Review of key policies and events in the US virtual asset industry in Q1

Article title: 2023 Q1 US virtual Asset Industry Key Policies, events Review

We3 small law

Up to now, the United States has not formed a unified regulatory framework for the Web3 virtual asset industry, showing the trend of "multi-regulatory", mainly at the federal and state levels of supervision, and by the United States Securities and Exchange Commission (SEC) represented by financial regulators, Regulate the market through the form of "Regulation by Enforcement". Since the United States is a country of case law, which is the main source of law in the United States, it is necessary to pay special attention to related judicial precedents of courts and administrative enforcement of regulatory departments in addition to relevant laws and regulations on virtual assets promulgated by Congress and regulatory authorities.

(from lawstrust.com)

The key policies and events of the US virtual asset industry in Q1 of 2023 are summarized as follows:

1. Coinbase was fined $50 million by financial regulators for violating anti-money laundering rules

On January 4, 2023, Coinbase agreed to pay a $50 million fine to the New York Department of Financial Services (NYDFS) to settle charges that it had allowed users to open accounts in 18/19 without adequate background checks. [1] Coinbase allegedly violated New York State financial Services laws and regulations relating to virtual currencies, remitters, transaction monitoring, and cybersecurity. These issues have left Coinbase vulnerable to serious criminal activity, including but not limited to fraud, money laundering, and potentially drug trafficking.

NYDFS also asked Coinbase to invest $50 million to strengthen its compliance program. [2] Paul Grewal, Coinbase's chief legal officer, said: "Coinbase and NYDFS have reached an agreement. Coinbase has taken substantive steps to address these historical deficiencies and remains committed to being a leader and role model in the virtual asset industry, including working with regulators on compliance."

2. The SEC accused Genesis and Gemini of issuing and selling unregistered securities to retail investors

On January 12, 2023, the SEC filed a lawsuit against Genesis, a virtual asset lending platform, and Gemini, a virtual asset exchange, alleging that the companies issued and sold unregistered securities to retail investors through their Gemini Earn lending products. [3]

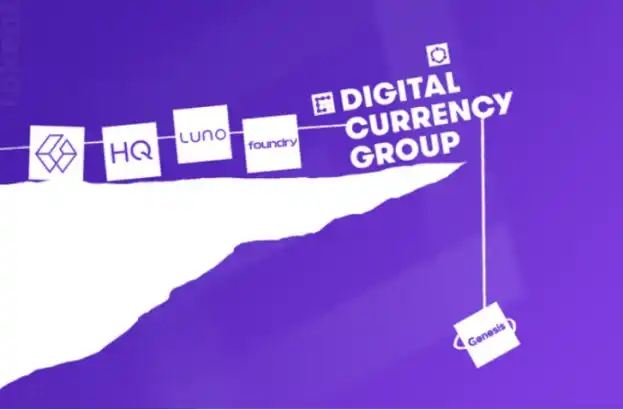

According to the complaint, in December 2020, Genesis, a subsidiary of the DCG Group, entered into a partnership with Gemini to provide Genesis's virtual asset lending services to Gemini's clients, including U.S. retail investors. Starting in February 2021, both parties began offering Gemini Earn products to retail investors, whereby investors lend virtual assets to Genesis in exchange for a promised high interest rate, with Gemini receiving a commission for acting as an agent to facilitate the transaction. In addition, Genesis then exercised its discretion to determine how to use the investors' virtual assets to generate income, and determined interest payments to Gemini Earn investors at its own discretion, according to the complaint.

In November 2022, Genesis suspended withdrawals from Gemini Earn investors because of a liquidity crisis involving $900 million in virtual assets and 340,000 Gemini Earn retail investors. Subsequently, Cameron Winklevoss, co-founder of Gemini, issued an open letter to the board of directors of DCG, parent company of Genesis, on January 10, 2023 [4], accusing DCG of making false statements to the public and to individuals regarding the arrearage. Led Gemini Earn investors to demand that DCG's board ouster DCG Chairman Barry Silbert, arguing that DCG had pumped $1.2 billion into Genesis and was involved in fraud in its loan books. Barry Silbert later denied the allegations.

The SEC argued that Genesis and Gemini were partners and that their products constituted an unregistered offering and sale of securities. In addition to the fact that Genesis was the issuer, both companies were liable and civil liability was sought from both companies. SEC Enforcement Director Gurbir S. Grewal said: "The recent collapse of virtual asset lenders and the suspension of Genesis withdrawals highlight the urgent need for relevant entities to comply with the U.S. Securities Act if they are offering securities to retail investors. As we have seen time and time again, failure to do so will deny investors the basic information they need to make informed investment decisions."

On January 13, 2023, Tyler Winklevoss issued a statement via Twitter saying he was disappointed by the SEC's action, noting that Gemini and other creditors were working together to recover their money, and that the SEC's action was not helpful to those creditors. Nor will it help Gemini Earn investors their money back. Tyler Winklevoss also noted that Gemini Earn is regulated by NYDFS, and that Gemini Earn has been in discussions with the SEC for more than 17 months, following the suspension of withdrawals from Genesis on November 16. The SEC has never raised any possibility of enforcement action.

(from Will Genesis Go Bankrupt? A Review of the Genesis/DCG Incident)

3. The SEC's review division lists emerging technologies and virtual assets as priorities for 2023

The SEC has come under fire from markets and lawmakers for failing to regulate the volatile industry in the wake of the collapse of FTX and numerous virtual asset platforms. On February 7, 2023, the SEC's Division of Examinations announced its six examinations for 2023, These include "Emerging Technologies and Crypto-Assets". [5] Each year, the department releases highlights of its review to help provide insight into its risk-based assessment methodology, including areas it believes pose potential risks to investors and U.S. capital markets.

After the release of the priority task, SEC on the virtual asset industry, more stringent, more tough new round of Regulation by Enforcement supervision. At the top of the list is Kraken and its ETH pledged interest-bearing products.

4. The SEC alleged that Kraken issued and sold pledged interest-bearing products that were unregistered securities

On February 9, 2023, the SEC issued a statement stating that Kraken, a SAN Francisco-based virtual asset exchange, has agreed to pay $30 million to the SEC and to cease offering U.S. customers its Staking as a Service, To settle SEC charges that it sold unregistered securities. [6] "When investors provide assets to such pledge services, they lose control of those assets and bear the risks associated with the platforms, with little protection," the SEC said. After receiving the investor's asset KEY, Kraken will control the investor's asset for any purpose (lack of disclosure, investors do not know), and finally promise the investor a high return.

SEC Chairman Gary Gensler went on camera to explain, in a video message, why Kraken and its ilk are subject to the Securities Act: "When a company or platform offers you these types of products and promises something in return, whether they call their services Lending, Earn Rewards, APY or Staking, the act of offering an investment contract in exchange for investors' money, should be protected under the federal Securities Act... "This enforcement action should make it clear to the market that service providers offering pledged interest-bearing products must register and provide full, fair and truthful information disclosure and investor protection."

Staking is a good staking staking. Kraken's staking products are staking a "security" staking. There is a good reason why Kraken's staking products are staking. The announcement Outlines the SEC's rationale for identifying Kraken's pledged interest-bearing products as' securities. ' First, Kraken received money from investors (complete control); Secondly, the funds are confused with the capital pool and used by Kraken for a common cause (the specific purpose is unknown); Kraken Staking promises up to 21% staking. (ETH Staking is somewhere between 3% and 5%.) Finally, investors only participate in the investment and realize returns through Kraken's efforts. This satisfies all the conditions of the Howey test, constitutes an "investment contract," and is a securities transaction.

(from kraken.com)

5. New York's financial regulator ordered Paxos to stop developing its Stablecoin BUSD

On February 13, 2023, Binance CZ issued a statement: New York State Department of Financial Services (NYDFS) Instructing Stablecoin issuer Paxos to stop minting new BUSDs (BUSDs are stablecoins wholly owned and managed by Paxos). Meanwhile, Paxos confirmed that it has received notice from the SEC regarding potential charges related to its BUSD product.

Paxos is a stablecoin issuer registered in New York State. It holds the virtual asset operation license of New York State Bitlicense and is directly regulated by NYDFS. Its BUSD product is built on the Ethereum blockchain. In accordance with the Guidelines [7] issued by NYDFS in June 2022, the full reserve shall be made in accordance with the assets of 1:1 USD. NYDFS reserves the right to require Paxos to stop issuing BUSDs or to stop Paxos's Bitlicense for failing to complete periodic user risk assessment and due diligence commitments to prevent the occurrence of bad behavior (such as money laundering) and other compliance matters. NYDFS said the regulatory action was intended to clarify the complex unresolved issues between Paxos and Binance.

In response to NYDFS 'regulatory action, Paxos said on its website that effective February 21, at NYDFS' direction and in close cooperation with the NYDFS, Paxos will cease issuing new BUSD tokens and will terminate its BUSD partnership with Binance. It will be followed by the Pax Dollar (USDP) to replace the previous BUSD. [8]

In a report on the issue, CNBC said that Paxos' BUSD product should be distinguished from Binance's self-published Binance-peg BUSD. Binance's self-issued BusDs are not regulated by NYDFS and are packaged independently on other chains outside Ethereum and listed on exchanges. In other words, Binance can freeze a Paxos-issued BUSD and recreate a similar BUSD on another chain, such as a BSC chain, called a binance-peg BUSD. [9] NYDFS stated, "The Department has not authorized Binance-Peg BUSD on any blockchain, and Binance-Peg BUSD is not issued by Paxos."

On February 13, 2023, Paxos issued a Notice stating that it had received a Wells Notice from the SEC on February 3, stating: "The SEC will consider taking action to designate BUSDs as securities and charge Paxos with failing to register its issue of BUSD Stabecoins with the SEC under the U.S. Securities Act." The SEC's Wells Notice is a formal notice that tells the recipient that the regulator plans to take relevant enforcement action against it and that the recipient has an opportunity to submit a written statement of its non-prosecution opinion to the SEC. "Paxos disagrees with the SEC staff," Paxos said. "Paxos has always placed the safety of its customers' assets first, and Paxos's issued BUSDs have always been backed by a fully dollar-denominated reserve 1:1, fully segregated and kept in remote accounts, and is prepared to litigate if necessary." [10]

There is a lot of speculation about the reasons for the SEC's regulatory action. One view is that Kraken's underlying interest-bearing assets may have something to do with the fact that Kraken's pledged interest-bearing products were penalized by the SEC. Stablecoins may be treated as Money Market Mutual Funds (MMMFs), although they have no expectation of profit. MMMFS are securities offered by companies that invest in commercial notes, certificates of deposit, Treasury bonds and other assets, which are regulated by the SEC. Circle also has similar products, so it may be regulated similarly.

Later, NYDFS explained more in a report with Bloomberg [11]. The reason for NYDFS 'request to stop issuing BUSDs appears to have nothing to do with Stablecoin's security designation, and the real reason may have to do with Circle's complaint of mismanagement of Binance-Peg BusDs' reserves.

(from cryptotimes.io)

6. SEC's New Virtual Asset Hosting Rules

On February 15, 2023, SEC issued a proposed proposal on qualified custodians of investment advisers [12], which further enhanced the custody requirements for virtual assets and extended the requirements to investment advisers such as funds. They are required to hold the virtual assets using Qualified Custodians. The proposal aims to raise the threshold for improper use and abuse of user assets by investment advisers, and may further squeeze the living space of small and medium-sized virtual asset platforms.

SEC Chairman Gary Gensler has stressed that the current rules (the 2009 rule) cover a wide range of virtual assets and make them subject to regulation. Although some virtual asset trading and lending platforms claim to be able to hold investors' virtual assets, this does not mean that they are qualified custodians. Some platforms do not properly isolate investors' virtual assets, but confuse investors' assets, resulting in the "bank run" and other similar situations, investors' assets become the assets of failed companies. Seriously violate the interests of investors. Through this expanded Qualified Custodian rule for investment advisers, both investors and advisers will receive the protections they deserve. [13]

It can be seen that after the collapse of FTX, SEC put forward higher requirements for the hosting business of virtual asset platform. The SEC proposal would encourage investors to place their virtual assets in custody with licensed institutions or mainstream banks. At the same time, it will give bank financial regulators the ability to examine virtual asset activities.

In practice, we see that the main body with custody business has at least obtained the relevant Trust Charter at the state level and accepted the supervision of state financial regulators. Anchorage Digital Bank went a step further and got federal approval from the Office of the Comptroller of the Currency, which oversees U.S. banking institutions, To become a truly federally chartered virtual asset bank. [14]

7. The SEC charged Terraform Labs and Do Kwon with billions of dollars in virtual asset securities fraud

On February 16, 2023, the SEC issued a notice announcing that it had filed a civil lawsuit against Terraform Labs, the Singapore-based company behind TerraUSD Stablecoin, and its CEO Do Kwon, alleging that it had failed to disclose information related to the virtual asset security to the public as required. And misled investors with false accounts before the crash. [15] Do Kwon's behavior may constitute fraud in virtual asset securities, which violates the Securities Act and Securities Exchange Act of the United States concerning the issuance and sale of unregistered securities, anti-fraud and other laws and regulations. It is important to note that the SEC specifically alleges in the filing that Luna and UST are unregistered securities.

Terraform and Do Kwon marketed virtual asset securities to investors seeking a profit and repeatedly claimed the tokens would increase in value, the SEC complaint said. For example, they tout UST as a "" yielding" "stablecoin and advertise that it pays up to 20 percent interest through anchored agreements. The SEC also alleges that in marketing LUNA tokens, Terraform and Kwon repeatedly misled and deceived investors into believing that a popular South Korean mobile payment app was using Terra blockchain to settle transactions in order to add value to LUNA. Terraform and Kwon also allegedly misled investors about the stability of UST. UST was de-pegged from the dollar in May 2022, and the price of its and its sister tokens plummeted to near zero.

Do Kwon was arrested in Montenegro on March 23, 2023. Montenegro's Interior Minister FilipAdzic said via Twitter that police detained a South Korean citizen, Kwon, who is suspected to be one of the wanted men. He was detained at Podgorica airport for falsifying documents while trying to fly to Dubai using false documents. After his identity was confirmed, the United States and South Korea filed extradition requests for Do Kwon.

(from Staff at crypto operator Terraform Labs hit with flight ban)

8. Utah DAO act

On March 1, 2023, the Utah Legislature passed H.B. 357 the Utah Decentralized Autonomous Organizations Act [16], This marks the DAO as an organization form in the United States after the Wyoming DAO Act once again gained independent legal status. The law goes into effect in 2024 on January 1.

The Utah DAO Act gave DAO an independent and new form of legal recognition. In terms of legal nature, DAO has independent and legal person status different from other members, can Sue and respond to lawsuits in its own name, and has the right to carry out any legal affairs. In this respect, the Utah DAO Act differs from Wyoming's regulatory framework that only incorporated DAO into the Limited Liability Company (LLC), but created DAO LLD as a separate legal entity with a clear distinction from LLC.

In terms of limitation of liability, the system of limited liability applies. With all the assets of DAO as the upper limit of liability, external liability is limited; DAO members are not liable after the assets of the DAO are exhausted; Not personally liable as a DAO member for the errors or faults of other DAO members, but only for on-chain contributions promised by DAO members to DAO. In this regard, the issue that the Commodity Trading Commission (CFTC) of the United States required Ooki DAO members to assume unlimited joint and several liability with their personal assets was resolved in court.

The Utah DAO Act also made innovative provisions on the taxation system of DAO (the form of partnership is default, but the form of company is changed), legal representative (it is convenient to deal with the affairs that cannot be completed on the chain, and does not bear joint and several liabilities), DAO members and governance (identification of token holders) and other aspects. It aims at organic integration between on-chain DAO and off-chain legal entities.

9. Crypto-friendly banks Slivergate Bank and Signature Bank were taken over by the FDIC

On March 1, 2023, Silvergate Bank announced that it would not be able to file its annual 10-K report with the SEC on time and that it would likely experience a "capital shortfall." [17] A number of partners, including Coinbase, Circle, Tether, and Galaxy Digital, subsequently disassociated themselves, causing Silvergate Bank's share price to plummet.

Silvergate Bank is a community retail bank based in California that positions itself as a gateway to the virtual asset industry, accepting deposits from virtual asset exchanges and institutions, And established its own virtual currency settlement and payment Network - "Silvergate Exchange Network" (SEN) real-time payment system. The system enables virtual asset exchanges, institutions and customers to exchange virtual currencies with fiat currencies. With the development of the virtual asset industry, Silvergate Bank listed on the New York Stock Exchange at $13 in November 2019.

In late 2022, with virtual asset prices falling and the collapse of many virtual asset exchanges and lenders, concerns arose about the potential impact of deposit losses and credit exposure on Silvergate Bank, as well as Silvergate Bank's potential impact on the broader virtual asset industry. The collapse of FTX in November 2022 left Silvergate Bank with more than $1 billion in exposure to FTX. What's more, the FTX crash caused a serious "Bank run". Silvergate Bank handled more than $8.1 billion of withdrawals. In order to meet the massive withdrawals, Silvergate Bank was forced to take a huge discount loss and sell assets of about $5.2 billion. And received a $4.3 billion loan from the Federal Home Loan Banks. According to Silvergate Bank's Q4 2022 results, customer deposits under management plummeted to $3.8 billion, down from $11.9 billion in Q3, and resulted in a loss of nearly $1 billion.

On March 8, 2023, Silvergate Bank said in an SEC filing that it would wind up operations and voluntarily liquidate Silvergate Bank in accordance with applicable regulatory procedures. [18] "The bank's liquidation plan includes full repayment of all deposits and consideration of how best to resolve claims and preserve the remaining value of its assets, including its know-how and tax assets." Silvergate Bank was subsequently taken over by the Federal Deposit Insurance Corporation (FDIC).

On March 10, 2023, a brief 48-hour Bank run, against the backdrop of the Fed's rate hike, caused severe liquidity problems at Silicon Valley Bank (SVB), the 16th largest bank in the United States with a 40-year history. It was taken over by the FDIC. It was the second-largest bank failure in US history, after Washington Mutual's failure in 2008. On March 12, 2023, the Treasury Department, the Federal Reserve, and the FDIC issued a joint statement saying that, after negotiations, they had agreed to complete their bailout of Silicon Valley Banks through the FDIC in a manner that fully protects all depositors. Beginning Monday, March 13, depositors will have access to and access to all their money. Losses related to Silicon Valley Bank's resolution will not be borne by taxpayers. [19]

Due to the influence of Silicon Valley Bank, on March 12, 2023, the US Treasury, the US Federal Reserve Board and the FDIC issued a joint statement, citing "systemic risk" to announce the closure of encryption-friendly bank Signature Bank, to prevent the continued spread of banking crisis; [20] At the same time, NYDFS appointed the FDIC as receiver to dispose of Signature Bank's assets, even though Signature Bank had recovered from the influence of Silicon Valley Bank and held a strong balance sheet.

U.S. bank regulators (the Office of the Comptroller of the Currency, OCC, at the federal level, and state financial regulators, such as NYDFS) have the power to revoke a bank's license because of mismanagement or insolvency. When a bank ceases operations, the Federal Deposit Insurance Corporation (FDIC) is appointed as the manager or receiver of the troubled bank (it plays an integral role in bailing it out or winding it up), Protect depositors' deposits and minimize the negative impact of bank closures on the overall financial system.

The closure of Silvergate Bank and Signature Bank, two crypto-friendly banks, has sent the virtual asset industry back to the days when formal banking accounts for virtual assets were not available years ago, as there was no immediate opportunity for any start-up to obtain a banking licence.

(from Crypto "s Last Stand in the US: USDC, Silvergate, Silicon Valley and Signature Banks Collapse in One Week)

10. The SEC charged Justin Sun with selling unregistered securities, fraud and market manipulation

On March 22, 2023, the SEC issued a notice announcing its decision against Justin Sun and three wholly owned companies, Tron Foundation Limited, BitTorrent Foundation Ltd. And Rainberry Inc., Sun and its affiliates. [21] The SEC complaint, filed in the U.S. District Court for the Southern District of New York, alleges that Sun and its affiliates offered multiple online "bounty programs" of unregistered securities, issued and sold TRX and BTT, and that these programs directly directed interested parties to promote TRX and BTT on social media, Join or recruit others to join Tron-affiliated Telegram and Discord channels and create BitTorrent accounts in exchange for TRX and BTT allocations. According to the complaint, these unregistered securities were issued and sold in violation of Section 5 of the Securities Act.

The SEC also accused Sun of orchestrating a Wash Trading scheme that artificially inflated the volume of trading in the secondary market TRX, involving large amounts of real-time buying and selling that made TRX appear to be actively trading without actual beneficial ownership changes, in violation of the anti-fraud and market manipulation provisions of the Securities Act. From at least April 2018 to February 2019, Sun directed the team he controlled to make more than 600,000 fake TRX transactions between the two accounts, an average of 4.5 million to 7.4 million transactions per day. Sun also provided a large supply of TRX, selling TRX to the secondary market, reaping $31 million in proceeds from illegal, unregistered token offerings and sales. In addition, the SEC alleged Sun violated the Securities and Exchange Act by conducting a scheme to pay celebrities to peddle TRX and BTT and by concealing information from the public about the celebrities' payments.

"This case once again demonstrates the very high risk that investors face when virtual asset securities are issued and sold without proper disclosure," SEC Chairman Gary Gensler said. "As alleged, Sun and its affiliates not only conducted the issuance and sale of unregistered securities targeting U.S. investors, but also made millions in illegal gains at the expense of investors, but they also falsely traded on unregistered virtual asset trading platforms in order to create the misleading appearance of active trading. Sun further induced investors to buy TRX and BTT by orchestrating a celebrity promotion in which he and the celebrities concealed the fact that the promotion was paid."

"While we are neutral when it comes to controversial technology, we are anything but neutral when it comes to investor protection," said SEC Enforcement Director Gurbir S. Grewal. "As alleged in the complaint, Sun and its affiliates used an age-old playbook to mislead and harm investors, First offering securities without complying with registration and disclosure requirements, and then manipulating the market for those securities. At the same time, Sun paid celebrities with millions of followers on social media to promote products with unregistered securities, while specifically instructing them not to disclose their compensation. This is exactly the kind of conduct the Securities Act is designed to prevent." [22]

11. The White House's annual economic report casts a negative light on the virtual property industry

On March 22, 2023, in the 2023 Economic Report of the President [23] of the White House, virtual assets were mentioned for the first time, saying that blockchain technology promoted financial innovation and led to the rise of virtual assets. But at the same time, the report lists many negative effects of virtual assets, attacking virtual assets as useless and worthless. Virtual currency does not serve as a store of value and is not an effective payment tool.

"Although advocates often claim that virtual assets are a revolutionary innovation, the design of these assets often reflects ignorance of fundamental economic principles learned over centuries in economics and finance, and such inadequate design is often detrimental to consumers and investors." There is also a conflict with virtual assets being declared both "currencies" and "investment vehicles." As a currency, such an instrument should have a stable value and exhibit limited price fluctuations. But as a risky asset, it should experience price fluctuations in order for investors to achieve high expected returns, and the riskier the asset, the less likely it is to function effectively as a currency.

12. The CFTC accused Binance and its founder, CZ, of deliberately evading U.S. law by operating an illegal exchange for virtual asset derivatives

On March 27, 2023, the Commodity Futures Trading Commission (CFTC) announced that it had filed a civil complaint in the United States District Court for the Northern District of Illinois alleging multiple violations of the Commodity Exchange Act (CEA) and the CFTC by CZ and the three entities that operate the Binance platform. The CFTC also accused Samuel Lim, Binance's former chief compliance officer, of aiding and abetting Binance's practices. [24]

According to the indictment, from July 2019 to the present, Binance offered and executed virtual asset derivatives transactions to U.S. persons (although blocking U.S. IP addresses). Under the direction of CZ, Binance instructed its employees and clients to avoid compliance controls (including through VPNs, shell companies, etc.), Willfully evades U.S. law, conducts business in an opaque manner, flouts CEA and CFTC regulations, and systematically engages in regulatory arbitrage for commercial gain. [25]

The CFTC alleged that entities such as Binance, which offer virtual asset derivatives services in the United States, should register with the CFTC as Futures Commission Merchants (FCM) to undertake compliance obligations such as KYC, And to implement basic compliance requirements aimed at preventing and detecting terrorist financing and money laundering. Under the derivatives trading business conducted by Binance, it should also be registered with the CFTC as a Designated Contract Market (DCM) or Swap Execution Facility (SEF). Binance has never registered anything with the CFTC.

As a result, the CFTC alleges, through civil action, that CZ and its affiliates violated laws and regulations related to futures trading, illegal over-the-counter commodity options, failure to register as futures commissioners, or designated contract markets, or swap executioners, and that they failed to monitor, implement KYC or anti-money laundering procedures, and develop substandard compliance programs. Seek civil penalties and permanent bans on trading and registration from the court against CZ and its affiliates.

Rostin Behnam, chairman of the CFTC, said: "Today's enforcement action shows that no district, or purported lack of jurisdiction, can prevent the CFTC from protecting American investors. I have made it clear that the CFTC will continue to use all of its authority to detect and stop misconduct in the volatile and high-risk virtual asset industry... Binance knew for years that they were violating CFTC regulations, but actively worked to keep money flowing and avoid compliance. This should serve as a warning to everyone in the world of virtual assets that the CFTC will not tolerate deliberate circumvention of U.S. law."

(from Binance)

summarize

In the context of frequent occurrence of black swans in the industry and the absence of legislation in Congress, the Regulation of the virtual asset industry in the United States in the first quarter of 2023 is still the financial regulator represented by the SEC, which standardizes the market through "Regulation by Enforcement".

SEC has been aiming at protecting the interests of investors and maintaining the fair and orderly operation of the securities market, and regulating the entire virtual asset industry. Gary Gensler in the August 2022 working video "What Are Crypto Trading Platforms? [26], talking about SEC's regulatory thoughts on the virtual asset market:

(1) Protect investors' interests on the basis of the U.S. Securities Act, which has worked well for 90 years. This is why we see the SEC desperately trying to classify all virtual assets as securities, and the first sentence in almost all enforcement actions is: "XXX issues and sells unregistered securities." The reason for this. We can see the SEC, after recovering from the aftermath of the FTX and other crashes in January, launching a new round of tougher regulatory enforcement, guided by the 2023 priorities issued by its review division, Genesis, Kraken, Paxos, Terraform Labs, Coinbase, Justin SUN, and more.

(2) Virtual asset exchanges need to be separated (such as market-making trading business and custody business) to avoid conflicts of interest and theft. This was evident in the FTX case, which was followed by the SEC's new rules for hosting virtual assets. Consider the 1933 Glass SteagallAct (which separated investment and commercial banking strictly to avoid investment banking risks) in the context of the Great Depression. And the 2010 Dodd Frank Act against the background of the subprime crisis (to break up speculative proprietary trading by large financial institutions and strengthen the regulation of financial derivatives to prevent systemic financial risks).

While we also saw an enforcement action by the CFTC against Binance at the end of Q1, the CFTC is still just doing what it's supposed to do -- market regulation and registration compliance for derivatives trading. There is still a regulatory vacuum. If virtual assets are allowed to be used, To tube, although CFTC It has the ability to regulate fraud and manipulation in the spot market, but it does. CFTC There is no ability to regulate spot trading practices that do not involve margin, leverage or financing. Eg. If you say Jean SEC To tube, then. SEC Only on the premise of identifying virtual assets as securities can its jurisdiction be exercised, and only under this high standard can fraud and market manipulation involving securities be derived. Therefore, under the background of no unified virtual assets supervision Act, the "Regulation by Enforcement" type supervision represented by SEC may continue for a long time.

But, as Coinbase put it after receiving the SEC's Wells Notice: "The U.S. virtual asset industry needs more guidance than enforcement." [27]

REFERENCE:

[1] NYDFS: Consent Order Issued to Coinbase, Inc.

https://www.dfs.ny.gov/system/files/documents/2023/01/ea20230104_coinbase.pdf

[2] Coinbase and NYDFS reach agreement to resolve compliance investigation

https://www.coinbase.com/blog/Coinbase-and-NYDFS-reach-agreement-to-resolve-compliance-investigation

[3] SEC Charges Genesis and Gemini for the Unregistered Offer and Sale of Crypto Asset Securities through the Gemini Earn Lending Program

https://www.sec.gov/news/press-release/2023-7

[4] An Open Letter to the Board of Digital Currency Group

https://assets.ctfassets.net/jg6lo9a2ukvr/7iwDdJ1D88ZUVCqVJzocDL/394114442846c3daccc7b05978e267e0/2023-01-10_-_Gemini_-_ Open_Letter_to_DCG_Board.pdf

[5] SEC Division of Examinations Announces 2023 Priorities

https://www.sec.gov/news/press-release/2023-24

[6] SEC, Kraken to Discontinue Unregistered Offer and Sale of Crypto Asset Staking-As-A-Service Program and Pay $30 Million to Settle SEC Charges

https://www.sec.gov/news/press-release/2023-25

[7] NYDFS, Guidance on the Issuance of U.S. Dollar-Backed Stablecoins

https://www.dfs.ny.gov/industry_guidance/industry_letters/il20220608_issuance_stablecoins

[8] Paxos Will Halt Minting New BUSD Tokens

https://paxos.com/2023/02/13/paxos-will-halt-minting-new-busd-tokens/

[9] Crypto firm Paxos to face SEC charges, ordered to stop minting Binance stablecoin

https://www.cnbc.com/2023/02/13/paxos-ordered-to-cease-minting-binance-stablecoin-by-new-york-regulator.html

[10] Paxos Issues Statement

https://paxos.com/2023/02/13/paxos-issues-statement/

[11] Bloomberg, Stablecoin Issuer Circle Warned Watchdog About Binance Token

https://news.bloomberglaw.com/securities-law/stablecoin-issuer-circle-warned-ny-watchdog-about-binance-token

[12] SEC Proposes Enhanced Safeguarding Rule for Registered Investment Advisers

https://www.sec.gov/news/press-release/2023-30

[13] Gary Gensler, Statement on Proposed Rules Regarding Investment Adviser Custody

https://www.sec.gov/news/statement/gensler-statement-custody-021523

[14] Anchorage Trust Company Convert to a National Trust Bank

https://www.occ.gov/news-issuances/news-releases/2021/nr-occ-2021-6a.pdf

[15] SEC Charges Terraform and CEO Do Kwon with Defrauding Investors in Crypto Schemes

https://www.sec.gov/news/press-release/2023-32

[16] Uath, H.B. 357 Decentralized Autonomous Organizations Amendments

https://le.utah.gov/~2023/bills/static/HB0357.html

[17] Slivergate SEC Filing

https://ir.silvergate.com/sec-filings/default.aspx

[18] Slivergate, FORM 8-K, 03/08/2023

https://ir.silvergate.com/sec-filings/sec-filings-details/default.aspx?FilingId=100117321969

[19] Silicon Valley Bank, Joint Statement by Treasury, Federal Reserve, and FDIC

https://www.federalreserve.gov/newsevents/pressreleases/monetary20230312b.htm

[20] Signature Bank, Joint Statement by the Department of the Treasury, Federal Reserve, and FDIC

https://www.fdic.gov/news/press-releases/2023/pr23017.html

[21] SEC Charges Crypto Entrepreneur Justin Sun and his Companies for Fraud and Other Securities Law Violations

https://www.sec.gov/news/press-release/2023-59

[22] SEC v. Justin Sun, et al.

https://downloads.coindesk.com/legal/justin.PDF

[23] Economic Report of the President

https://www.whitehouse.gov/wp-content/uploads/2023/03/ERP-2023.pdf

[24] CFTC Charges Binance and Its Founder, Changpeng Zhao, with Willful Evasion of Federal Law and Operating an Illegal Digital Asset Derivatives Exchange

https://www.cftc.gov/PressRoom/PressReleases/8680-23

[25] Commodity Futures Trading Commission v. Zhao et al

https://www.courtlistener.com/docket/67092867/1/commodity-futures-trading-commission-v-zhao/

[26] Office Hours with Gary Gensler: What Are Crypto Trading Platforms?

https://www.sec.gov/news/sec-videos/office-hours-gary-gensler-what-are-crypto-trading-platforms

[27] We asked the SEC for reasonable crypto rules for Americans. We got legal threats instead.

https://www.coinbase.com/blog/we-asked-the-sec-for-reasonable-crypto-rules-for-americans-we-got-legal

Original link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR