Abstract

The hammer candlestick chart is one of the most commonly used patterns in technical analysis and is widely used in cryptocurrency, stocks, indices, bonds and foreign exchange trading. Hammer charts are an effective way for price action traders to identify potential reversals following a bullish or bearish trend. Depending on the context and time frame, these candlestick patterns may suggest a bullish reversal at the end of a downtrend, or a bearish reversal following an uptrend. Traders combine the hammer chart with other technical indicators to choose the right time to take long and short positions.

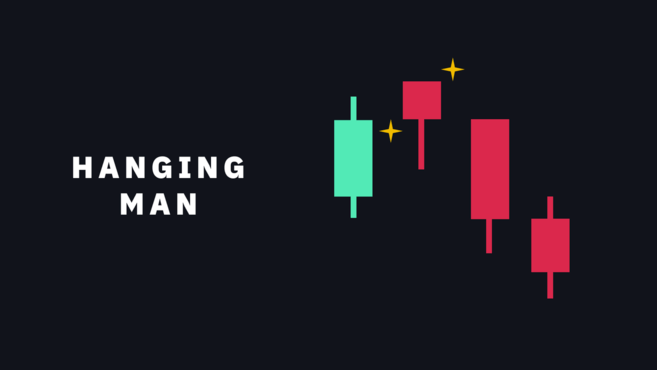

The bullish hammer candlestick consists of a hammer and an inverted hammer that appear after a downtrend. Bearish hammer candlestick patterns include hanging necks and shooting stars following an uptrend.

Introduction

The hammer K-line chart pattern is widely applicable to various financial markets and is an ideal choice for traders When analyzing price trends, a K-line chart pattern is most commonly used to measure the probability of results.

Combined with trading methods such as fundamental analysis and other market analysis tools, the hammer K-line chart pattern can provide new ideas about trading opportunities. This article will introduce what hammer candlestick chart patterns are and how to understand them.

How does the K-line chart work?

Each candlestick in the K-line chart represents a period, depending on the selected time frame. Each candle on the daily chart represents a day's worth of trading activity. Each candle on the 4-hour K-line chart represents 4 hours of trading.

The opening price and closing price of each K-line chart form the candle body, and the candle wick (or shadow line) represents the time period. Thehighest andlowest prices within.

If you are not familiar with K-line charts, it is recommended to read our "Beginner's Guide to K-line Charts" first.

What is the hammer K-line chart pattern?

The candle line consists of a small candle body and a long candle wick at the bottom, which is a hammer K-line chart. The wick (or shadow) should be at least twice as long as the body of the candle. A long shadow at the bottom indicates that sellers have driven the price down before buyers can push the price up to the opening price.

The following figure shows: the opening price (1), the closing price (2), and the wick or shadow formed between the high and low levels (3).

Bullish hammer line

Hammer K-line chart pattern

When the closing price is higher than the opening price, a bullish hammer K-line chart is formed, which means that the buyer has taken control of the market before the end of the trading cycle.

Inverted hammer K-line chart pattern

If the opening price is lower than the closing price, an inverted hammer K will be formed. line graph. A long wick above the candle body indicates that there is buying pressure that is trying to push the price higher, but is ultimately pulled lower by the close of the candle. Although not as bullish as a regular hammer candlestick, the inverted hammer is also a bullish reversal pattern that can appear after a downtrend.

Bearish hammer line

Hanging neck K-line chart

The bearish hammer K-line chart is called the "hanging neck line". When the opening price is higher than the closing price, a hanging line will appear, which is displayed as a red candle line. A wick on a bearish hammer indicates that the market is experiencing selling pressure, signaling a possible downside reversal.

Meteor K-line chart

Looking at the falling hammer line, it is called "Meteor K-line" In Figure 1, the pattern is almost the same as a regular inverted hammer, but it indicates a potential bearish reversal rather than a bullish one. In other words, the shooting star K-line chart is the inverted hammer after the upward trend. When the opening price is higher than the closing price, a shooting star K-line chart is formed, and the candle wick indicates that the upward market trend is about to come to an end.

How to use the hammer K-line chart to spot potential trend reversals

ABullish Hammer Candle occurs during a bearish trend, signaling an imminent price reversal and signaling that the downside has bottomed. The example below is a bullish hammer candlestick chart (Source: TradingView).

Bearish hammer candlestick chart shown as hanging line , orMeteor Line. Both occur after a bullish trend and indicate a potential downside reversal. The example below shows a shooting star (Source: TradingView).

Therefore, if you want to use the hammer K-line chart in trading, you need to consider its positional relationship with the preceding and following candlesticks. Depending on the circumstances, the reversal pattern is either ruled out or confirmed. Let’s take a look at the various types of hammer lines.

Advantages and Disadvantages of Hammer K-line Chart Form

Each K-line chart pattern has advantages and disadvantages. After all, no technical analysis tool or indicator can guarantee that a trader will make a sure profit by sweeping the financial markets. If used in conjunction with trading strategies such as moving averages, trend lines, relative strength index (RSI), exponential moving average (MACD), and Fibonacci retracements, the hammer K-line chart pattern can often achieve twice the result with half the effort. .

Advantages

The hammer candlestick chart pattern is suitable for identifying trend reversals in all financial markets.

Traders can use the hammer pattern on multiple time frames and can be effective in both swing trading and day trading.

Disadvantages

The hammer K-line chart pattern is subject to the specific circumstances before and after, not A trend reversal is bound to occur.

The hammer K-line chart pattern itself is not completely reliable. Traders should always use it in conjunction with other strategies and tools to increase their chances of success.

What is the difference between the hammer K-line chart and the cross star

A Doji is similar to a hammer without a body. The opening price and closing price of the Doji candlestick chart are the same. Hammer candlesticks signal potential price reversals, while dojis often represent sideways, consolidation, or an unresolved market. Doji candlesticks are generally neutral formations, but in some cases can appear before a bullish or bearish trend.

The Dragonfly Doji pattern is similar to a hammer or hanging neck without a body.

The Tombstone Doji is similar to the Inverted Hammer or Shooting Star.

However, hammers and dojis alone don’t mean anything. This should always be done in conjunction with specific circumstances such as market trends, preceding and following candlesticks, volume, and other indicators.

Summary

The hammer K-line chart pattern is to help traders An effective tool for identifying potential trend reversals. However, these patterns by themselves are not necessarily signals to buy or sell. Similar to other trading strategies, hammer candlesticks should be used in conjunction with other analytical tools and technical indicators to get twice the result with half the effort.

Traders should also adopt appropriate risk management and evaluate trading returns. When the market fluctuates violently, stop-loss orders should also be set to avoid heavy losses.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR