A detailed analysis of on-chain fund flows: Which public chains have the most net fund inflows in Q1?

Original title: Analyzing Flows Between Blockchains

Original author: Michael Nadeau, The DeFi Report

Original translation: Luffy, Foresight News

People say that investing should follow the smart money, and the beauty of public blockchains is that we can easily do this with on-chain data.

As the infrastructure connecting blockchains improves, network effects and economic moats within any single network may become increasingly difficult to achieve. Therefore, we have been studying the net capital flows of the top 15 L1 and L2 to accurately reveal the direction of value flow in public blockchain networks, and now it is time to share our findings with you.

Which blockchains have the largest net capital inflows?

Winners:

· We can see that Arbitrum is the biggest winner. Arbitrum has received over $2.3 billion in net flows from other blockchains in the past 3 months.

· Optimism is in second place, with nearly $800 million in net inflows over the same period.

· StarkWare is in third place with over $700 million in net inflows.

· Base is in fourth place, with nearly $600 million in net inflows over the past 3 months.

· Finally, Sui is in the top five with $423 million in inflows, and is the only non-EVM chain to have seen significant inflows in the past 90 days.

Losers:

· Ethereum has seen over $3.6 billion in net outflows over the past 90 days. During the same period, over $4.4 billion entered the Ethereum ecosystem via L2. L2 pays settlement fees to ETH L1, so the funds don’t actually leave Ethereum.

· Over $1 billion has flowed out of zkSync in the past 3 months.

· Over $500 million has exited the ecosystem from Avalanche.

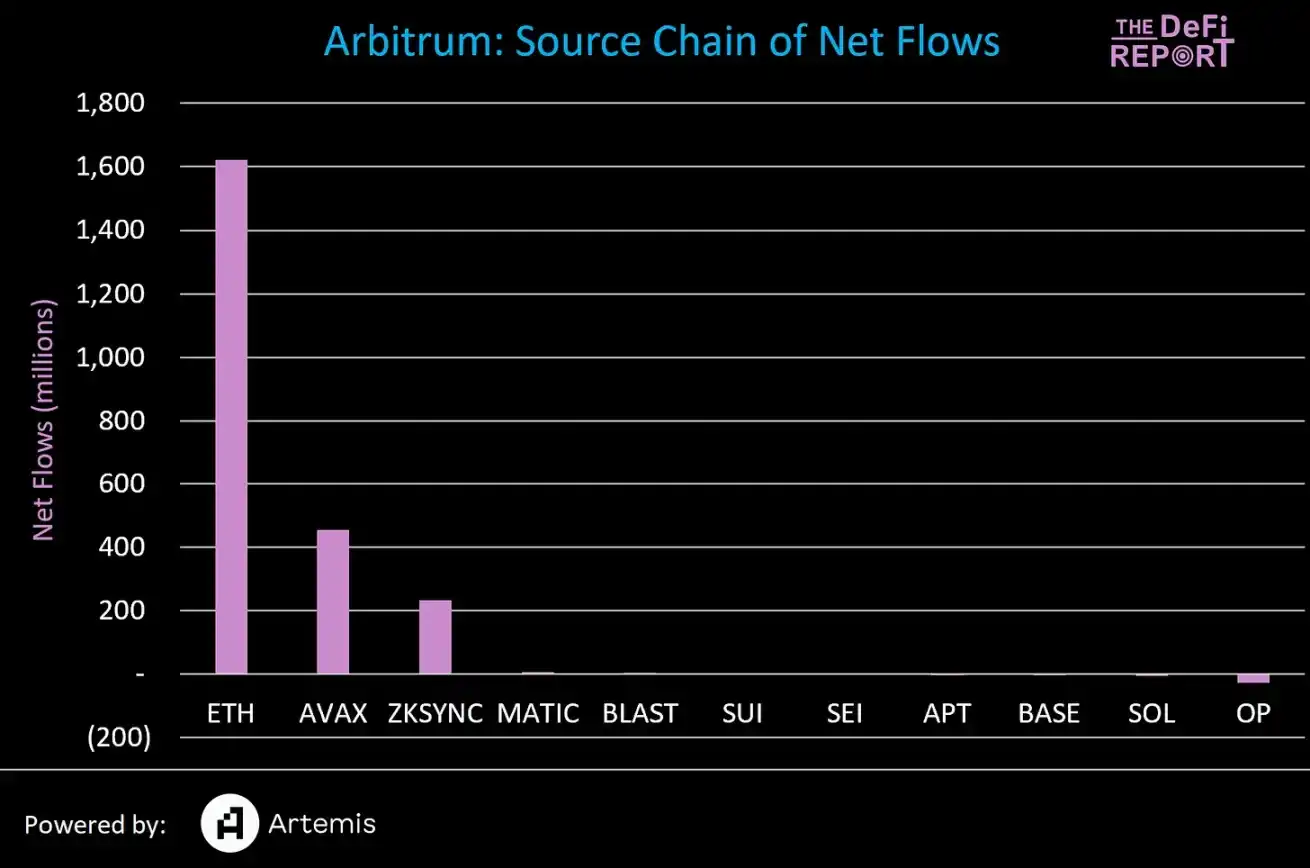

Where is Arbitrum’s net inflow coming from?

We can see that the vast majority of Arbitrum’s inflows (70%) came from Ethereum L1. About 25% of the inflows were stablecoins, and other tokens accounted for 75%. We expect funds to continue to leave Ethereum L1 and flow into the most popular L2.

But surprisingly, nearly $500 million left the Avalanche ecosystem and went to Arbitrum. If we revisit the first chart, Avalanche was one of the biggest losers in the group, with $543 million leaving the ecosystem last quarter, 84% of which went to Arbitrum.

Which projects on Arbitrum are capturing these inflows?

We can’t say for sure which projects on Arbitrum are capturing these inflows, but the above projects accounted for the most gas consumption on Arbitrum over the past quarter.

When we look at the 90-day trend, RabbitHole (a game) stands out as its gas consumption is up 1,147% over the past quarter.

Another interesting observation about Arbitrum is that Pyth Network (the leading data oracle within Solana) has seen a 600% increase in gas consumption over the past quarter after supporting Arbitrum.

Blockchains with the Most Outflows

We talked about Avalanche, but zkSync (Ethereum L2) has lost over $1B in the past 90 days. Where did all that money go?

· $328M into Optimism

· $313M into Ethereum

· $232M into Arbitrum

· $37M into Base

Key Point: All funds out of zkSync stayed within the Ethereum ecosystem.

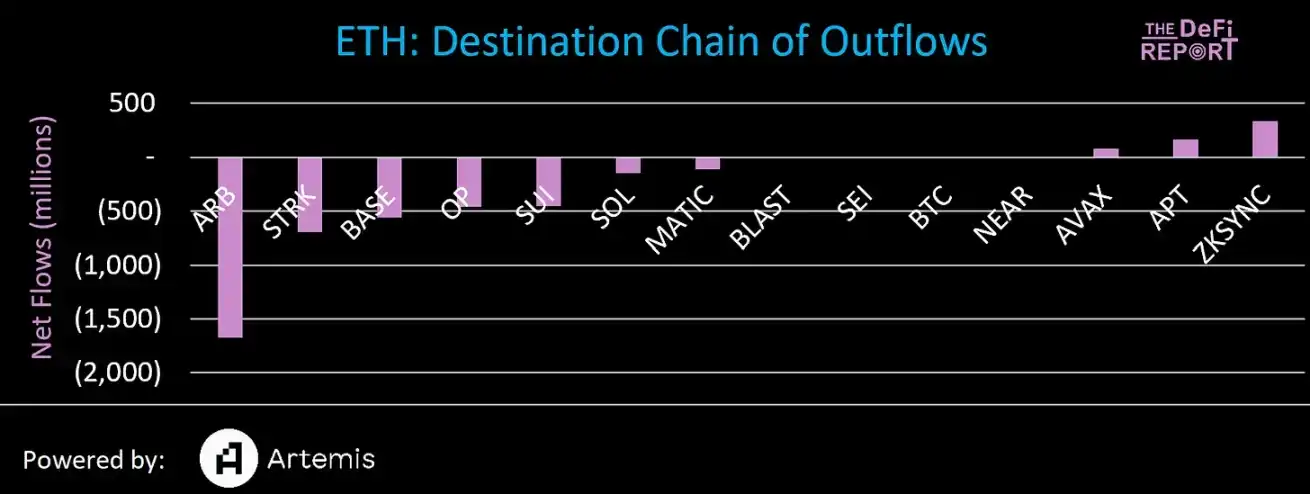

What about Ethereum? We know Arbitrum received $1.6 billion from Ethereum, but where did the rest of the money go?

The vast majority of Ethereum’s net outflows also stayed within the Ethereum ecosystem, flowing to Starknet, Base, and Optimism.

Sui was the largest non-EVM beneficiary of Ethereum’s outflows, receiving $452 million. In addition, Solana received $152 million in inflows from Ethereum.

Key Points

As public blockchain networks mature, we expect the amount of money in the tech stack to rise.

We also expect that there will eventually be 3-5 major L1s (and possibly a range of less significant L1 blockchains).

But as cross-chain infrastructure and account abstraction mature, we expect value to be able to flow freely across various networks and ecosystems, making impenetrable network effects and economic moats harder to achieve.

That being said, we draw some key conclusions from analyzing the flow of money in the major L1s and L2s.

Ethereum

The largest L1 has lost a lot of money, but it has been picked up at the L2 level. In my opinion, this is good for Ethereum. If we see money leaving L1 instead of flowing to L2, and leaving the Ethereum ecosystem altogether, it will be a red flag. To be clear, we are not seeing this today.

Furthermore, despite over $3B in outflows, Ethereum’s TVL is up 60% in the last 3 months. This highlights the flaws of TVL as a KPI (underlying asset prices are highly volatile and can be easily manipulated).

Solana

Solana has seen only $169M in net inflows across the 15 largest L1s and L2s in the last 3 months. During the same period, Solana’s TVL grew from $1.4B to $4.5B (up 221%).

So how did this happen?

· The price of SOL has risen from $100 to $171 (up 77%) in the last 3 months.

· More and more SOL is being added to liquidity staking solutions (Marinade, Jito, BlazeStake)

· Several projects within the Solana ecosystem have issued tokens, such as Jito, Pyth, Jupiter, and Tensor. These projects have created billions of dollars in wealth, some of which remains in Solana DeFi.

· Memecoin on Solana has been on a wild ride for months, with increasing volume and "value locked".

Solana's growth in TVL has been largely organic growth within the ecosystem.

Sui

Sui is the biggest winner among the new era “high throughput” blockchains. It received $423M in net inflows, the vast majority of which came from Ethereum. This appears to be the main catalyst that has driven Sui TVL up from $220M to $660M today.

Cross-Chain Bridges

As mentioned above, as cross-chain infrastructure matures, the flow of value across various networks is likely to accelerate, driving value out of any particular L1 and potentially into the cross-chain bridges themselves. To be clear, we are not seeing this happening yet, but are still monitoring it.

Wormhole is one of the largest cross-chain bridges today. It provides interoperability between Solana, Ethereum, Arbitrum, BNB, Avalanche, Optimism, Near, and Polygon. The team recently launched a token, and the FDV briefly exceeded $10 billion. This number is close to that of Ethereum L2, which is a market signal that cross-chain infrastructure is strong and worth paying attention to.

Original link

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR