ENA's market value exceeds $1 billion, but some people worry that it is creating the next black swan

Perhaps the hottest thing in the DeFi field yesterday was the Ethena airdrop. After the airdrop tokens were opened for claiming, Binance launched Ethena (ENA) on financial management, flash exchange, leverage, and contracts. Within 1 hour of opening, the investment volume exceeded 19 million BNB. The ENA token rose by more than 30% in one day, directly entering the billion-dollar market value ranks.

Then, Ethena announced that the second season of the "Sats" event Epoch 1 has been launched. Users can deposit USDe to earn Sats. The new Pendle pool on Mantle is capped at $100 million, and will receive additional Eigenlayer points. The existing USDe Pendle pool on the ETH mainnet is also capped at $100 million. Existing users will receive an additional 20% reward for depositing funds into the pool.

MakerDAO founder Rune Christensen (@RuneKek) deposited 5.66 million USDT to Ethena 16 hours ago and minted 5.655 million USDe. This is Rune's first participation in Ethena. Not only that, MakerDAO is considering allocating 600 million DAI to USDe and staking USDe (sUSDe) through the DeFi lending agreement Morpho Labs.

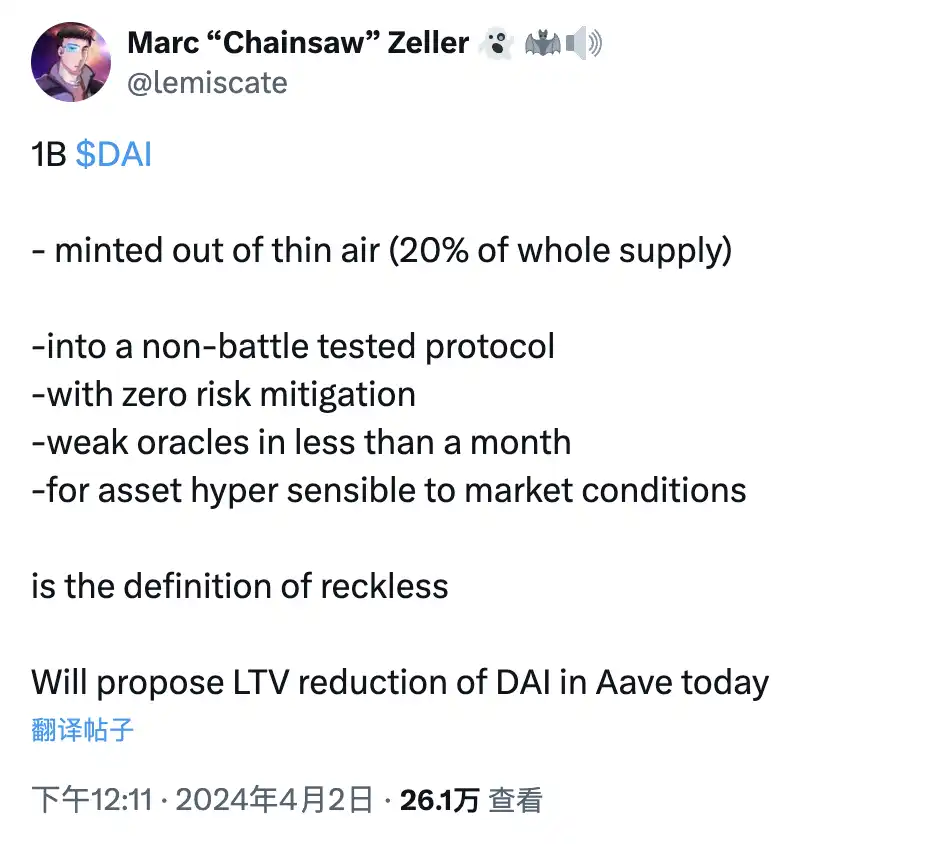

However, just when everything seemed to be going smoothly, some different voices emerged within the community. Marc (@lemiscate), founder of Aavechan, published a tweet criticizing the recklessness of certain DeFi practices, especially pointing out that $100 million of DAI, representing 20% of its total supply, was invested in "an untested" protocol (Ethena) without any risk mitigation measures and the weak oracle problem that occurred not long ago. Marc believes that this treatment of an asset that is extremely vulnerable to market conditions is extremely reckless and announced that he will propose to reduce the loan-to-value ratio of DAI at Aave.

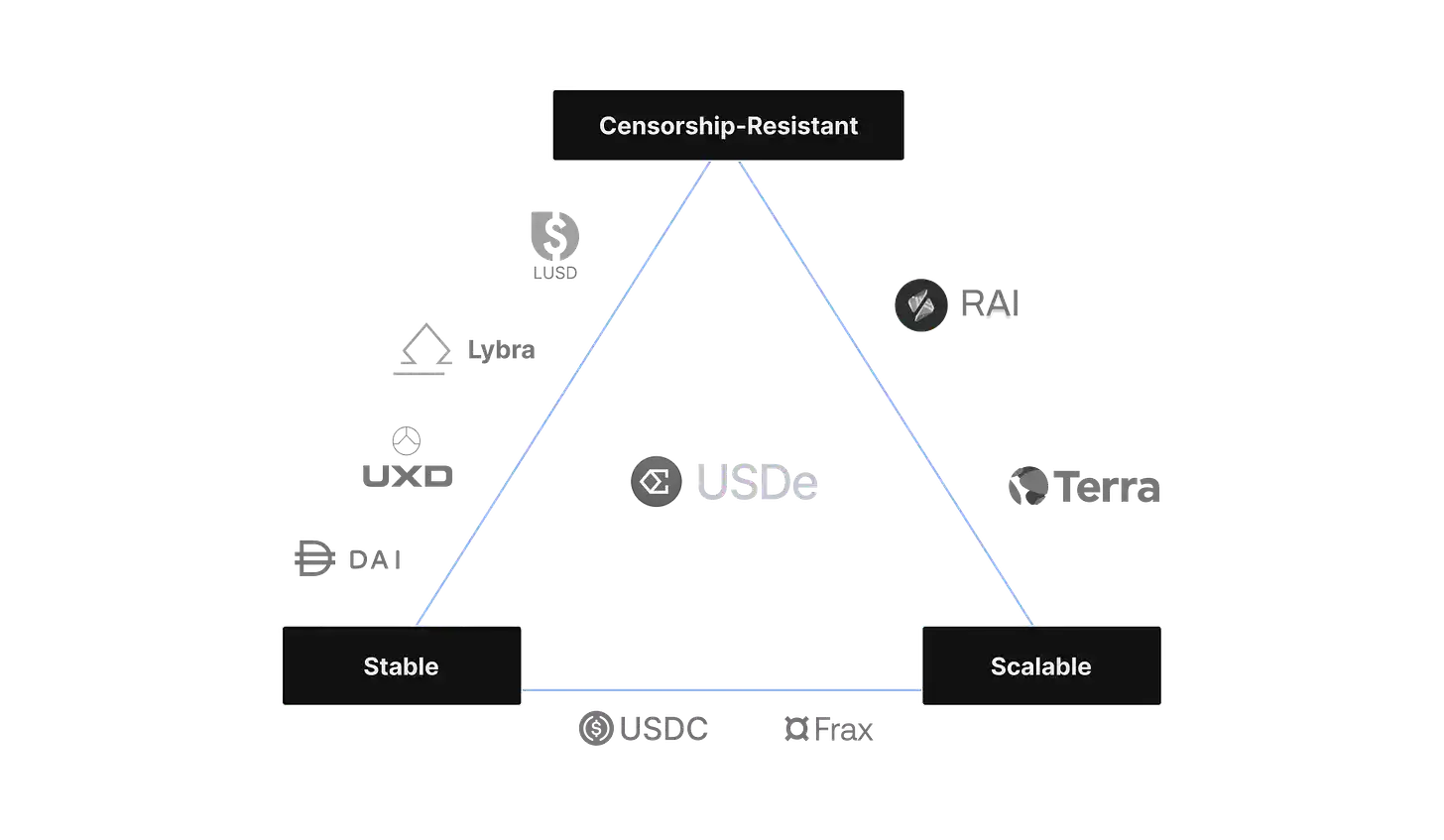

We all know that in the field of cryptocurrency, stablecoins are regarded as one of the most important tools. Whether it is a centralized or decentralized trading platform, whether it is a spot or futures market, most transactions are denominated in stablecoins. Stablecoins have settled more than $12 trillion on the chain, becoming one of the top five assets in the DeFi field, accounting for more than 40% of the total value locked (TVL), and are by far the most widely used asset in the decentralized currency market.

As a stable currency, USDe hopes to provide scalability to improve capital utilization through the use of derivatives. By Ethena's design, USDe is able to scale while maintaining capital efficiency because the staked ETH assets are perfectly hedged through equivalent short positions, requiring only a 1:1 "collateral" to create synthetic USD.

Marc also hit one An analogy to explain the importance of risk management when using USDe: If you add 5 cl of gin to a cocktail, it might make you have a great night; but if you drink 3 bottles of gin, You may end up "living with the toilet." This metaphor emphasizes the importance of proper risk management and setting reasonable upper limits in DeFi projects.

「ENA/USDe, smells like LUNA/UST」

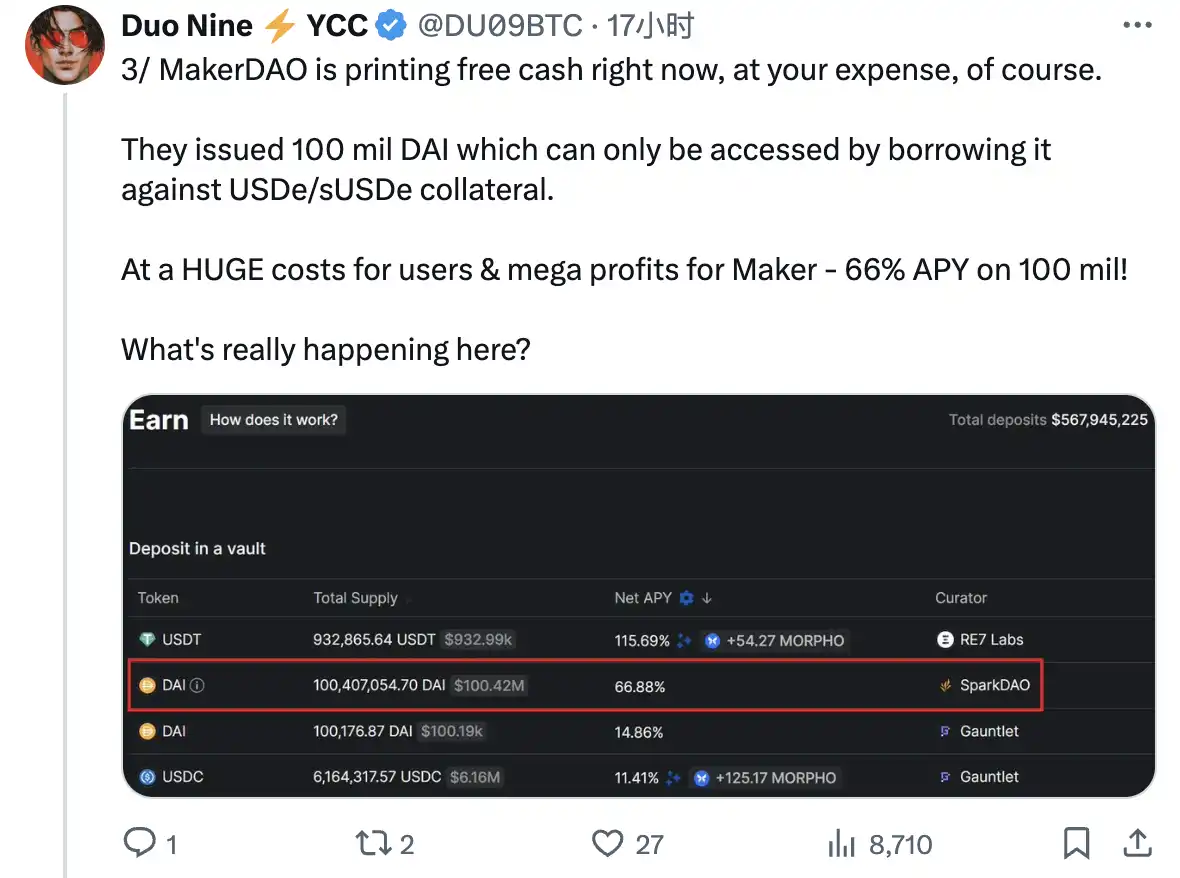

Analyst Duo Nine( @DU09BTC) further directly pointed out that MakerDAO is "printing money for free" and may eventually make ordinary investors pay: "They issued 100 million DAI, which can only be borrowed by using USDe/sUSDe as collateral. For users, it is Huge costs are huge profits for Maker, with an annualized rate of return of 100 million reaching 66%!"

In Duo Nine’s view, it is only a matter of time before USDe becomes unanchored. The larger the bubble, the greater the probability of this happening. Ethena growing too fast could pose systemic risks to everyone. USDe, in particular, is untested in a bear market and the risks loom large once billions of dollars are involved.

“MakerDAO is taking advantage of the greed of users who are pursuing higher annualized returns on USDe. They don’t care, they will use billions of dollars to fuel this greed. Maker has made huge profits, and USDe’s market value will continue to soar.” Duo Nine pointed out a potential trap in its tweet: USDe’s market value is approximately US$10 billion, of which US$2 billion is Maker’s liability. If USDe breaks its anchor and panics and liquidations begin, Maker will be the first to sell USDe and recover funds to maintain their profits and principal, while those users who borrowed DAI with USDe and sUSDe on Morpho will be liquidated quickly .

As such, he calls on all the big players in Ethena to show some restraint and build for the long term.

Following Luna’s experience, the possibility of algorithmic stablecoin decoupling and the potential risks of rehypothecation have also worried some observers. And to some community members, it all looks really Luna-like. Many people are worried that the next DeFi black swan event may occur on an original stablecoin protocol that mishandles risk management, but we also hope that this prediction is wrong. After all, no one wants to experience Luna again. .

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR