Rhythm Evening News | FDUSD issued about 500 million coins in 24 hours, and 80% of the total is participating in Binance's new coin mining; Solana Ecological Meme Coin MANEKI briefly broke through $0.02

Featured News:

1. FDUSD issued about 500 million more coins in 24 hours, and 80% of the total is participating in Binance's new coin mining;

2. Altcoins fell across the board, and HBAR fell 30% in 24 hours;

3. Solana's ecological meme coin MANEKI briefly broke through $0.02, with a 24-hour increase of 35.2%;

4. Since its launch, rune transactions have accounted for 68% of all Bitcoin transactions;

5. Sui Semi-Annual Report: Average daily DEX transaction volume increased by 3689%, and TVL increased by 1459%

Price Observation

Altcoins fell across the board, HBAR fell 30% in 24 hours

On April 25, according to CoinGecko data, as Bitcoin fell below $64,000 for a short period of time, altcoins fell across the board, including:

· HBAR fell 30% in 24 hours and is now quoted at $0.119

· BOME fell 12.2% in 24 hours and is now quoted at $0.01

· WLD fell 11.2% in 24 hours and is now quoted at $4.86

· W fell 7.9% in 24 hours and is now quoted at $0.545

· MINA fell 6.8% in 24 hours and is now quoted at $0.86

· PYTH fell 8.6% in 24 hours and is now quoted at 0.6 USD

Solana Ecological Meme Coin MANEKI briefly broke through 0.02 USD, with a 24-hour increase of 35.2%

On April 25, according to market information, the price of Solana Ecological Meme Coin MANEKI briefly broke through 0.02 USD, with a 24-hour increase of 35.2%, and currently fell back to 0.0178 USD. BlockBeats reminds users that meme coins have no actual use cases and their prices fluctuate greatly, so users should pay attention to the risks.

ETH fell below $3,100, down 5.12% in 24 hours

On April 25, according to OKX market data, ETH fell below $3,100 and is currently quoted at $3,095.3, down 5.12% in 24 hours.

Transaction Tracking

On April 25, according to Ember monitoring, Justin Sun Tron Address continued to redeem 45.35 million USDT from JustLend and transferred to Binance, and it is expected that he will continue to purchase ETH.

Previously, it was reported that the suspected Justin Sun address withdrew 7,127.9 ETH from Binance 6 hours ago, worth 22.28 million US dollars.

On April 25, according to data monitoring by The Data Nerd, the whale address starting with 0x0Ed withdrew 799 ETH (about 2.52 million US dollars) from Binance 2 hours ago, and deposited 200 ETH into Pendle. Last week, the address withdrew 3.08 million ENA from Gate and deposited all of them into Pendle.

A newly created wallet withdrew 23,752 ETH from Coinbase Prime 6 hours ago

On April 25, according to Scopescan monitoring, a newly created wallet withdrew 23,752 ETH (about 74.9 million US dollars) from Coinbase Prime 6 hours ago.

The whale address starting with 0x435 withdrew 7127 ETH from Binance again 9 hours ago

On April 25, according to Scopescan monitoring, the whale address starting with 0x435 withdrew 7127 ETH (about 22.1 million US dollars) from Binance again 9 hours ago.

A whale spent 25,948 SOL to buy MEW and MANEKI in the past 3 days

On April 25, according to Lookonchain monitoring, a whale address (cat-addict.sol) withdrew 25,948 SOL (US$4.05 million) from Binance in the past 3 days, and then spent 19,445 SOL (US$3.03 million) to buy 456 million MEW (currently worth US$2.67 million). And spent 6,503 SOL (US$1.01 million) to buy 109 million MANEKI (US$2.26 million).

A whale withdrew 620 BTC from Binance 3 hours ago, about 39.83 million US dollars

On April 25, according to The Data Nerd's monitoring, 3 hours ago, a whale withdrew 620 BTC (about 39.83 million US dollars) from Binance.

In the past month, the whale has withdrawn a total of 4,380 BTC (about 282.38 million US dollars) from Binance.

A Smart Money has made a profit of $231,000 by buying CatGPT at a low point

On April 25, according to @ai_9684xtpa monitoring, the Smart Money address starting with 6PmK has made a profit of $231,000 by buying CatGPT at a low point, with a return rate of 559%.

The Smart Money patiently waited for the price of CatGPT to fall to the psychological price before buying the bottom, and then sold all at the short-term price peak.

FLOKI early investors transferred 3 billion FLOKI to Binance 2 days ago, about 519,000 US dollars.

On April 25, according to monitoring by The Data Nerd, 2 days ago, FLOKI early investors transferred 3 billion FLOKI to Binance, about 519,000 US dollars.

ENA, HIGH and PEPE top the Smart Money 24-hour inflow list

On April 25, according to Nansen data, Smart Money 24-hour Ethereum network fund inflow tracking list is as follows:

ENA: inflow of 4.06 million US dollars, current price is 0.865 US dollars;

HIGH: inflow of 730,000 US dollars, current price is 3.32 US dollars;

PEPE: inflow of 330,000 US dollars, current price is 0.00000747 US dollars.

7 wallets spent 3388 SOL to buy 44.9% of the total tokens within 1 minute after MANEKI went online

On April 25, according to Lookonchain monitoring, 7 wallets (likely belonging to the same person) spent 3,388 SOL (about $525,000) to buy 3.99 billion MANEKI (44.9% of the total supply) within 1 minute after MANEKI went online.

Then, the 7 wallets distributed these 3.99 billion MANEKI to nearly 100 new wallets instead of selling them, currently worth about $88 million.

Project Dynamics

Manta Renew Paradigm has opened MANTA token rewards

On April 25, according to the official website data, Manta Renew Paradigm has opened MANTA token rewards. Users who Burn NFTs before the snapshot at 22:00 on April 24, Singapore time, can share 3 million MANTA rewards. Ecological project airdrop rewards will still be issued according to the specific airdrop rules of the project party. Users who use STONE to participate in Manta Renew Paradigm can obtain StakeStone airdrop points.

On April 25, Cointelegrph and a BlackRock spokesperson confirmed that BlackRock has no business relationship with Hedera and has not chosen Hedera to tokenize any BlackRock fund. The spokesperson added that BlackRock has always communicated directly with the public about the evolution of its digital asset strategy.

According to CoinGecko data, HBAR fell 30% in 24 hours and is currently quoted at $0.119.

BlockBeats previously reported that Archax CEO Graham Rodford clarified yesterday that "deploying the 'fund' on Hedera is indeed Archax's choice", and BlackRock is not directly involved in launching a tokenized money market fund on Hedera. HBAR fell more than 25% in a short period of time.

UniSat market now supports Runestone transactions

On April 25, UniSat posted on social media that the UniSat market has added support for Runestone transactions.

On April 25, according to the official announcement, Bitcoin re-staking public chain BounceBit announced that the Water Margin (Points Paradise) and East-to-West (BIT Incentive Program) activities have ended. Before trading begins, BounceBit will airdrop BB to all eligible participants who participated in any of the activities. Distribution will be automatic and no claim is required.

If users deposit MUBI, AUCTION or DAII, they will receive bridge tokens on the BounceBit chain in their wallets. These tokens can be withdrawn from the BounceBit chain through bridging. The bridge will be available once the mainnet is launched. WBTC, BTCB, FDUSD and USDT will be available for withdrawal at the end of May 2024.

All new and previously deposited tokens in the Premium Yield Program will continue to accrue earnings. These tokens will be available for withdrawal at the end of May 2024.

SynFutures launches perpetual contracts such as MERL, YIELD and MANEKI

On April 25, SynFutures launched the 4th phase of the points reward activity on April 23. Users can get Blast points, Blast gold and SynFutures points by providing liquidity and trading. The cumulative rewards issued by its trading competition have exceeded 450,000 US dollars.

SynFutures is the largest decentralized derivatives exchange on Blast. Since its launch on the Blast mainnet in March, its cumulative trading volume has exceeded US$30 billion. SynFutures previously announced that it had received US$38 million in financing from top industry institutions such as Pantera, Polychain, Dragonfly, and Standard Crypto, and the agreement has passed the Quantstamp audit.

On April 25, according to on-chain data statistics, the total number of transactions conducted by users using the cross-chain interoperability protocol Owlto Finance on Bitcoin ecosystem Layer 2 and other networks has reached 1,549,313, ranking first among all cross-chain protocols, occupying an absolute leading position. Owlto Finance's market share is even greater than the total of the 2nd to 5th BTC ecosystem cross-chain volume, exceeding 65%.

Currently, Owlto Finance has provided high coverage support for the BTC ecosystem, and has supported users to perform cross-chain operations on Merlin Chain, B Squared Network, BitLayer, BEVM, MAP Protocol, Taproot Chain, and Core networks.

BlasterSwap will live broadcast the on-chain game on the YOLO Games platform

On April 25, according to official news, at 22:00 Singapore time on April 25, BlasterSwap will live broadcast the Degen Game on the Yolo Games platform on Twitter and Youtube. After community voting, BlasterSwap will use 210,000 $PAC creator airdrops to interact with games on Yolo. Participants in the live broadcast will have the opportunity to receive PAC, Yolo points and Blast Gold rewards provided by BlasterSwap. BlasterSwap is the native DEX on Blast, with an average daily trading volume of 4 million US dollars and 30,000 independent active addresses. It provides V2/V3 AMM Pools, Aggregation, DCA, limit orders and Launchpad, and is also the winning project of the Big Bang competition.

CeFi News

On April 25, according to CoinGecko data, the total amount of FDUSD has exceeded 4.4 billion (about 3.9 billion 24 hours ago), and about 500 million coins have been issued in 24 hours.

According to Binance data, there are currently 3.527 billion FDUSD participating in this REZ new coin mining activity, accounting for 80% of the total.

A whale address borrowed 5,000 BNB from Venus and deposited it in Binance

On April 25, according to Scopescan monitoring, a whale address borrowed 5,000 BNB (approximately US$3 million) from Venus and deposited it in Binance.

OKX Jumpstart launches MSN (Meson Network)

On April 25, according to official news, OKX Jumpstart will launch a new project MSN (Meson Network), and the mining activity will start at 14:00 on April 26, Beijing time, and will last for 2 days.

This Jumpstart will support users to invest in ETH and BTC. The number of MSN in the two mining pools is 400,000, and a single account can stake up to 0.3 BTC or 3.5 ETH.

HashKey Global will be launched on Meson Network (MSN)

On April 25, according to official news, HashKey Global will be listed on Meson Network (MSN), and trading will be open at 15:00 on April 29, Beijing time.

Binance will list ALGO/USDC, EOS/USDC spot trading pairs

On April 25, according to the official announcement, Binance will list ALGO/USDC, EOS/USDC spot trading pairs at 16:00 on April 26, 2024 (Eastern Time Zone 8).

In addition, Binance will open trading robot services for spot algorithmic orders for ALGO/USDC and EOS/USDC trading pairs at 16:00 (ET) on April 26, 2024.

Binance BounceBit (BB) Megadrop is now open, and BB will be listed for trading on May 13

On April 25, according to the official announcement, Binance users can participate in the BounceBit Megadrop from 08:00:00 (ET) on April 26, 2024. The BounceBit (BB) Megadrop App page is expected to be launched within approximately five hours of this announcement.

Binance will list BounceBit (BB) at 18:00 (ET on May 13, 2024) and open BB/BTC, BB/USDT, BB/BNB, BB/FDUSD and BB/TRY trading markets, subject to seed tag trading rules.

Funding Express

Crypto VC March transaction volume hit a 12-month high, with total investment exceeding $1 billion

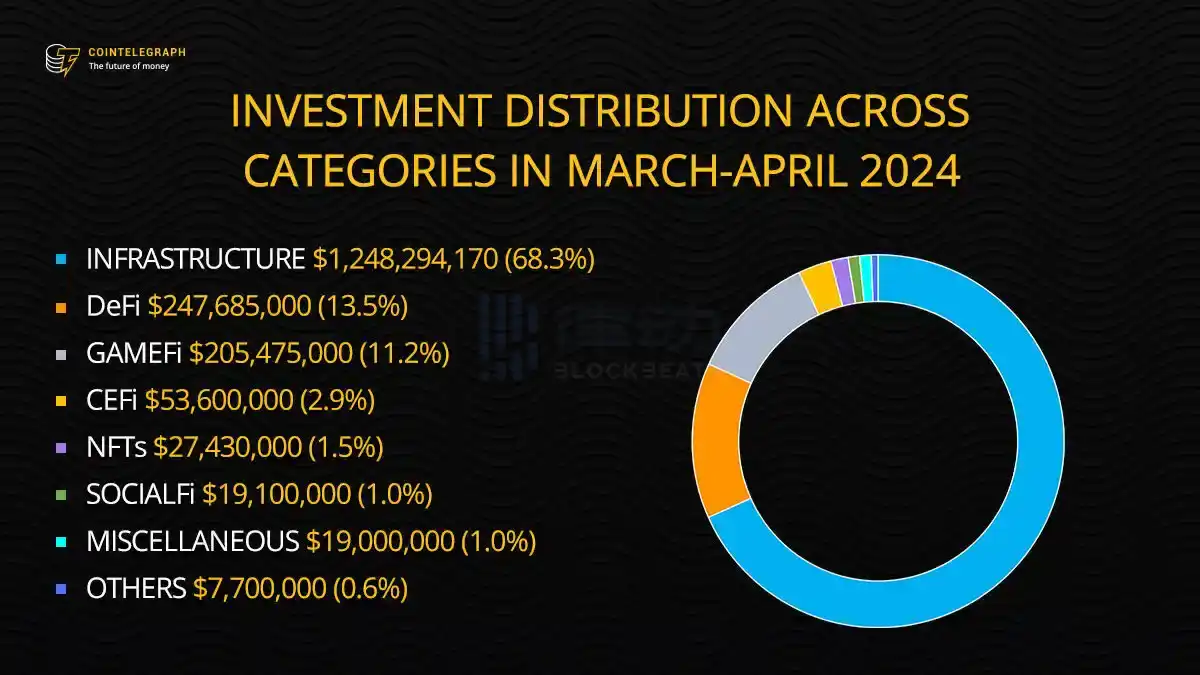

On April 25, according to Cointelegraph data, the crypto venture capital market continued to recover in March and April 2024. 161 separate transactions were completed in March, setting a 12-month record, with a total investment of more than $1 billion, up 52% from the previous month. Although April has not yet ended, 90 transactions have been completed so far, attracting more than $820 million in investment and financing.

Aligned Layer Completes $20 Million Series A Financing, Hack VC Leads Investment

On April 25, according to official news, Aligned Layer, a decentralized zero-knowledge proof verification layer for Ethereum developed based on EigenLayer, announced the completion of a $20 million Series A financing, led by Hack VC, with participation from dao5, L2IV, Nomad Capital, etc.

The Aligned Layer mainnet is scheduled to launch in the second quarter of 2024. As EigenLayer AVS, Aligned Layer provides Ethereum with a new infrastructure to obtain affordable zero-knowledge proof verification for all proof systems.

Viewpoint data

Bitcoin spot ETF net outflow of $121 million yesterday

On April 25, according to HODL15Capital data, Bitcoin spot ETF net outflow of $121 million yesterday, of which GBTC net outflow of $130.4 million, IBIT inflow of 0.

Sui Semi-Annual Report: Daily Average DEX Trading Volume Increased by 3689%, TVL Increased by 1459%

On April 25, messari released Sui 2023 Q4 and 2024 Q1 reports. Key information includes:

· Sui's average daily DEX trading volume increased by 3,689% to US$78 million in the past two quarters. Cetus and DeepBook led with daily average DEX trading volumes of US$37 million and US$26 million, respectively.

· Projects built primarily on Sui raised $11.3 million in Q1 2024, 31% more than the total amount raised by Sui projects in all of 2023. Projects that raised in Q1 included Talofa Games, Scallop, NAVI, Cetus, and Karrier One.

· Towards the end of March, Mysten Labs launched Pilotfish, a new execution scaling solution that distributes execution work across multiple machines for a single validator.

· Sui’s DeFi TVL grew 1,459% to $786.6 million over the past two quarters. Incentive programs helped drive growth, with multiple top protocols including NAVI, Scallop, and DeepBook launching or announcing tokens in Q1 24.

· During the on-chain game mission Quest 3, Sui had an average of 151,000 daily active addresses, with a peak of 453,000. Excluding this period, Sui's average daily active addresses in the past two quarters were 24,000.

On April 25, according to DeFiLllama data, the total market value of stablecoins has increased by 6.45% in the past month and is now reported at US$157.96 billion. (US$148.39 billion on March 25)

On April 25, according to the CoinGecko report, the NFT mortgage lending market Q1 transaction volume exceeded US$2 billion, a month-on-month increase of 44%, a record high. Among them, the total amount of NFT loans in January reached a record high of US$900 million, exceeding the single-month high of US$850 million set in June 2023.

The lending platform Blend has shown significant dominance in the market. As of March 2024, the monthly loan amount was US$562.3 million, accounting for nearly 93% of the market share. Blend has been leading the market, with its share fluctuating between 88.8% and 96.5%. In the first quarter of 2024, Blend's NFT lending volume increased by 49.2% month-on-month, totaling more than $2.02 billion.

Arcade has a 2.8% market share with $16.9 million in loans, and NFTfi follows closely with a 2.2% share, with $13.3 million in loans in March 2024. Both platforms have maintained a monthly market share above 1% since last year.

Other NFT lending platforms, such as X2Y2 (X2Y2) and BendDAO (BEND), each have a 0.8% market share, while Parallel Finance (formerly ParaX) has a 0.5% market share.

Runes account for 68% of all Bitcoin transactions since launch

On April 25, Cointelegraph reported that Bitcoin's new token standard Runes has accounted for more than two-thirds of Bitcoin transactions since its launch on April 20, following the network's halving event. According to data from the Dune Analytics dashboard shared by blockchain research firm Crypto Koryo, the Bitcoin network has processed more than 2.38 million Rune transactions, accounting for 68% of all Bitcoin transactions since its launch on April 20. Regular Bitcoin peer-to-peer transactions, BRC-20, Ordinals, and Runes are all included in the total transaction count.

On April 25, according to mempool.space data, Bitcoin network transaction fees have fallen back to normal levels, with high priority temporarily reported at 49 Sat/byte.

The open interest of Bitcoin contracts across the network reached US$31.41 billion

On April 25, according to Coinglass data, the open interest of Bitcoin futures contracts across the network was 487,500 BTC (approximately US$31.41 billion).

Among them, the open interest of CME Bitcoin contracts was 143,600 BTC (about US$9.23 billion), ranking first; the open interest of Binance Bitcoin contracts was 109,400 BTC (about US$7.07 billion), ranking second.

Bitcoin mining difficulty increased by 1.99% to 88.1 T yesterday, a record high

On April 25, according to BTC.com data, the difficulty of Bitcoin mining ushered in a mining difficulty adjustment at block height 840,672 (2024-04-24 22:51:52), and the mining difficulty was increased by 1.99% to 88.1 T, a record high. The current average computing power of the entire network is 642.78 EH/s.

Grayscale ETHE negative premium rate widens to 24.17%

On April 25, according to Coinglass data, the current Grayscale ETH Trust Fund (ETHE) negative premium rate is 24.17%; the ETC Trust negative premium rate is 42.24%. BlockBeats previously reported that Grayscale ETHE negative premium rate narrowed to 8.17% on March 9.

On April 25, according to Ember's monitoring, the eleven BTC spot ETFs had a net outflow of US$120.64 million on April 24, corresponding to a net outflow of about 1,886 BTC from the ETF custodian address after the opening of the U.S. stock market tonight (4/25).

Outflow: Grayscale (GBTC) outflow of about 2039 BTC (corresponding to an outflow of $130.42 million on April 24;

Inflow: The remaining ten ETFs inflow of about 153 BTC (corresponding to an inflow of $9.78 million on April 24).

The Bitcoin Volatility Index fell to 65.84 yesterday, a daily drop of 6.46%

On April 25, the BitVol (Bitcoin Volatility) Index, launched by financial index company T3 Index and Bitcoin options trading platform LedgerX, fell to 65.84 yesterday, a daily drop of 6.46%.

BlockBeats Note: BitVol 指数衡量从可交易的比特币期权价格中得出的 30 天预期隐含波动率。隐含波动率是指实际期权价格所隐含的波动率。它是利用 B-S 期权定价公式,将期权实际价格以及除波动率σ以外的其他参数代入公式而反推出的波动率。

期权的实际价格是由众多期权交易者竞争而形成,因此,隐含波动率代表了市场参与者对于市场未来的看法和预期,从而被视为最接近当时的真实波动率。

消息人士:美 SEC 预计下个月将拒绝批准现货以太坊 ETF

4 月 25 日,据路透社援引四名知情人士报道,在最近几周与美国证券交易委员会(SEC)举行会议后,美国发行商预计 SEC 将否决他们启动现货以太坊 ETF 的申请。

Four people who attended the meeting said that the recent meeting between issuers and the U.S. Securities and Exchange Commission (SEC) was one-sided, and agency staff did not discuss substantive details about the proposed products. People familiar with the matter said that SEC staff listened to their statements but did not clearly state specific concerns or ask general questions, indicating that the agency would reject the applications.

Regulatory News

On April 25, according to Caixin, the first batch of 6 virtual asset spot ETFs issued by Bosera International, China Asset Management (Hong Kong) and Harvest International have been officially approved by the Hong Kong Securities and Futures Commission, with the goal of listing on April 30, 2024. Although the ETF was first issued by a Hong Kong company under a Chinese public fund, it should be pointed out that mainland Chinese investors are not yet allowed to participate in the trading.

According to the product list on the website of the Hong Kong Securities Regulatory Commission, these six virtual asset spot ETFs were officially approved on April 23, 2024. The relevant products are: Harvest Bitcoin Spot ETF (03439.HK), Harvest Ethereum Spot ETF (03179.HK), China Asset Bitcoin ETF (03042.HK), China Asset Ethereum ETF (03046.HK), Bosera HashKey Bitcoin ETF (03008.HK) and Bosera HashKey Ethereum ETF (03009.HK).

On April 25, according to Bloomberg, Maxine Waters, the leader of the Democratic members of the U.S. House Financial Services Committee, predicted on Wednesday that she and Chairman Patrick McHenry will soon reach an agreement on stablecoin regulatory legislation.

In an interview, Waters said: "We are working to reach a stablecoin bill in the short term." She added that she had discussed stablecoins with Senate Majority Leader Chuck Schumer and Senate Banking Chairman Sherrod Brown, and said that the Federal Reserve, the Treasury Department and the White House were all involved in drafting the bill.

“This is about making sure investors and citizens are protected. We have to make sure they have the assets that back stablecoins,” Waters said. Federal regulation could lend legitimacy to the asset class, which could lead to wider adoption.

Welcome to join the BlockBeats official community

Telegram subscription group: https://t.me/theblockbeats

Telegram communication group: https://t.me/theblockbeatsApp

Twitter official account: https://twitter.com/BlockBeatsAsia

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR