Introduction

When you think of safe-haven assets, you may first think of precious metals such as gold or silver. Many individual investors have turned to such investments as a hedge against traditional market turbulence.

The debate continues over whether Bitcoin will follow in the footsteps of these assets. In this article, we will look at some of the main arguments for and against Bitcoin as a store of value.

What is a store of value?

A store of value is an asset that retains its value over time. If you purchase an item today that serves as a store of value, you have reasonable confidence that its value will not depreciate over time. In the future, you would expect the asset to be worth the same as it is today (perhaps even more).

When you think of such "safe-haven" assets, gold or silver may first come to mind. There are many reasons why these items have traditionally been valuable, which we'll get to shortly.

Learn the latest price of Bitcoin (BTC) now.

What is a store of value?

To understand what is an ideal store of value, let’s first explore what is a poor store of value. If we want something to be preserved for a long time, it stands to reason that it must havedurable properties.

Take food as an example. Both apples and bananas have intrinsic value because humans need nutrients to survive. In times of food shortages, these items would undoubtedly be worth a fortune. But that doesn’t make them a good store of value. If you leave them in a safe for a few years, their value will drop significantly as they will obviously deteriorate.

And what about items that have intrinsic value and are durable? Like dry pasta? This is the better option in the long run, but there's still no guarantee it will retain its value. Pasta is produced using readily available resources at low cost. Anyone can put more pasta on the market, so the pasta in circulation will lose value due to oversupply. Therefore, for an item to retain its value, it must also bescarce.

Some people believe that fiat currencies (dollars, euros, yen) are a good way to store wealth because they retain their value over the long term. But they are actually poor stores of value because as the number of units increases, their purchasing power decreases significantly (just like pasta). You can take out your life savings and hide them under your mattress for 20 years, but when you finally decide to spend the money, it may not have as much purchasing power as it once did.

$100,000 could buy far more in 2000 than it does now. This is primarily due to inflation, which is an increase in the prices of goods and services. In many cases, inflation is caused by an oversupply of fiat currency due to the government's practice of printing more money.

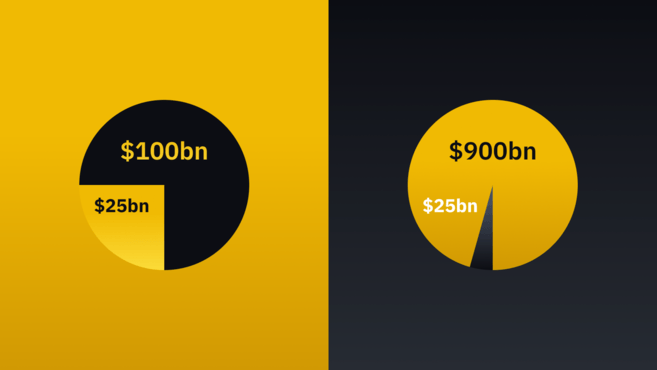

For example, let’s say you hold 25% of the total supply of $100 billion, which is $25 billion. As time went on, the government decided to print an additional $800 billion to stimulate the economy. Your share suddenly drops to around 3%. There's more money in circulation, so obviously your share doesn't have nearly as much purchasing power as it once did.

Buying power is lost over time.

Like the pasta mentioned above, the manufacturing cost in US dollars is not high. The above situation can happen in just a few days. With a good store of value in place, flooding the market with new units becomes less easy. In other words, if your share is diluted, it should be diluted very slowly.

Take gold as an example. We all know that its supply is limited. We also know that it is very difficult to mine. So even if demand for gold suddenly rises, people can't just run a printer to make more gold, but have to mine it from the ground as usual. Despite a massive increase in demand, supply was unable to materially increase to meet this demand.

Bitcoin as a store of value

As early as the birth of Bitcoin, supporters have always believed that This cryptocurrency is more similar to "digital gold" than a simple digital currency. In recent years, this statement has been recognized by many Bitcoin enthusiasts.

Bitcoin’s store of value theory holds that it is one of the most reliable assets known to mankind. Proponents of this theory believe that Bitcoin is the best way to store wealth so that it does not lose value over time.

Bitcoin’s extreme volatility is well known. Many people think that if an asset can lose 20% of its value in a day, it may seem weird to use it as a store of value. But even taking its multiple declines into account, it's still the best-performing asset class by far.

So, why is Bitcoin hailed as a store of value?

Scarcity

Perhaps one of the most convincing arguments for the store of value theory is the supply of Bitcoin Quantity is limited. If you have read our article What is Bitcoin, you may remember that the number of Bitcoins will never exceed 21 million. The protocol uses hard-coded rules to ensure this.

The only way to create new tokens is through the mining process, which is somewhat similar to the mining process of gold. But the difference is that instead of drilling underground, Bitcoin miners must use computing power to crack a cryptographic puzzle. In this way, they will win new tokens.

Over time, rewards decrease through an event called halving. If you guessed that this would cut the reward in half, you'd be absolutely right. In the early days of Bitcoin, the system rewarded 50 Bitcoins to any miner who produced a valid block. During the first halving, the number was reduced to 25 Bitcoins. Subsequent halvings reduced this to 12.5 Bitcoins, and the next halving slashed miner rewards to 6.25 Bitcoins per block. This process will continue for more than 100 years until the last part of the token enters circulation.

We build a model for this process in a similar way to the fiat currency example mentioned earlier. Let’s say you purchased 25% of the supply of Bitcoin (i.e. 5.25 million tokens) many years ago. When you earn these tokens, you know that your percentage will remain the same because no entity will be able to add more tokens to the system. There is no government here, well, not in the traditional sense really (more on that later). So if you bought (and held for the long term) 25% of the maximum supply in 2010, you still own 25% now.

Decentralization

You may be thinking, It is a Open source software. I can copy the code and create an additional 100 million tokens myself.

You can. Let's say you clone the software, make changes, and run a node. Everything seems normal. There's just one problem: there are no other nodes to connect to. As soon as you change the parameters of your software, members of the Bitcoin network will start ignoring you. You have forked and the program you are running is no longer a globally recognized Bitcoin.

What you have done previously is the functional equivalent of taking a picture of the Mona Lisa and then claiming that there are now two Mona Lisas. You can convince yourself that this is true, but it's not so easy to convince others.

We have said that there is a "government" in a certain sense in the Bitcoin field. The government consists of every user running the software. The only way to change the agreement is if a majority of users agree to the change.

Convincing most people to increase their token holdings is not easy - after all, you are asking them to reduce their holdings. As is the case today, even seemingly trivial features can take years to reach consensus on the network.

As you scale, implementing change only gets harder and harder. Therefore, holders have reason to believe that the supply will not increase significantly. Although the software is man-made, the decentralization of the network means Bitcoin is more like a natural resource than code that can be changed at will.

Properties of "good money"

Adherents of the store of value theory also point to the Some of the characteristics that make Bitcoin "good money". Not only is it a scarce digital resource, it also has characteristics that money has had for centuries.

Gold has been used as currency in many civilizations since its birth. There are many reasons behind this. We've already discussed durability and scarcity. These characteristics make for a good asset, but not necessarily a good currency. In addition, Fungibility, Portability and Divisibility are also required.

Fungibility

Fungibility means that units are indistinguishable. In the case of gold, any two ounces of gold are worth the same amount. The same goes for stocks and cash. No matter which specific unit you hold, it is worth the same as other units of its kind.

Bitcoin’s fungibility is a thorny issue. It doesn’t matter which token you hold. In most cases, 1 Bitcoin = 1 Bitcoin. Things get complicated when you consider that each unit can be connected to previous transactions. In some cases, businesses will blacklist funds they believe were involved in criminal activity, even if the holder later receives the funds.

Is this really that important? It's hard to see why. When you buy something with a dollar bill, neither you nor the merchant know where it was used three transactions ago. There is no concept of transaction history here - new banknotes are not worth more than old banknotes.

However, in a worst-case scenario, older Bitcoins (with more history) may sell for less than newer Bitcoins. Depending on who you ask, this scenario could be a significant threat to Bitcoin, or it could be something not to worry about too much. Regardless, for now, Bitcoin is functionally fungible. Tokens being frozen due to questionable history are only isolated incidents.

Portability

Portability means the ease of transferring assets. Convert $10,000 into $100 bills? Easy to take everywhere with you. What about $10,000 worth of oil? It's not that easy.

The ideal currency must have smaller dimensions. It must be portable so people can pay each other for goods and services.

Gold has always excelled at this. At the time of writing, a standard gold coin is worth nearly $1,500. You're less likely to buy an ounce of gold, so smaller denominations take up less space.

Bitcoin actually outperforms precious metals when it comes to transportability. It doesn't even have a physical body. You can store trillions of dollars worth of wealth on a hardware device the size of the palm of your hand.

Moving $1 billion worth of gold (more than 20 tons at current value) requires a huge amount of manpower and financial resources. Even in cash, you'll need to carry several pallets of $100 bills. With Bitcoin, you can send the same amount of money anywhere in the world for less than a dollar.

Divisibility

Another important characteristic of currency is divisibility - that is, whether it can be divisible Money is divided into smaller units. For gold, you can cut a one-ounce gold coin in half to get two half-ounce units. You may lose an extra fee by destroying the eagle or buffalo image on the gold coin, but the overall value of the gold remains the same. You can cut your half-ounce gold coins into smaller denominations over and over again.

Divisibility is another advantage of Bitcoin. There are only 21 million Bitcoins in the world, but each one is made up of 100 million small units (satoshis). This gives users a large degree of control over their transactions, as they can specify the amount to send up to eight decimal places. Bitcoin's divisibility also makes it easier for small investors to purchase a portion of Bitcoin.

Storage of value, medium of exchange and unit of account

There are mixed views on Bitcoin’s current role. Many people think of Bitcoin as just a currency—a vehicle for moving money from point A to point B. We will discuss this in the next section, but this view is diametrically opposed to the view defended by many proponents of the store of value theory.

Proponents of the store-of-value theory believe that Bitcoin must go through several stages before becoming the ultimate currency. It started out as a collectible (arguably the stage we are currently in): it has proven itself functional and safe, but has only been adopted by a small group of people. Its core audience is primarily amateurs and speculators.

Only when the relevant knowledge is more comprehensive, the organization's infrastructure is more robust, and there is greater confidence in its ability to maintain value, it can move to the next stage: Store of Value . Some believe Bitcoin has already entered this phase.

At this time, Bitcoin was not widely used because Gresham's law pointed out that bad coinsExpelling good money. This means that when faced with two currencies, individuals are more inclined to consume the bad currency and hoard the good currency. Bitcoin users prefer to spend fiat currencies because they have little confidence in the long-term viability of these currencies. They will hold (or hold for the long term) Bitcoin because they believe it will retain its value.

If the Bitcoin network continues to grow, more users will adopt Bitcoin, liquidity will increase, and prices will become more stable. Due to its greater stability, people will not have much incentive to hold Bitcoin in the hope of higher returns in the future. Therefore, we can expect that Bitcoin will be used more for business and daily payments as a powerfulmedium of exchange.

Increased use further stabilizes prices. In the final phase, Bitcoin will become a unit of account that will be used to price other assets. You might price a gallon of gasoline at $4, and similarly, in a world where Bitcoin is the dominant currency, you would value oil in Bitcoins.

If these three monetary milestones are achieved, proponents believe that in the future Bitcoin will become the new standard to replace currently used currencies.

Bitcoin as a Store of Value

The arguments presented in the previous section may be confusing to some It makes perfect sense, and to others it seems like complete fantasy. Both Bitcoiners and cryptocurrency skeptics have some criticism of the idea of Bitcoin as "digital gold."

Bitcoin as digital cash

When disagreements arise on this issue, many People quickly turned to the Bitcoin white paper. To them, it was obvious that Satoshi Nakamoto intended Bitcoin to be used for consumption from the beginning. In fact, this can be seen in the title of the paper Bitcoin: A Peer-to-Peer Electronic Cash System.

This view holds that Bitcoin only has value if users consume the tokens. Long-term hoarding of Bitcoin isn’t helping adoption, it’s hurting it. If Bitcoin does not gain widespread acceptance as a digital currency, it is not utility but speculation that drives its core proposition.

These ideological differences led to a major fork in 2017. A minority of Bitcoin users want a system with larger blocks, which means lower transaction fees. As usage of the original network increases, transaction costs may rise significantly, with many users abandoning lower value transactions. If the average fee is $10, then there is no point spending $3 on a token.

This forked network is now known as Bitcoin Cash. At the same time, the original network launched its own upgraded version called SegWit. SegWit nominally increases block capacity, but this is not its main goal. It also laid the foundation for the Lightning Network, which attempts to facilitate low-fee transactions by pushing them off-chain.

In practice, however, the Lightning Network is far from perfect. Regular Bitcoin transactions are very easy to understand, while managing the Lightning Network’s channels and capacity requires a steep learning curve. It remains to be seen whether this network can be simplified, or whether the design of the solution is fundamentally too complex to abstract.

Due to the increasing demand for block space, on-chain transactions are no longer cheap during busy periods. With this, one might make the argument that not increasing the block size would harm Bitcoin’s usability as a currency.

No intrinsic value

For many people, comparing Bitcoin to gold is Ridiculous approach. The history of gold is essentially the history of civilization. This precious metal has been an important part of society for thousands of years. It is undeniable that gold has indeed lost some of its dominance since the gold standard was abolished, but it is still a classic safe-haven asset.

In fact, comparing the network effects of the "King of Assets" to an 11-year-old protocol seems a bit far-fetched. For thousands of years, gold has been revered as a symbol of social status and an important industrial metal.

In contrast, Bitcoin is useless outside its network. It doesn't serve as a conductor for electronics, and it doesn't make for a giant sparkly necklace when you decide to start a hip-hop career. It may mimic gold (mining, limited supply, etc.), but that doesn't change the fact that it's a digital asset.

To some extent, all money is a shared belief - the dollar has value because the government says it has value and society accepts it. Gold is valuable because everyone thinks it is valuable. Bitcoin is no different, but those who place value on Bitcoin are still only a small portion of a vast population. In your real life, you may often need to explain what Bitcoin is during the course of a conversation because the vast majority of people are unaware of its existence.

Volatility and correlation

Those who entered the Bitcoin market early will definitely enjoy it The joy of growing wealth by orders of magnitude. To them, Bitcoin does store value—and much more. But those who bought the first batch of tokens at an all-time high price did not get to enjoy this pleasure. Many people suffered huge losses by selling at any time thereafter.

Bitcoin is incredibly volatile and its market is completely unpredictable. In comparison, metals such as gold and silver move very little. You might argue that it’s still early and that Bitcoin’s price will eventually stabilize. But this in itself may be an indication that Bitcoin is not currently a store of value.

You also need to consider Bitcoin's relationship to traditional markets. Bitcoin has been on a steady upward trend since its birth. If all other asset classes are doing well, cryptocurrencies don’t really pass the test as a safe-haven asset. Bitcoin enthusiasts might say it's "uncorrelated" to other assets, but there's no way to know that unless other assets are affected and Bitcoin remains stable.

“Tulip Mania”“Beanie Babies”

A proper critique of Bitcoin's store-of-value properties can be made if we compare it to Tulip Mania and Beanie Babies. These aren't great analogies at the best of times, but they illustrate the dangers of a bubble bursting.

In both cases, investors rushed to buy items they considered rare, hoping to resell them at a profit. The items themselves are not that valuable because they are relatively easy to produce. When investors realized they had overvalued their investments, the bubble burst and the Tulip and Beanie Babies markets subsequently collapsed.

Again, this is not a very good analogy. Bitcoin's value does come from users' belief in it, but unlike tulips, people can't farm more Bitcoins to satisfy demand. That said, there's no guarantee that investors won't think Bitcoin is overvalued in the future, causing its bubble to burst.

Summary

It is true that Bitcoin has most of the characteristics of a store of value such as gold. It has a limited number of units, the network is decentralized enough to ensure security for holders, and it can be used to hold and transfer value.

Ultimately, it will have to prove its worth as a safe-haven asset -- it's too early to tell. Things could go both ways—the entire world could flock to Bitcoin during times of economic turmoil, or it could remain accessible to a select few.

Time will tell.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR