Note: Before reading further, we strongly recommend that you read our guide on limit orders and stop-limit orders.

One Cancels the Other (OCO) allows you to place two orders at the same time. It combines a limit order and a stop-limit order, but only one of them can be executed.

In other words, as long as one of the orders is partially or completely filled, the other order will be automatically canceled. Please note that manually canceling one order will also cancel the other order.

When trading on the Binance exchange, you can use OCO orders as a basic form of trading automation. This feature gives you the option to place two limit orders at the same time, helping to take profits and minimize potential losses.

How to use OCO orders?

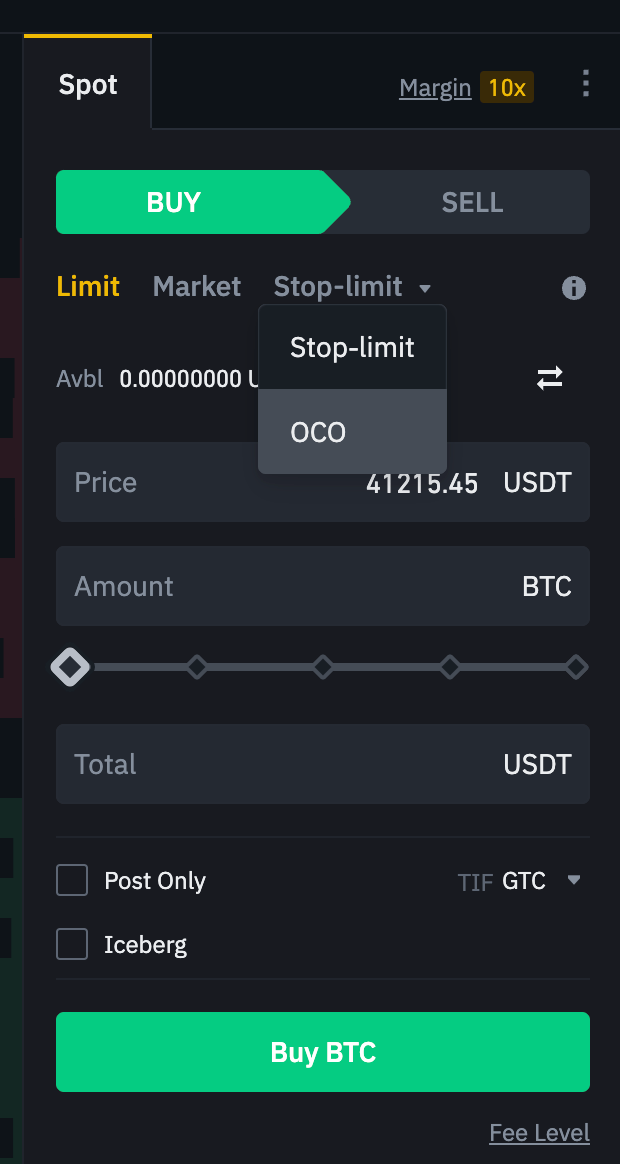

After logging in to your Binance account, please go to the basic trading interface and find the trading area shown in the picture below. Click "Stop Limit Order", open the drop-down menu, and select "OCO".

On Binance, OCO orders can be placed to complete a pair of buy or sell orders. Click the "i" mark to view the relevant details of the OCO order.

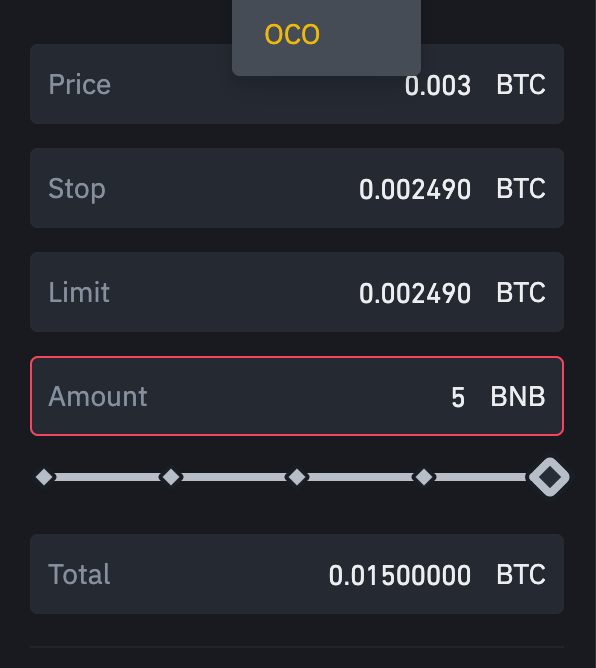

After selecting the “OCO” option, a new trading interface will be loaded ,As shown below. This interface allows you to set limit orders and stop-limit orders at the same time.

Limit Order

Price: The price of your limit order. This order will appear in the order book.

Stop-limit order

- Stop-loss: Trigger your stop-limit order The price of the order (for example, 0.0024950 BTC). Limit Price: The actual price of your limit order after the stop is triggered (e.g. 0.0024900 BTC)

- Quantity: The size of the order (e.g. 5 Binance Coin (BNB)).

- Total: The total value of the order.

After placing an OCO order, you can scroll down to view the details of both orders in the "Current Orders" section.

For example, let's say you just bought 5 BNB at 0.0026837 BTC because you believe the price is close to a major support zone and may move higher.

In this case, you can use the OCO function to place a take-profit order at 0.0030 BTC and a limit-stop order at 0.0024900 BTC.

If your prediction is correct, the price rises to 0.0030 BTC or higher, your sell order will be executed and your stop-limit order will be automatically canceled.

On the other hand, if your prediction is wrong and the price drops to 0.0024950 BTC, your stop-limit order will be triggered. This may reduce your losses in case the price falls further.

It should be noted in this example that the stop loss price is 0.0024950 (trigger price) and the limit price is 0.0024900 (the transaction price of the order). In other words, the stop-limit order will be triggered the moment the price reaches 0.0024950. But the actual order price as a limit order is 0.0024900. In other words, if BNB/BTC falls to 0.0024950 or lower, a sell limit order will be placed at 0.0024900. However, if the price falls below 0.0024950, the limit order will face the risk of not being able to be filled.

The OCO order type is a simple yet powerful tool that allows Binance users to trade in a safer and more flexible way. This special type of order is beneficial for locking in profits, limiting risk, and even used to enter and exit positions. But before using OCO orders, traders should have a full understanding of limit orders and stop-limit orders.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR