Market Predictions 2.0 Preview: 5 New Product Forms Beyond "Pure Speculation"

Original Title: Beyond the Basic Bet: Newer Expressions of Prediction Markets

Original Author: neel daftary

Original Translation: Golem, Odaily Planet Daily

The future of prediction markets may currently be dominated by Polymarket/Kalshi, capturing all attention and market share. Nevertheless, even so, we might eventually use entirely reimagined prediction markets in the future, markets that cater to everyone's needs and align with their preferences and interests.

Reflect on how the trading of Meme coins has evolved. From simply buying a token featuring a dog on its face back in 2015, to needing to utilize tools (Axiom), track wallets (Cielo, Nansen, Arkham), and join a community by 2025, engaging with others to hunt for tokens on platforms like Solana, BNB, and Base.

Every opportunity emerging in the crypto space started from a simple pattern. Over time, these simple patterns either fade away (e.g., NFTs) or grow more complex as more participants join, eroding early advantages (e.g., Meme coins). Naturally, users also desire to engage in more intricate games, as evident in the evolution of most video games (God of War, Assassin's Creed, FIFA, etc.). To maintain appeal and relevance to the core user base, gaming and gaming-like platforms need to introduce features and complexity, enabling top players to stand out from the 99% of players.

When this pattern repeats and aligns with the prediction market category, it will no longer be a singular, monolithic platform but a comprehensive ecosystem consisting of numerous prediction-related applications.

These standalone products can leverage the core mechanisms of prediction markets (incentivized forecasting and vested interests) to create entirely new experiences. Here are five highly anticipated categories:

Trading Expected Impact: Illustrated by Lightcone

This is perhaps the newest and most intricate original concept, transcending the realm of probability, allowing users to trade on the impact of events.

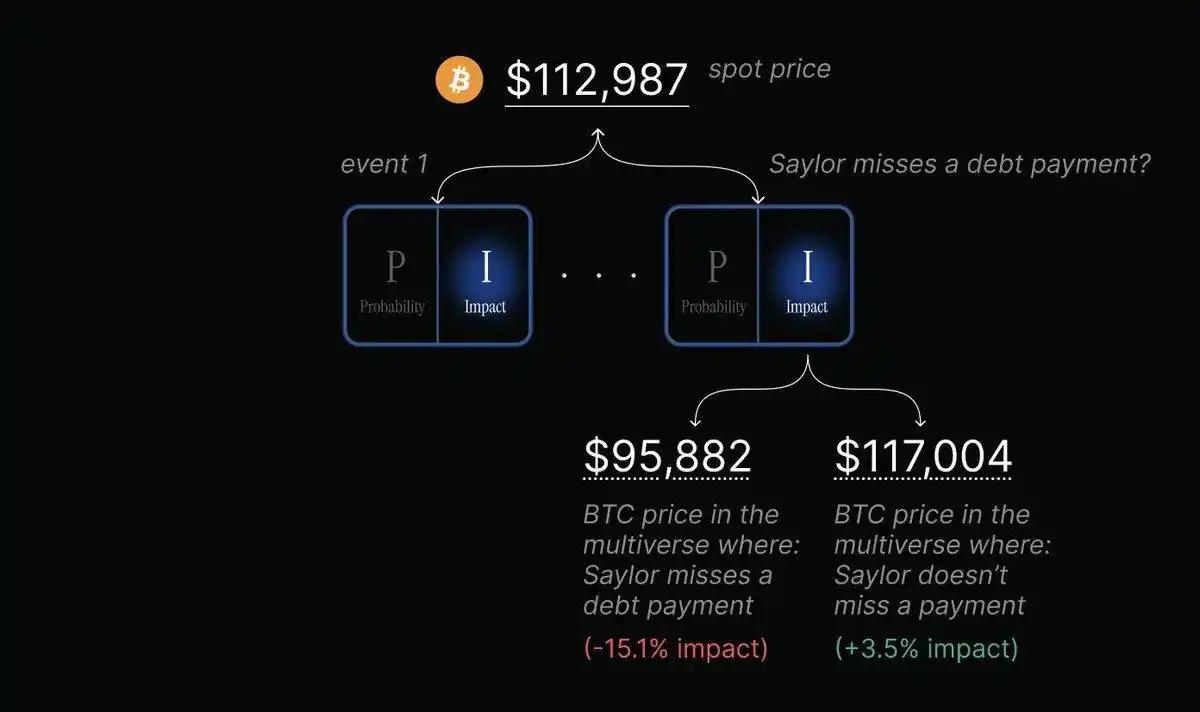

You can understand it as follows: a prediction market informs you of the probability (P) of an event occurring, while a spot market informs you of the spot price (S) of an event occurring. However, the new category defined by Lightcone, an "Impact Market," aims to separate and price impact (I).

Its operation is based on cloning assets to a "parallel universe" based on future events. For example, a user can deposit 1 BTC before the U.S. presidential election and receive two new tradable tokens, Trump-BTC and Kamala-BTC.

These tokens trade in separate "parallel universes." When the event occurs (e.g., Trump's victory), all Trump-BTC can be redeemed for real Bitcoin, while all Kamala-BTC will be reset to zero (and vice versa).

This model's advantage is that it has spawned two new applications:

· New Information Machine: It provides us with a sandbox to predict financial impacts. By comparing the prices of Trump-BTC (e.g., $130,000) and Kamala-BTC (e.g., $91,000) to the current spot price of Bitcoin ($102,000), the market explicitly tells us the expected financial impact of each outcome, completely independent of the probability of the outcome occurring.

· Event-Based Hedging: Traders can hedge specific risks without paying a premium unless that risk materializes. For example, traders concerned about a specific credit event (such as a Saylor default) can hold strSolvent-BTC while selling their strDefault-BTC for strDefault-USDC.

If a default occurs, their strDefault-USDC will convert to real USDC. They have successfully hedged and sold their Bitcoin before the event occurred; if no default occurs, their strSolvent-BTC can be redeemed for their original Bitcoin. They still hold a long position, and the hedging operation incurred no costs.

This is a complex tool. It removes the "probability" variable from trading, allowing institutions and traders to trade solely based on impact factors, truly creating a new financial foundation.

Opinion Market: Betting on Belief

This is a captivating concept where participants no longer bet on objective facts (e.g., "Can Ethereum reach $5,000?") but on what people will believe.

For example: "Will over 70% of participants bet 'Yes' in this market?"

This model has two main advantages:

· Fast Settlement: The market can settle based on its own internal dynamics daily or even every few hours. It does not rely on slow external oracles.

· Social Capital Monetization: It rewards players who can accurately predict collective psychology rather than facts. This is a direct way to monetize cultural influence and understanding.

Currently, platforms such as Melee, vPOP, opinions.fun, among others, are attempting to build this model to allow people to convert social capital into profits.

Virtual Sports: High-Frequency Prediction Market

Virtual sports is a $250 billion industry centered around a cyclical prediction market.

On the Football.Fun platform, users don't place just one bet but engage in combination predictions. Building a team is essentially a bet on the overall performance of the players, with all players being subject to a budget constraint.

The strength of this model lies in:

· Generating continuous, cyclical betting volume (e.g., weekly NFL/NBA/PL tournaments).

· Allowing users to monetize the expertise they have accumulated through watching over 10 hours of matches weekly.

The native advantage of cryptocurrency lies in its tradable assets. Digital player cards themselves are a prediction of a player's in-game value. Native cryptocurrency virtual sports enable players to profit through participating in pure player card trading (similar to gacha boxes, physical collectibles) and regular cyclic prediction market games.

Opportunity Market: Private Information Discovery

This is the second innovative mechanism proposed by the Paradigm team, enabling prediction markets to address the problem enterprises face: finding valuable early information.

The model is as follows:

· Initiator (VC): Provides all liquidity for the private market (e.g., "Will we invest in Startup Y this year?").

· Scout (Expert): Utilizes their own information and expertise to purchase shares of "Yes."

· Signal: Price increases become a proprietary aggregate signal for VCs/institutions, signaling the market should investigate/reinvestigate this project.

This is actually a decentralized reconnaissance program. It can also address the "free-rider problem" in some way (signals are private and only the initiator can access) and the liquidity problem (the initiator is a permanent liquidity provider).

Wisdom of Stake Market Governance

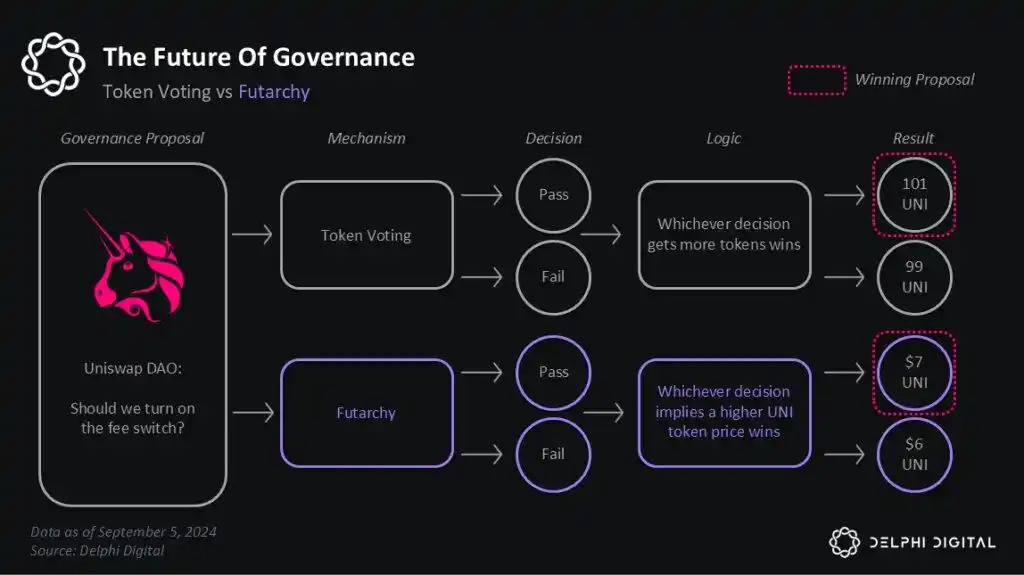

This is a governance model that delegates policy decision-making to market wisdom. The core idea is: "People will vote based on values but will stake based on beliefs."

It operates as follows:

· A DAO achieves consensus on a certain value or goal (e.g., "maximize monthly active users").

· Propose a proposal ("Proposal 123: Spend 50,000 tokens to launch a new incentive program").

· Create two conditional prediction markets: Market A, "If Proposal 123 passes, what will be the number of monthly active users on December 31st?"; Market B, "If Proposal 123 fails, what will be the number of monthly active users on December 31st?"

· If the price (prediction) in Market A is higher than in Market B, the proposal automatically passes.

It forces participants to stake funds for their beliefs, shifting governance from a subjective popularity contest to an information-driven practice.

But honestly, the innovation in the application layer of prediction markets goes far beyond this. In addition to the applications listed above, we also see concepts such as the prediction market-based news platform Boring News and the dedicated prediction market fund PolyFund under construction.

The design space for the application layer of prediction markets is just beginning to be explored, and we are not optimistic enough.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR