Summary

Algorand was founded in 2017 before launching its mainnet and ALGO token in June 2019. This blockchain is capable of handling scalability and consensus mechanism issues common to first- and second-generation blockchains. The main feature of Algorand is its pure proof-of-stake consensus protocol, which randomly selects validators weighted by the ALGO coins staked.

Users who have staked ALGO coins have the opportunity to be selected to propose and verify a new block, which is then verified by a randomly selected committee. Once a block is added to the blockchain, all transactions are considered confirmed. If the block is deemed bad, a new user is selected as a validator and the process is restarted.

The main advantage of this system is the decentralization of power, since every staker has the opportunity to become a validator. In addition to consensus, ALGO coins can also be used to pay network transaction fees and obtain block rewards. If you want to buy or sell ALGO coins, you can easily do so through Binance’s exchange feature or trading view.

Introduction

Algorand is a fairly new blockchain that focuses on both decentralization and Improve scalability. This problem is common in many first- and second-generation blockchains, such as Bitcoin and Ethereum. To solve this problem, Algorand developed its most noteworthy feature: the pure proof-of-stake (PPoS) consensus mechanism. Along with its passive staking feature, these two features have made Algorand a high-cap project popular among users looking to earn rewards.

What is Algorand?

Algorand is a blockchain network and project founded in 2017 by MIT computer scientist Professor Silvio Micali. Its mainnet network and native cryptocurrency ALGO coin were launched in June 2019. As mentioned earlier, this blockchain focuses on improving scalability while also supporting smart contracts. The Algorand network is a public, decentralized pure proof-of-stake blockchain that supports customizable layer 1 blockchains. The latter can be used to create blockchains customized for specific purposes. The project claims its technology is particularly applicable to financial services, decentralized finance (DeFi), fintech and institutions.

What is the Algorand Foundation?

The Algorand Foundation is a non-profit organization established in 2019 to fund and promote the development of the Algorand network. In addition, the fund is responsible for carrying out important community, research and governance work on blockchain.

For example, the Foundation educates developers at universities and supports Algorand projects in its ecosystem through an accelerator program. But technology development is being done by Algorand Inc., a private company. The Algorand Foundation is also a large-scale holder of ALGO coins and uses ALGO coins to fund its own activities.

How does Algorand work?

The key to Algorand’s scalability is its pure proof-of-stake consensus mechanism. The protocol allows Algorand to quickly process large volumes of transactions while maintaining decentralization. Proof-of-Stake (PoS) blockchains are scalable, but often at the expense of a small number of validators holding large amounts of stake, allowing them to dominate block approval. Proof of Work (PoW) suffers from the same problem, as in the competition to create new blocks, the winner is almost always the large mining pool.

In contrast, Alogrand's PPoS consensus mechanism randomly selects validators and block proposers from anyone who has staked and generated a participating key. A participant's chance of being selected is directly related to the ratio of their stake to the total stake.

The probability of small holders being selected is naturally lower than that of large holders. But unlike PoS blockchains, Algorand does not require a minimum stake amount, a barrier to participation that would be insurmountable for ordinary users. Since every staker running a node may be a validator, the security of the network is more decentralized than selected validators, such as in Delegated Proof-of-Stake.

Proposal Steps

After users pledge and participate in key generation, they will become participating nodes. Communication between these nodes occurs through Algorand relay nodes. The block proposal phase then selects multiple block proposers through a verifiable random function (VRF), taking into account each validator’s stake ratio. Once a block proposer is selected, their identity remains secret until a new block is proposed. In this way, criminals cannot maliciously target the selected validators, thereby improving network security. But proposers can show their VRF output along with the proposed block to prove their legitimacy.

Soft voting stage

After the block is submitted, participating nodes will be randomly selected to join the soft voting committee. Proposals are screened at this stage so that only one candidate can be added to the blockchain. The voting power of the soft voting committee is proportional to the staked amount of each node, and the purpose of voting is to select the proposed block with the lowest VRF hash value. This means that pre-attacking the proposer of a block is impossible because the lowest VRF hash is an unpredictable value.

Verify voting phase

Next, a new committee needs to be created to check whether there is a double-spending problem and whether the transactions in the block during the soft voting phase are complete. If the committee deems the work valid, the block will be added. If deemed invalid, the block will be rejected and the blockchain will enter recovery mode and select a new block. Leaders who propose bad blocks are not severely punished, making it a controversial part of the PPoS consensus mechanism. The chance of an Algorand fork is extremely rare because only one block proposal can enter the verification phase at a time. After a block is added, all transactions are considered final.

What is ALGO?

ALGO is Algorand’s native token, and its maximum total supply will reach 10 billion by 2030. New ALGO coins are sent with each newly minted block to the specific wallet holding ALGO coins. You need to hold at least 1 ALGO coin in your non-custodial wallet to receive these ALGO coin rewards. This reward can generate an annual interest rate of approximately 5-8% for ALGO coin holders and is distributed approximately every 10 minutes. This mechanism makes ALGO Coin one of the easiest cryptocurrencies to generate passive income because you can "passively stake" the tokens.

What are the use cases for ALGO coin?

Like many other native tokens, there are three main use cases for ALGO coins:

1. ALGO coins can be used to pay transaction fees on the Algorand network. Algorand’s fees are among the lowest compared to networks like Ethereum (ETH) and Bitcoin (BTC). As of January 2022, the cost per transaction is just $0.0014.

2. ALGO coins can be pledged, and pledgers have the opportunity to be selected as block proposers or validators.

3. ALGO coins can be stored in non-custodial wallets, and holders can receive rewards for each block successfully added to the chain.

The third use case greatly incentivizes ordinary users to invest in ALGO coins. There's no need to use a decentralized application (DApp) to stake your tokens, and there's no lock-up period, so you can start earning immediately. All operations are automatically handled by smart contracts. Algorand also released a list of projects adopting blockchain technology, many of which require the use of ALGO coins.

How to buy ALGO coins on Binance

You can use a credit or debit card on Binance Buy ALGO coins in just two steps. If you already have a cryptocurrency in your account that is paired with ALGO Coin, you can exchange it directly for ALGO Coin. First, let's learn how to use a credit or debit card.

Since ALGO Coin cannot be purchased directly with fiat currency, you will need to purchase another token through the ALGO Coin trading pair. We recommend the BUSD coin because its price is very stable. You can view the full list of available trading pairs later in this guide.

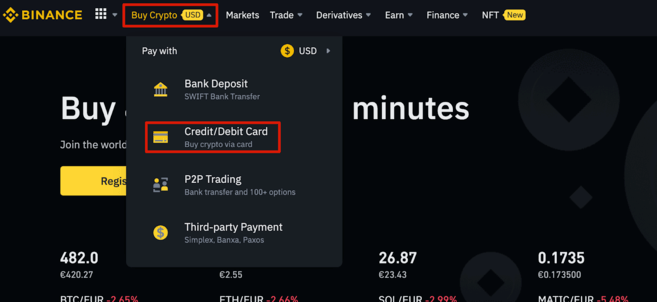

1. Log in to your Binance account and hover your mouse over the [Buy Cryptocurrency] title in the upper left corner of the homepage. Select [Credit/Debit Card] from the drop-down menu.

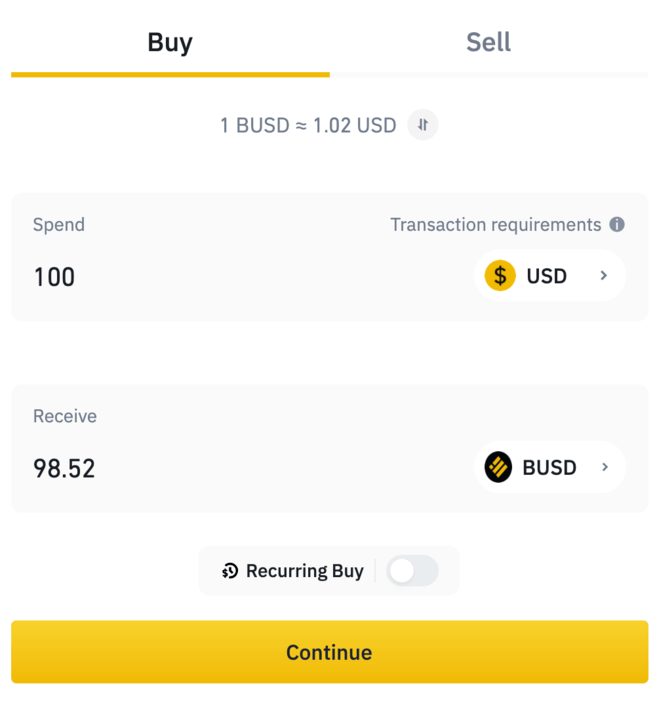

2. Next, select the fiat currency you want to pay with your credit card in the top field. In the bottom field, select the desired cryptocurrency. Please ensure that this currency is in a trading pair with ALGO and can be traded directly.

3. If this is your first time purchasing with fiat currency, please click [Continue] and accept all terms and conditions.

4. Click [Add New Card] or select a card already added to your account and follow the instructions to complete the payment.

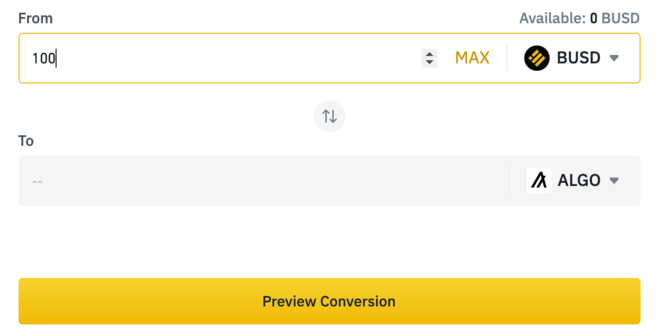

5. Now you need to exchange your BUSD coins for ALGO coins. You can easily complete this step through the [Exchange] function under the [Transaction] heading.

6. Select the cryptocurrency you want to exchange in the top field and ALGO Coin in the bottom field. If you don't find the ALGO coin in the bottom field, it means it is not a trading pair with the cryptocurrency of your choice. After entering the amount to be redeemed, click [Preview Redemption].

7. You will now see a preview of the amount of ALGO coins you will receive, as well as instructions on how to proceed. Explain clearly. Once the exchange is complete, ALGO coins will appear in your spot wallet.

8. You can also choose to trade using the Classic or Advanced trading views. Hover your mouse over the currently displayed trading pair to search all available ALGO coin trading pairs.

How to sell ALGO coins on Binance

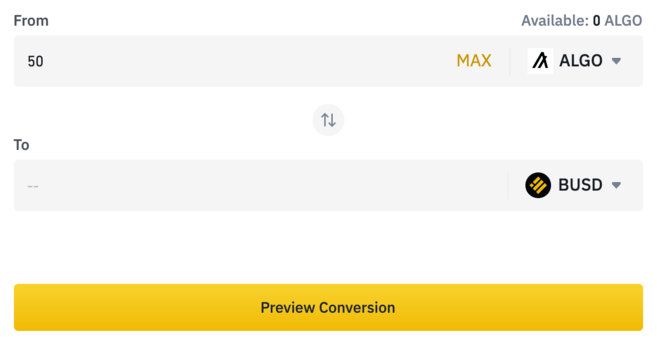

1. If required Sell ALGO coins and you can use the exchange function again. This time you need to select the ALGO coin in the top field and the cryptocurrency you want to exchange for in the bottom field. Click [Preview Exchange] to view the exchange rate.

2. After confirming the amount you will receive, follow the instructions given to complete the transaction.

3. Then, as long as the currency you exchange with ALGO coins is a legal currency trading pair, you can use the same process to convert It is exchanged for fiat currency.

Conclusion

Other alternatives to Bitcoin and Ethereum Like blockchain, Algorand focuses heavily on scalability and decentralization. Its pure proof-of-stake consensus mechanism provides a unique solution for VRF, and many find this blockchain technology’s success in decentralizing power attractive.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR