Abstract

Decentralized Finance ( DeFi) has become a must-win place for “unicorns” and “cartoon sushi” to compete for liquidity. Uniswap has been one of the most successful DeFi protocols for Ethereum token trading. Its elite construction team is full of passion and open source the code, allowing everyone to fork. This is where SushiSwap came into being!

SushiSwap is a fork of Uniswap, with the icing on the cake adding SUSHI tokens. Token holders control the protocol and receive a portion of the fees. Let’s learn how to play with SushiSwap!

Introduction

With the development of the decentralized finance (DeFi) field, more and more emerging financial platforms are emerging. We have already seen how investors can make money using methods such as flash loans and liquidity mining (known in English as “yield farming” or “liquidity mining”).

Uniswap has always been the dominant player in the core DeFi protocol, with transaction volume second to none. Despite its decentralized nature and heavy reliance on smart contracts, users don’t have much say in its direction.

SushiSwap, a rising star on the track, promises to change this situation. The locked value of its protocol exceeded $1 billion in just a few days after its launch, which fully proves that most users are very interested in this change. In this article, we will discuss this Uniswap fork storm that has taken over the cryptocurrency space.

What is SushiSwap?

SushiSwap was launched in September 2020 by two anonymous developers known as "Chef" Nomi and 0xMaki. As one of the most popular decentralized applications (DApps) currently on the Ethereum blockchain, SushiSwap adopts the automated market maker (AMM) model in its own decentralized exchange (DEX) protocol. In short, there is no order book on SushiSwap. Instead, the buying and selling of cryptocurrencies is facilitated by smart contracts.

SushiSwap was originally a fork of Uniswap, built on Uniswap's code while introducing some key differences. The biggest difference is that rewards are issued in the form of SUSHI tokens. SushiSwap’s liquidity providers are rewarded with the protocol’s native token SUSHI, which is also a governance token. Unlike Uniswap (UNI), SUSHI holders can continue to earn income even after they stop providing liquidity.

Once it came out, SushiSwap paid additional SUSHI rewards of high annualized yield (APY) to encourage liquidity providers to Liquidity Pool (LP) tokens are pledged to Uniswap. In just one week, SushiSwap successfully attracted more than $1 billion in liquidity, and the total locked value exceeded $150 million. Two weeks later, staked liquidity provider tokens were migrated from Uniswap to SushiSwap. This means that all Uniswap liquidity provider tokens staked on SushiSwap have been redeemed from Uniswap in the form of corresponding tokens. A new liquidity pool that brings together these tokens was created in SushiSwap, marking the official launch of the SushiSwap trading platform.

In the second quarter of 2021, the SushiSwap ecosystem unveiled its latest product, the non-fungible token (NFT) platform, taking Name "Shoyu". In fact, Shoyu's design concept was proposed by SUSHI governance members and planned to create a simple and easy-to-use NFT platform. The platform aims to address the shortcomings of the existing NFT market, such as limited file format choices, limited image sizes, and high Ethereum transaction fees.

What is SUSHI?

SUSHI is the native token of SushiSwap. It is an ERC-20 issued to liquidity providers through liquidity mining in SushiSwap. Token. The supply of SUSHI tokens is capped at 250 million, and the supply is determined by the block output rate. As of November 2021, the output rate of each block is 100 tokens, and the circulating supply has reached 127 million tokens, accounting for approximately 50% of the total supply.

SUSHI holders hold the governance rights of the protocol and can receive part of the fees paid to the protocol. To put it simply, we can understand that the SUSHI community has ownership of the protocol. Why does this spark so much interest among users? Because community governance and the nature of decentralized finance (DeFi) are closely related. As an effective way to issue tokens, the development of liquidity mining (called “yield farming” or “liquidity mining” in English) has spawned the issuance of a large number of new tokens.

The fair token issuance model aims to provide a fair environment for all participants, and the rules include no early mining , founders are not allowed or only have a small share of tokens, and users receive fair distribution based on the amount of funds provided. In most cases, token holders are also given token governance rights.

So, how do token holders exercise these governance rights? Everyone can submit a SushiSwap Improvement Proposal (SIP) on SushiSwap, which is then voted on by SUSHI holders. Afterwards, the SushiSwap protocol will undergo minor or even major changes accordingly. Unlike more traditional teams like Uniswap, the development of SushiSwap is in the hands of SUSHI token holders.

A strong community is a key advantage of all token projects, especially for DeFi protocols. For example, MISO, the minimal initial coin offering platform launched by SushiSwap, is the product of governance proposals. MISO is the token launchpad platform of the SushiSwap ecosystem, tailor-made to meet the needs of the SUSHI community. With MISO, individuals and communities can issue new project tokens on their own through the SushiSwap platform.

How does SushiSwap work?

As mentioned before, SushiSwap is a decentralized trading platform using the Automated Market Maker (AMM) protocol, and there are no orders It is not subject to intervention by centralized institutions. Cryptocurrency transactions on SushiSwap are handled by smart contracts in a liquidity pool. SushiSwap users can become a liquidity provider (LP) by locking their cryptocurrency assets in the liquidity pool. Anyone can become a liquidity provider on SushiSwap and earn income based on their share of the fund pool. This can be achieved by depositing two tokens of equal value into the fund pool. Each pool is a market where other users can go to buy and sell tokens. For a more comprehensive understanding of how automated market makers operate within the DEX protocol, please read our Uniswap article.

Like other decentralized trading platform protocols, SushiSwap can also trade ERC-20 tokens. For example, stablecoins USDT and BUSD can be exchanged for cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH). Additionally, there are various sushi-themed features that allow users to earn passive income. For example, stake SUSHI to SushiBar to obtain xSUSHI. With staked xSUSHI, holders can earn a 0.05% bonus fee on all liquidity pool transactions without exception. After the launch of Shoyu, SUSHI holders who stake their tokens as xSUSHI will also be eligible to receive the NFT market’s 2.5% fee per NFT transaction.

There is also a feature on SushiSwap to earn rewards called BentoBox. This is an innovative asset library where users can experience all of SushiSwap’s revenue earning tools. In other words, users can deposit assets into BentoBox and earn interest by pledging and lending them to others in SushiBar. At the same time, xSUSHI holders can also earn income from the transaction fees generated by BentoBox.

Comparison between Uniswap and SushiSwap

As we all know, cryptocurrencies are deeply rooted in the open source ethos. Many believe that Bitcoin and the growing number of permissionless DeFi protocols will become a new type of public good in the form of software. Since these projects can be easily copied and reissued with only minor changes, this naturally leads to intense competition among similar products. However, we can foresee that through survival of the fittest, end users will eventually enjoy the best quality products.

There is no doubt that the Uniswap team has made significant progress in the field of decentralized finance (DeFi). We believe that Uniswap, SushiSwap, or other forks will flourish in the future. Uniswap is still at the forefront of innovation in the field of automated market makers, and SushiSwap has great potential to replace it, focusing more on developing functions that meet the needs of the community.

Having said that, splitting liquidity between similar protocols is not ideal. Users who have read our Uniswap article will understand that the higher the liquidity of the capital pool, the better the effect of the automated market maker will be. If decentralized finance (DeFi) liquidity is diverted on a large scale to many different automated market maker protocols, this may lead to a poor end-user experience.

How to provide liquidity to SushiSwap?

If you plan to pledge tokens in exchange for SUSHI, the first step is to purchase tokens. Cryptocurrencies for pledge can be purchased through centralized cryptocurrency trading platforms such as Binance, or decentralized trading platforms Uniswap and 1INCH.

In this example, we introduce how to provide liquidity for BNB-ETH. Of course, users can follow the method of this example at any time to operate other liquidity provider token trading pairs supported for use in SushiSwap.

1. Go to the Sushi website, click [Enter App], and then enter SushiSwap.

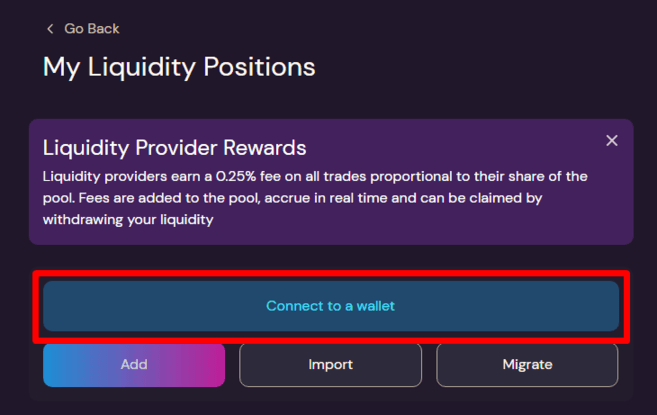

2. Go to [Fund Pool] through the top navigation bar. Before starting, you need to connect to your personal wallet. Applicable wallets include: Binance Wallet, MetaMask, WalletConnect, or other available Ethereum wallets. In this example, we use Binance wallet.

3. After clicking [Binance], a pop-up window will be displayed here. Enter your password to unlock the wallet. If you have not created a wallet yet, please click [Create New Wallet].

4. Click [Connect].

5 .Return to SushiSwap pool. Click [Add] to add liquidity.

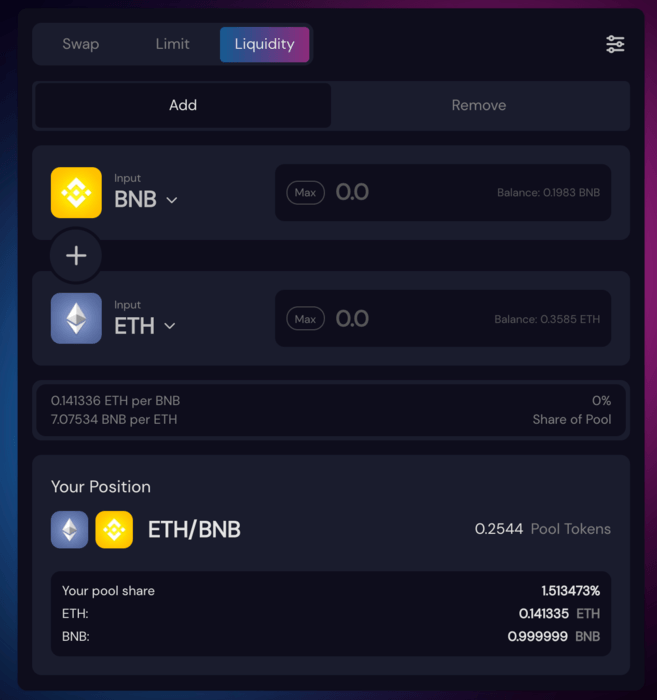

6. Click [Select Token] and select the cryptocurrency pair you wish to provide liquidity for. Then, enter the amount of one of the coins (for example: 1 BNB). The system will automatically calculate the amount of the other token.

The user's share of the fund pool will be displayed at the bottom. Click [Approve ETH] to confirm.

7. At this time, the pop-up window is displayed again, displaying the transaction details and fuel fee. Click [Confirm] to approve, or [Reject] to edit.

8. Click [Confirm to add liquidity] and [Confirm supply] in sequence to add liquidity to the BNB-ETH fund pool .

Please note: Due to the potential risk of impermanent loss, the number of tokens received when users redeem may differ from the initial amount. There was a discrepancy when added. This risk must be understood before adding liquidity.

9. Confirm the transaction in the wallet pop-up window.

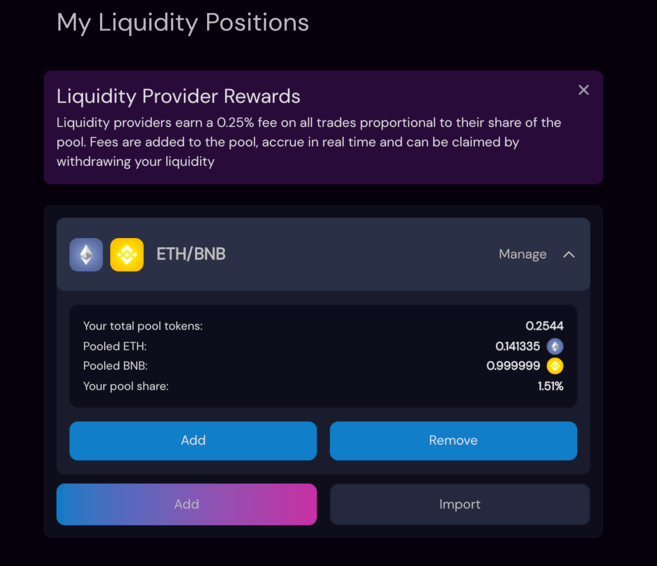

10 .Successfully added liquidity to the BNB-ETH fund pool. The user's holding positions and share in the fund pool will be displayed here. In other words, when other users trade BNB/ETH, the user will be rewarded with transaction fees.

11. From Visit [Capital Pool] on the top navigation bar, click "Position" to add or remove liquidity, and you can manage your position.

User You will notice that there are some SLP tokens generated by the transaction in your wallet. The SLP token is SushiSwap’s liquidity provider token and represents the user’s share of the fund pool that has been deposited. All liquidity pools in SushiSwap are uniformly labeled as SLP, but actually represent different pools.

How to buy and sell SUSHI on Binance?

In addition to earning from SushiSwap, SUSHI tokens can also be purchased through cryptocurrency exchanges such as Binance. In addition, if you need to sell the SUSHI obtained on SushiSwap, you can transfer it to your personal wallet and then sell it through cryptocurrency trading platforms such as Binance.

1. Log in to your personal Binance account, enter [Trading] in the top navigation bar, and select the Standard or Professional Edition trading page.

2. Enter "SUSHI" in the search bar on the right side of the screen to view available trading pairs. In this example, we use SUSHI/BUSD. Click [SUSHI/BUSD] to open the transaction page.

3 .Scroll down to the [Spot] area, where you can buy and sell SUSHI. Enter the quantity of SUSHI you wish to buy or sell. Then, select the order type for the order. In this example, we select Market Order. Click [Buy SUSHI] or [Sell SUSHI] to confirm the order.

Is SushiSwap safe?

Depositing funds into smart contracts always faces the risk of vulnerabilities, even for projects that have passed audits and are reputable. Therefore, never deposit more money than you can afford. Before investing, please be sure to do your own research (DYOR). In addition, due to the high gas cost of Ethereum, smaller investments will still require mining for a considerable period of time to truly achieve profitability.

Summary

SushiSwap is an exciting attempt to challenge the successful DeFi protocol Uniswap and demonstrate its own competitive advantages. Although SushiSwap is a fork of Uniswap, it adds entirely new features to the protocol, with the most notable difference being community governance. In 2021, SushiSwap launched the NFT platform, taking advantage of the trend to enter the prosperous NFT market.

Since its launch, SushiSwap’s total locked value has quickly surpassed that of many decentralized finance (DeFi) projects and has become popular It will continue to grow in scope and appeal. No matter what achievements SushiSwap will achieve, its existence proves that in decentralized finance (DeFi), the advantages of no product or service are unshakable.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR