CFTC wins lawsuit against Ooki DAO, setting a precedent for DAOs to assume legal responsibility.

Original Title: "CFTC Wins Lawsuit Against Ooki DAO, Setting Precedent for DAOs to Assume Legal Responsibility"

Original Source: Web3 Xiao Lu

Summary

- The judge agreed that CFTC could define DAO as an unincorporated organization, and therefore DAO could be held liable as the defendant.

- After DAO can be sued, the blockchain is no longer a lawless place. Regulatory enforcement agencies can use this as a breakthrough to regulate DAO, DeFi, and DEX projects on the chain.

- On-chain DAO = Unincorporated Association = All participating governance members may bear joint and several liability for the DAO.

One, CFTC's victory

On June 9th, 2023, the US Commodity Futures Trading Commission (CFTC) announced its "Sweeping Victory" in the legal battle against Ooki DAO, setting an unprecedented precedent for DAOs to bear legal responsibility as defendants.

In the case of CFTC v. Ooki DAO, a California judge ruled in favor of CFTC on June 8, 2023, issuing a default judgment against Ooki DAO for operating an Illegal Trading Platform and Unlawfully Acting as a Futures Commission Merchant (FCM), imposing a civil penalty of $643,542, and ordering the permanent closure of Ooki DAO's website and removal of its content from the internet.

It is crucial that in this precedent-setting ruling, the court deemed Ooki DAO a "Person" under the definition of the U.S. Commodity Exchange Act and therefore subject to legal liability. Officials from the CFTC stated: "This ruling should serve as a warning to those who believe they can evade legal responsibility and regulatory enforcement by adopting a DAO structure, ultimately putting the public in danger."

This ruling is crucial for the DAO and DeFi projects: (1) The court defines DAO as a legal entity (Person), which means that the blockchain is no longer a lawless place and regulatory enforcement agencies can use this as a breakthrough to regulate DAOs, DeFi, and DEX projects on the chain; (2) The legal status of the on-chain DAO is defined by the CFTC as an "Unincorporated Association" and accepted by the court, which means that members participating in DAO governance may bear joint legal responsibility for the DAO.

二、Ooki Case Details

The bZx protocol is a blockchain-based decentralized DeFi protocol that allows users to provide virtual assets as collateral to establish leverage positions for trading. The value of the trade is determined by the price difference between two virtual assets, without involving the actual sale of virtual assets.

The bZx protocol was originally developed and maintained by bZeroX LLC and its founders. Around August 23, 2021, bZeroX LLC transferred control of the bZx protocol to bZx DAO (which was ultimately renamed Ooki DAO on November 18, 2021), and since then, Ooki DAO can only be governed by the votes of OOKI Token holders. The CFTC cited one of the bZx protocol founders' statements at the time: "The transition to DAO will exempt the bZx protocol from legal regulation and accountability." Clearly, the CFTC disagrees.

On September 22, 2022, CFTC took two enforcement actions against Ooki DAO: (1) imposed penalties on bZeroX LLC and bZx protocol founder, ultimately settling the case; and (2) filed a lawsuit against Ooki DAO for (i) illegally providing off-exchange leveraged and margined retail commodity transactions; (ii) engaging in futures trading (FCM) without registration; and (iii) failing to comply with KYC verification and customer identification procedures (CIP) as required by the Bank Secrecy Act. The court subsequently approved the service of process through forum chatbot bot and forum post notices to Ooki DAO and DAO members, and served the subpoena.

Later, Paradigm, a16z, DeFi Education Fund (supported by UniSwap), and LeXpunK_Army (supported by Yearn, Curve & Lido) all submitted Amicus Briefs to the court in support of Ooki DAO, stating that it is unreasonable for the CFTC to require DAO members/token holders to bear the responsibility of the DAO solely through governance voting. Miles Jennings, General Counsel of a16z, further stated that the focus should be on those members who vote on illegal actions of the DAO rather than the entire membership of the DAO.

After missing the final deadline for response in January 2023, Ooki DAO, CFTC began applying to the court for a "default judgment" in the case, which means that Ooki DAO failed to defend itself in court and may be a "strategic" abandonment, apparently no DAO members are willing to bear the responsibility of CFTC's pursuit.

On June 8th, 2023, a California judge made a final ruling in favor of CFTC in a "default judgment" case, which means that CFTC does not need to prove its reasons for accusing Ooki DAO. Despite receiving a lot of support, Ooki DAO faced a bad precedent for regulatory oversight of DAOs due to the lack of response to the accusations.

CFTC Chairman Rostin Behnam believes that Ooki DAO is a clear case of fraud, with organizers suspected of attempting to evade CFTC regulation and illegally offering leveraged and margined digital asset derivatives trading to US retail customers. He describes DAO as a unique technology, but this does not exempt DAO from state or federal regulatory frameworks.

Three, Impact and Consequences of CFTC's Victory

Due to the fact that Ooki DAO did not respond, the California judge basically agreed to all of CFTC's claims, and CFTC does not need to explain its claims. As the United States is a common law country, this ruling will inevitably have a huge impact on the crypto world: defining DAO as a subject of litigation, and from now on, the chain is no longer a lawless place. Regulatory enforcement agencies can use this case as a breakthrough to regulate DAO, DeFi, and DEX projects. At the same time, members participating in DAO governance may be held jointly liable for DAO's legal responsibilities.

3.1 On-chain DAO is no longer a lawless place

On the Digital Assets column of the CFTC official website, all virtual assets, including all virtual currencies, are classified as "commodities". This will enable the CFTC to regulate derivative transactions in the virtual asset futures market, as well as fraudulent and market manipulation activities in the virtual asset spot market. However, the CFTC has no authority to regulate virtual asset transactions in the spot market that do not involve margin, leverage, or financing.

Before bZeroX LLC transformed into a DAO, it was undoubtedly responsible for any violations committed by bZeroX and its founders. It is worth noting that a California judge agreed with the CFTC's definition of Ooki DAO as an "Unincorporated Association," which is a sueable entity (Person) under the Commodity Exchange Act and can be held liable as a defendant.

This means that after this case, the CFTC will have the right to regulate DAO, DeFi, and other projects engaged in the virtual asset futures derivatives market, and file lawsuits. It is estimated that decentralized derivative exchanges such as dYdX and Synthetix are trembling? Even more frightening is whether the SEC can use this ruling to directly enforce administrative law against project parties and decentralized exchanges (DEX) that the SEC considers to be "issuing and selling unregistered securities".

(https://www.bitstamp.net/learn/web3/what-is-a-decentralized-exchange-dex/)

3.2 Members of DAO may need to bear joint legal responsibility for DAO

Although the punishment imposed by the judge is only for Ooki DAO, CFTC, based on federal law and a series of state precedents on partnership law, holds that members of for-profit illegal organizations are personally liable for the organization's actions. This means that members participating in Ooki DAO governance may be exposed to the risk of personal joint liability. It is currently unknown how CFTC will enforce the fines.

For DAO, this is fatal, unlike legal entities such as LLC or Corp that can distinguish the responsibility of legal entities from personal responsibility. CFTC analogizes bZeroX LLC with Ooki DAO, stating that LLC and Ooki DAO both control the bZx protocol and govern it through member voting. Therefore, CFTC states: Once OOKI Token holders influence the results of Ooki DAO governance proposals through governance token voting, they can be deemed to voluntarily participate in Ooki DAO governance and be personally responsible for the actions of the DAO.

3.3 对 DeFi 的监管开拓了思路

3.3 Exploring Regulatory Approaches to DeFi

After the US regulatory agency sanctioned the mixed currency DeFi protocol Tonardo Cash in August 2022, the US regulatory agency further expanded its regulatory dimension for on-chain DeFi projects. For Tonardo Cash, the US regulator listed it on the SDN list on the grounds of terrorist money laundering, which means that all US individuals or entities are prohibited from trading with Tonardo Cash or wallet addresses associated with the protocol. Ooki DAO went even further, with the US regulator citing illegal and irregular DAO business practices, directly requesting the relevant servers to shut down the Ooki DAO website, delete online content, and prohibit Ooki DAO from conducting any business in the US.

On April 6th, 2023, the US Department of Treasury released the 2023 DeFi Illegal Financial Activity Assessment Report, which is the world's first illegal financial activity assessment report based on DeFi. The report recommends strengthening the supervision of AML/CFT in the United States and, where possible, strengthening the enforcement of virtual asset activities (including DeFi services) to improve compliance with BSA obligations by virtual asset service providers. It can be seen that US regulation also follows this approach, regulating the inflow and outflow of virtual assets from the perspective of AML/CTF, controlling the source, and then regulating the compliance of specific project business from the perspective of investor protection.

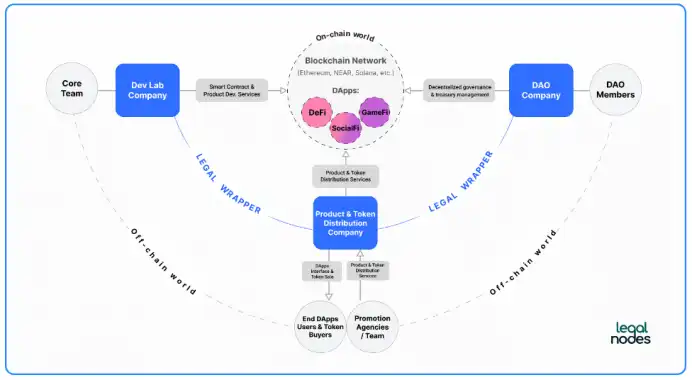

Four, Solution - Legal Wrapper of DAO

Obviously, CFTC can tear down the barrier of lawlessness on the chain with this case, so the chain is no longer a lawless land. It is now a must to legally package decentralized DAO and DeFi projects to ensure limited liability of members, rather than an option.

The legal wrapper of DAO is a collection of legal frameworks or legal entities specifically designed for DAO, providing DAO with a recognized legal status in relevant jurisdictions. Its essence is to "wrap" DAO in a legal framework, enabling DAO to link with traditional legal systems, ensuring compliance with relevant laws and regulations, protecting the limited liability of DAO members, and bridging the gap between DAO and the real world.

Founders and members who have not registered their DAO will face legal risks, especially:

A. Legal Liability Risks. Just like Ooki DAO, an unregistered DAO can be considered a General Partnership. Once a DAO is recognized as a General Partnership, each member of the DAO may be personally liable for all of the assets and liabilities of the DAO. On the other hand, a registered DAO can operate as a separate legal entity, which not only complies with regulatory requirements in the registration jurisdiction and other jurisdictions, but also provides limited liability for DAO members similar to that of a corporate organizational form.

B. Tax Risks. If DAO members fail to pay income tax, they may face fines or other penalties. However, a registered DAO can carry out a series of mature tax declarations based on its organizational form and meet the tax compliance requirements of relevant jurisdictions.

C. Financial Compliance Risks. Without relevant KYC/AML/CTF verification procedures to check the source of funds, absorbing funds or engaging in economic activities in the anonymous blockchain world may face administrative and criminal investigations involving securities compliance, AML/CTF compliance, and financial crimes.

DAO legal entities can register in different organizational forms: Foundations, Associations, Non-Profit LLCs, or For-Profit LLCs.

The actual choice of organizational form and jurisdictional control depends on the type of DAO (community/protocol, service, investment), business model, token functionality, and other factors.

When deciding where to establish a DAO within a judicial jurisdiction, it depends entirely on the DAO's business model, legal requirements, and preferences. There are usually three main criteria for determining this:

(1) Does DAO hope to generate revenue and distribute it to its members?

(2) The degree of decentralization of DAO;

(3) Will DAO issue tokens in the future?

Five, in conclusion

The US regulatory agency, after recovering from the FTX incident, conducted regulatory enforcement activities against many major participants in the cryptocurrency world, such as Coinbase, Kraken, Paxos, Slivergate Bank, Signature Bank, Justin Sun, and Binance in the first quarter of 2023. Especially recently, the SEC has chosen to simultaneously challenge Coinbase and Binance, the two cryptocurrency giants, and has listed some of the tokens they have listed as "securities". The CFTC has already torn down the barrier of the cryptocurrency world behind the scenes, exposing nearly 12,745 DAO organizations and their $200 billion in virtual assets to the CFTC's gun.

DAO, DeFi, and DEX - project parties need to be especially vigilant!

Original article link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR