Summary

Limit take profit and stop loss orders combine the take profit and stop loss triggering mechanism with the limit order. Traders use this type of order to set the minimum profit target they expect to accept, or the maximum cost or loss they are willing to bear on a trade. After setting a limit, stop-profit and stop-loss order and reaching the trigger price, the limit order will be automatically issued even if you log out or go offline. Traders can strategically issue limit-price, stop-profit, and stop-loss orders based on resistance levels, support levels, and asset volatility.

In a limit price, stop-profit and stop-loss order, the take-profit and stop-loss price is the trigger price for the trading platform to issue a limit order. The limit price is the price point at which the order is placed. The limit price can be set by yourself - the limit price for buy orders is usually set higher than the take-profit and stop-loss prices, and the limit price for sell orders is lower than the take-profit and stop-loss prices. This difference takes into account the change in market price within the time difference between the triggering of the take-profit and stop-loss prices and the issuance of the limit order.

Introduction

If you want to actively participate in trading rather than holding it for a long time, understanding market orders is far from enough. . Limit price, stop profit and stop loss orders have greater control and customizability. Beginners may be confused by this concept, so let’s first understand the key differences between limit orders, stop orders, and stop-limit orders.

Comparison of limit orders, stop-loss orders and limit-price, stop-profit and stop-loss orders h2>

Limit orders, stop-loss orders, and limit-price-take-profit-stop-loss orders are all common order types. Limit orders allow traders to set a target price range, stop-loss orders set the take-profit and stop-loss prices that trigger market orders, and limit-price take-profit and stop-loss orders are a combination of the first two. Let’s take a closer look:

Limit Order

When setting up a limit order, you can choose a maximum buy price or a minimum sell price. When the market price reaches or is better than the limit price, the trading platform will automatically promote the completion of the limit order. These orders are useful if you have a clear target opening or selling price and are willing to wait for the market to meet the set conditions.

Traders usually issue limit sell orders at a point above the current market price and place buy limit orders at a point below the current market price. If a limit order is posted at the current market price, it is likely to be executed within seconds (except in low-liquidity markets).

For example, assuming the market price of Bitcoin is $32,000 (BUSD), the limit buy order can be set to $31,000. Buy Bitcoin immediately when the price drops to $31,000 and below. In addition, a limit sell order can be issued at the $33,000 level. If the price rises to $33,000 and above, the trading platform will sell Bitcoin.

Limit price, stop profit and stop loss order

As mentioned before, limit price, stop profit and stop loss order is a combination of the stop profit and stop loss mechanism and the limit order. Stop-loss orders add a trigger price for issuing limit orders in the trading platform. Let's understand how it works.

How do limit-price, stop-profit and stop-loss orders work?

The best way to understand limit and stop-profit orders is to break them down and analyze them. The Take Profit and Stop Loss Price acts as the trigger price for placing a limit order. When the market price reaches the take profit and stop loss price, the system will automatically create a limit order with a custom price (Limit Price).

Although the Take Profit, Stop Loss and Limit prices can be the same, they do not have to be. In fact, a safer operation is to set the take profit and stop loss price (trigger price) slightly higher than the limit price if it is a sell order, and set it slightly lower than the limit price if it is a buy order. Some. This increases the chance of your limit order being filled.

Examples of limit-price, stop-profit and stop-loss buy and sell orders

Limit-price, stop-profit and stop-loss buy orders

Assume that the current price of Binance Coin is $300 (BUSD) and you want to buy when it shows a bullish trend. However, if Binance Coin rises too quickly and you are not willing to pay too much for it, then you need to limit the price you pay.

Assuming that according to technical analysis, if the market breaks through $310, an upward trend may start. Traders decide to use take-profit, stop-loss and limit buy orders to open positions in response to rising market prices. The take-profit, stop-loss and limit prices are set at $310 and $315 respectively. When the BNB price reaches $310, the system immediately issues a limit order to buy at $315. The order may be filled at $315 or lower. Please note that $315 is the price limit. If the market price exceeds this value quickly, the order may not be filled at all.

Limit price, stop profit, stop loss sell order

Assume that BNB bought at US$285 (BUSD) has now risen to US$300. In order to avoid losses, the trader decided to use a limit and stop-loss order to sell BNB when the price fell back to the opening price. The stop-loss price for a stop-limit sell order is set to $289, and the limit price is set to $285 (the buying price of BNB). If the price reaches $289, the system will immediately issue a limit order to sell BNB at $285. The order may be filled at $285 or higher.

How to issue a limit price, stop profit and stop loss order on Binance?

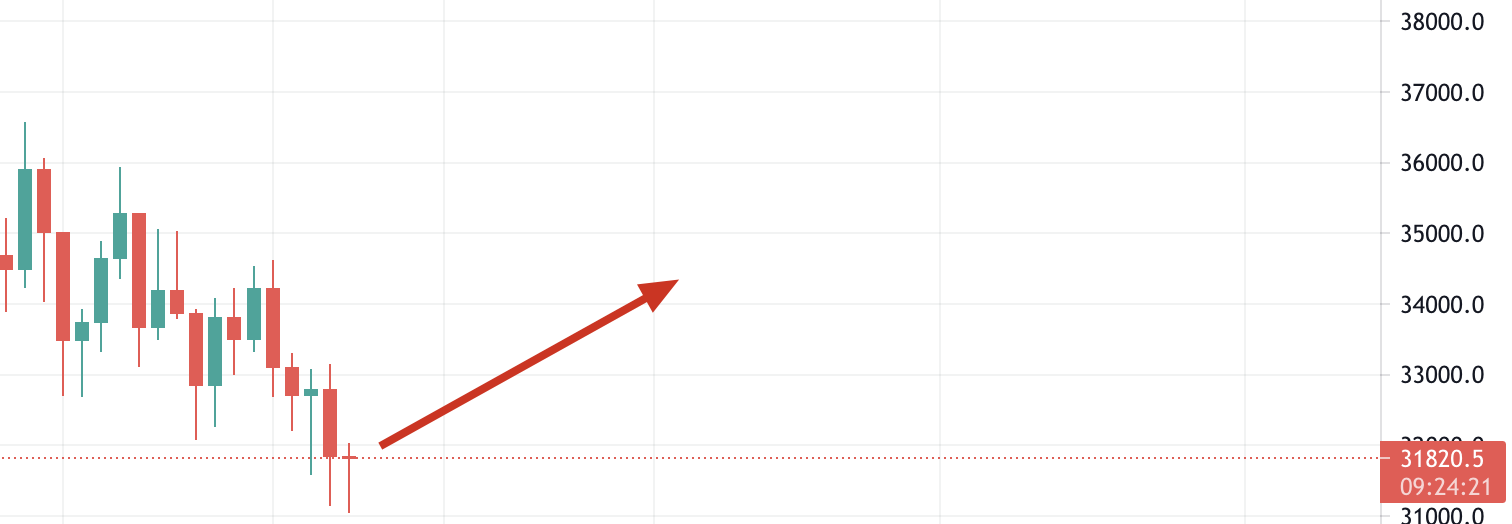

Suppose you have just bought five Bitcoins at $31,820.50 (BUSD) and predict that the price is about to rise.

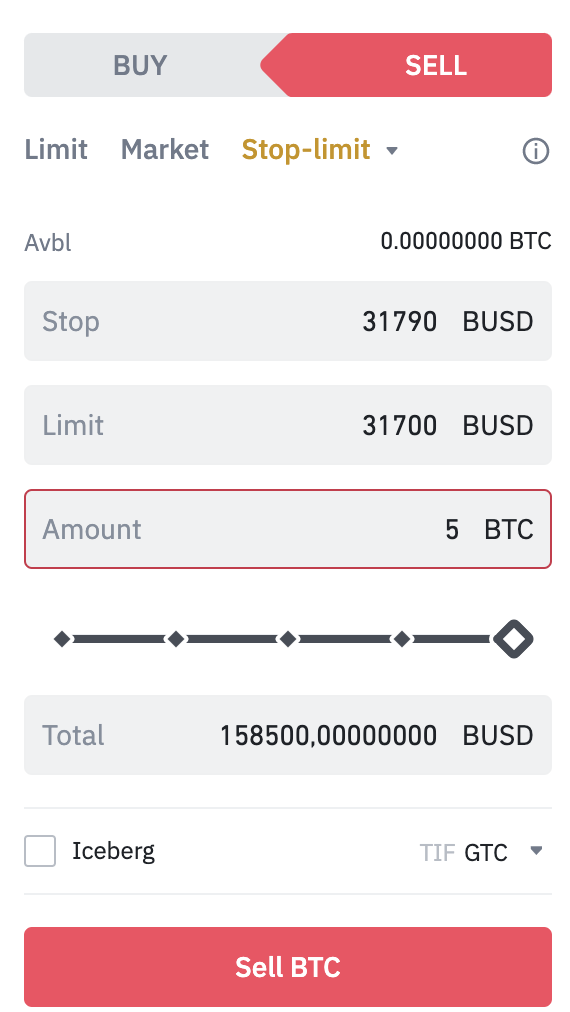

If the prediction is wrong and the price starts to fall, you may reduce your losses by placing a limit sell order. To do this, log into your personal Binance account and enter the BTC/BUSD market. Then click the [Limit Price, Take Profit and Stop Loss] tab to set the take profit, stop loss price and limit price as well as the number of Bitcoins to be sold.

If you believe $31,820 is reliable support, you can place a limit-take-profit order below that price (in case support breaks down). In this example, we will issue a stop-limit order for 5 Bitcoins, with a stop-loss price of $31,790 and a limit price of $31,700. Below we demonstrate the specific operations step by step.

After clicking [Sell BTC], a confirmation window will appear. Make sure everything is correct and click [Place Order] to confirm. You will receive a confirmation message after your limit/stop order is issued. You can also scroll down to view and manage your open orders.

Please note that limit-price and stop-loss orders will only be executed when the stop-loss price is reached. In other words, the limit order will be executed only when the market price reaches or exceeds the limit price set by the trader. If a limit order is triggered by a take-profit or stop-loss price, but the market price does not reach or exceed the set price, the limit order will remain open.

Occasionally you may face a situation where the price drops too fast and the limit price, stop profit and stop loss orders fail to be filled. In this case, it may be necessary to use a market order to exit the trade quickly.

Advantages of using limit price, stop profit and stop loss orders

Limit price, stop profit and stop loss orders support trading to customize and plan transactions. We cannot keep an eye on prices all the time, and it is even more impossible to keep an eye on the cryptocurrency market that operates around the clock. Another big advantage is that stop-limit orders allow traders to set reasonable profit limits. If there is no limit, your order will be filled at any market price. Some traders prefer to hold on to the asset for the long term rather than sell the asset at any cost.

Disadvantages of using limit price, take profit and stop loss orders

Limit price, take profit and stop loss orders and limit price The disadvantages of price orders are the same in that they are not guaranteed to be filled. A limit order will only be filled if the price reaches or exceeds a specific value. However, it is possible that this price will never be reached. Even if you allow a spread between the limit price and the take profit and stop loss price, the spread may not be enough. For extremely volatile assets, the price movement may directly exceed the spread set in the order.

Liquidity can also become a problem if there are not enough takers to push orders through. If you are worried that your order will only be partially filled, you may consider using the "Full or Cancel" order. The plan stipulates that orders can only be executed after full closing conditions are met. However, please note that the more conditions you add to your order, the lower the probability of execution.

Issue strategy of limit price, stop profit and stop loss orders

Study on limit price, stop profit and stop loss orders Finally, how do we make the most of this type of order? The following basic trading strategies can improve the effectiveness of limit-price, stop-profit and stop-loss orders and maximize strengths and avoid weaknesses.

1.Study the volatility of the assets corresponding to limit price, stop profit and stop loss orders. Previously, we recommended setting a small spread between take-profit and stop-loss orders and limit orders to increase the probability of a limit order being filled. However, if the asset being traded fluctuates wildly, the spread may need to be increased.

2.Consider the liquidity of the trading asset. Stop-limit orders are very effective when trading assets with large bid-ask spreads or low liquidity (to avoid unwanted prices due to sliding spreads).

3.Use technical analysis to determine price points. A reasonable approach is to set the take-profit and stop-loss prices at the asset’s support or resistance levels. Technical analysis is a means of determining these points. For example, you can use a take-profit and stop-loss buy order, setting the take-profit and stop-loss prices just above important resistance levels to take advantage of price breakouts to profit. Alternatively, you can use a take-profit and stop-loss sell order to set the take-profit and stop-loss price just below the support level to ensure you exit before the market continues to fall.

If you are not sure what support and resistance levels are, please read "Detailed Explanation of the Basic Principles of Support and Resistance".

Summary

Limit price stop profit and stop loss order is a A powerful tool whose trading capabilities are better than ordinary market orders. This type of order has the added advantage that the trader does not need to actively participate in the transaction for the order to be filled. By combining multiple limit-price, stop-profit and stop-loss orders, you can manage your assets with peace of mind, regardless of whether prices rise or fall.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR