What new products are available on CEX to help users survive the bear market?

The content you provided is:

Original author: 0xFat

After a round of small bull, the wealth effect on the chain weakened, coupled with weak income from mining, and players' funds began to return to centralized platforms, only hoping to survive the bear market and wait for the trend by returning to CEX for new investments.

Of course, there are more than just DeFi in the industry that have apy. In order to attract funds, CeFi also uses financial products to attract users. Here we take OKX as an example to see what decent products are available on CEX to help retail investors survive the bear market.

币本位收益产品

translates to

Coin-based Yield Products

Simple Coin Earning

Simple Earning is a product that helps digital asset holders with free time to earn coins with low threshold. It is easy to get started with different options for different periods. The current account corresponds to Yu'ebao, and income is obtained by lending to leveraged trading users in the lending market. The regular account obtains PoS income or project rewards by locking the currency. It supports 24-hour subscription and redemption, and the redemption of the current account is immediately credited, while the redemption of the regular account is credited within 30 minutes.

On-chain Earning

On-chain coin earning mainly provides holders with opportunities to earn on-chain income, mainly including Proof-of-Stake (PoS) and Decentralized Finance Protocol (DeFi protocol) two ways of earning income. Investors can participate in PoS staking or DeFi projects on Ouyi at any time without paying network fees.

屯币宝

translates to

屯币宝

in English.

Tunbibao is an automated strategy that can intelligently dynamically adjust the investment portfolio in the selected currency combination of investors, using the exchange rate fluctuations between different currencies to earn and store coins, lock in profits, and increase the holdings of potential currencies, to obtain excess returns.

It should be noted that after the creation of the TBB strategy, the invested funds will be isolated from the trading account and used independently in the strategy. Investors need to pay attention to the risk of the overall position of the trading account after the funds are transferred out. In addition, if the currency encounters unpredictable abnormal situations such as suspension or delisting during the operation of the TBB strategy, the TBB strategy will automatically stop.

Compound Interest Products

Compared to traditional financial markets, the grid trading mechanism in the cryptocurrency market has some innovations. Taking OKX, the platform with the most complete grid products, as an example, its grid strategy includes spot grid, infinite grid, contract grid, and heaven and earth grid.

Currently, in the current market, there are more people using spot grids. The trading logic is that investors set an upper and lower boundary range and decide to divide it into N segments in between. Selling a portion will occur when it rises one segment, and buying a portion will occur when it falls one segment. It is suitable for oscillating markets, automatically buying low and selling high, and completing compound interest. The advantage of spot grids is that it is easier to hold onto coins and not completely miss out on the market. Investors can earn both grid profits and floating spreads, and can also withdraw profits at any time for other transactions. More importantly, it can continuously buy low and sell high through robots without having to constantly monitor the market, saving a lot of energy. Of course, the disadvantage is that if the oscillation range of the market is too small, it will not be able to trade, and if it continues to be a one-sided market, it will cause idle assets. It should be noted that in the current market, the capital efficiency of ordinary spot grids is relatively low, but OKX spot grids support mobile grid functions, which can move the grid according to the market within a reasonable range and effectively improve capital utilization.

2万u本金,9天的套利收益在250u左右

Translation:

A principal of 20,000 u yielded an arbitrage profit of around 250 u in 9 days.

Spot "Bottom Fishing" Products

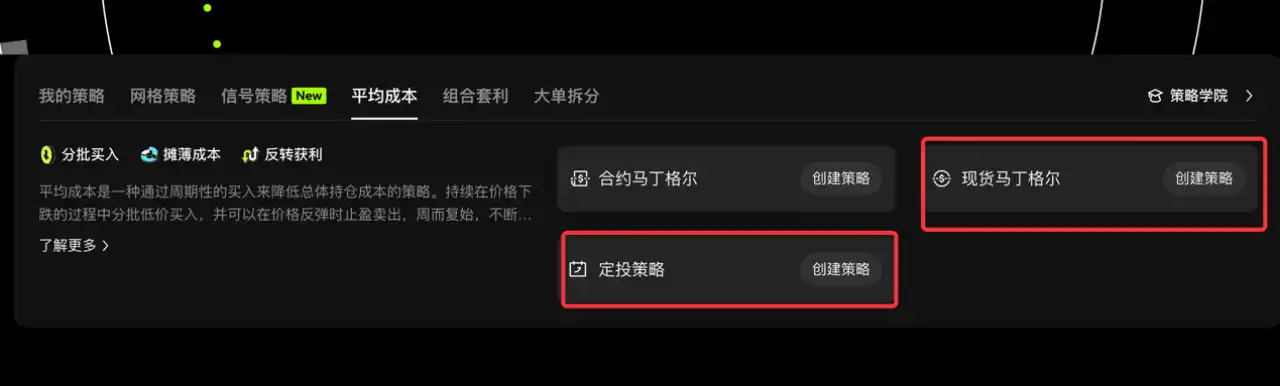

Martingale Strategy

This strategy is commonly used in the foreign exchange market in traditional finance. The basic principle is to bet on only one side in a two-way market where you can buy or sell. If you bet on the wrong side, you keep adding to the opposite side until the market rebounds, allowing you to profit from buying low and selling high. OKX's spot Martingale strategy combines the basic principles of the traditional version with the characteristics of the cryptocurrency market to make a series of optimizations, balancing the average cost of investors' bottom-fishing.

Under the current market conditions, investors can choose to buy a spot DCA every time the market drops by 1-5%, and use the remaining funds to gradually increase their position to reduce the overall cost of holding. When the price rebounds, they can take profits and exit. Compared to simply holding digital currencies, the spot Martingale strategy is more flexible, capturing profits from small rebounds and continuously realizing floating profits.

抄底宝

translates to

Bottom-fishing Treasure

in English.It is a structured product derived from the OKX options trading function. It is very suitable for investors who want to buy a certain amount of assets at a price lower than the market price, but are worried that their limit order at this lower price may not be executed. By using the "bottom-fishing treasure" limit order, even if the strategy does not fall to the limit order price when it expires, the system still guarantees that you can buy a certain proportion of assets at a limit order price lower than the market price.

The operation path for the Web end is as follows:

现货定投

translates to

Spot Investment Plan

This is a strategy that involves investing a fixed amount of money at a fixed time interval in a selected combination of cryptocurrencies. By using a suitable dollar-cost averaging strategy during periods of high market volatility, investors can purchase more chips at lower prices with the same investment amount, helping them to achieve more significant returns. This strategy is suitable for everyone, especially long-term investors, and supports one-click investment, anytime redemption, and free combination of cryptocurrencies.

The path to create a fixed investment strategy is to click on "Trading"-"Strategy Trading" on the OKX homepage, then select "Dollar Cost Averaging"-"Fixed Investment Strategy" under "Create Strategy". After that, enter the strategy creation interface to set the currency, investment cycle and other content, and click "Create Strategy" to complete.

The Martin Gale strategy and the spot investment strategy are both part of the dollar-cost averaging sector. Dollar-cost averaging is a strategy that lowers the overall holding cost by periodically buying in. It involves buying in batches at low prices during a price decline and selling at a profit during a price rebound, repeating the process in a continuous cycle for arbitrage.

Signal Strategy

Meanwhile, OKX also provides signal strategy products for professional traders. Simply put, OKX's signal strategy feature allows traders to freely customize their trading signals on the TradingView platform to meet specific needs, truly achieving trading experience freedom, greatly improving trading efficiency and accuracy while reducing the risk of irrational operations.

The picture shows a custom signal entrance.

The core concept of OKX signal strategy is based on historical market data and patterns to predict future price trends. Traders can find potential buying or selling opportunities by observing and analyzing market signals to conduct transactions.

Its advantages can be explained with three keywords. Firstly, signal-driven. OKX aggregates top signal providers composed of the smartest and most professional investors and institutions from around the world, providing traders with the highest quality trading signal services, reducing the learning cost of traders while improving their trading accuracy, and reducing trading errors caused by emotional problems. Secondly, automatic trading. Signal strategies can help traders automatically execute trades as soon as signals are confirmed, with stronger timeliness and higher efficiency compared to manual trading, helping traders avoid missing opportunities as much as possible. Thirdly, low latency. Compared to other platforms with delays in seconds, OKX's signal strategy is committed to providing millisecond-level delays, helping traders seize market opportunities in a timely manner. Overall, signal strategies provide professional traders with a more rational and intelligent operating system, essentially helping them improve capital efficiency.

Currently, the signal strategy connects professional traders, nodes, and ordinary users. Ordinary users can use OKX signal strategy to let professionals/institutions help them make money by paying subscription fees or commissions. Signal providers can apply to become OKX signal providers, providing professional trading signals and realizing the monetization of professional knowledge and cognition. For nodes, they can cooperate with signal providers in the future to obtain profit sharing, forming a trading closed loop. According to official sources, OKX will also launch a signal plaza for ordinary users in the future, integrating and displaying the trading signals completed by signal providers. Ordinary users can subscribe and use these signals through the signal plaza, and create their own signal strategies based on this.

Risk Warning: This article is for reference only and does not constitute any investment advice. The market is risky, and investment needs to be cautious!

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR