Summary

A typical cryptocurrency card allows users to earn cryptocurrency rewards or instantly convert cryptocurrencies into fiat currency to pay for goods and services. Both MasterCard and Visa issue cryptocurrency cards that allow cardholders to spend cryptocurrencies at millions of locations around the world.

Prepaid cryptocurrency cards are similar to debit cards in that you must pre-load cryptocurrency before you can spend it. You can collect a cryptocurrency card from a licensed issuer such as a cryptocurrency exchange or bank. However, cryptocurrency cards also come with certain risks. Funds deposited on the card may still lose market value, and all transactions completed with such a card may be subject to taxes.

Cryptocurrency credit cards are more like standard credit cards with cryptocurrency rewards. You can pay your credit card bills with fiat cash and get cryptocurrency rewards for spending your funds.

Binance offers the Binance Visa Card to customers who pass identity verification (KYC) and anti-money laundering (AML) certification. You can sign up in minutes, get zero administration or transaction fees, and enjoy cash back and other benefits.

Introduction

Although people mainly value cryptocurrencies for their investment potential, their use as a transfer of value also Can not be ignored. Satoshi Nakamoto’s original intention when creating Bitcoin was not to make people billionaires. He hopes to create a global digital payment system. One way to achieve this is with cryptocurrency cards. Currently, this payment method is driving the use of cryptocurrencies and digital assets in daily life, and consumers are even being rewarded with cryptocurrencies.

What is a digital currency wallet?

A typical cryptocurrency card functions similarly to a debit card. You can use it to pay for items or services at suppliers that accept the card. While this may sound like using digital currency to pay suppliers directly, this is not the case. Vendor accounts receive fiat currencynotcryptocurrencys. Your cryptocurrency card uses the cryptocurrency in the linked account, converts it into the local currency of the region where the payment is made, and then uses that cash to complete the payment. We will illustrate this later with specific examples.

Both Visa and MasterCard offer cryptocurrency cards to partner companies that apply for licenses. They are two of the most widely used payment service providers in the world, making cryptocurrency cards almost universally accepted by major retailers. Some cryptocurrency cards only offer cryptocurrency rewards for swiping purchases. This kind of card is generally a credit card that can only be registered after passing a credit check.

How do cryptocurrency cards work?

As mentioned above, cryptocurrency cards do not actually pay the vendor in cryptocurrency. It makes it easy and convenient to convert cryptocurrencies into cash, which you can then use to pay your suppliers.

For example, let’s say you have $500 in BNB in your Binance Card funding wallet. You need to pay your $100 bill at the restaurant using your cryptocurrency card. After inserting the card and agreeing to pay, Binance sells $100 worth of BNB and deposits fiat currency into it. The restaurant is then credited with $100, while you have $400 worth of BNB left in your funding wallet. All this is done in seconds with the help of cryptocurrency cards.

You can also use a cryptocurrency card to withdraw money from an ATM if the service provider supports the withdrawal service. The above method also works for withdrawing cash.

What is the difference between a cryptocurrency card and a credit/debit card?

There are some subtle differences between credit cards, debit cards, and cryptocurrency cards. For the most part, all three work the same way when it comes to payments. The most obvious difference between a cryptocurrency card and a credit/debit card is this: A typical cryptocurrency card requires a deposit of cryptocurrency in order to use it. Debit cards are pre-loaded with fiat currency, and credit card transactions are also repaid in fiat currency at a later date.

Prepaid cryptocurrency cards work similarly to traditional debit cards. You must deposit funds into your account before they can be used. Fiat cash cannot be deposited into the card, only cryptocurrencies can be used. When making a payment, the funds are instantly converted in the cryptocurrency wallet.

On the other hand, cryptocurrency credit cards expand credit limits and support purchase now, pay later. Gemini and BlockFi both issue cryptocurrency credit cards that offer cryptocurrency cash back. Your credit card bill is paid in regular fiat currency, so a cryptocurrency credit card is broadly a rewards credit card.

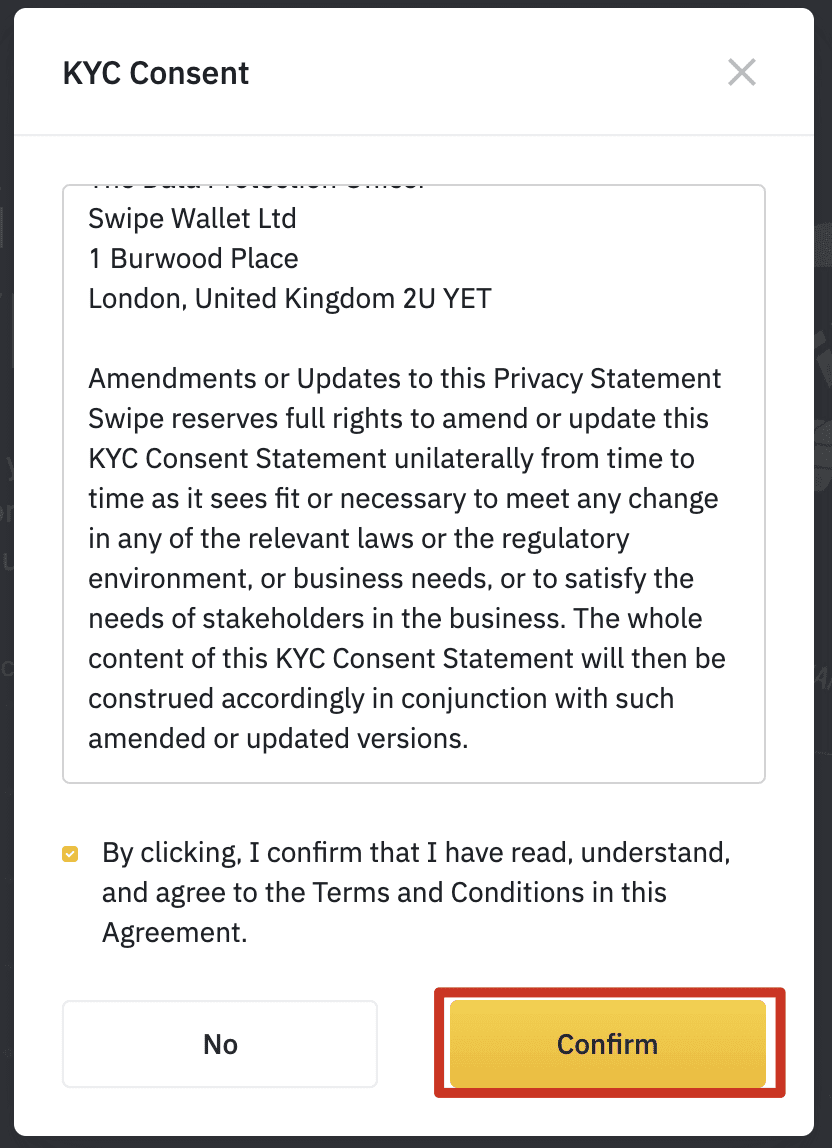

To open a card, you should first become a customer of a cryptocurrency card provider, such as a cryptocurrency exchange or a cryptocurrency-enabled bank. As with any regular credit or debit card, identity verification (KYC) and anti-money laundering verification processes must be completed before applying for a cryptocurrency card. You also need to pass a credit check before using a cryptocurrency credit card.

What are the advantages of using a cryptocurrency debit card?

The main advantage of prepaid cryptocurrency cards is that they allow the use of cryptocurrencies for everyday spending. In traditional processes, this would be difficult to do unless the supplier accepts cryptocurrencies directly. Even if a provider accepts cryptocurrencies, currencies like Bitcoin can take up to 30 minutes to confirm a transaction. Cryptocurrency prices are also unstable, and actual fees paid may be higher or lower than expected.

Many cryptocurrency cards also come with other benefits, such as cash back rewards or discounts when subscribing to certain services, such as Spotify or Netflix. These benefits, which attract users to a specific credit card provider, are very similar to those offered on standard debit/credit cards. Be sure to compare the benefits each card offers to find the benefits that work best for you. Also, don’t forget that you may need to pay exchange fees during the conversion process.

Are there risks with cryptocurrency cards?

Owning a cryptocurrency card carries the same risks as holding cryptocurrency. If you use Bitcoin (BTC) or Ethereum (ETH) to recharge your account, the fiat value of your account will always change. This means you may not be able to determine the exact amount of money in your account because it depends on the exchange rate.

It is also important to note that in many tax jurisdictions, cryptocurrency consumption is a taxable event. Whether you spend a few dollars on a cup of coffee or a few thousand dollars on a car, you pay taxes. If you make any gains or losses in cryptocurrency before spending with your cryptocurrency card, you must pay or write off the corresponding taxable amount.

You can avoid this problem by purchasing stablecoins and using them with a cryptocurrency card, as the price of stablecoins rarely deviates from their pegged value.

What is Binance Card?

Binance Card is a VISA debit card linked to a Binance account. Once you top up the card's funding wallet, you can spend cryptocurrencies everywhere Visa is accepted. It works the same as the prepaid cryptocurrency debit card described above.

In which countries can Binance Card be used?

Binance Card is only available to users in certain countries, including:

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.

How to apply for a Binance Card

If you have a Binance account and live in an eligible country/ Region, applying for a Binance Card will be very simple. If you haven’t signed up for a Binance account yet, check out our Binance Beginner’s Guide to get set up in minutes. Before successfully applying for a Binance Card, you need to complete all relevant identity authentication and anti-money laundering verification processes.

To open a card, please log in to your Binance account and go to the Binance Card page. You can also access this page by hovering your mouse over [Finance] on the Binance homepage and clicking [Binance Visa Card].

Next, click [Start] and [Open Card]. Now you can see some authentication information and protocols that need to be confirmed.

After confirmation, enter the card opening page. Here you can choose the format in which the name appears on the card. After confirming your selection, click [Continue].

Now that your details are pre-filled, please fill in any other missing information. Finally, agree to the Privacy Policy, Terms of Use and Cardholder Agreement before clicking [Open Binance Card].

After opening the card, you can use the virtual card before the physical card is delivered. You can add this card to Google Pay Send and even apply it to online purchases. If you prefer to use the Binance Mobile App, you can also apply for a card on the App. To learn more about how to apply for the Binance Card, please refer to our FAQ.

Advantages of using Binance Card

In addition to being in stores, restaurants and institutions around the world that accept VISA and In addition to personal payments using cryptocurrencies, Binance Card also offers exclusive benefits and privileges.

1. Zero Fees - All Binance users can get a Binance Visa Card for free. Binance does not charge management fees, processing fees, or annual fees, but you may occasionally need to pay third-party fees.

2. Continue to hold cryptocurrencies - There is no need to convert cryptocurrencies into fiat currency when spending. Binance converts cryptocurrencies exactly when you need them, and you still get potential market gains on your cryptocurrencies.

3. Up to 8% cash back - Based on the average monthly BNB balance, you can enjoy up to 8% cash back. The funds will be returned to the personal Binance account in the form of BNB. You can learn more about the cash back program here.

4. Funds are safe and secure - Your cryptocurrency funds are SAFU and protected by Binance. Binance adopts robust security standards and strictly ensures security.

Summary

For those who do not want to continue to hold for a long time Cryptocurrency, which can be easily converted into fiat currency using a cryptocurrency card. Without using a cryptocurrency card, you have to go through the entire conversion process and manually transfer fiat currency to your bank account. This may take several days depending on the bank and cryptocurrency trading platform. Cryptocurrency cards are indeed one of the fastest ways to spend cryptocurrency and are becoming more and more popular among users. However, it is important to keep track of your consumer spending for tax reasons.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR