Contents

- Introduction

- What is dollar-cost averaging?

- Why use dollar-cost averaging?

- Example of dollar-cost averaging

- Averaging calculator

- Objections to dollar-cost averaging

- Summary

Introduction

Active trading is time-consuming and laborious, and the returns may not be satisfactory. Fortunately, there are other investment options . Perhaps you, like many investors, are looking for investment strategies that are less difficult, less time-consuming, or more passive. The Binance ecosystem provides users with numerous options, including staking, depositing assets into Binance Savings, and joining the Binance mining pool.

Do you want to participate in market investment but don’t know where to start? What is the best way to take a long-term position? In this article, we will discuss an investment strategy called "DCA". This strategy can easily reduce some of the risk of opening a position.

What is dollar-cost averaging?

Cost averaging is an investment strategy designed to avoid the impact of volatility on asset purchases. The specific method is to buy equal amounts of assets regularly.

By entering the market this way, the investment is not as susceptible to volatility as a lump sum (i.e., single payment). Why is this? Regular buying can help the average price level out. In the long run, this strategy reduces the negative impact of poor timing on your investment. Next, we’ll explain how dollar-cost averaging works and why it’s recommended.

Why use dollar-cost averaging?

The main advantage of dollar-cost averaging is that it reduces the risk of poorly timed purchases. "Choosing the right time to enter the market" is a major problem in trading or investing. Even if the trade is in the right direction, but the timing is wrong, the entire trade will usually fall short. For such problems, the average cost method can effectively mitigate this risk.

Compared with investing a large sum at once, investing the same amount into several smaller portions may lead to better results. Buying at the wrong time often happens and can lead to poor investment results. Additionally, applying dollar-cost averaging can remove some of the investment decision bias and make the decision directly for you.

Of course, dollar-cost averaging cannot completely avoid risks. It can only help traders enter the market smoothly and minimize the risk of bad timing. Dollar-cost averaging is by no means a guarantee of successful investing. After all, there are other factors to consider.

As mentioned in the previous discussion, choosing an opportunity to enter the market is a big problem. Even experienced traders find it difficult to accurately judge good opportunities to enter the market. Therefore, after opening a position using the dollar-cost averaging method, don't forget to formulate a selling plan, that is, a trading strategy for closing the position.

If you already have a target price (or price range), it's pretty simple. You can divide your investment into smaller equal amounts and start selling once you get close to your target price. This effectively mitigates the risk of a poorly timed sale. Of course, the specific operation method completely depends on the individual's trading system.

Some people adopt a "buy and hold" strategy, with the basic goal of never selling, believing that the assets they purchase will continue to appreciate in value over time. The chart below shows the performance trend of the Dow Jones Industrial Average over the last century.

Dow Jones Industrial Average (DJIA) Performance Since 1915 trend.

Despite brief periods of recession, the index has always been on an upward trend. The goal of a buy-and-hold strategy is to enter a market and hold on to a position long enough that the timing of the entry becomes irrelevant.

However, it is worth noting that this strategy is generally more suitable for the stock market and may not necessarily apply to the cryptocurrency market. Don’t forget that the Dow Jones Industrial Average’s performance trends are closely related to real-world economic conditions, while other asset classes are completely different.

Cost averaging example

Let us understand this strategy through the following example. Suppose we have a fixed capital of $10,000 and believe that investing in Bitcoin is a wise move. We predict that the price will fluctuate within the current range, so using the average cost method strategy to gradually open positions will achieve good results.

We divide $10,000 into 100 equal parts of $100. We buy $100 worth of Bitcoin regardless of the daily price movement. In this way, the time to enter the market can be spread out over a time span of about three months.

Now, let’s change the approach and see how the average cost method can be used flexibly. Assuming that Bitcoin has just entered a bear market, we predict that there will be no long-term bull market in the next two years, but we are also sure that a bull market will appear sooner or later, so we want to prepare for a rainy day.

Should we still follow the above strategy? Maybe change it. Because the time horizon of this portfolio will be longer. We must be mentally prepared to allocate this $10,000 capital according to this strategy for the next few years. So what should we do?

We again divide the investment into 100 shares of $100, but this time choose to buy $100 worth of Bitcoin each week. There are approximately 52 weeks in a year, so the entire strategy will be executed within two years.

In this way, we establish long-term positions in a continued downward trend in the market. We don't miss out on the market recovery while mitigating some of the risks of buying on the downside.

However, don’t forget that, after all, the market is in a downward trend and this strategy still carries risks. For some investors, it may be best to wait until a downtrend is clearly over before re-entering the market. If you choose to wait, average costs (or price per serving) may increase, but many of the downside risks will be mitigated.

Average dollar cost calculator

A simple version of the Bitcoin dollar dollar dollar dollar average calculation can be used through dcabtc.com device. By selecting the amount, time span and time interval, you can understand the performance of different strategies within the set period. In the case of Bitcoin, this strategy has been working well because of its long-term upward momentum.

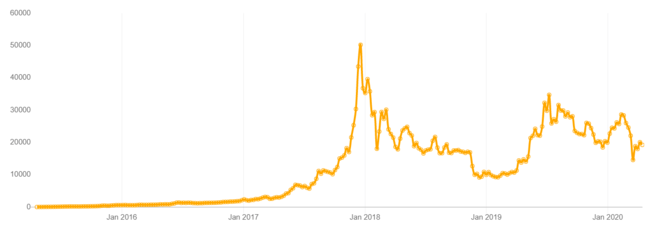

Assuming that only $10 worth of Bitcoin was purchased every week over the past five years, the following is the detailed investment performance. A $10 weekly investment may not seem like much, but as of April 2020, your cumulative investment would be around $2,600, and your Bitcoin holdings would be worth approximately $20,000.

Buy $10 in Bitcoin every week for the past five years market trends. Source: dcabtc.com

Want to start a cryptocurrency journey ? Buy Bitcoin on Binance today!

Opposition to the average cost method

Although the average cost method is a a profitable strategy, but some are skeptical. Dollar-dollar averaging undoubtedly works best when markets are volatile. This makes sense, as it is a strategy specifically tailored to mitigate the impact of high volatility on positions.

But some people believe that this strategy will actually reduce investors' returns when the market is performing well. Why? If the market continues to be in a bull market, it can be inferred that the income of early investors will be more substantial. In this way, dollar-cost averaging suppresses earnings growth in an upward market trend, and in this case, the performance of a one-time investment may actually be better than dollar-cost averaging.

However, most investors do not have large sums of money to invest in one-time investments and can only make small long-term investments. In this case, dollar-cost averaging is still the appropriate strategy.

Summary

The average cost method is a redemption strategy. While opening a position normally, the maximum Reduces the impact of volatility on investment. The main method is to "break the investment into parts" and buy them regularly.

The main advantage of this strategy is that it can get rid of the problem of "timing the market" and is suitable for investors who do not want to watch the market.

However, some skeptics believe that during bull markets, dollar-cost averaging can reduce the returns of some investors. That being said, it's not a big deal if earnings shrink slightly. For many people, dollar-cost averaging remains a convenient investment strategy.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR