The CZ era of Binance comes to an end, possibly the greatest 6 years of Chinese entrepreneurship.

43 billion dollars in fines, this is the largest fine amount in the history of Chinese entrepreneurship, bar none.

The only amount that can be compared to this is the 18.2 billion yuan fine imposed on Alibaba two years ago, which is only 65% of the world's largest cryptocurrency trading platform Binance. Even if we look at global internet giants, the $4.3 billion fine is one of the largest in history.

From 6 years ago, when he recorded a video introducing Binance in front of his own company in Shanghai, to using a $4.3 billion fine and resigning as a condition to preserve Binance's operation, founder Zhao Changpeng took only 6 years to make Binance the world's largest cryptocurrency trading platform with 150 million users and thousands of employees around the world, as well as one of the most successful companies going global, all under the support of the cryptocurrency boom.

This is also destined to be a week recorded in the history of technology and the internet. Two top influential companies in the two most dynamic and highly watched fields of technology and the internet, AI and Crypto, OpenAI and Binance, have resigned for different reasons.

6 years in the CZ era, also 6 years of Crypto's booming development and wealth effect. Binance's role in this, especially in boosting industry confidence during the bear market, cannot be ignored.

Now that regulations have been implemented, regardless of what happens to Binance in the future, we still want to record Binance's 6 years, where CZ and another co-founder, He Yi, made the right choices at the right time, amidst the backdrop of the Bitcoin bull market, with favorable timing, location, and people. This may be the greatest 6 years of entrepreneurship for Chinese people.

CZ early entrepreneurial video screenshot

"Crypto Iron Triangle" and the Birth of Binance

In 2014, Zhao Changpeng was just a Canadian technology returnee, serving as the CTO at the cryptocurrency market website Blockchain.info. Once, He Yi was organizing an event for OKCoin in Hangzhou, and CZ was a guest. After listening to CZ's sharing, He Yi was impressed by his talent and asked for his WeChat after the meeting.

Later, He Yi wanted to advertise for OKCoin on Blockchain.info and approached CZ for a discount. However, CZ informed He Yi that "our advertising does not offer discounts." Despite being turned down, He Yi had a higher opinion of CZ, believing that he did not let personal relationships affect his decision-making and was highly professional. He then introduced CZ to Xu Mingxing and brought him on board at OKCoin.

CZ, who just joined the company, has done a great job. In addition to being responsible for the basic infrastructure, custody, and security of on-chain transactions, CZ also manages the development of all products. Because of his good English, CZ is also responsible for promoting the overseas market. And so, the "Coin Circle Iron Triangle" that echoed throughout the encryption industry in 2014 was formed.

"Crypto Iron Triangle" featured in high-end magazine "Fashion Bazaar"

Of course, now it seems that this triangle is not so "ironclad". In the entrepreneurial circle, one mountain can never accommodate two tigers. CZ and Xu Mingxing both have technical backgrounds, and the two often have differences due to differences in decision-making logic and cultural backgrounds.

In late 2014, CZ signed an agreement with his former employer, Blockchain.info, which stipulated that OKCoin would be responsible for operating the Bitcoin.com domain for five years, during which time all advertising revenue from the website would belong to OKCoin. However, due to poor operational performance, OKCoin wished to terminate the partnership ahead of schedule.

However, Roger Ver, the owner of Bitcoin.com, also known as "Bitcoin Jesus," believes that OKCoin should pay compensation on a monthly basis, leading to a months-long economic dispute between the two parties.

What surprised Xu Mingxing was that CZ took a strong stance on Roger Ver's side in this dispute, pointing out that OKCoin violated professional ethics and forged his signature for bank transfers. Subsequently, OKCoin immediately issued a statement, stating that CZ not only forged the contract, but also fabricated lies to attack OKCoin.

Finally, the verbal battle ended with OKCoin firing CZ. As the person who recommended CZ to join the company, He Yi was caught in the middle of this dispute and was in a difficult position. In the second half of 2015, He Yi quietly said goodbye to OKCoin.

After leaving OKCoin, He Yi chose to join a technology company with a market value of 20 billion yuan at the time. In June 2017, CZ officially established Binance. In July 2017, Binance launched its own platform token BNB with an issue price of 1 yuan. However, shortly after its launch, BNB fell below its issue price and was only worth 50 cents per BNB. At that time, Binance "was heavily criticized", and He Yi later recalled that it was the most stressful period for CZ, during which he lost 10 kilograms in three weeks.

Two months after the establishment of Binance, He Yi decided to leave Yixia Technology and choose to "start from scratch" as the CMO to build Binance together with CZ. After the news of He Yi joining Binance was announced, the price of BNB rose sharply, and the trading volume of BNB and the newly launched BTM token on the platform immediately surged, pushing the trading volume ranking into the top 10 globally.

He Yi brought her experience in operations from Yizhibo to Binance, where she gave away coins and luxury cars during live broadcasts. Although it may seem crude, it effectively attracted a lot of traffic to Binance. On August 22nd, Binance hosted a live broadcast featuring Justin Sun, who talked about the TRON project. During the broadcast, a TRON purchase activity was launched and 500 million TRON were sold in just 53 seconds. TRON was immediately recognized as the "ICO first project" of the second half of 2017.

On August 25th, Binance and Sequoia China signed an investment letter of intent. The letter of intent stipulates that Sequoia China will invest approximately RMB 60 million in Binance's Series A financing, accounting for 10.7% of the shares. At the same time, Sequoia China has agreed to provide Binance's Japanese subsidiary with a bridge loan of approximately RMB 30 million. Binance's valuation has now reached RMB 500 million.

九四危机,币安完成「弯道超车」

The 94 Crisis: Binance Completes "Curve Overtaking"

As Binance was rapidly developing, the arrival of "94" directly poured cold water on the entire cryptocurrency industry, including Binance. On September 4, 2017, the government launched a heavy blow against the chaos in the cryptocurrency industry, announcing that all token issuance and financing activities, including ICOs, would be stopped. As soon as the news came out, Bitcoin plummeted, and everyone thought that cryptocurrency was going to die.

Of course, for Binance, "94" is a rare opportunity to "overtake". Binance has always only done spot trading, and the company's servers are also registered overseas. CZ himself is also a foreigner, so taking an international route has become a natural choice: "Since we cannot operate in China at present, we have decisively withdrawn from the Chinese market and focused on international business."

What impressed many investors at the time was Binance's "market price liquidation" of Chinese investors.

According to the rules, if the issue price is one yuan, then only one yuan needs to be refunded when liquidating, returning the principal to investors. However, Binance decided to liquidate based on the market price of BNB. At that time, BNB had gone through a round of growth, and the price was still around 6 yuan after "94". Many projects were also involved with ETH, and Binance also refunded based on the market price of ETH, subsidizing a large sum of money. Although Binance suffered losses in this wave, it won the trust of the industry.

Afterwards, Binance faced pressure while promoting on social media, but at the same time, it took the lead in launching in Japan, filling the gap in the domestic trading platform. For a time, many domestic users from OKCoin, Huobi, and other platforms flocked to Binance, and Binance once again surged ahead, all the way up.

On December 15, 2017, Binance, which had been established for half a year, announced its operational data: top three in global trading volume, 24-hour trading volume exceeding 2.1 billion US dollars, and a 100% increase in BNB market value compared to the previous period. On December 18, Binance's daily trading volume exceeded 3 billion US dollars, ranking as the world's top cryptocurrency trading platform. On the 19th, the number of Binance users exceeded 2 million, and then soared to 5 million in less than a month.

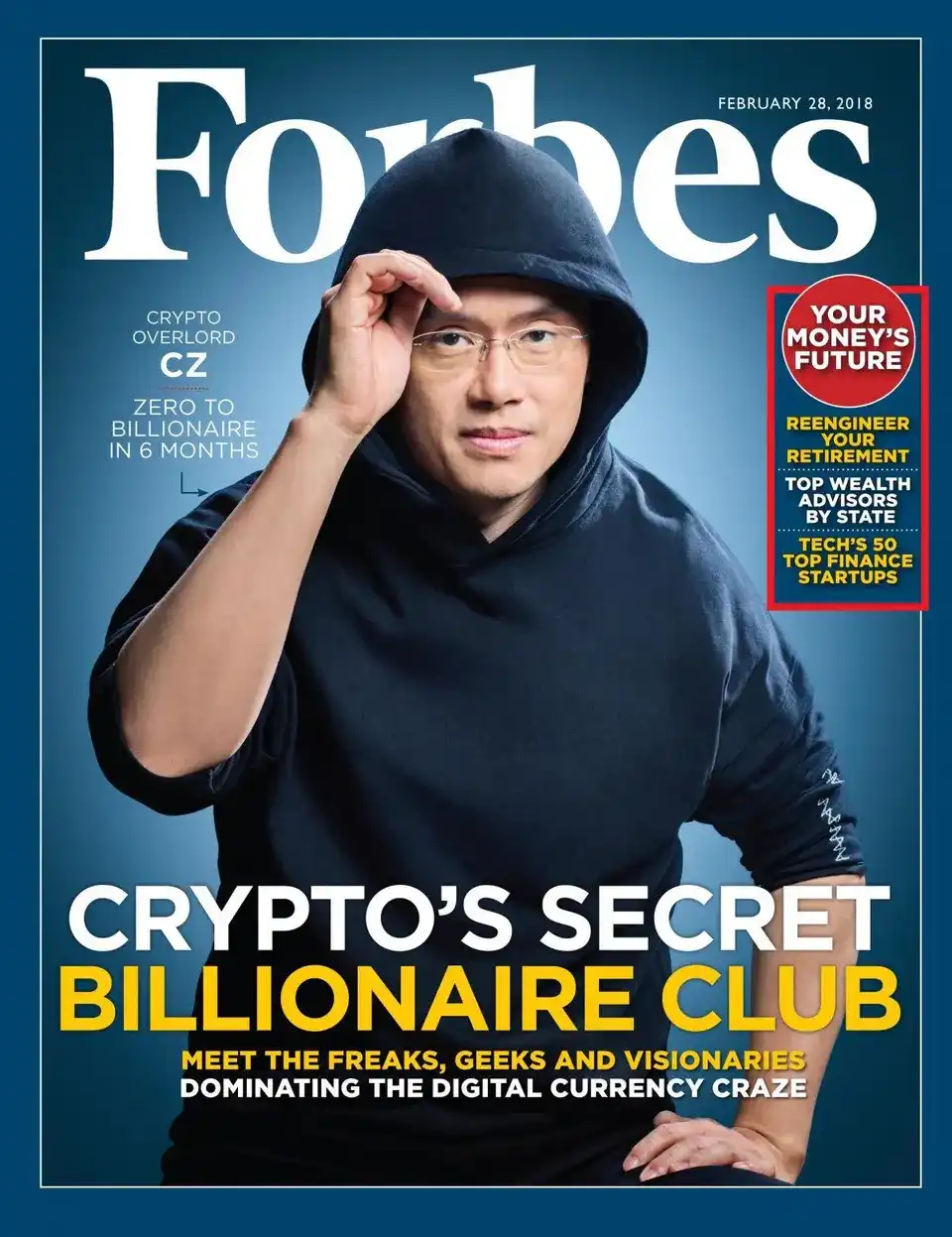

On January 10, 2018, Binance's trading volume exceeded 10 billion US dollars; in February, CZ appeared on the cover of Forbes magazine.

Of course, Binance has not had a smooth sailing journey. On the night of March 7, 2018, Binance was hacked and many users found that the tokens in their accounts had been traded at market price for Bitcoin, causing the prices of most cryptocurrencies to fall. After causing panic selling, the hackers bought all the stolen Bitcoin in an altcoin called VIA, causing the price of VIA to skyrocket by over 110% in a short period of time, which in turn caused the price of Bitcoin to drop by over 10% in just one hour.

Someone calculated the value of fiat currency destroyed by Binance in the third quarter of BNB, and despite the decline in trading in the cryptocurrency market, Binance's profits continued to increase in the third quarter of 2019, even by about $10 million more than the second quarter.

Related reading: "Conversation with Zhao Changpeng and He Yi: People won't need to know about Binance in the future."

At the third anniversary of Binance, it has become the platform with the largest trading volume in the industry. The total value of Binance's platform coin BNB has also exceeded 2.4 billion US dollars (*based on the proportion of BNB repurchase and destruction).

Binance has built its own ecosystem in three years, with 10 wholly-owned acquisitions and more than 20 investments. The total amount of investment and acquisition is expected to exceed $500 million. In April 2020 alone, the acquisition of data aggregation platform CoinMarketCap was reported to be worth $400 million. In the first quarter of 2020, the total amount of investment and financing in the blockchain industry was only about $800 million, and Binance's acquisition accounted for half of the total investment and financing in the industry in the first quarter.

Meanwhile, there are increasing controversies surrounding Binance. Binance, which has always taken the High Level route overseas, has also adopted a strategy of using attractive women to promote its image. Co-founder He Yi also engages in daily social media battles with "friendly competitors".

The bigger controversy lies in the business aspect. Binance also started its own leverage trading last year, which it had previously criticized. In addition, as mentioned earlier, Binance acquired CoinMarketCap, the largest market data platform in the industry in the first half of this year. This behavior of athletes buying referees has led to more people criticizing Binance.

FTX falls, Binance becomes the first target of regulation

After the bankruptcy of FTX and last year's cryptocurrency crash, regulatory lawsuits and various other cases against trading platforms have been increasing. Binance has naturally become the first target of regulation.

In fact, the first to target Binance may have been the US Department of Justice. According to sources cited by Reuters, the Department of Justice's investigation into Binance began in 2018 and included allegations of unlicensed money transfers, money laundering, and violations of criminal sanctions.

In 2019, Binance was banned in the United States due to regulatory reasons. In response, Binance and other investors opened Binance.US. In May 2021, Bloomberg reported that Binance was under investigation by the US Department of Justice and the Internal Revenue Service for money laundering and tax evasion. In December 2022, Binance's US entity, Binance.US, announced a $1.02 billion acquisition of Voyager Digital's assets. The deal was canceled in April 2023 due to what Binance.US called a "hostile and uncertain regulatory environment."

At the end of 2022, there were internal disagreements among US Department of Justice prosecutors on whether to bring criminal charges, including money laundering, against Binance. Some prosecutors believed they had enough evidence to bring criminal charges against Binance executives, including CZ; while others believed more time was needed to review additional evidence. In addition, sources said that officials from the Department of Justice have discussed possible plea agreements with Binance lawyers.

除了来自司法部的诉讼外,Binance 也因涉嫌违反证券交易规则被美国证券交易委员会(SEC)和起诉。2022 年 6 月,美国证券交易委员会对币安展开调查,以确定该公司 2017 年 BNB 代币的 ICO 是否构成非法出售证券。

Except for the lawsuit from the Department of Justice, Binance has also been sued by the US Securities and Exchange Commission (SEC) for allegedly violating securities trading rules. In June 2022, the SEC launched an investigation into Binance to determine whether the company's 2017 BNB token ICO constituted an illegal sale of securities.SEC accuses Binance and CZ of illegally promoting cryptocurrency securities to US investors and issuing and selling unregistered cryptocurrency securities and other investment plans through unregistered online trading platforms on Binance.com and Binance.US. Binance and CZ have made billions of dollars in profits through this method, while putting investors' assets at significant risk.

Related reading: "Latest development in Binance lawsuit: US judge denies asset freeze request, Binance may reach a settlement with SEC".

The Commodity Futures Trading Commission (CFTC), which is in contrast to the SEC in the United States, has been using Binance to compete for regulatory control over cryptocurrencies. The CFTC obtained chat records between CZ and employees through various means and used them to initiate a lawsuit against Binance. On March 27, 2023, the CFTC released the lawsuit documents, which mentioned several chat records about CZ using the Signal chat application, including conversations between him and Binance employees, as well as American customers. The chat records also mentioned instructions given by CZ to employees, requiring them to use Signal to communicate about the "US ban".

The next day, CZ responded to the CFTC's lawsuit on the official website, stating that Binance had been working with the CFTC for over two years and expressed disappointment with the civil lawsuit. "Upon preliminary review, the lawsuit appears to contain incomplete factual statements, and we disagree with the description of many issues," including compliance technology and the prohibition of US users from accessing, cooperation and transparency with law enforcement agencies, registration and licensing, and trading, among other aspects.

Despite CZ's repeated emphasis on Binance's compliance, Binance has repeatedly applied to the court to dismiss the CFTC's lawsuit. However, the tug-of-war came to an end today. CFTC Chairman Rostin Behnam said at a press conference on Tuesday that Binance's behavior "undermined the foundation of a safe and sound financial market." CFTC charged Binance $1.35 billion in transaction fees, the largest fine in CFTC history.

Related reading: "Why does everyone want to regulate Crypto?"

CZ Era Comes to an End

On November 22, 2023, a day that will go down in history, especially when it comes to the history of Binance. After the news broke, CZ, the CEO, responded to messages in various communities, maintaining stability and even participating in discussions in some inactive groups. As a customer service representative, CZ explained things in the groups whenever she saw them.

In order to reach a settlement, CZ has let go of the achievements he has made in his six years of entrepreneurship, and has chosen a stable path for the future of Binance. This settlement plan also signifies Binance's acknowledgement of past criminal and compliance violations, and expresses its commitment to laying the foundation for the next 50 years of development.

Meanwhile, CZ also completed the "heroic sacrifice" and officially became a part of Binance's history, admitting to committing money laundering and violating US sanctions, and stepping down as Binance CEO. The sentencing hearing is scheduled for February next year.

The new CEO of Binance will be Richard Teng, the former global regional market leader of the company. CZ stated in an open letter that with his thirty years of financial service and regulatory experience, Richard Teng will lead Binance into the next phase of growth, ensuring the company's development in security, transparency, compliance, and growth. CZ himself will continue to provide consulting services to the team and plans to passively invest in blockchain, Web3, DeFi, artificial intelligence, and biotechnology after a short break.

The Super Jun once recalled a past event. Many years ago, he attended a blockchain conference and met some big shots at the time. During the event, a young man next to him took the initiative to help him take a photo. And this young man was CZ.

Regardless of right or wrong, CZ is indeed one of the most faithful believers in Bitcoin in the industry, and this faith has also allowed us to witness the exaggerated speed of a company from zero to global number one. As the most important infrastructure of cryptocurrency, CZ has completed his mission, but Binance has not yet.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR