Delphi: Why Ethena is our investment focus in this bull market

Original title: "Ethena Thesis—The Internet Bond"

Original author: José Maria Macedo, José Maria Macedo

Original translation: Rhythm Worker, BlockBeats

Delphi, one of the "Midnightcaps" of the last round of crypto bull market, became famous for betting on GameFi's originator Axie Infinity and algorithmic stablecoin Terra Labs (consisting of governance token Luna, algorithmic stablecoin UST and DeFi protocol Anchor, etc.) in the last round of bull market. At the same time, it was also hit hard by the UST crash. Even former team member Larry lost most of his funds in the crypto field in the Terra ecosystem project Anchor.

Even so, José Maria Macedo, CEO of Delphi Labs, once again chose the "algorithmic stablecoin" Ethena on behalf of himself and Delphi Ventures, saying that Ethena is one of their most determined and unwavering investments in this bull market.

In this article, Delphi explains why Ethena's design is clever, why USDe is different from earlier algorithmic stablecoins, what improvements it has made compared to previous similar protocols, and most importantly - the risks of Ethena, will USDe encounter the UST (Terra's stablecoin) moment? Rhythm will translate the full text as follows.

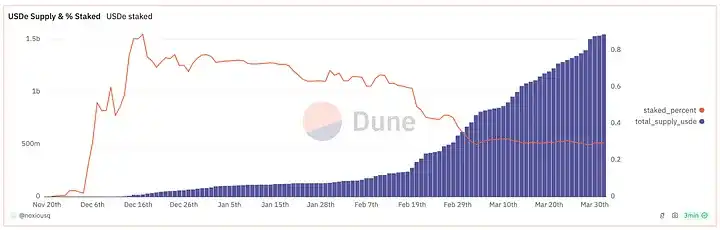

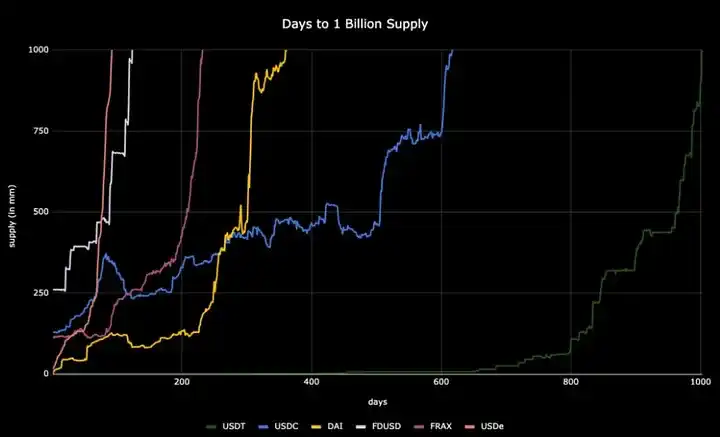

For both Delphi Ventures and me personally, Ethena is one of our most convinced investments in this cycle. I believe that: sUSDe will offer the highest USD yield in crypto at scale; USDe will become the largest stablecoin outside of USDC/USDT in 2024; and Ethena will become the highest-earning project in all of crypto. In this post, I’ll cover what Ethena is, why it’s interesting, and break down the risks I can currently see.

Opportunity

It is undeniable that stablecoins remain one of the killer applications of cryptocurrencies.

The market has repeatedly shown that it wants the yield of stablecoins. The problem is generating it in an organic, sustainable way.

Ethena is able to provide this yield, and the byproduct is stablecoins. Stablecoins earn yield, while the capital used to mint stablecoins generates yield.

Specifically, the funds used to back stablecoins are used to stake ETH and short in perpetual contracts, maintaining a delta-neutral exposure in the process, and both legs of the position typically provide yield (note, staking ETH to obtain PoS income, and shorting an equal amount of ETH to obtain funding fee income).

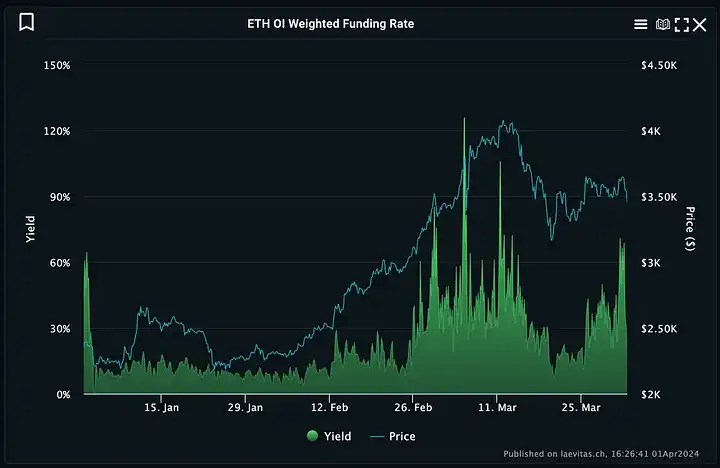

sUSDE yield = stETH yield + funding rate (currently 35.4%)

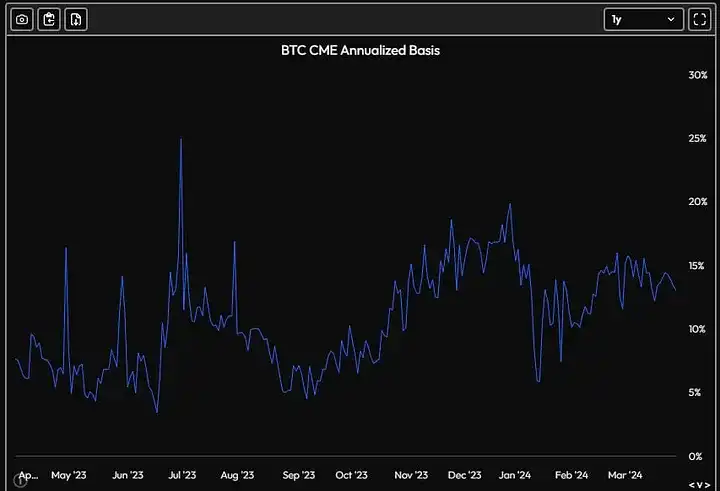

In this way, Ethena effectively combines the two largest sources of "real yield" in cryptocurrency: ETH staking (about $3.5 billion/year) and perpetual contract funding rates (OI between ETH/SOL/BTC is about $37 billion per year, with an average yield of about 12%)

This is the implementation of Arthur Hayes' original idea "synthetic USD". Although similar Delta-neutral stablecoin projects have been attempted before (such as UXD), they have never been able to take advantage of the liquidity of centralized trading platforms (CEX) before.

Ethena and the Stablecoin Trilemma

Before diving into the designs and their risks, it’s worth providing a brief summary/history of stablecoin designs and where they fit in the stablecoin trilemma.

There are 3 popular forms of stablecoins: overcollateralized, fiat-backed, and algorithmic stablecoins. They each address parts of the stablecoin trilemma (i.e., decentralization, stability, and scalability/capital efficiency), but ultimately fail to address all three.

Fiat-backed (USDC, USDT)

· Stability: Authorized participants (i.e., market makers) can mint them and redeem them at arbitrage prices with the assurance that they remain pegged.

· Scalability: They are 1:1 collateralized, making them scalable + capital efficient.

· Decentralization: Highly centralized, meaning holders are exposed to counterparty risk (bank solvency, asset seizure, etc.) and censorship risk as legal entities can be coerced and bank accounts can be frozen.

Overcollateralized (DAI)

· Stability: Anyone can mint and redeem the underlying collateral and arbitrage, creating stability.

· Scalability: Struggles with scalability as it exists primarily as a byproduct of leverage demand. Aave and others are further outperformed when it comes to this feature.

· Decentralization: Highly decentralized compared to alternatives, despite some reliance on centralized stablecoins and treasuries as collateral.

Algorithmic Stablecoins

Scalability: Algorithmic stablecoins are highly capital efficient and scalable because they can be minted without exogenous collateral and typically distribute some form of yield to participants when demand exceeds supply.

Decentralization: They are also decentralized because they tend to rely solely on crypto-native collateral.

Stability: However, they fail miserably on stability because they are backed only by endogenous collateral, which leads to reflexivity and ultimately collapse via a death spiral. Every algorithmic stablecoin that has been tried has suffered this fate.

What about USDe

In my opinion, USDe is the most scalable fully collateralized stablecoin ever created. It is not yet fully decentralized, nor can it ever be fully decentralized, but it is at a very interesting point in the balance in my opinion.

Stability

USDe is fully collateralized by a Delta Neutral position that is offset by staked ETH and shorting ETH in perpetual contracts. Authorized participants can redeem stablecoins for the underlying collateral, which should bring stability. That said, this is a new design and there are obviously risks (more on this later). It is also unlikely to be as stable as fiat-backed stablecoins, as the redemption cost of those stablecoins is free, while the redemption cost of USDe will depend on the liquidity conditions at the time (i.e. the cost of closing a short position).

Scalability

This is where USDe really shines, for two main reasons. First, like fiat-backed stablecoins, Ethena can be minted 1:1 with collateral. However, unlike fiat-backed stablecoins, Ethena is able to generate meaningful organic returns for its holders at scale. Specifically, USDe can be staked into sUSDe to earn the protocol yield, which is a combination of the stETH yield and the funding rate.

sUSDE yield = stETH yield + funding rate (currently 35.4%)

Crucially, this yield is likely to be: a) scalable, b) counter-cyclical to Treasury rates

On scalability: Ethena effectively combines the two largest sources of "real yield" in crypto:

ETH staking: 3.5 billion output per year;

Funding rate for perpetual contracts: Open interest between ETH and BTC is about $35 billion per year (published this week), with an average return of about 11% over the past 3 years.

As we have seen in the past 3 months, this number may be higher during a bull market, with an average funding rate of about 30%.

Ethena could also eventually add other assets like BTC (25 billion holdings) and SOL (and possibly jitoSOL) over time to further scale supply.

On counter-cyclicality: Treasury yields are likely to move lower over time, and demand for leverage in crypto should rise as people move further up the risk curve. As yields on competitors backed by US Treasuries fall, Ethena's yield should remain high (due to rising demand for leverage).

Decentralization

Decentralization is a multi-dimensional spectrum that will ultimately depend on the weight of each dimension. Personally, I think Ethena falls somewhere between fiat-backed and over-collateralized stablecoins in terms of decentralization.

It is more censorship resistant than fiat-backed stablecoins because it does not rely on traditional banking rails, which ultimately rely on the Federal Reserve through correspondent banks and can be shut down overnight. Arthur describes this very well in his recent article.

However, it does face some counterparty risk from CEXs. Specifically, Ethena holds collateral on exchanges with institutional-grade custodians in MPC wallets, and then uses Copper, Ceffu, and Cobo to map the collateral in equal amounts to CEXs. Settlements are made every 4-8 hours, and trading risk is mitigated through profits during settlement.

More importantly, unlike over-collateralized stablecoins that can be minted/redeemed permissionlessly on-chain, Ethena relies on calling off-chain servers to calculate the CEX with the most efficient funding rate and mint USDe. Admittedly, this is a centralized factor that makes it vulnerable to censorship.

Profitability:

Unlike most other crypto projects, Ethena is also very profitable. It has become the most profitable dApp in the cryptocurrency space, surpassing all DeFi and second only to Ethereum and Tron in 30-day revenue.

Ethena’s profitability comes from all the yield it generates. Currently, this money will be deposited into the insurance fund, but it is expected that this money will eventually be distributed to stakers in a certain proportion.

Assuming a 10% distribution rate, Ethena’s protocol revenue is:

Total yield * (1–90% * (1—sUSDe supply / USDe supply))

It is worth noting that Ethena’s profitability is currently higher due to Ethena’s activity, and the staking rate is only around 30% due to the point incentive of locking USDe.

This dynamic also highlights the benefits of why USDe is successful as a stablecoin. The more USDe used by stablecoins, the less USDe is staked, and the more profitable Ethena is.

Risks

The most common FUD I’ve seen people focus on is the risk of funding rates, i.e. what happens if funding is negative for a long time? Will we see something like UST de-pegging/crashing?

In this regard, it is worth pointing out that:

Historically, funding rates have usually been positive

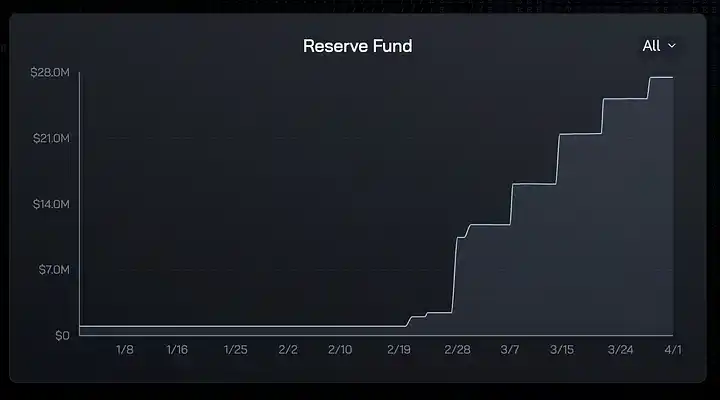

· There is an Insurance Fund (IF) to cover periods of negative funding

· Most importantly, even in the worst case scenario where funding is negative for an unprecedented period of time and the IF is completely exhausted, USDe is fully collateralized by external assets and has a degree of anti-reflexivity built into the design that makes it very different from UST.

Historical situation of funding rates

Historically, funding rates have been positive, especially when considering Ethereum staking yields. Past 3 years:

· Funding has averaged a positive 8.5% on an OI-weighted basis

· Funding rates after deducting staked ETH yields have only been negative on 11% of days

· Maximum consecutive funding days of 13 days vs. 110 days of funding

There may also be reason to believe that funding rates will remain structurally positive for the long term. Some exchanges (Binance, Bybit) have a base funding rate of 11%, meaning that if the funding rate is within a certain range, it will default back to 11%. These exchanges account for more than 50% of the open interest. Even when we look at TradFi, CME Bitcoin futures are larger than Binance, with a current difference of about 15%. Generally speaking, as a proxy for capital cost, the futures yield basis is positive the vast majority of the time.

Insurance Fund (IF)

When the funding rate does go negative, there will be an insurance fund to subsidize the sUSDE yield and ensure that its floor is 0 (i.e. it will never go negative).

A portion of the protocol revenue will be reallocated to the IF to ensure it grows organically over time. Ethena Labs provided a $10 million donation to launch the IF.

It’s currently sitting on $27m, with all protocol revenue being sent there (roughly $3m/week at the current run rate).

both the Ethena team and Chaos Labs have conducted in-depth research to determine the optimal size of the insurance fund. Their proposal is to match $20 million to $33 million in insurance funds for every $1 billion of USDe.

Anti-Reflexivity

Now, let’s assume a situation where the funding rate is negative beyond the stETH yield and lasts long enough to deplete the insurance fund.

In this case, the principal balance of the stablecoin will slowly drop below $1 because the funding rate is paid on the collateral balance. While this sounds bad, the risk here is very different from the adjustable risk because the collateral will slowly decrease over time instead of crashing to 0 quickly and violently. For example, Binance’s maximum negative funding rate of -100% implies a loss of 0.273% per day

As Guy points out, this exogenous funding rate actually embeds “anti-reflexivity” or a negative feedback loop into the design.

Yield is negative → users redeem stablecoins → short positions are closed → funding rate returns to above 0

Stablecoin redemptions help balance out funding rates and bring the system back into balance. This is in contrast to algorithmic stablecoins, where redemptions reduce the price of the corresponding token and create a feedback loop that constitutes a so-called "death spiral."

Two additional things to note:

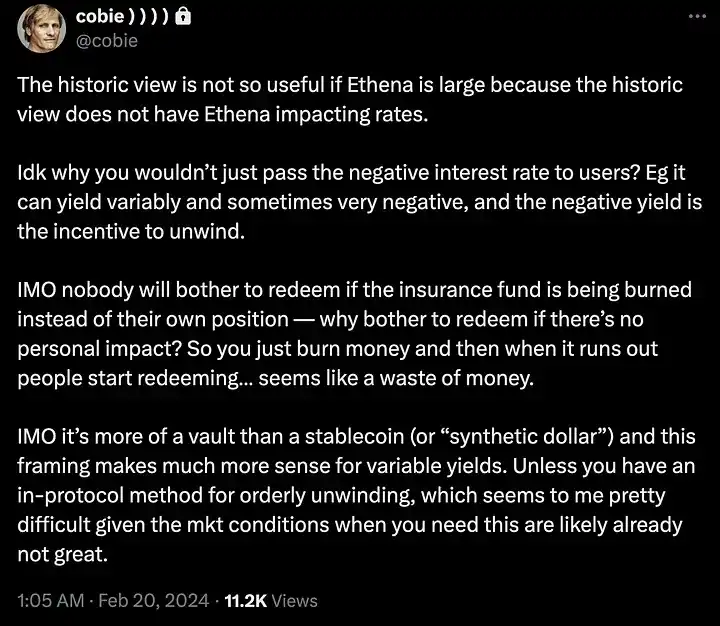

1) When the funding rate turns negative, the unpegging may not happen suddenly, but rather gradually as the yield decreases over time. If you can get the same yield from Treasuries (or RWA products), why hold USDeE?

2) The insurance fund is a design choice to optimize the user experience for sUSDE holders by smoothing the yield and avoiding them worrying about the loss of principal every day.

Ethena can choose to pass on the negative yield to holders, as Cobie suggests below, which will make the negative feedback loop stronger by encouraging people to redeem their funds more quickly in response to changes in funding.

Other Risks

While I don’t think negative funding rates are a particularly big risk, there are certainly a lot of other risks to consider.

After all, this is a brand new mechanism that offers very high yields. No yield is without risk, and the higher the yield, the more skeptical one should be.

Here is a non-exhaustive list of risks and mitigations that I consider:

1. Historical funding rate data does not include Ethena itself. If USDe becomes large enough relative to overall open interest, it could: a) significantly reduce average funding rates b) exacerbate funding rate volatility, which could lead to violent liquidations, poor execution, and potential USDe depegging.

Relatedly, stETH yields could also continue to decline over time, further damaging the economy and making the above problems worse. This is definitely a risk. There are some mitigation measures here:

a) There is a 7-day delay in unstaking sUSDe, which will ease market panic when a large amount of supply will be staked

b) Even in the worst case, this unpegging will not have a serious impact on the protocol solvency, because the spread will cause the authorized participants to redeem. This will mainly hurt users who redeem at a loss, and more importantly, it will hurt protocols/users who use leverage in USDe.

2. LST collateral has relatively poor liquidity and may be severely slashed and/or unpegged. A sufficiently violent unpegging may cause Ethena to be liquidated and suffer losses.

However, given that Ethena uses limited or no leverage, only an unprecedented unpegging will lead to liquidation. According to Ethena's own research, this requires LST to be unpegged from ETH to reach 41-65%, and the highest unpegging ratio of stETH in 2022 is about 8%.

Ethena has also now diversified its LST exposure, which further alleviates this problem, and currently only holds 22% of collateral in LST, of which ETH currently accounts for 51%. When the funding rate reaches +30% in a bull market, the 3/4% stETH yield becomes less important, so Ethena may hold more ETH in a bull market and more stETH in a bear market.

3. Ethena has credit risk on its short counterparties on CEX. A counterparty crash could mean that: a) Ethena ends up being net long rather than Delta neutral b) USDe is depegged based on its P&L exposure to a particular counterparty.

However, Ethena settles with CEX every 4-8 hours, so they are only affected by the difference between the two settlement cycles. While this can be large during rapid and violent market fluctuations, this is completely different from the entire capital being affected.

It is also worth noting that, as we saw with the USDC incident in May last year, all stablecoins have a certain degree of counterparty risk.

4. All of the above risks may be amplified and systemic once USDe circular leverage begins to be added.

This will definitely lead to some panic, chain liquidations, and depegging. These situations may be more destructive to users and protocols that use USDe than Ethena itself. However, in extreme cases, it could also hurt Ethena.

The only way to re-anchor is to redeem the underlying asset and close the short position. If liquidity is thin, this step could result in huge losses.

5. Ethena Labs and related multi-signatures have control over the assets (currently ⅔ multi-signatures with Ethena, Copper, and independent third parties)

In theory, they can exert influence on the assets off-chain or otherwise harm the assets, and USDe holders have no legal rights and must resolve this issue in court without precedent.

6. Ethena may also be subject to an injunction from regulators and require the freezing of assets, thereby indirectly controlling a bunch of ETH/stETH

7. Finally, there may be a lot of unknowns.

Ethena actually operates as a tokenized hedge fund on the back end. This stuff is difficult, with a lot of moving parts and ways that can go wrong. Don't invest more than you can afford to lose.

Everything in crypto carries risk, as we've discovered the hard way repeatedly. In my opinion, it's important to be as transparent as possible about the risks and allow individuals to make their own decisions.

I'd say the Ethena team has done a great job overall on this front, providing the most comprehensive documentation and risk disclosure I've seen from an early-stage project.

For my part, I have had a lot of personal exposure on Ethena since before the shard event, bought a bunch of USDE/sUSDE Pendle YT, and invested through Delphi Ventures. As you may know by now, this is one of the projects I am most excited about this cycle.

I still think stablecoins are a $10 billion opportunity. Ethena brings a very interesting point of view on the stablecoin tradeoff spectrum and is hard to beat on this and larger volumes.

I also think Guy is one of the best founders we have ever backed, who has taken Ethena from an idea to the fastest growing USD-denominated crypto asset of all time with $1.5 billion TVL in a little over a year.

This time around, he’s assembled a stellar team to realize his vision and surrounded himself with some of the best backers in the space (top CEXs, VCs, market makers, etc.), and it’s exciting to see where he goes in the coming years.

Thanks to Yan Liberman for helping me brainstorm and put together this post, 0xDef1, Jordan, and Conor Ryder for reviewing, and Guy Young for answering all my stupid questions.

Original link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR