There is too much content and I am too lazy to read it all. Why not get a summary?

- Fear, Hesitation, and Doubt (FUD): Spreading fear and uncertainty to gain a competitive advantage.

- Fear of missing out (FOMO): The mentality of buying blindly due to fear of missing opportunities.

- Hold for the Long Term (HODL): Buy and hold for the long term!

- BUIDL: Keep your head down and build the next financial system.

- Safe Asset Fund for Users (SAFU): Funds are absolutely safe!

- Return on Investment (ROI): Money earned (or lost).

- All-time high (ATH): The highest price in history!

- All-time low (ATL): The lowest price in history.

- Do your own research (DYOR): Don’t trust easily, verify carefully.

- Due Diligence (DD): Reasonable people make decisions based on facts.

- Anti-Money Laundering (AML): Regulations that prevent criminals from hiding money.

- Identity Verification (KYC): Regulations for the trading platform to verify user identity.

Introduction

Whether it is the stock market or day trading , foreign exchange, or emerging cryptocurrencies, unfamiliar trading terminology is everywhere. What do FOMO, ROI, ATH, and HODL stand for? Trading and investing have their own terminology, and learning new terms can always be daunting. However, if you want to keep up with financial market trends, learning these terms is very useful.

This article has compiled some of the important terms you need to know when trading cryptocurrencies.

1. Fear, hesitation and doubt (FUD)

Fear, hesitation and doubt (FUD) is not an exclusive trading term, but is commonly used in financial markets. Fear, hesitation, and doubt (FUD) is a tactic used to discredit a specific company, product, or project by spreading negative information with the goal of creating fear to gain a competitive advantage. This advantage may be a competitive advantage or a tactical advantage, or it may be the opportunity to profit from a drop in stock prices due to potentially negative news.

Fear, hesitation, and doubt (FUD) have proven to be commonplace in the cryptocurrency space. In many cases, investors take a short position in an asset and then publish potentially harmful or misleading news, and then make huge profits by selling short or buying put options. Investors also arrange over-the-counter (OTC) transactions in advance.

Most of the time, these news tend to be false, or at least misleading, but there are some cases where it turns out to be true. It is worth advocating to consider the controversy in its entirety. It’s helpful to think about people’s motivations for sharing their exact opinions publicly.

2. Fear of missing out on opportunities (FOMO)

Fear of missing out on opportunities (FOMO) means that investors are afraid The mentality of rushing to buy assets while missing out on profit opportunities. A large number of users have a fear of missing out (FOMO) mentality, and this violent fluctuation of emotions leads to parabolic price trends. Investors' "FOMO-ing" from waiting and watching to seizing asset investment opportunities usually indicates that they have entered the late stage of the bull market.

If you read our article on common mistakes in technical analysis (TA), you will know that extreme market conditions can change market practices. Once emotions get out of hand, many investors may open positions out of fear of missing out (FOMO), which may lead to two-way action, and many traders who try to make reverse trades may be trapped.

Fear of missing out on opportunities (FOMO) is also widely used in social media app design. Have we ever wondered why social media posts are not displayed in strict chronological order? This also goes hand in hand with the fear of missing out (FOMO). If the user can still see all posts from the last time they logged in, they will assume they are done with the latest content.

Social media platforms deliberately disrupt the timeline of new and old posts to instill fear of missing out (FOMO) among users. As a result, users will refresh their browsing frequently for fear of missing important information.

3. Long-term holding (HODL)

Long-term holding (HODL) comes from "hold" The misspelling of ; is basically equivalent to a buy and hold strategy for cryptocurrencies. "Long-term holding (HODL)" first appeared in a well-known post on the BitcoinTalk forum in 2013, originating from the misspelling of the post title "I AM HODLING".

“HODLing” means continuing to hold a stock despite a falling price. This term is often used to describe investors who admit that they are not good at short-term trading, but want to understand the price of cryptocurrency ("long-term holders"), or those who have high trust in a specific currency and intend to invest in the long term. investor.

The long-term holding strategy is similar to the traditional market buy-and-hold investment strategy. Investors buy and hold undervalued assets for the long term. Many investors use this strategy to invest in Bitcoin.

If you have read our article on dollar-cost averaging (DCA), you will know that this is a great strategy for investing in Bitcoin to achieve high returns. If you had bought just $10 in Bitcoin every week over the past 5 years, your investment income would have been more than 7 times your principal!

4. BUIDL

BUIDL is a derivative term of HODL, which usually describes insisting on building despite price fluctuations. Infrastructure for Cryptocurrency Industry Players. The main logic of this concept is that no matter how brutal the bear market is, loyal fans will continue to build the ecosystem of the cryptocurrency industry. In this sense, "BUIDLer" truly supports the development of blockchain and cryptocurrency and continues to actively contribute to the realization of this goal.

BUIDL is a mindset that provides insight into how cryptocurrencies are not just speculation, but a new technology worth promoting to the masses. This concept always reminds us to keep a low profile and continue to build the infrastructure of cryptocurrency to better provide services to billions of users in the future. In addition, BUIDLer believes that teams with a long-term vision can go further.

5. User Security Asset Fund (SAFU)

The Safe Asset Fund for Users (SAFU) originated from a meme uploaded by Bizonacci. In the video, Binance CEO Changpeng Zhao (CZ) said that "funds are safe and worry-free" even during unplanned platform maintenance.

The video quickly went viral in the cryptocurrency community. In response, Binance established the Safe Asset Fund for Users (SAFU), charging 10% of transaction fees as an emergency insurance fund. These funds are stored in separate cold wallets. The idea behind its creation is that in the event of extreme circumstances, the Safe Asset Fund for Users (SAFU) can make up for users' capital losses and provide additional protection for Binance users. This is why it is often heard that "funds are protected by SAFU".

6. Return on Investment (ROI)

Return on Investment (ROI) is a measure of investment income Way. Return on investment (ROI) measures return on investment based on principal and is a convenient way to compare returns from different investments.

Calculate return on investment (ROI) by subtracting the investment principal from the current value of the investment and dividing by the principal.

Return on Investment = (Current Value - Principal) / Principal

Suppose you buy Bitcoin at a price of $6,000, and the current price of Bitcoin is $8,000.

ROI = (8000 - 6000) / 6000

ROI = 0.33

In other words, the current price has increased by 33% from the principal. For more accurate results, you also need to take into account the fees (or interest rates) paid.

After all, rough numbers don’t tell the whole story. There are other factors to consider when comparing investment projects. What are the risks? How long is the time span? How liquid are the assets? Does sliding spread affect buying price? Return on investment (ROI) is not the ultimate metric in itself, but a tool to effectively measure investment returns.

Calculating position size is critical when considering investment returns. For a simple formula for effective risk management, read How to Calculate Position Size in Trading.

7. All-time High (ATH)

This concept should require no further explanation, right? An all-time high is the highest recorded price for an asset. For example, during the 2017 bull market, the trading volume of Bitcoin in the Binance BTC/USDT trading pair was 19,798.86 USDT, a record high. That said, this is the highest price Bitcoin has ever traded at in this market pair.

The most gratifying thing is that as long as the asset reaches a record high, almost all users who buy can make a profit. If an asset is in a long-term bear market, many losing traders will want to exit the position when it reaches breakeven.

However, traders who had hoped to exit the market at breakeven will not leave once the asset breaks out to a new all-time high (ATH). This is why some call the all-time high (ATH) a "blue sky breakout" because there may be no resistance zone above.

A breakout of an all-time high (ATH) is usually accompanied by a surge in trading volume. why? Because day traders will also seize the opportunity to buy market orders and sell them at a higher price to make a quick profit.

Does breaking through new all-time highs (ATH) mean there will be no limit to price increases? of course not. Traders and investors seek to profit at certain points and place limit orders at certain price levels. Especially when previous all-time highs are continually being breached.

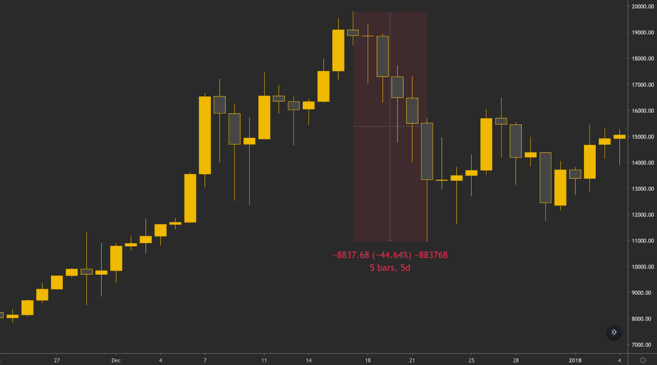

Many investors rush out of the market once they realize that the uptrend is coming to an end. Therefore, parabolic moves often end in sharp price declines. Please look at Bitcoin’s plunge after rising to $20,000 in December 2017, showing a parabolic trend.

Bitcoin price went from $20,000 in just five days dropped to $11,000.

After reaching a new all-time high (ATH) of $19,798.86, Bitcoin dropped nearly 45% in just a few days. Therefore traders should manage their risk and always use stop loss orders.

8. All-time low (ATL)

Contrary to all-time high (ATH), all-time low (ATL ) is the lowest price of the asset. For example, in the BNB/USDT market pairing, BNB’s historical lowest price on the first trading day was 0.5 USDT.

A breakout of an asset price's all-time low can lead to similar results as a breakout of a new all-time high, but in the opposite direction. When an asset's price breaks past its previous all-time low, many take-profit and stop-loss orders can be triggered, causing the price to plummet.

Because the price at an all-time low is unprecedented, the market value will continue to fall without a lower limit. Since there is no logical lower limit, buying during this period is extremely risky.

Many traders wait for a significant trend to emerge, confirmed by moving averages or other indicators, before considering entering a long position. Otherwise, you may be stuck for a long time and trapped in a situation of falling prices.

Want to start your cryptocurrency journey? Welcome to buy Bitcoin on Binance!

9. Do your own research (DYOR)

In the financial market, the term "Do Your Own Research (DYOR)" is closely related to fundamental analysis (FA), which means that investors should conduct their own research on their investments. Research independently and should not rely on others. In the cryptocurrency market, there is another sentence that is often used to express a similar meaning, that is, "Don't trust easily, verify carefully."

The most successful investors do their own research and draw their own conclusions. If you want to succeed in the financial market, you must have your own unique trading strategy. This can lead to disagreements between different investors, but is perfectly normal for investing and trading. Some investors are bullish, and others are bearish.

Different viewpoints can adapt to different strategies, and successful traders and investors may adopt completely different trading strategies. The key is that they all did their own research, came to their own conclusions, and made investment decisions based on those conclusions.

10. Due Diligence (DD)

Due Diligence (DD) and Do Your Own Research (DYOR ) exists, which refers to the investigation and attention that a reasonable person or business would make before reaching an agreement with the other party.

If reasonable business entities reach an agreement, it means they have completed due diligence on each other. Why? Because rational investors want to ensure that a trade does not raise potential red flags, how else can they compare potential risks with expected returns?

The same goes for investing. When investors are looking for potential investment opportunities, they need to conduct due diligence on the project to ensure that all risks are fully considered. Otherwise, they will not be able to make confident investment decisions and may end up making wrong choices.

11. Anti-money laundering (AML)

Anti-money laundering (AML) refers to the prevention of criminals A series of regulations, laws and procedures to convert illegal income into legal income. Anti-money laundering (AML) procedures make it difficult for criminals to "launder money" by hiding or pretending to be legitimate.

Criminals will find ways to hide the true source of funds. Due to the complexity of financial markets, operating methods can also be varied. Derivatives, which are made up of derivatives, and other complex market instruments make it difficult, but not impossible, to trace the true source of funds.

Anti-money laundering (AML) regulations require banks and other financial institutions to monitor customer transactions and report suspicious behavior. Therefore, criminals who use money laundering to convert illegal gains will eventually be unable to escape the law.

12. Identity verification (KYC)

Stock exchanges and trading platforms must comply with national and international standards . For example, the New York Stock Exchange (NYSE) and Nasdaq (NASDAQ) must comply with regulations set by the U.S. government.

Know-your-customer (KYC) guidelines ensure that institutions verify the identity of their customers using financial trading tools. Why is this important? This is mainly because it minimizes the risk of money laundering.

In addition, not only financial industry participants must comply with identity verification (KYC) guidelines, but many other industry segments must also adhere to these guidelines. Generally speaking, identity verification (KYC) guidelines are a broader anti-money laundering (AML) strategy.

Summary

Cryptocurrency trading terminology may seem confusing at first glance. Now that you have a general understanding, let’s look at it again. When you see these abbreviations, you will feel that you have gained more SAFU protection. Make sure to do your own research (DYOR) on fear, hesitation and doubt (FUD), and do not blindly buy currencies that have broken through all-time highs (ATH) with a fear of missing out opportunity (FOMO). Please continue to hold them for the long term ( HODLing) and continue to build infrastructure (BUIDLing)!

Want to learn more cryptocurrency trading terms? Please visit our Q&A platform Ask Academy, where members of the Binance community will patiently answer your questions.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR