RWA strategy accelerates, Avalanche announces cooperation with JPMorgan Chase, AVAX rises by more than 20% daily

Content Directory:

· Avalanche announces partnership with JPMorgan

· Avalanche ecosystem token surges over 300% in 7 days

· This partnership may also be part of Avalanche RWA strategy

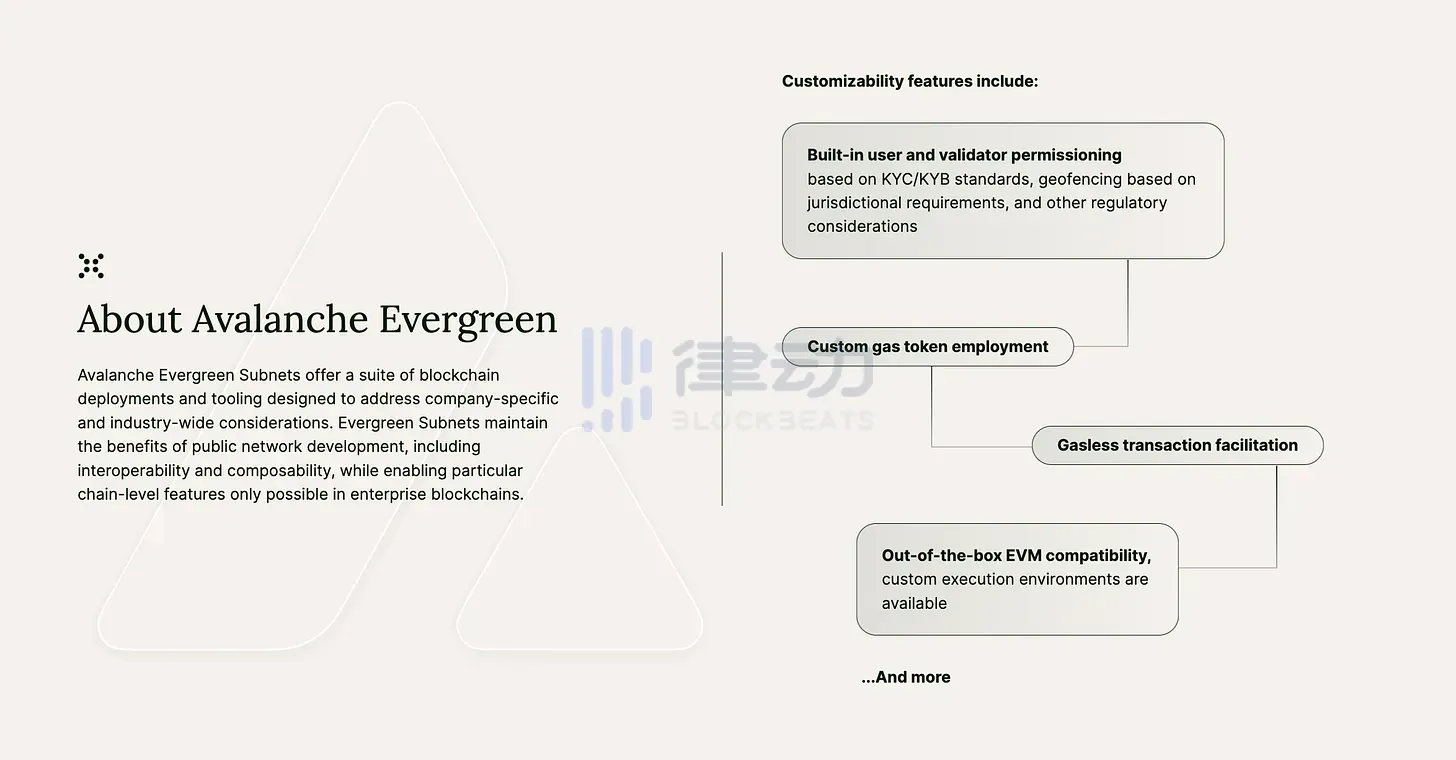

· Avalanche Evergreen: Key to expanding RWA

· Onyx: JPMorgan's blockchain ambition, has settled nearly trillions of dollars in tokenized government bonds

· Project Guardian: Singapore's crypto layout

On November 16th, the native token of the Avalanche ecosystem, AVAX, briefly surged to $24. According to CoinGecko data, it increased by 26.2% in the past 24 hours, 77.5% in the past 7 days, and 152.1% in the past 30 days. At the time of writing, it is priced at $23.65.

And just the day before, Avalanche announced its collaboration with JPMorgan Chase.

Avalanche announces partnership with JPMorgan Chase

On November 15th, Avalanche officially announced that Onyx, the digital asset platform of JPMorgan, has partnered with alternative asset management company Apollo to demonstrate a proof-of-concept. This partnership is also included in the "Project Guardian" launched by the Monetary Authority of Singapore (MAS) and the financial industry.

Meanwhile, the collaboration between the two will leverage the LayerZero full-chain interoperability protocol to connect Onyx with the licensed Avalanche Evergreen subnet launched by Avalanche for institutional blockchain deployment, thereby facilitating fund subscriptions and redemptions provided by tokenized asset application Wisdom Tree Prime.

Ava Labs President John Wu stated in the official document that "Project Guardian fundamentally aligns with Ava Labs' mission to provide tools and technology to enable the digitization and tokenization of world assets, while leveraging Avalanche's speed, scalability, and customizability. We are honored to collaborate with these industry leaders as they help drive the future of finance."

Ava Labs' founder and CEO also stated: "This is a big event happening on Avalanche."

Avalanche ecosystem token surges over 300% in 7 days

Due to its partnership with JPMorgan, the Avalanche ecosystem token saw a general uptrend today. According to CoinGecko, JOE rose by 37.2% in the past 7 days, BENQI rose by 54.0% in the past 7 days, PNG rose by 324.3% in the past 7 days, XAVA rose by 119.7% in the past 7 days, and ALOT rose by 63.8% in the past 7 days.

Source: CoinGecko

This collaboration is also part of the Avalanche RWA strategy.

It is worth noting that this time Avalanche connects its subnet, Avalanche Evergreen, specifically deployed for institutional capital, with Onyx, which may also be part of the Avalanche RWA strategy.

The launch of Avalanche Evergreen's subnet Spruce will focus on introducing institutional partners into DeFi, initially involving some core financial services such as foreign exchange and swaps, with plans to expand to more asset types and financial services in future stages.

Related reading: "Avalanche's RWA strategy and European market expansion, up 100% in a week."

"The RWA market is expected to quickly surpass the current DeFi industry. Recognizing this huge potential, Avalanche has launched a $50 million fund called Avalanche Vista to accelerate the adoption of RWA by purchasing tokenized assets minted on its chain."

"Major asset management company Franklin Templeton plans to introduce its money market fund to Avalanche. Prominent investors Andreessen Horowitz and Polychain Capital also support Avalanche's institutional appeal."

Avalanche Evergreen: A Key Piece in Extending RWA

The Avalanche Evergreen, which is connected to JPMorgan Onyx, is a subnet specifically deployed for institutions by Avalanche in April this year. It is reported that this subnet will be a set of institutional blockchain deployment services and tools designed specifically for financial services. Institutions can launch their own Evergreen subnet for research and "production-ready use cases", and can implement blockchain strategies with known and approved counterparts in private and licensed chains, while retaining the ability to communicate with other subnets through Avalanche's local communication protocol, Avalanche Warp Messaging (AWM).

In addition, Avalanche Evergreen announced a partnership with DeFi oracle RedStone in July. The latter provides data sources for dApps on Avalanche Evergreen's subnetwork testnet Spruce, supporting interactions between traditional financial institutions and OnFi (on-chain finance).

Onyx: JPMorgan's blockchain ambition, has settled nearly trillions of dollars in tokenized government bonds

In addition, Onyx, which has reached a cooperation with Avalanche this time, is a department established under JPMorgan Chase specifically for handling blockchain business.

October 27, 2020, Takis Georgakopoulos, the head of global payments at JPMorgan Chase, announced that the management team has agreed to establish a new department called Onyx to oversee blockchain and digital currency projects, which will be officially launched in October 2022.

据悉, Onyx processes 1-2 billion dollars of tokenized assets per day since its launch and has settled over 950 billion dollars of tokenized government bonds.

Onyx Digital Assets' leader, Tyrone Lobban, also expressed his views on this collaboration: "Our work under Project Guardian demonstrates significant opportunities in the asset and wealth management industry. By harnessing the power of blockchain technology, we have shown how to build and manage fully delegated investment portfolios."

Apart from partnering with Avalanche, Onyx has also partnered with cross-chain infrastructure protocol Axelar on the same day. According to reports, Onyx from JPMorgan Chase uses Axelar's cross-chain technology to achieve interoperability with the Provenance blockchain, which currently has $9 billion worth of RWA assets locked on-chain.

Project Guardian: Singapore's Cryptography Layout

In this cooperation, there is also a frequent appearance of a figure - Project Guardian. The project announced its collaboration with the financial industry on November 15th to expand asset tokenization plans and enhance basic capabilities to promote the scale development of the tokenization market.

Welcome to join the official BlockBeats community:

Telegram Subscription Group: https://t.me/theblockbeats

Telegram Discussion Group: https://t.me/BlockBeats_App

Official Twitter Account: https://twitter.com/BlockBeatsAsia

Forum

Forum OPRR

OPRR Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities