Summary

WOO is a deep liquidity network incubated by Kronos Research. It connects traders, trading platforms, institutions and decentralized finance platforms with democratized access to best-in-class liquidity, trade execution and revenue generation strategies at low or no cost.

As part of the liquidity network, WOO Network provides both centralized and decentralized trading platforms. WOO X (centralized trading platform) provides low-cost trading, customizable workspace and deep liquidity. WOOFi (a decentralized trading platform) provides a new synthetic active market-making model that mimics the order book of a traditional trading platform. Users of the trading platform can exchange, earn and stake the project’s native token WOO. You can buy WOO on Binance using a credit or debit card, or exchange it for other cryptocurrencies. WOO can also be staked on WOOFi to receive rewards.

Introduction

Since the advent of Bitcoin, the blockchain field has continued to grow rapidly, and the importance of cryptocurrency trading platforms today is obvious. But if we go back to 2016, the options are slim. Binance didn’t launch until July 2017, and there were no Uniswap or other automated market makers (AMMs) at the time. Many people buy Bitcoin (BTC) and other digital assets directly from others through peer-to-peer (C2C) markets or over-the-counter (OTC) transactions.

Today, there are hundreds of cryptocurrency trading platforms to choose from. WOO Network is part of this ecosystem, but it offers unique features that go beyond the cryptocurrency trading platform model. If you want to learn more about investing in Binance Labs, you’ve come to the right place.

What is WOO Network?

WOO Network is a deep liquidity network that connects traders, trading platforms, institutions and decentralized financial platforms. It provides democratized access to market liquidity, trade execution, and revenue-generating strategies at low or no cost.

WOO Network was incubated in 2019 by Kronos Research, a quantitative trading firm that has long been a fixture on all major trading platforms Leading market maker in , with daily trading volume of US$5 billion to US$10 billion. Through these years of cryptocurrency experience, the Kronos team noticed a critical flaw - many cryptocurrency trading platforms, (centralized and decentralized), had insufficient and unaffordable liquidity.

Subsequently, Kronos launched WOO Network, which now offers a suite of products to users with low or even zero fees Provide better liquidity. Binance Labs led WOO Network’s Series A funding round in January 2022 with an investment of $12 million.

WOO Network divides most of its services into the centralized trading platform WOO X (CEX) and the decentralized trading platform WOOFi ( DEX) and staking platform. WOO Network provides WOO Trade for institutional clients, allowing partner trading platforms to integrate WOO Network's liquidity into their services through APIs.

How does the WOO network work?

WOO Network partners with Kronos Research to aggregate and integrate liquidity using quantitative trading and hedging strategies. Liquidity is sourced from many leading centralized and institutional trading platforms, and more recently aggregated through decentralized financial networks such as Ethereum, Binance Coin Chain, Polygon, and the Avalanche consensus protocol. Clients connect directly to the network via API or GUI on WOO X and WOOFi. Others can connect indirectly through DeFi platforms such as 1INCH, 0x or Paraswap.

Market makers on other platforms, such as dYdX, can also use WOO Network as a place to hedge their risk exposures. The zero-fee model and preferential terms for takers are ideal for low-cost hedging. Thanks to the exponential growth of popular platforms like dYdX, the network's trading volume has been growing steadily, with 24-hour trading volume reaching $2.5 billion in mid-September 2021.

What makes WOO Network unique?

The WOO Network team has extensive financial and technical experience in many companies such as Citadel, Virtu, Allston, Deutsche Bank and BNP Paribas. In addition, WOO Network's products include:

WOO Network - a portal for institutional clients to convert their order books Upgrade to the depth to compete with top trading platforms and tighten their bid-ask spreads.

WOO X is a zero-fee or even negative-fee trading platform, providing top-level liquidity and execution for professional and institutional traders. It has fully customizable modules for workspace customization.

WOOFi is a set of products designed to extend WOO Network’s liquidity network to DeFi and help DeFi users obtain the best prices, lowest fees, and smallest bid-ask spreads and rewarding yet safe income-generating opportunities.

WOO Ventures is the investment arm of WOO Network, aiming to establish strategic partnerships with projects and ecosystems. 50% of returns on all investments will be distributed to WOO token holders.

WOO What is X?

WOO X is the main product of WOO Network that provides centralized financial (CeFi) trading services. The exchange features low-fee trading, deep liquidity, and private custom workspaces.

Low fee transaction

Fees is an important factor that any trader needs to consider when choosing a platform. Users who trade manually (without using the API) on WOO Anyone who holds 1,800 WOO shares on WOO X can reach Level 2, and CEX will occasionally provide additional benefits to Level 2 users.

Deep Liquidity

The ability of buyers and sellers to effectively complete orders is the key to the success of any trading platform. Ideally, there should be almost no slippage for large orders and tight bid-ask spreads, and this is only possible with deep liquidity. This means that there are many people supplying cryptocurrency to the order book for buying and selling, and the trading platform can easily cater to the buying and selling demand.

WOO Network obtains liquidity from traders, professional liquidity providers, trading platforms, market makers and institutions that use the platform sex. The most important provider of WOO X is Kronos Research, a trading company engaged in market making. Through the deep liquidity foundation provided by Kronos Research, WOO X can attract more liquidity into the network.

Private customized workspace

WOO X allows users to customize their trading views using widgets, charts and other personalizable elements. For experienced traders, this gives them access to the information and tools they need. TradingView also offers advanced charting tools for creating indicators for technical analysis.

What is WOOFi?

WOOFi is a BSC-based automated market maker that uses the Synthetic Active Market Making (sPMM) model to determine prices. Most typical automated market makers use the more straightforward, classic Constant Product Market Maker (CPMM). WOOFi provides three main functions:

1. Exchange - Users can trade in the WOOFi liquidity pool exchange between pairs of tokens. The sPMM model has more in common with the order books of traditional trading platforms than with automated market makers like Uniswap on Ethereum (ETH). sPMM relies on WOO Network's market data oracle to review order book prices from centralized trading platforms such as Binance and calculate an appropriate transaction price.

Liquidity comes from a single fund pool instead of the traditional dual-asset liquidity pool (LP) system. WOOFi provides investors with low-liquidity assets with incentives to manage and rebalance these assets.

2. Earn - Users can deposit LP tokens from other DEXs and personal assets , create mining revenue. These vaults automatically and efficiently reinvest profits, allowing you to earn compound interest.

3. Staking - WOO holders can stake their tokens to share via WOOFi Income generated from currency exchange or financial management.

OMG token

WOO is the native token of WOO Network, linking all DeFi and CeFi products and services together. Its maximum supply is 3 billion tokens and is gradually reduced with monthly token burns until 50% of the maximum supply has been burned.

WOO is a utility token that works through chain bridges such as Binance Chain, Ethereum, Avalanche, Polygon, Solana, Arbitrum, Fantom, and NEAR Exists on multiple blockchains. It is embedded in well-known decentralized exchange platforms of various chains: Bancor, SushiSwap, Uniswap, PancakeSwap, QuickSwap and SpookySwap.

Through WOO tokens, users can enjoy WOO X zero-fee transactions, trade rebates (Trade-to-Earn), and pledge , discounts, WOO Ventures airdrops and governance utility. Let’s take a closer look at its current and upcoming use cases.

1. Governance - WOO stakers on WOOFi and WOO X, and on-chain wallets Anyone holding at least 1,800 WOO in WOO can participate in decentralized governance by creating proposals or voting in WOODAO (Decentralized Autonomous Organization).

2. Staking - By staking WOO tokens, transaction fees can be reduced, and even You can enjoy zero-fee transactions on WOO X. Traders with large trading volumes on WOO X can also stake WOO to increase trading limits and reduce fees.

3. Distribution of proceeds - Part of the tokens obtained from WOO Ventures’ early project investments will be distributed To WOO token stakers on WOO X. You can also stake WOO on WOOFi and earn income from the handling fees of Swap and Earn products.

4. Provide liquidity and liquidity mining - Use WOO to enter SushiSwap, Uniswap, Liquidity pools and mining farms for trading platforms such as PancakeSwap. These provide cross-chain opportunities.

5. Loans and Lending - WOO can be used as collateral for cryptocurrency loans and lent to others user.

6. Social Trading - In the future, WOO stakers will be able to imitate the best performing traders of highly professional trading strategies.

7. WOO token destruction - TWOO Network uses 50% of platform revenue to buy back every month and destroy WOO.

Where to buy WOO?

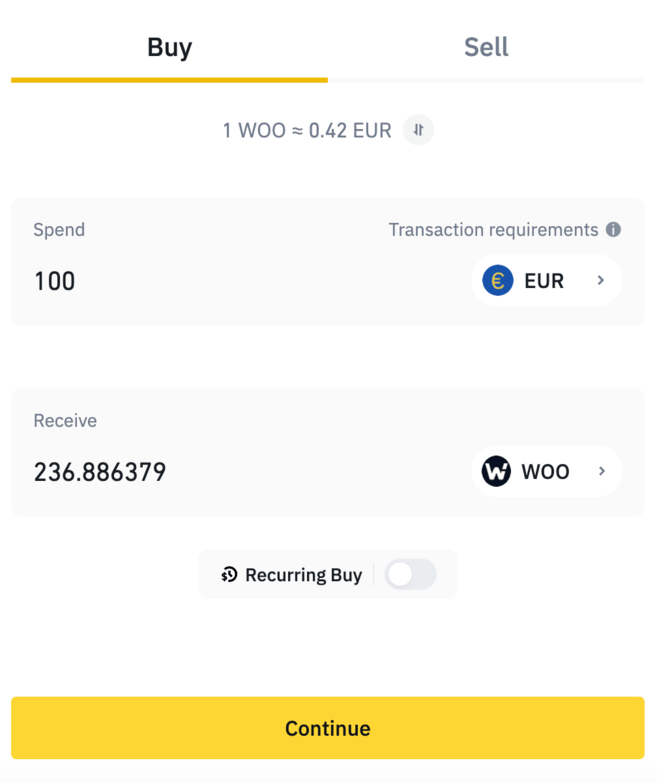

There are two ways to buy WOO on Binance. First, it is possible to use a credit or debit card in fiat currency. Go to Binance’s [Buy Coins with Debit/Credit Card One-Click] page, select the currency you want to use, and select WOO in the bottom field. Click [Continue] to confirm your purchase and view further instructions.

Cryptocurrencies such as BUSD and BNB can also be exchanged for WOO. Go to the Trading Platform view and enter WOO in the trading pair search field to find a list of all available trading pairs. For more information about the Trading Platform View, go to How to Use Trading View on the Binance website.

How to stake WOO on WOOFi?

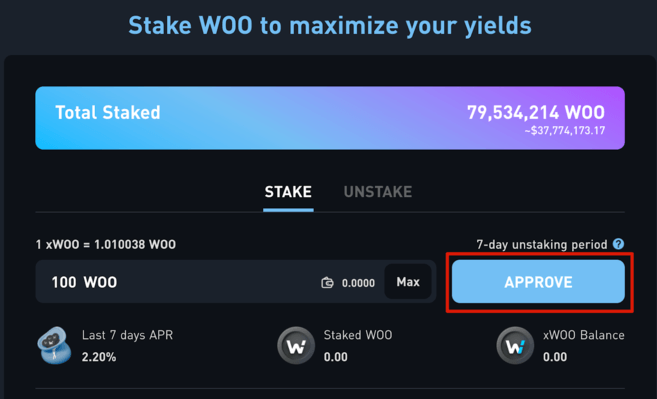

You can stake WOO on the WOOFi platform of Binance Coin Smart Chain and earn income. After staking, you will receive xWOO as your share of the pool. The exchange fees on WOOFi will go into the fund pool. Once the stake is removed, xWOO will be destroyed and you will receive back your initial principal and the interest earned. Don’t forget, you need BEP-20 BNB to pay transaction fees.

1. First, use the [Bind Wallet] button to connect the wallet containing WOO to the WOOFi platform.

2. Enter the pledge amount and click [Approve].

Please note that there is a 7-day lock-up period, and withdrawals before the end of this period will be subject to a 5% penalty .

Summary

If you want the security of CEX , and want to access unlisted tokens on the DeFi platform, WOO Network is a convenient choice. Focusing on liquidity is crucial for blockchain users who want to avoid sliding spreads at all costs. Overall, this project is a rare solution that combines CEX and DEX services.

As WOO Network’s liquidity continues to grow in the DeFi and CeFi sectors, the utility of the WOO token is also expanding. It has an experienced team, support from industry leaders like Binance, and a foundational product set that has helped it establish itself in today’s industry. To build on its growth momentum, WOO Network plans to continue enriching its products, features and partnerships.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR