Summary

MakerDAO is a decentralized finance (DeFi) project that uses cryptocurrency as collateral and the stablecoin DAI is pegged to the U.S. dollar. Its community manages tokens through a decentralized autonomous organization (DAO). Users generate DAI by locking their cryptocurrency in the Maker profit pool at a certain forced liquidation ratio. For example, a 125% liquidation ratio requires $1.25 worth of cryptocurrency to be collateralized for every $1 of DAI.

In response to the fluctuating prices of cryptocurrencies, stablecoins are over-collateralized and are also subject to stability fees. If the collateral value falls below the liquidation ratio, your cryptocurrency will be liquidated to cover any losses.

DAI can remain stable because DAO controls the stability fee and DAI savings rate. Stability fees affect the supply of DAI by changing the cost of minting DAI. The DAI savings rate can affect the market demand for the token, changing the returns investors can receive for staking DAI. When there is a disconnect between DAI and the pegged currency, DAO will use these two mechanisms to bring the price back on track.

DAI’s advantages are similar to other stablecoins and cryptocurrency assets. It can be easily transferred around the world, used for payments, or to lock in profits and losses. You can also use DAI as leverage to earn interest by investing in the DAI Savings Rate smart contract.

In order to participate in "governance polls" and "execution voting", users will purchase MKR tokens and obtain voting rights. This voting power can be used to adjust stability fees, DAI savings fees, teams, smart contracts, and other topics.

Introduction

Stablecoins are very popular cryptocurrencies, between traditional finance and digital assets Provides a middle ground. These blockchain-based tokens are similar to fiat currencies and operate like cryptocurrencies, making them attractive in terms of "locking in" profits and losses.

Up to now, high-market-capitalization stablecoins are all linked to legal tender, and stablecoins are supported through reserve reserves. However, stablecoins backed by cryptocurrencies are also popular. In this article, we’ll look at a well-known example, MakerDAO, and see how it maintains a 1:1 peg to the U.S. dollar despite using a volatile currency as collateral.

What is MakerDAO?

MakerDAO is an Ethereum (ETH) project launched by Rune Christensen in December 2017. It focuses on creating DAI, a stablecoin backed by cryptocurrency and pegged to the U.S. dollar. The MakerDAO ecosystem is not run by a group of developers or a single organization, but uses the governance token MKR for project proposals and decisions. This governance model is called a DAO (Decentralized Autonomous Organization).

Users access MakerDAO through Oasis DApp. Here, they can apply for mortgages, participate in governance, and manage their existing Maker revenue pool. These interactions rely on smart contracts and game theory to allow DAI to maintain a relatively stable value. DAI also works with stablecoins backed by fiat currencies and has the same advantages.

What is DAI?

DAI is MakerDAO’s stablecoin, pegged to the U.S. dollar, and is one of the largest stablecoins and cryptocurrencies by market value. As long as users keep providing collateral to generate more DAI, the supply of this ERC-20 token will be endless.

MakerDAO uses cryptocurrency collateral to maintain its peg ratio, rather than using fiat reserves. This may be a bit confusing, how can a cryptocurrency known for its volatility provide support for a stablecoin? Simply put, the cryptocurrency users deposit to create DAI is worth much more than the stablecoins they receive. This provides headroom for price declines in cryptocurrency collateral.

Similar to other stablecoins, DAI has the following advantages when using it:

1. More suitable for expenditures with stable needs. Retailers and retail investors are not always willing to pay for cryptocurrencies that fluctuate wildly in value.

2.DAI benefits from the advantages of blockchain. Stablecoins can be transferred globally without the need for a bank account. It is also extremely safe and reliable if stored correctly.

3. You can use it to lock in profits and losses and hedge risks. DAI will offset some of the overall risk of a portfolio, helping to enter or exit positions without the need for off-chain operations.

How does cryptocurrency collateral work?

Collateral is a common concept in traditional finance, and you may have understood it before. When taking out a loan, you will need to provide something of value as collateral. This will be used to pay down the loan if you are unable to repay it.

Physical collateral and fiat currency collateral

Let’s take a pawn shop as an example. You can pledge your jewelry (collateral) to a pawn shop in exchange for a cash loan. You can then repay the loan plus interest, redeem the collateral, or allow the pawn shop to keep the collateral and cover its losses. Collateral acts as a safety net, and the same concept applies to mortgages and car financing. In these examples, the goods (property or cars) serve as collateral.

For stablecoins like BUSD that are backed by legal currency, their collateral is legal currency. Users pledge funds (collateral) in exchange for tokens. They can return the tokens to the issuer if they wish, but if they don't return the tokens, the issuer still owns the funds. This mechanism provides the ground for arbitrage, and arbitrage can ensure the status of the stable currency peg. For more information, please refer toWhat is a Stablecoin? 》.

Cryptocurrency Collateral

Cryptocurrency-collateralized stablecoins like DAI accept cryptocurrency as collateral instead of fiat currency. Smart contracts manage these funds according to rules: for Y amount of Ethereum deposits, issue X amount of stablecoin tokens. When X amount of stablecoins are withdrawn, Z amount of Ethereum is returned. The exact amount of collateral required depends on the project issuing the token. This ratio will primarily depend on the volatility and risk of the collateral assets.

What is over-collateralization?

Low-risk assets with stable prices, such as fiat currencies, precious metals and real estate, are common collateral. As we mentioned, using cryptocurrency as collateral is riskier for lenders because its price is more volatile. Imagine that a project requires $400 of Ethereum as collateral in exchange for 400 USD-pegged tokens.

If the price of Ethereum suddenly drops, lenders’ collateral will not be able to cover the loans they make. Then overcollateralization is the solution: when a lender lends 400 USD stablecoin tokens, it requires $600 in Ethereum.

What is Collateralized Debt Position (CDP)?

MakerDAO has used over-collateralization for many years to maintain a reasonable and reliable peg ratio. Since the generation process of DAI is controlled by smart contracts, it can operate efficiently and away from human interference. When you want to borrow the DAI stablecoin, your cryptocurrency is locked in the CDP smart contract. CDP will set a liquidation ratio, for example, 1.5x, which means you need to provide $150 of Ethereum in exchange for $100 of DAI. If users wish, they can add more collateral, reducing their risk. If the collateral amount falls below 150% (1.5x), there will be a penalty. Ultimately, if users fail to repay DAI with an additional interest rate (stability fee), they will face the risk of forced liquidation.

What is the Maker revenue pool?

The Maker revenue pool is where users place collateral and generate DAI. This allows you to use multiple different cryptocurrencies as collateral at the same time. As long as the user returns DAI, the Maker revenue pool will destroy it. The process is as follows:

1. Deposit supported cryptocurrencies into the Maker protocol.

2. The deposit will open a Maker income pool position.

3. You can withdraw DAI based on the amount of collateral. You also pay a stabilization fee.

4. To redeem the cryptocurrency collateral, please repay the DAI you withdrawn.

You can generate or return DAI, and add or redeem collateral at any time. However, you must maintain the liquidation ratio shown in the profit pool. If it falls below this ratio, the yield pool will force liquidate your collateral.

How does the value of DAI remain stable?

In addition to reducing MakerDAO’s risk as a lender, the CDP mechanism helps peg DAI to the U.S. dollar. MakerDAO can also vote to change the stability fee and DAI savings rate (the interest paid to stakers in the DAi savings rate smart contract) to control the supply and demand of DAI. Together, these three tools maintain a 1:1 ratio between DAI and the U.S. dollar. Let’s take a look at what’s going on:

1. When DAI falls below the peg ratio, the system attracts users to repay debts, recover collateral, and destroy DAI. This could be accomplished by increasing stability fees, making borrowing more expensive. DAO can also increase the DAI savings rate and expand the demand for token investment.

2. When DAI is higher than its peg ratio, the opposite is true. If the stability fee is reduced, the DAO will stimulate the generation of DAI. This creates new DAI, increasing the total supply and lowering the price. MakerDAO can also reduce the demand for DAI by lowering the DAI savings rate, which means investors will find other ways to earn interest.

Use cases of DAI

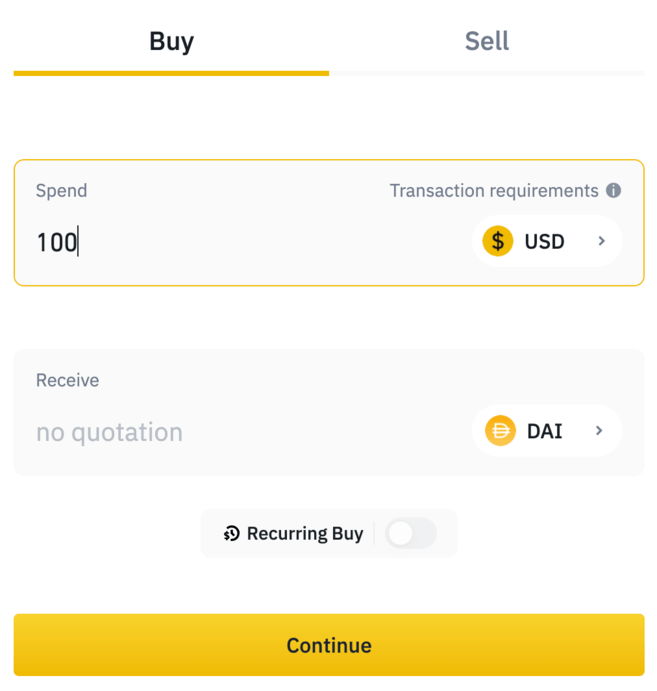

As mentioned above, the use of DAI is similar to other stablecoins, and the advantages are similar. . You don’t even need to generate DAI yourself, you can buy it on the cryptocurrency market, such as going to the Binance market to buy it. DAI also has several unique use cases:

1. Leverage—Suppose you have $1,000 of Ethereum and you predict that the price will increase. However, you currently do not have the funds to spare to purchase Ethereum. At this point, you can use Ethereum as collateral, generate DAI, and then use it to purchase more Ethereum. If the price of Ethereum rises and you want to cash out, you can sell part of the Ethereum for DAI tokens and redeem your collateral.

2. DAI Savings Rate— Deposit DAI into the DAI Savings Rate smart contract to earn interest. This ratio changes as the DAO controls the price of DAI.

Where to buy DAI?

DAI can be purchased on large cryptocurrency exchanges, such as Binance. After creating an account and completing identity verification checks, you can purchase DAI directly using a credit or debit card.

Select the fiat currency you want to pay in the top area, and select DAI at the bottom. You'll then see specific instructions for adding the card to your account. If you wish, you can also use the trading platform view to exchange DAI for another cryptocurrency.

How to participate in the governance system of MakerDAO?

To have the right to speak and vote in MakerDAO, you need to hold the project’s governance token MKR. The maximum supply of the token is 1,005,577 MKR, with approximately 40% allocated to the team and early investors. The DAO holds the remainder for future sales.

MKR holders can vote to change the platform’s stability fee, DAI savings rate, forced liquidation rate, etc. Their voting power is proportional to the amount of DAI they hold. You can go to MakerDAO’s governance portal to view and participate in current votes.

Governance Polls

Governance Polls allow users to create non-technical proposals for other MKR holders to vote on. For example, adjust governance models, goals, teams, or budgets. Governance polls feature an instant runoff mechanism, which means you can rank your choices from multiple options.

Execution voting

Execution voting involves changes to technical smart contracts. Proposals are subject to a continuous approval voting system, which means that competing new proposals can be introduced at any time. Executing a vote will result in hard changes to the smart contract code, such as adjusting fees or collateral levels. In order to implement some of the changes voted on in the governance survey, an executive vote must first be held.

Summary

As a mainstream cryptocurrency mortgage stablecoin, DAI The success has been proven. This system mitigates the volatility of cryptocurrencies without fiat collateral, which is an incredible feat. And it also plays an important role in the development of DAO. It is the longest-running and largest DAO organization, laying the foundation for the development of many other DAOs. If you decide to try DAI, don’t forget that it carries the same risks as other stablecoins.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR