Abstract

In cryptocurrency trading, leverage refers to using borrowed funds to trade. Leveraged trading can expand your buying or selling power, allowing you to conduct larger transactions. Therefore, even if your initial capital is small, you can mortgage it for leveraged trading. While leveraged trading can multiply your potential profits, it also comes with high risks, especially in the volatile cryptocurrency market. Please exercise caution when trading cryptocurrencies using leverage. If the market moves against your position, you could suffer significant losses.

Introduction

Leveraged trading can be very difficult to understand, especially for beginners. But before you try to use leverage, you must first understand what leverage is and how it works. This article will focus on leveraged trading in the cryptocurrency market, but much of the information is equally applicable to traditional markets.

What is leverage in cryptocurrency trading?

Leverage is the use of borrowed funds to trade cryptocurrencies or other financial assets. It can expand your buying or selling capabilities, giving you more tradable funds than you currently have in your wallet. Depending on the cryptocurrency exchange you trade with, you can borrow up to 100x your account balance.

The leverage multiple is expressed as a ratio, such as 1:5 (5 times), 1:10 (10 times) or 1:20 (20x). The ratio shows the magnification of the initial capital. For example, let’s say you have $100 in your trading platform account, but want to open a Bitcoin (BTC) position worth $1,000. With 10x leverage, your buying power of $100 would be equivalent to $1,000.

You can trade different cryptocurrency derivatives with leverage. Common types of leveraged trading include margin trading, leveraged tokens, and futures contracts.

How does leverage trading work?

You need to deposit funds into your trading account before you can borrow funds to start margin trading. The initial capital you provide is what we call collateral. The collateral required depends on the leverage you use and the total value of the position you want to open (called margin).

Suppose you want to invest $1,000 in Ethereum (ETH) with 10x leverage. The required margin is then 1/10 of $1,000, which means you need $100 in your account as collateral for the borrowed funds. If you use 20x leverage, the required margin is lower (1/20th of $1,000 = $50). But keep in mind that the higher the leverage, the higher the risk of forced liquidation.

In addition to the initial margin deposit, you will also need to maintain a margin threshold for your trades. When the market moves against your position and your margin falls below the maintenance threshold, you need to put more money into your account to avoid being forced out. This threshold is also called the maintenance margin.

Leverage can be applied to both long and short positions. Entering a long position means you expect the price of an asset to rise. In contrast, entering a short position means you expect the price of the asset to fall. While this may sound like regular spot trading, using leverage allows you to buy and sell assets based solely on collateral rather than funds held. So if you think the market is going to go lower, you can borrow the asset and then sell it (open a short position) even if you don't own the asset.

Example of leveraged long position

Suppose you want to open a long position in BTC worth $10,000 with 10x leverage. This means you need to use $1,000 as collateral. If the price of BTC increases by 20%, you will make a net profit of $2,000 (before fees), which is much higher than the $200 you would make by trading $1,000 of capital without using leverage.

But if the price of BTC drops by 20%, your position will be down by $2,000. Since your initial capital (collateral) is only $1,000, a 20% drop will result in a forced liquidation (your balance will go to zero). In fact, even if the market only drops 10%, you may be forced out of your position. The exact stop-out value depends on the trading platform you use.

In order to avoid forced liquidation, you need to transfer more funds to your wallet and increase collateral. In most cases, the trading platform will send you a margin call (for example, sending you an email to remind you to add more funds) before a liquidation occurs.

Example of leveraged short position

Now let's say you want to open a short position of $10,000 in BTC with 10x leverage. In this case you need to borrow BTC from others and then sell it at the current market price. Your collateral is $1,000, but you are using 10x leverage, so you can sell $10,000 worth of BTC.

Suppose the current BTC price is $40,000 and you borrow 0.25 BTC and then sell it. If the price of BTC dropped 20% (to $32,000), you could buy back 0.25 BTC for $8,000. This gives you a net profit of $2,000 (before fees).

But if the BTC price rises by 20% to $48,000, you will need to pay an additional $2,000 to buy back 0.25 BTC . But your account balance is only $1,000, so your position will be liquidated. Again, in order to avoid being forced to liquidate, you need to transfer more funds to your wallet and increase your collateral before reaching the liquidation price.

Why use leverage to trade cryptocurrencies?

As mentioned before, traders can use leverage to increase their position size and potential profits. But the above example shows that leveraged trading can also result in higher losses.

Another reason why traders use leverage is that leverage can increase the liquidity of funds. For example, compared to holding a 2x leveraged position on a single trading platform, traders can use 4x leverage to maintain the same position size with lower collateral. This way they can use the other part of their funds elsewhere (e.g. trading another asset, staking, injecting liquidity into a decentralized exchange (DEX), investing in NFTs, etc.).

How to manage risk through leveraged trading? h2>

High-leverage trading may require less capital initially, but will increase the chance of forced liquidation. If your leverage is too high, even a 1% price movement can result in huge losses. The higher the leverage, the lower your tolerance for volatility. The lower the leverage used, the more error-tolerant the trade is. This is why Binance and other cryptocurrency trading platforms limit the maximum leverage available to new users.

Risk management strategies such as stop-loss and take-profit orders can help minimize losses in leveraged trading. You can automatically close your position at a specific price with a stop-loss order, a strategy that is useful when the market moves against you. Stop loss orders can protect you from significant losses. A take-profit order is the opposite; a take-profit order automatically closes your position when your profit reaches a certain value. This ensures you receive profits before market conditions turn.

By now, you should already know that leverage trading is a double-edged sword that can exponentially increase your profits and losses. It involves high risks, especially in the volatile cryptocurrency market. Binance recommends that you take responsibility for your actions and trade rationally. We provide tools such as anti-addiction notifications and cooling-off features to help you take control of your transactions. You should always exercise caution and don't forget to do your own research (DYOR) on how to use leverage correctly and plan your trading strategy.

How to use margin trading on Binance?

You can trade cryptocurrencies using leverage on cryptocurrency trading platforms like Binance. We'll show you how to trade on margin here, but the concept of leverage exists in other types of trading as well. First, you need a margin account. If you don't have a margin account yet, please open one using this FAQ article.

1. Go to [Trading] - [Margin] through the top navigation bar.

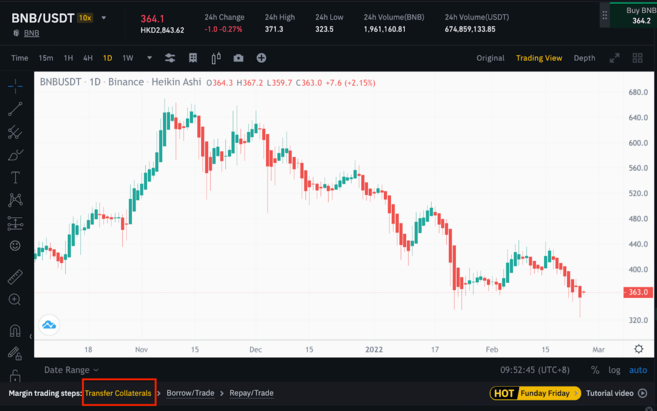

2. Click [BTC/USDT] to search for the trading pair you want to trade. We will be using the BNB/USDT trading pair.

3. You also need to transfer funds to your margin wallet. Click [Transfer Collateral] below the K-line chart.

4. Select the wallet to be transferred, the target margin account and the currency to be transferred. Enter the amount and click [Confirm]. In this example, we will transfer 100 USDT to the cross margin account.

5. Now go to the box on the right. Select [3x for full position] or [10x for individual positions]. The margin in cross margin mode can be shared among your margin accounts, while the margin in isolated margin mode exists independently for each trading pair. You can read the FAQ article to learn more about the differences between the two.

6. Select [Buy] (long) or [Sell] (short) and the order type, such as market order. Click [Loan], and then you will find that the 100 USDT we transferred to the cross-margin account has now tripled, becoming 300 USDT.

7. When using leverage to buy Binance Coin, you can enter the amount of USDT through [Total], or enter the amount you want through [Amount] The amount of Binance Coin purchased. You can also drag the adjustment bar below to choose the proportion of your available balance to use. You will then see the amount borrowed for the transaction. Click [Buy Binance Coin on Margin] to open a position.

Please note that you will also need to pay transaction fees, so you will not be able to use your entire available balance. The system will automatically withhold the transaction fee amount based on your VIP level.

Summary

Leverage makes it easy to get started with a low initial investment and potentially lead to higher profits. But leverage is tied to market movements and can lead to liquidations happening quickly, especially if trading with 100x leverage. Therefore, please always trade with caution and evaluate the risks before entering into leveraged trading. Never trade with more than your personal risk tolerance, especially when using leverage.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR