of short and leverage trading, and avoid volatile losses.

vAMM is an independent settlement market, and all profits and losses are settled directly in the guarantee vault, that is, the profit of one trader in vAMM is the loss of other traders.

How does vAMM settle profit and loss independently

However, the original static vAMM will have problems in the unilateral market: If the spot price rises sharply in a bull market, a large number of long positions need to be established to keep the contract price in line with the spot price, so the capital rate is likely to be paid to the long holders, and the short bears have no incentive to pay the capital rate, that is, the capital rate causes the imbalance of long and short interest, and the price will deviate far from the combination curve. There is a systemic risk to the agreement.

To address this problem, Perpetual Protocol v2 integrates the vAMM mechanism with Uniswap v3's centralized liquidity, while providing PERP liquidity incentives and on-line limit order features. On the basis of Solana's Drift, Dynamic vAMM is developed through "re-coupling" and "liquidity adjustment".

nftperp introduces dynamic vAMM

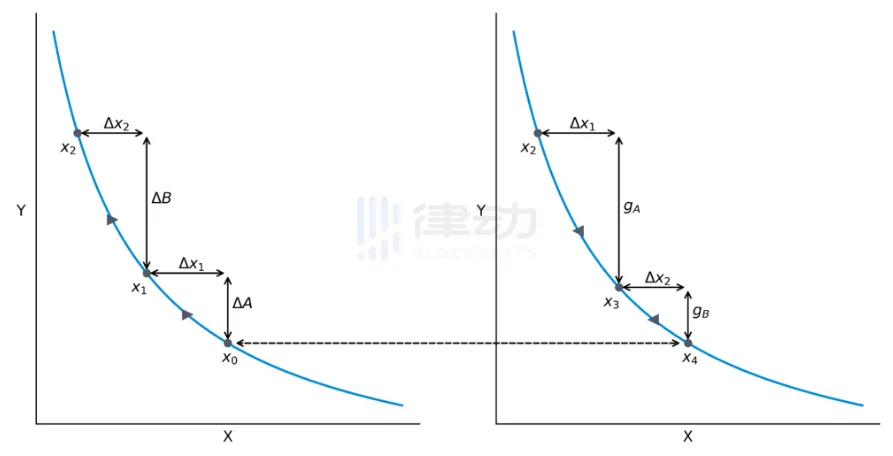

nftperp uses Dynamic Virtual Liquidity (DVL) for reference to the dynamic vAMM of Drift, so that the virtual assets x and y in x * y = k equation can be dynamically adjusted according to the following two situations (Refer to the nftperp documentation) :

• Convergence event: When the perpetual contract price deviates from the predictor price by more than 5% for more than 8 hours, a convergence event is identified. The system will adjust the y value to match the prognosticator price using the following formula. Once a convergence event is triggered, the virtual liquidity resets to the center of the union curve.

In addition, nftperp currently offers convergence incentives indefinitely. When the vAMM price deviates from the index price by more than 2.5%, users are incentivize with $vNFTP to narrow the price deviation. Convergence incentives are distributed according to the notional value of convergent trades (open for more than 30 minutes).

• Dynamic expansion/contraction of liquidity factor k: Since the protocol does not predict long/short positions on the platform, dynamic k is critical. k represents the depth of virtual liquidity. The larger the k, the smaller the slip point in the execution of the trade. As long as the process of k expansion/contraction does not affect the ratio between x and y, the agreement can withstand any market conditions (high versus low interest).

Through the above model, nftperp ensures that prices always trade in the most liquid part of the vAMM curve, and the available virtual liquidity corresponds to the trading demand, allowing traders to obtain the optimal slip point and available liquidity.

In addition, in order to ensure the high availability of nftperp vAMM in abnormal market conditions, the following two optimizations were carried out:

• Dynamic money rate: The standard money rate takes into account position size, contract marker price and predictor price, while nftperp takes into account the total ratio between long and short interest to better balance open interest. In addition, the capital rate is updated hourly to ensure that the contract price does not deviate too far from the NFT floor price.

• Volatility limits: A ±2% variation limit has been set for the contract price per block to protect the agreement from manipulation by flash lending attacks and insurance fund losses during periods of high volatility. This was experienced with Drift v1, where large fluctuations in LUNA prices resulted in unrealized losses and gains imbalances within the system, and excess gains could be withdrawn from the insurance fund without restriction.

Use robust tamper-proof "real floor" pricing

According tonftperp official documentThis indicates that NFT pricing/valuation is very difficult due to its non-homogeneity. Floor price is used as a pricing/valuation indicator in most current agreements related to NFT.

However, the direct use of NFT floor prices as predictive machine feed price data raises some problems:

• Price manipulation

• A single NFT listing (becoming a floor price) does not represent a broad consensus on the NFT series

• Minimum selling price represents seller only and not fair price (price agreed upon by bid and asking price)

Among them, price manipulation is the most obvious problem, even high unit price BAYC and other blue chip NFT can not escape. In November, for example, BAYC's seventh-largest positionFranklinHad "manipulated" floor prices to cause BendDAO to trigger auction liquidation in his "smash arbitrage" strategy. (Please refer toThe BAYC Crash: When a Man Dies, a Man Dies.One article)

Upshot x Chainlink

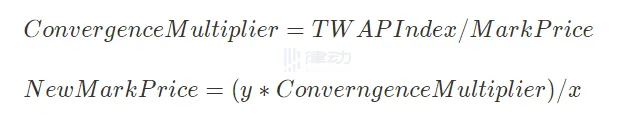

Referring to the DropsDAO NFT prognosticator model, nftperp integrated Chainlink prognosticator data with NFT Price evaluation protocol Upshot, and finally calculated the robust tamper-proof "True Floor Price" to feed to the platform for use.

Calculation method:

1. Collection and parsing: Collect and parse the on-chain/off-chain NFT trading events in the top NFT market

2. Check data eligibility: Determine whether data is qualified based on the transaction event type, Token ID, and cleaning transaction detection

3. Filtering abnormal data: Statistical methods and volatility scores are used to filter extreme outliers and possible outliers

4. Calculation: Use the time-weighted average price algorithm to calculate the filtered data and get the "real floor price".

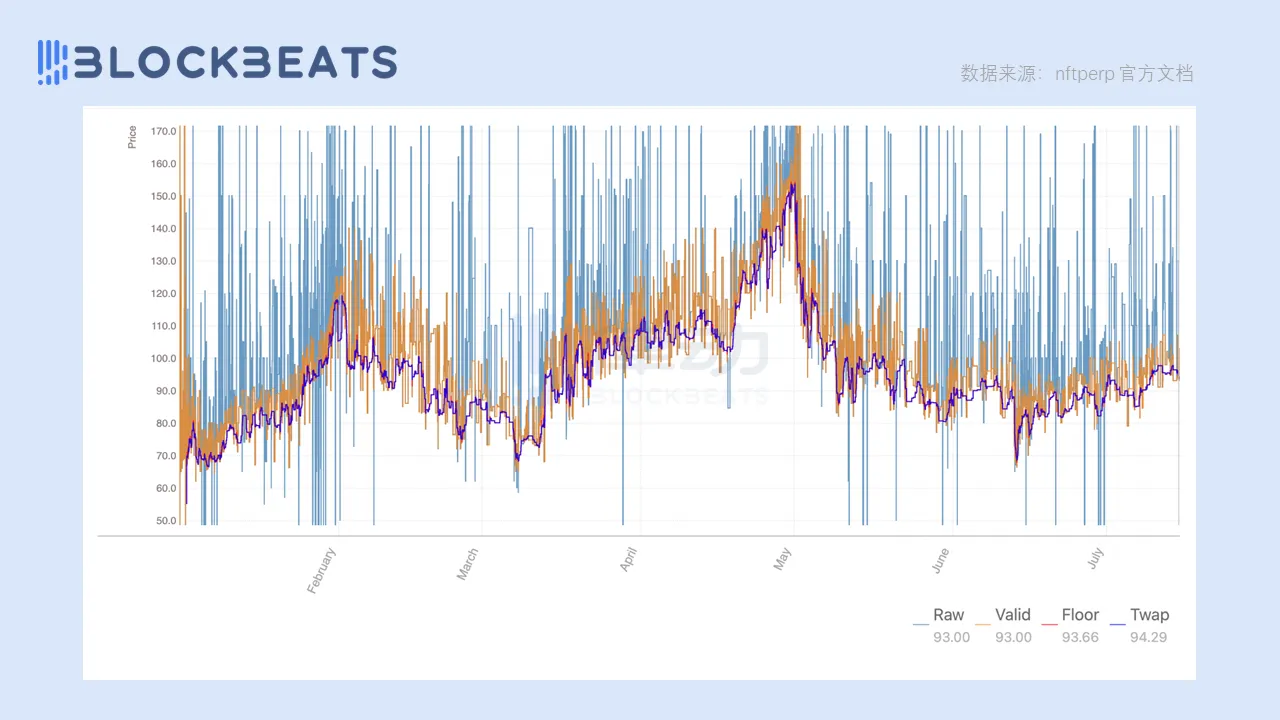

The data involved in the "real floor price" calculation is trade data extracted from the apis of Opensea, LooksRare and X2Y2 by NftPerp-operated prognostics. The calculated prices are updated every time a qualified public transaction occurs, ensuring that prices are up to date and protecting users from price manipulation. This process has been backtested on real blue-chip NFT transaction data sets to prove its effectiveness, as shown in the figure below.

Clearing, insurance, transaction costs

When traders take leveraged positions, they use collateral to borrow money from agreements to buy and sell assets. When the market moves against them and the value of the trader's position approaches a certain threshold with the value of the original collateral, the agreement liquidates the position to maintain its solvency.

When the value of the trader's position moves against them, their losses are shifted to their margin, or initial offset. That agreement is now at risk, with sudden price movements that could make traders' positions worth less than the original collateral. When the value of a trader's position gets too close to the value of the original collateral, the agreement liquidates the position to maintain its solvency.

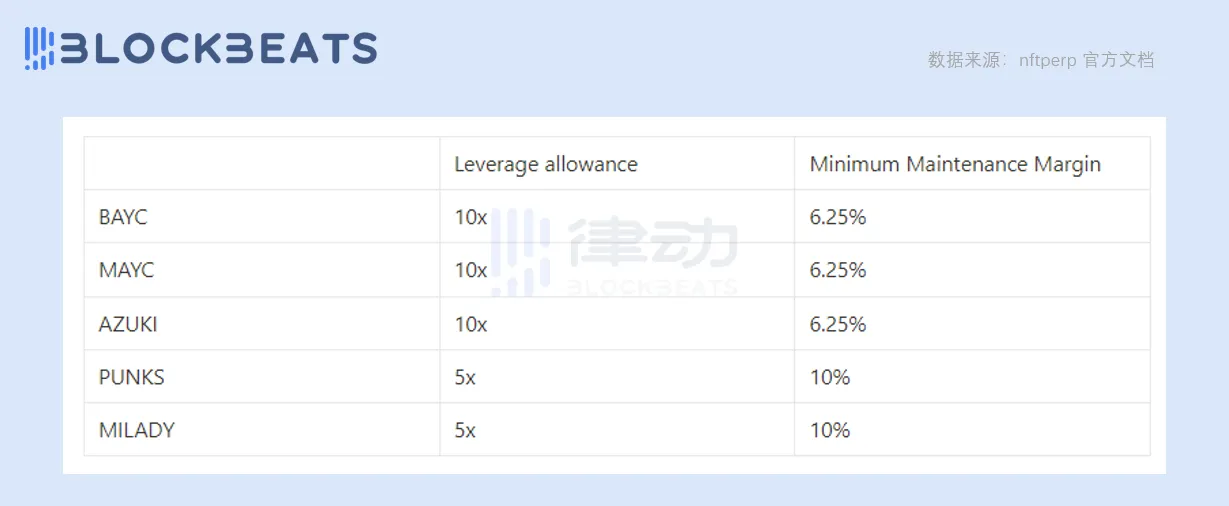

The maximum leverage permissible and minimum margin ratio requirements are different for each NFT set

nftperp employs the traditional Keeper bots liquidation mechanism, which earns 1.25% of the notional position size at liquidation, with the remainder going into the insurance fund of the agreement.

The insurance fund is used to ensure the solvency of the Agreement on bad debts. The funds in the fund pool are composed of settlement and transaction fee income (0.15% transaction commission of the Agreement). The size of the insurance fund will grow with the adoption of the agreement and it will be able to pay out more open interest in the future.

Dynamic adjustment of protocol transaction costs

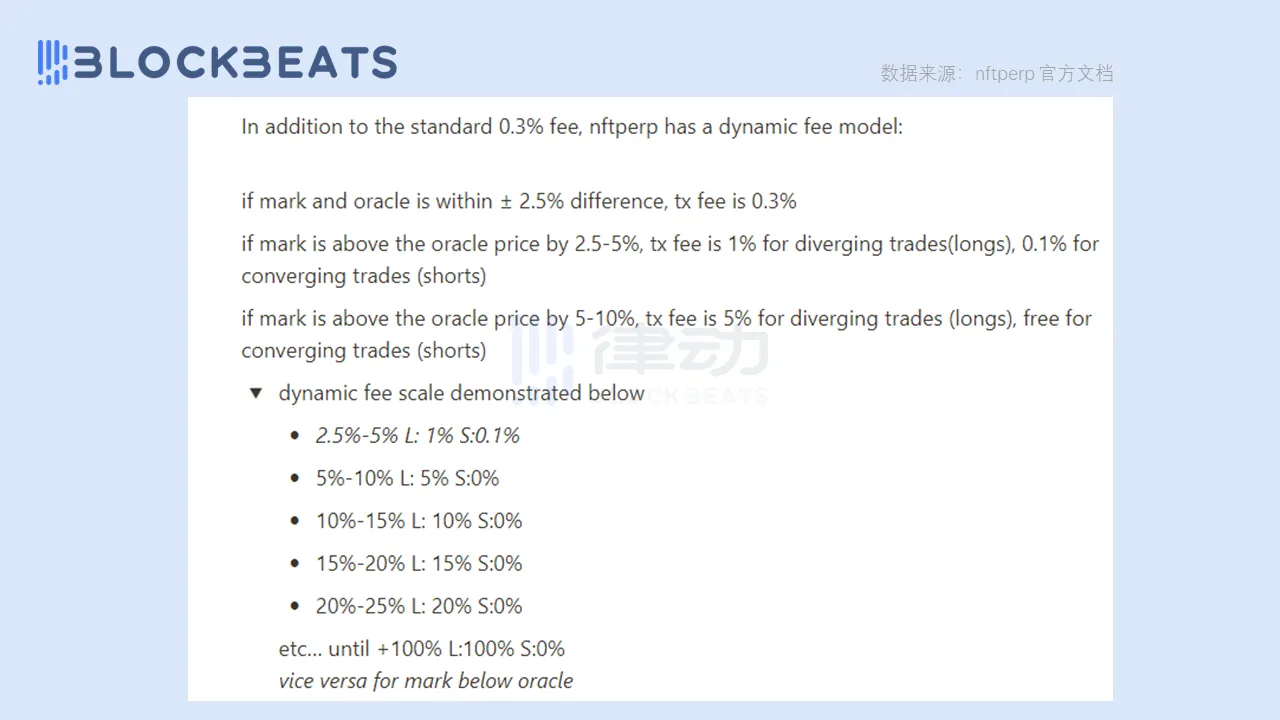

The base transaction fee for the agreement is set at 0.3%, but this figure is also dynamically adjusted with deviations from the marked price to incentivify the balance between bears and bulls. The fee adjustment mechanism is shown in the figure above. The official documents also mention that the token pledge will receive a portion of the transaction fee, but no information has been released yet.

What problems in the current NFT market can NFT perpetuals solve?

Current NFT market flaws:

• Inability to hedge risk

• Most people can't buy expensive blue chip NFT

• There is no easy and capital-efficient way to do leveraged trading

• Secondary market fees and royalties cut into traders' profits

nftperp offers seven scenario-specific solutions to these problems.

(See the official nftperp Use Case -- Filling the Gap in NFT Finance article)

1. Hedge your NFT position

To own NFT is to own the spot, and many traders/collectors want to hedge against a potential decline while holding on to NFT after its price has risen. In this case, you can choose to open a short position with a risk exposure equal to the price of the hedged NFT. This hedging strategy helps protect earnings while retaining ownership of the NFT, so the holder still gets all the associated benefits, such as whitelist opportunities, airdrops, and community access.

2. You can't afford expensive NFT

Blue-chip NFT are known to be expensive, and nftperp has lowered the barriers to entry, making it possible to create positions in Punks, BAYC, MAYC, Squiggles, Azuki and Moonbirds with collateral as low as $1.

This flexibility will not only cater to existing NFT traders, but will also make the entry to NFT trading more user friendly, which will be important for the future mass adoption of NFT.

3. Expand profit margin and improve trading liquidity

For example, when a trader bought BAYC from 70 ETH to 75 ETH and there was a surplus of 5 ETH, he decided to take profit. However, after deducting OpenSea's 2.5% commission plus BAYC's 2.5% royalty plus Gas Fee, the profit is less than 2 ETH. According to nftperp, the layer of platform and project parties not only reduces traders' profits, but also reduces the liquidity of the NFT market.

Nftperp offers a better option for optimizing trading profits, with the base fee for opening/closing a position set at 0.3%. To incentivethe balance between bears and bulls, the fee does adjust for open interest, but it would take extreme circumstances to achieve fees near OpenSea levels. Also, the protocol is based on Arbitrum, which has a much lower Gas Fee than Ethereum.

In addition to lower fees, perpetual contracts are more liquid than NFT spot contracts. Because there is no need to find a specific buyer for the NFT being sold, the position on the nftperp can be closed at any time. Liquidity is king in financial markets, especially for institutional trading, but the same benefits apply to all traders.

4. Leverage for Degen and senior traders

Leverage is a powerful tool, nftperp offers up to 10x long and short leverage, but that magnifies all gains and losses. Therefore, often the use of leverage requires expertise in NFT market dynamics and catalysts for the specific set of NFT being traded. For traders with a high risk tolerance or a strong belief in a particular trade, leverage can provide greater capital efficiency.

5. Delta neutral liquidity mining strategy

NFT mortgage lending protocols such as BendDAO and Jpeg'd allow users to deposit their NFT in a vault to lend money. Users can bring these loans into the wider DeFi ecosystem to earn revenue, and repay the loan to get back the NFT deposited at a profit. The main risk for borrowers is that their NFT will be liquidated if its value falls and reduces their mortgage rate below a certain threshold. In this case, short hedging can be a useful tool. In the event of a loss in the value of the deposited NFT, the short seller would profit, providing the depositor with additional capital to repay enough of the loan and avoid liquidation.

6. Hedging against options trading risk

Options can be used as another form of NFT financial derivative. Another common downside protection strategy for holders is the purchase of a put option, which grants them the right to sell the NFT at a predetermined price within a set period of time. The seller who trades a put assumes this downside risk in exchange for a benefit in the form of an option premium paid by the buyer. To hedge this risk using nftperp, put sellers will short on the same NFT set to protect them if the option is exercised. And vice versa.

Refer to the recent Hook Protocol on the nftperp and NFT options protocol for Delta neutralityContent of cooperation.

7. Market makers hedge

NFT market makers and users of NFT AMMs can also benefit from hedging. With platforms such as Sudoswap bringing liquidity pool-based trades to the NFT market, liquidity providers can now deposit their NFT/FT into these pools and specify their bid/ask price for buying/selling NFT. Traders can then buy and sell NFT in the pool at a price determined by the pool's association curve.

When LP can be hedged via nftperp, bid-ask spreads should tighten as bidders can reduce downside risk by shorting in the event of a falling price. This will improve the liquidity in the pool and may improve the utilization of funds for traders.

How big is the market for NFT perpetuals?

Let's start with the cryptocurrency derivatives market

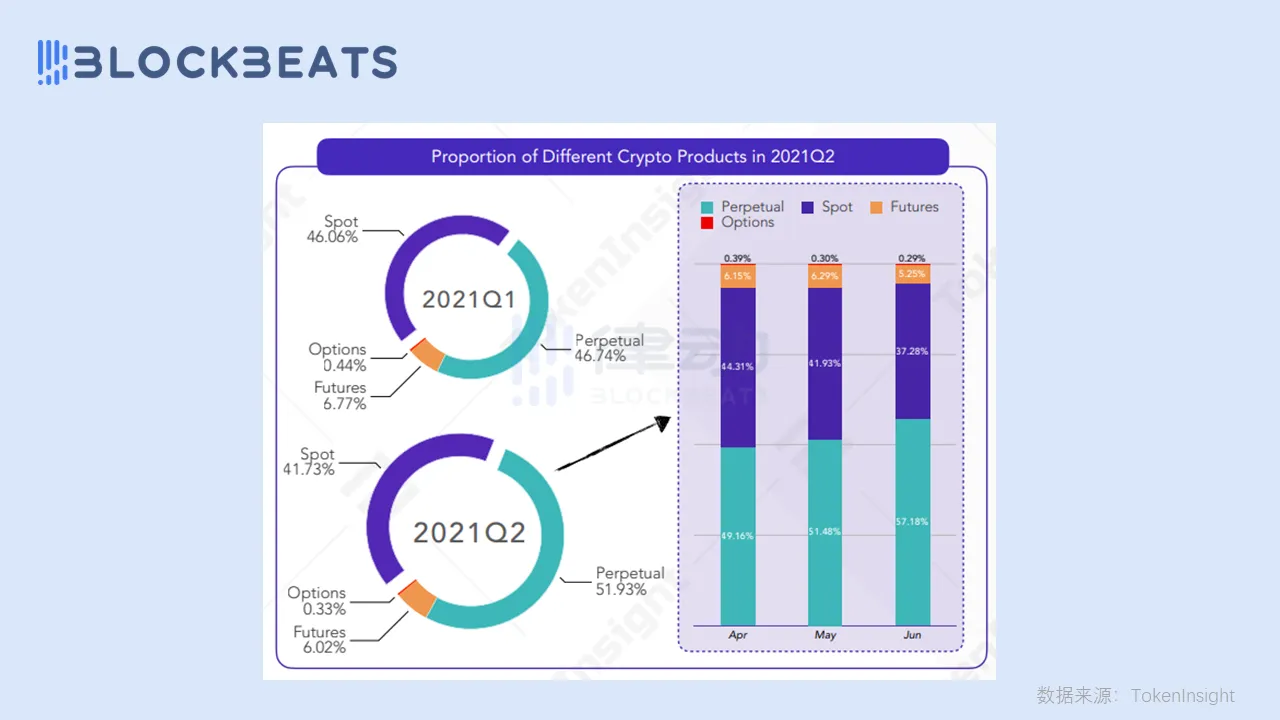

In line with traditional financial markets, crypto markets are larger than spot markets for derivatives trading. According to TokenInsight, $19 trillion has been traded in a single Q2 contract for the year 21, or more than $200 billion a day, surpassing the spot level. If the total market value of cryptocurrencies reaches $10 trillion within five years, the accompanying derivatives volume could reach $70- $100 trillion.

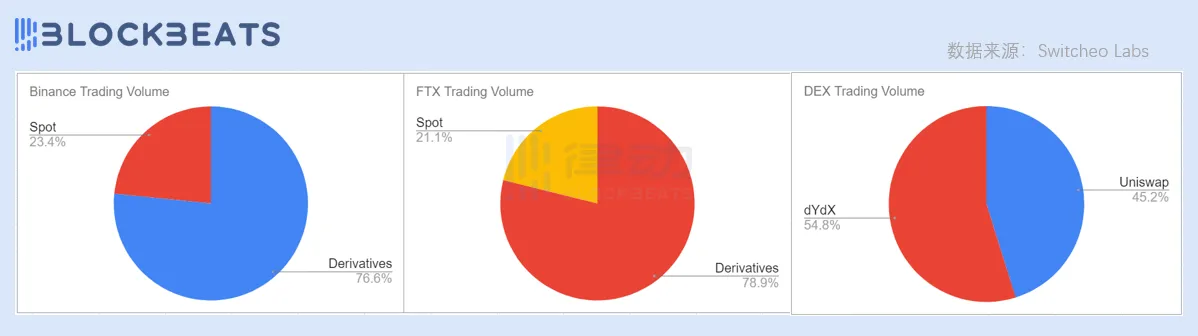

According to Switcheo Labs, cryptocurrency derivatives trading on centralized exchanges accounted for an average of 69% of total cryptocurrency trading volume. For example, Binance generated 76.6% of its daily trading volume from derivatives ($49.52 billion of $64.65 billion), while FTX generated 78.9% of its daily trading volume from derivatives ($6.22 billion of $7.88 billion).

In terms of decentralized exchanges, let's compare the volume of Uniswap and dYdX as they are the largest spot and derivatives markets in the space. Uniswap's daily trading volume was $1.09 billion, while dYdX's derivatives volume averaged $1.33 billion. That's 45.2 percent and 54.8 percent, respectively.

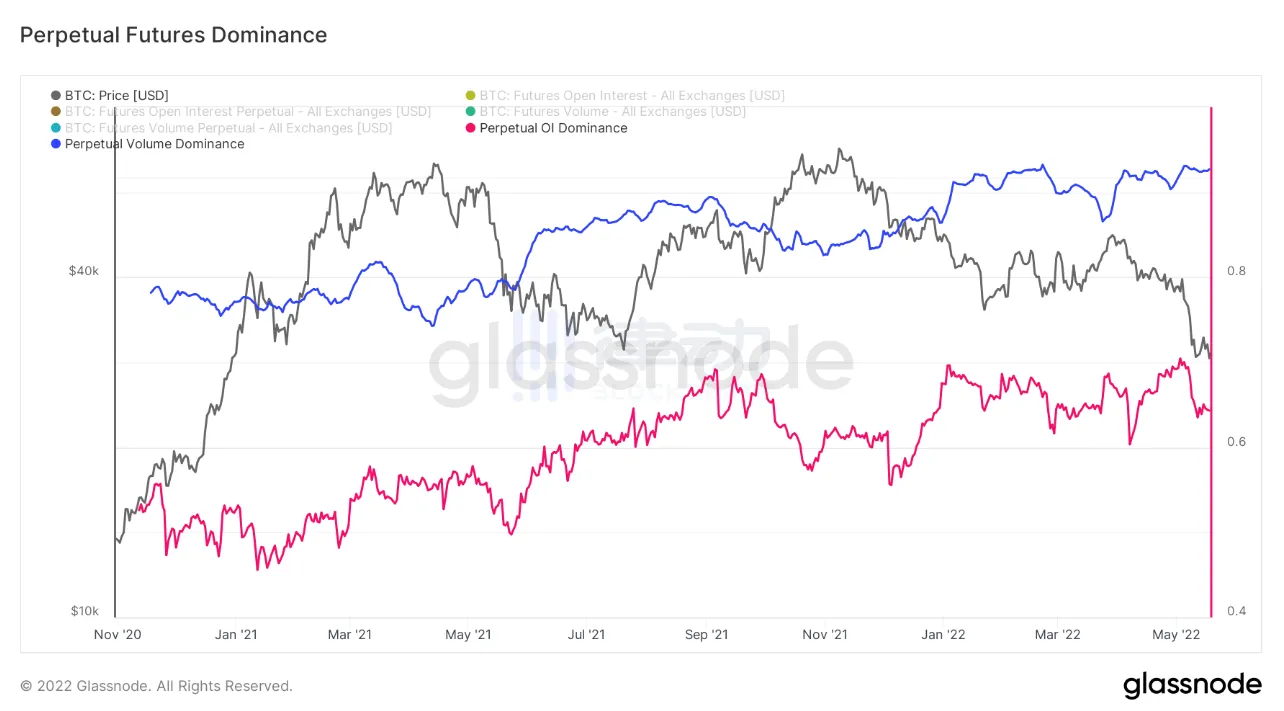

BloombergAs previously reported, BTC perpetual contracts account for 93 percent of total futures trading volume.

It follows that,Whether they are traditional financial markets, crypto markets, or decentralized exchanges, the derivatives market is larger than physical trading. As the first and unique derivative market of crypto market, perpetual contract is favored by the market because of its great trading flexibility compared with other financial products.

Estimated NFT sustainable market size

According to DappRadar, the largest NFT platform in terms of volume in the most recent month was Blur, with a total volume of $442 million and an average daily volume of $14.73 million. By comparing the head NFT spot trading platform, we can estimate the market share of nftperp as it is adopted by more traders.

According to Dune AnalyticsdataSince November 25, the cumulative total trading volume of nftperp is $71 million and the average daily trading volume is $1.01 million. By analogy with the ratio of spot trading to derivatives trading on decentralized trading platforms, it is conservatively estimated that the average daily trading volume of nftperp can reach the same level as that of the largest NFT spot trading platform. nftperp charges a 0.3 percent transaction fee for all positions on the platform, with a portion of the proceeds going to the pledge of its $NFTP platform token.

Trading volume in the NFT market over the past year

In addition, according to NFTGO, the total trading volume of the NFT market in the past year was $17.06 billion, and the average daily trading volume was $46.74 million. Similarly, similar to the cryptocurrency market, the potential of the derivatives market of NFT is huge.

What are the remaining challenges facing the NFT perpetual contract market?

There is still the possibility of price manipulation

There is the possibility of price manipulation in any financial market. Due to the small size of the NFT market, spot price is relatively easy to be manipulated. When spot price manipulation occurs, sharp price fluctuations may lead to a large number of liquidation events in the derivatives market, and the insurance fund of the agreement may not be enough to repay bad debts, thus the agreement will face systemic risks.

It is predictable that the market share of NFT derivatives will gradually increase. When the profit opportunity from the derivatives market is greater than the cost of manipulating the spot market, price manipulation is bound to occur. Therefore, how to avoid or minimize the probability of such an event should be considered in advance.

The robustness of vAMM, the "real floor price" mechanism, and whether it can cooperate with the capital rate to maintain the normal operation of the system are still to be tested by the market.

The long tail NFT's perpetual contract needs still need to be met

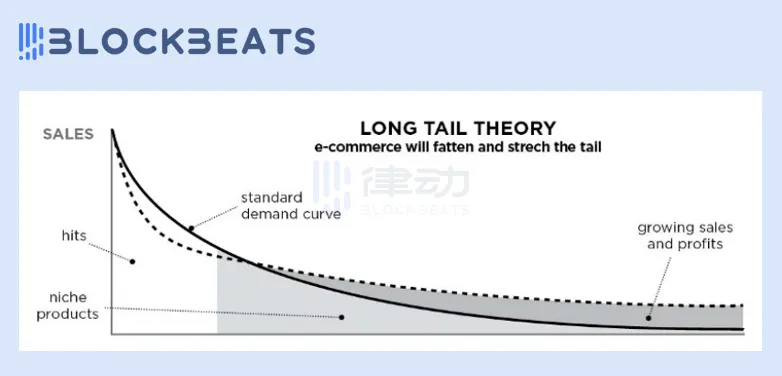

In 2004, Chris Anderson, editor-in-chief of Wired magazine, put forward The famous "The long tail theory", arguing thatThe Internet will enable a long tail of niche markets that will exceed even the economies of scale of a short head.

The NFT market has its own version of the "long tail.At present, there are tens of thousands of NFT projects in the NFT market, but only a few of them can enter the top 50, becoming the so-called "blue chip" and "quasi-blue chip", while the other projects constitute the "long tail". The same goes for cryptocurrency markets.

As a result, niche platforms/services that cater to the long tail of NFT and cryptocurrencies are likely to have greater value in the future.

Referring to the decentralized trading platform, DEX Uniswap, which trades spot, provides liquidity to many long-tail assets by allowing them to coin without a license. However, few decentralized perpetual contracts can realize the function of coin without a license (CoinFLEX, Mycelium, etc.). The reason is thatPerpetual contracts are more complex than spot deals, has higher requirements for matching trading mechanism, on-chain response speed, on-chain clearing and so on. At the same time,The barrier to creating a perpetual contract pool is highFor example, the decentralized perpetuation protocol TracerDAO (now Mycelium) requires a number of parameters to be configured if a perpetuation pool of tokens is to be deployed: leverage function, update interval, mint/burn fee, and so on.

For the NFT market, there is still demand for perpetual contracts for long-tail NFT assets, but products that enable non-blue-chip NFT projects to borrow and trade derivatives have not been available for a number of reasons.

In the case of nftperp, its "real floor price" requires high data quality and calculation methods, and the NFT market has a lot of unreliable data (such as wash trades), which makes it currently only applicable to the liquid blue chip NFT series. Take BendDAO as an example. Even the top blue chip BAYC will be manipulated by big players to "clear arbitrage" the floor price, let alone the smaller market value of long-tail NFT assets?

In the final analysis,The upstream problems such as poor liquidity of NFT and difficult valuation and pricing of NFT have not been well solved, which restricts the development of downstream NFTFi products and fails to release the potential of long-tail assets of NFT.

conclusion

Looking at DeFi, NFT and crypto in general, constant financial innovation has pushed the market to even higher levels. Increased composability between products in different segments will further stimulate innovation in the market, NBT-specific derivatives will provide more trading strategies for the market, and the nascent NFT market will gain more depth, just as options and futures contracts play an important role in mature financial markets.

As the NFT infrastructure becomes more and more complete, it is believed that the financial process of the upper level of NFT will continue to accelerate. NFT will not only be a small picture, but will become an important part of the crypto field and even the financial world together with NFTFi.

reference

https://www.coindesk.com/markets/2022/07/14/dex-contango-pushes-retro-alternative-to-perps-with-expirable-futures/

https://nftperp.notion.site/nftperp-xyz-2b456a853321481bac47e5a1a6bbfd4e

https://medium.com/@nftperp/nftperp-use-cases-filling-gaps-in-nft-finance-686c98813a0

https://medium.com/@nftperp/nftperp-raised-1-7m-for-its-seed-round-27a431b1f063

https://medium.com/@nftperp/nftperp-x-floordao-strategic-partnership-3293e060a257

https://image-tokeninsight-com.webpkgcache.com/doc/-/s/image.tokeninsight.com/levelPdf/TokenInsight_2021_Q2_Crypto_Tradi ng_Industry_Report(1)_2.pdf

https://mp.weixin.qq.com/s/CZ-vtQPaQBDxyl2qN0h1dQ

https://www.theblockbeats.info/news/31719

https://www.theblockbeats.info/news/33206

https://mp.weixin.qq.com/s/xKDtCK7EsoQgQWk-vTbBWw

https://mp.weixin.qq.com/s/efnm5uOa3GLoSHDcQoIJiw

https://blog.switcheo.com/trading-nft-perpetual-futures/

https://medium.com/huobi-research/nftfi%E5%8F%AF%E5%90%A6%E6%88%90%E7%82%BAnft%E5%B8%82%E5%A0%B4%E7%9A%84%E5%8A%A0%E9%80 %9F%E5%99%A8-cecbb57114cb

https://driftprotocol.medium.com/deep-dive-into-drifts-dynamic-vamm-part-1-3-c2121fbce3c4

https://www.bloomberg.com/news/articles/2022-05-25/end-of-risk-free-returns-leads-to-bitcoin-perpetuals-dominance

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR