SynFutures potential airdrop value analysis and interaction strategy

Original source: SynFutures

I. Project Introduction

SynFutures is the most outstanding decentralized perpetual contract protocol on Blast. Currently, the TVL exceeds $58 million, the total transaction volume exceeds $26B, and the daily transaction volume is stable at $1B. All indicators are very good.

Data source: https://info.synfutures.com/

The team received 2 rounds of financing totaling $38m, including Pantera, Polychain, Dragonfly and other well-known institutions. The protocol has passed the Quantstamp audit.

II. Analysis of Airdrop Returns

**SynFutures Airdrop Rewards: SynFutures has participated in the Blast Big Bang event and promised to take a certain proportion of tokens for airdrops, which is an open airdrop. **Currently, SynFutures has launched the Epoch 3 event. Inviting friends, adding liquidity, making markets through limit orders, and trading can earn points and obtain SynFutures' future airdrop rewards.

Blast Points Rewards: ETH and USDB can be obtained by depositing them in SynFutures, and share 50% of Blast's future airdrops. In addition, in the projects supported by the Blast Multiplier event, new users can get doubled Blast Points rewards by interacting with them.

**Blast Gold Rewards: You can get Blast Gold rewards by trading and providing liquidity on SynFutures, and share 50% of Blast's future airdrops.

**Blast native income: **ETH stored on SynFutures can get **4% annualized, **USDB can get 15% annualized.

From my experience of mining Vertex, for this kind of derivative project that earns points through trading volume, the first-phase return is 10 times the transaction fee, which is not a problem. **Overall, the return is about 4 or 5 times. **No one paid attention to Vertex at the beginning. At that time, it was the easiest to interact with. Later, I actually regretted not investing heavily.

If the valuation is aligned with $AEVO, then it is calculated based on 3 billion, and the airdrop is 5% to 10%, so there will be about 150 million to 300 million airdrops. Adding the rewards from Blast, a conservative estimate of 3-5 times the return should not be a problem.

3. Interaction Strategy

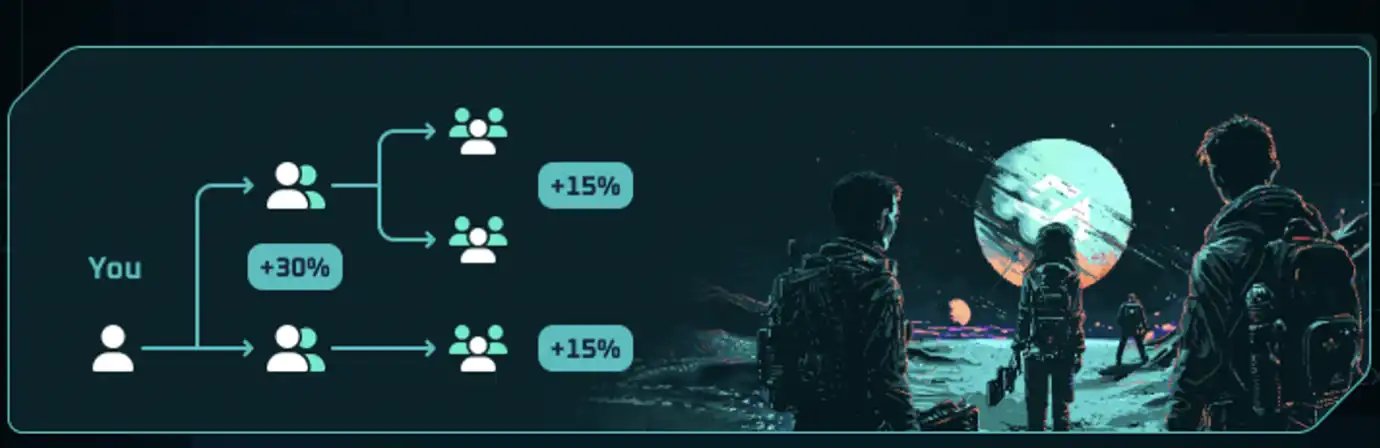

1. Establish an invitation relationship

First, create 2 small accounts and establish a binding relationship between them. This will ensure that you get the most points. The first account can use my invitation link, and you can get an additional 30% bonus in the first 7 days.

Link: https://oyster.synfutures.com/#/odyssey/44Q2P

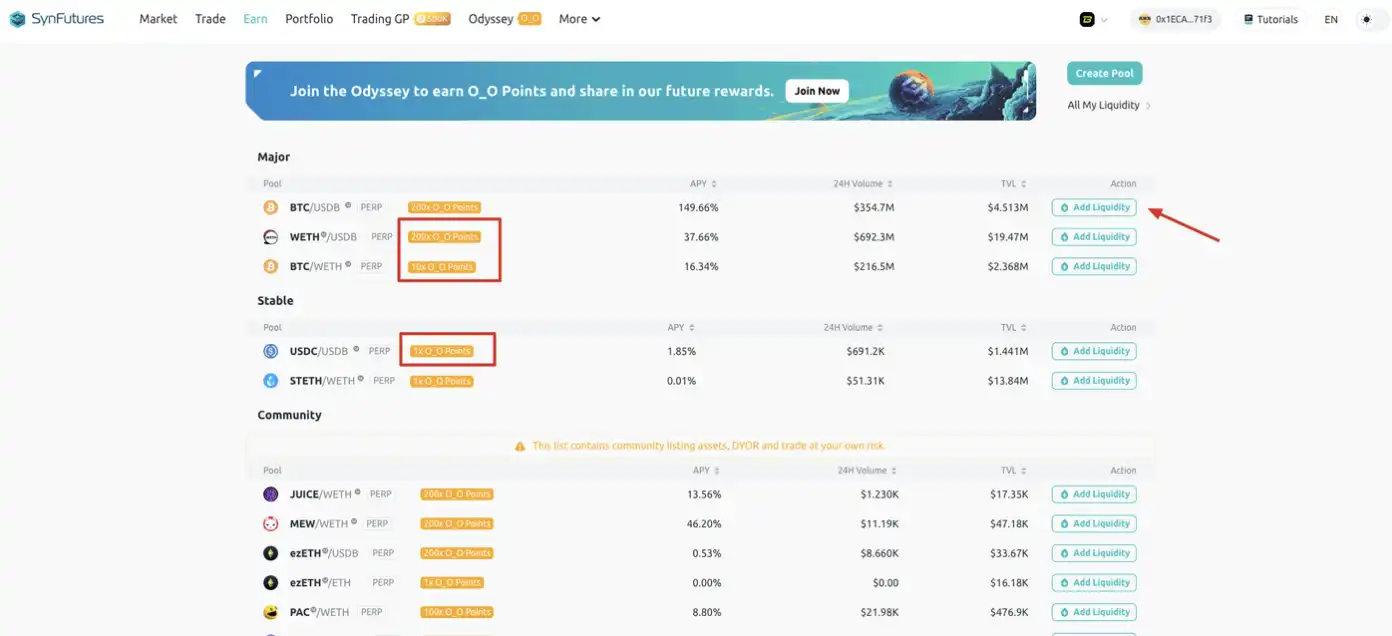

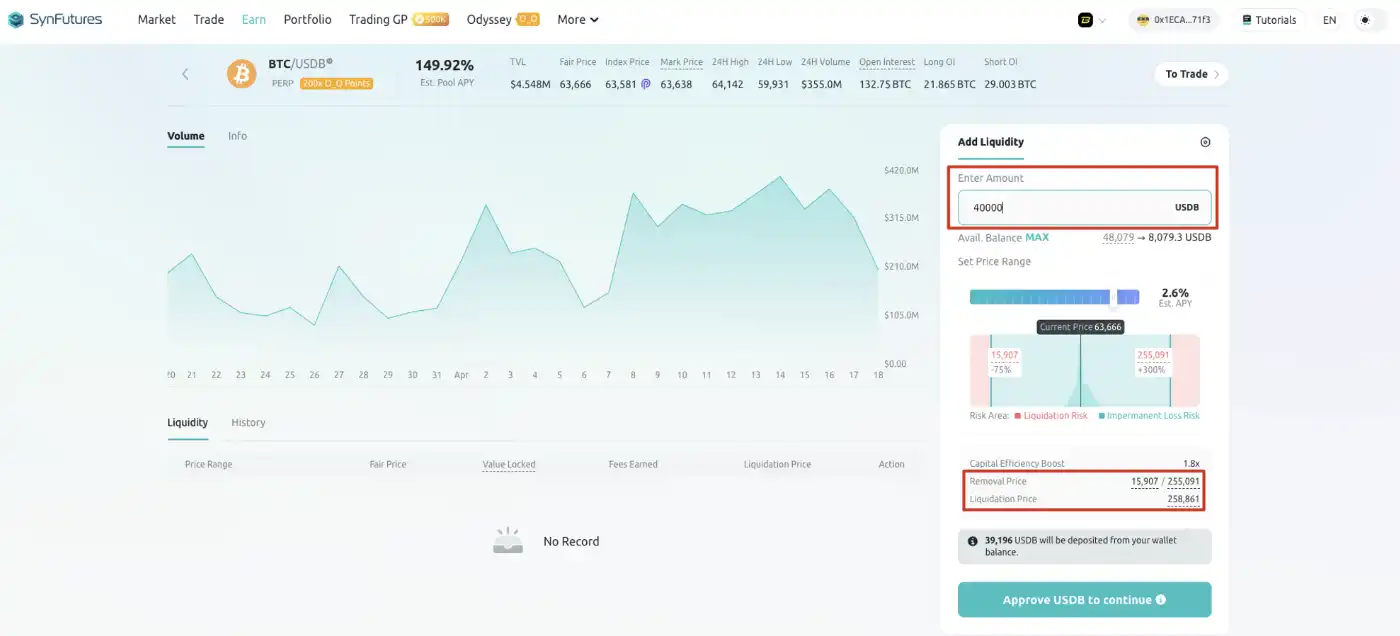

2. Earn points by providing liquidity

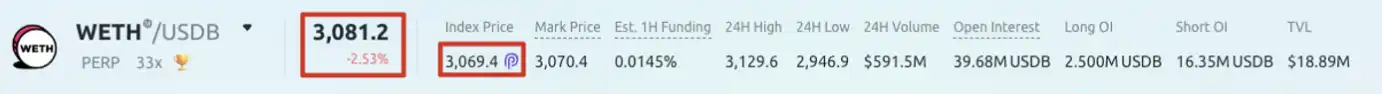

Similar to providing liquidity in UniSwap V3, adding liquidity on SynFutures also requires selecting a price range. **The narrower the price range, the more fees and points you earn, but the corresponding impermanent loss is also higher. The second red box means that **if the market price exceeds the price range, your liquidity will be removed and liquidated. **So in order to avoid this situation, we can choose a wider price range to avoid liquidation. For example, the price range I chose in the above picture is 15,907 ~ 255,091. To exceed this price range, **the probability is so small that it can be ignored. **Even in the most extreme case, if it keeps falling, this price range will allow me to calmly remove liquidity and avoid liquidation.

In addition, in a wider range of market making, the commission earned can easily cover the impermanent loss, **turning into a profitable state, **especially at present, many users are frequently trading to earn points.

3. Earn points through trading

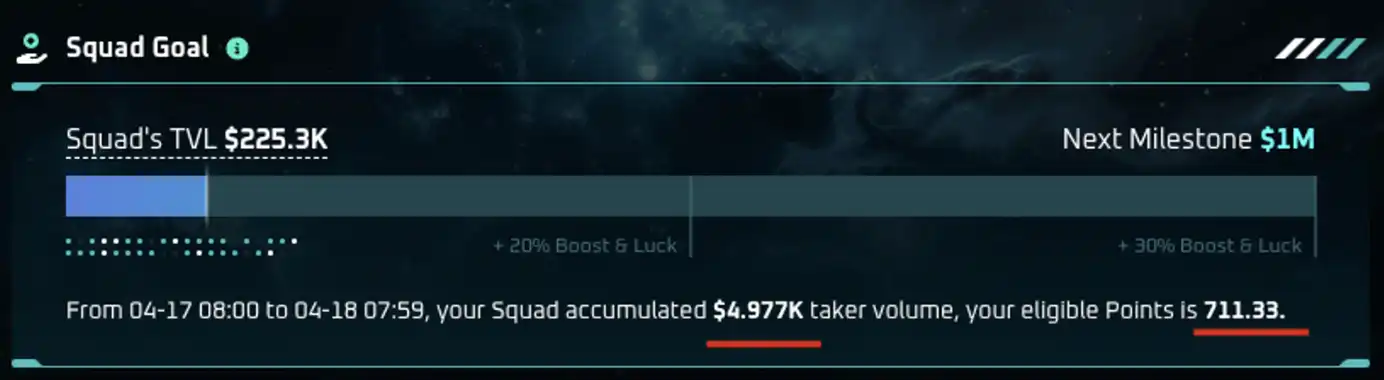

Considering the invitation relationship, we only need to **use the last invited account to interact with the protocol, so that the other two accounts can also get points. **Currently, the trading volume is settled every 24 hours. The points reward can be seen in the team.

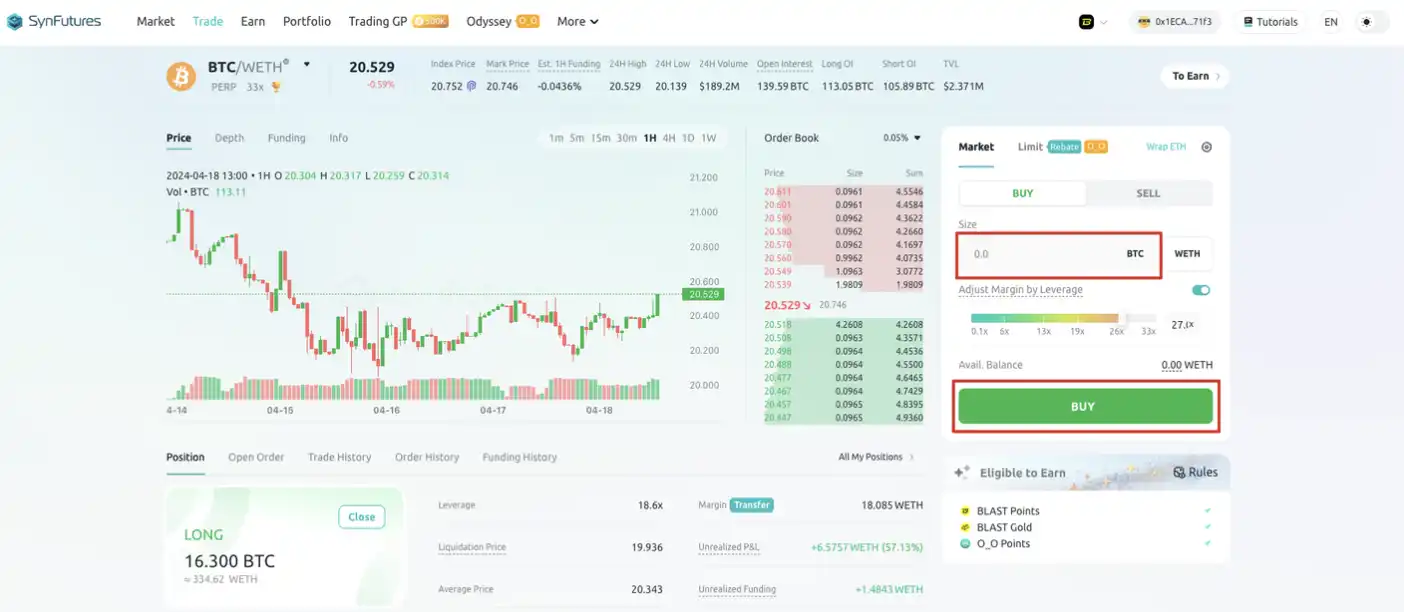

Earning points through trading is relatively simple, **and the cost is relatively controllable. You only need to keep buying and selling at the market price. **Before large transactions, you can try a small amount, understand it clearly, and then operate to avoid losses.

If you are doing it manually, here is a little trick. I suggest you open two browsers, open a long order in browser A, and then click Buy. At this time, a confirmation pop-up window of MetaMask will pop up. **Don't click Confirm at this time. **Then go to another browser to open a short order, and then click Sell. At this time, a confirmation pop-up window of MetaMask will also pop up. **Don't click Confirm yet. **After both sides are ready, click the confirmation of the Buy pop-up window first, and then click the confirmation of the Sell pop-up window. This ensures that your closing transaction follows your opening transaction and will not be arbitraged by others. The slippage needs to be set larger, otherwise it is easy to fail.

3. Earn points by market making

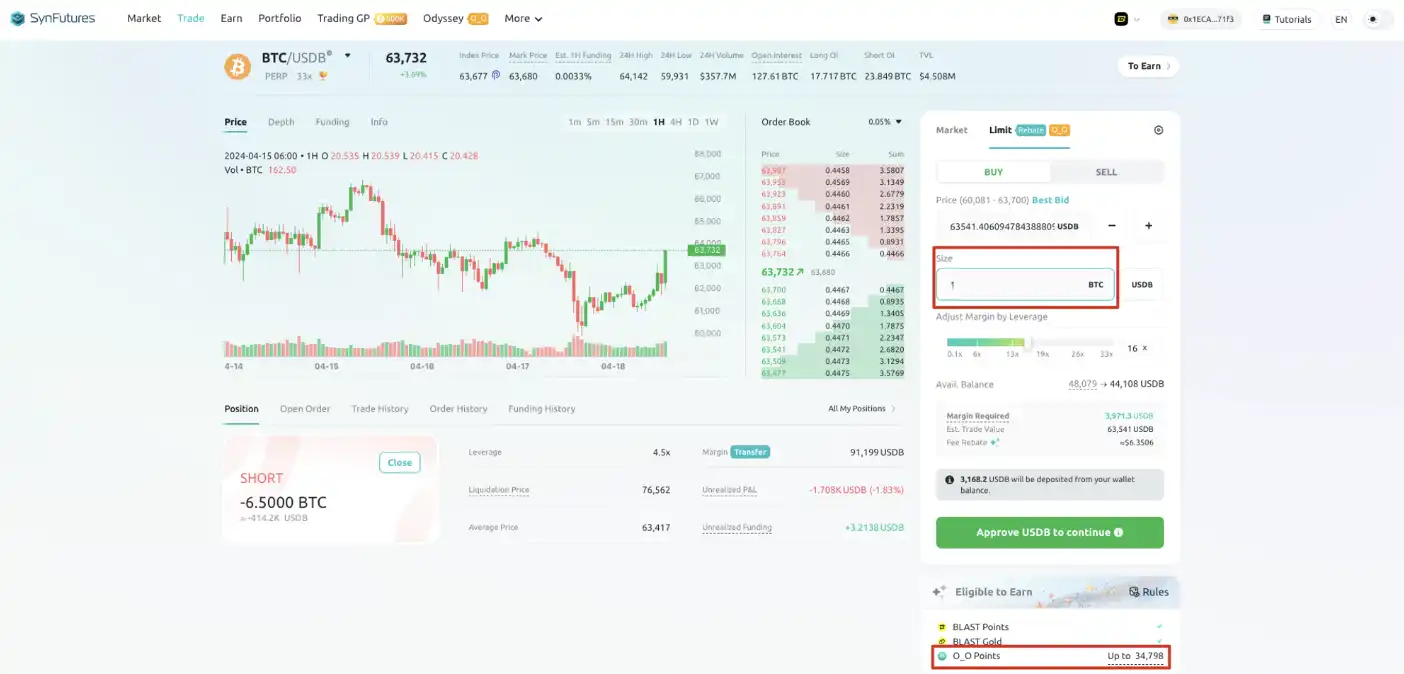

Here, just like centralized exchanges, enter the price, quantity and confirm the order. The second red box shows how many points you can earn for this limit order at most. The larger the order amount, the more points you earn. Also note that if the order is eaten within 12 hours, the points earned will be calculated based on 12 hours; if it is eaten after 12 hours, the points will be calculated based on the actual duration, with a maximum of 7 days.

Note that there is a 0.01% rebate for limit orders, which is equivalent to you trading $1w and you can earn $1. In addition, your own pending orders can be eaten by your own market orders. Combined with point 2, you can actually achieve a strategy for earning points with lower wear and tear.

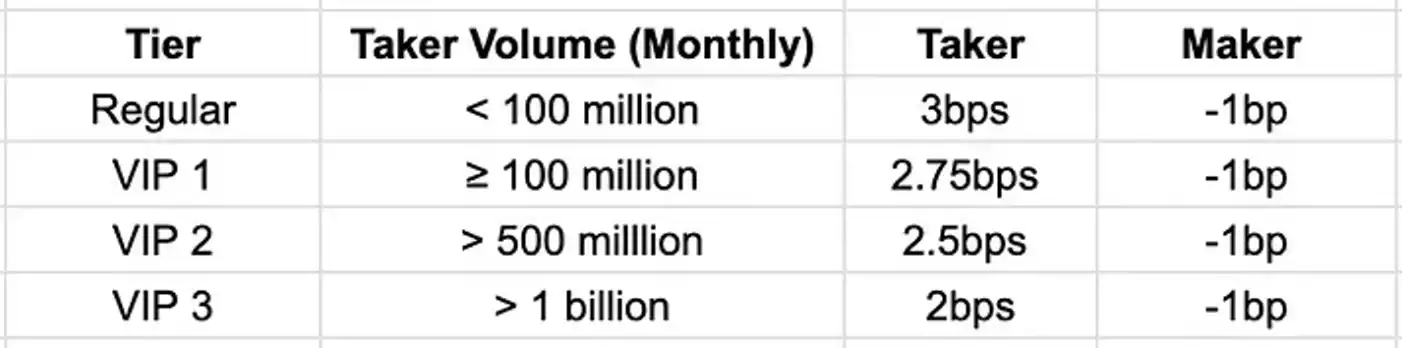

5. Enjoy VIP transaction fee discount

This needs no further introduction. Combining with point 2, you can continue to reduce costs. The preferential fee will be directly deposited into your address next month.

For more detailed information, please see the official article: https://medium.com/synfutures/v3-update-introducing-fee-tiering-and-institutional-tools-3d01462ce92c

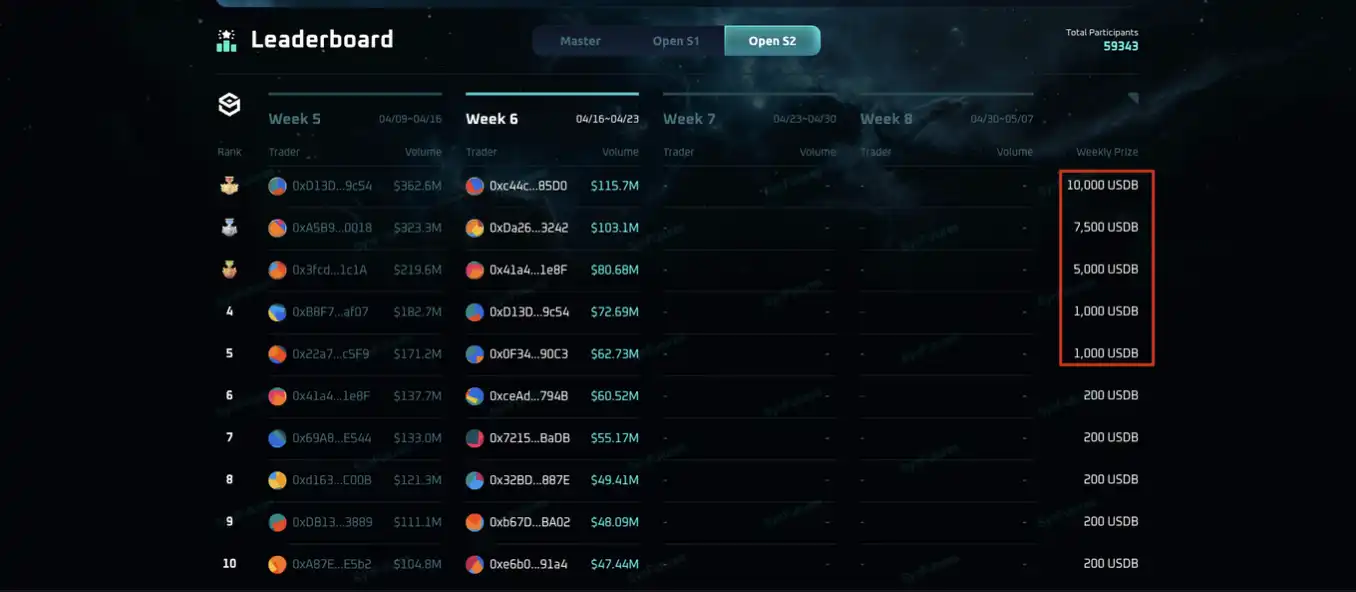

It should be mentioned here that its current trading competition is ranked according to weekly trading volume. The top 3 prizes are **$10,000, $7,500 and $5,000 respectively. **Capable big brothers can combine this activity to continue to reduce interaction costs.

6. Trading and arbitrage through SDK

The official SDK is now open, see here for details:https://www.npmjs.com/package/@synfutures/oyster-sdk

If you have the technology and experience, you can use their SDK to realize automated arbitrage and trading, which is more convenient. In addition, there is often a price difference between its price and centralized exchanges. When it plummeted, I had a price difference of 3-5 points. From the addresses of several market makers I tracked, the income is still good, but I can't beat Bot by hand.

Fourth, Summary

This should be the most detailed tutorial on the SynFutures airdrop in the entire network! ! !

I am personally interested in projects related to decentralized derivatives, so if I encounter good and reliable projects, I will move part of my transactions to these projects, and I will get some good gains from time to time. SynFutures is currently undervalued, and I think its TVL still has a lot of room for growth, and it should be no problem to reach 100-200 million. When others ignore it, it is an opportunity to re-position, which is a profound lesson that Wormhole has brought me.

If this article helps you, please use my invitation link to get a 30% Boost: https://oyster.synfutures.com/#/odyssey/44Q2P

This article comes from a contribution and does not represent the views of BlockBeats.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR