Summary

The bid-ask spread is the difference between the lowest ask price and the highest bid price for an asset. Assets like Bitcoin typically have tighter spreads than assets with less liquidity and trading volume.

A sliding spread occurs when the average price at which a transaction is settled differs from the initial request. Sliding spreads generally occur when executing market orders. If liquidity is insufficient to support order execution or there is market volatility, the final order price may change. To deal with sliding spreads on low-liquid assets, try dividing your order into several smaller orders.

Introduction

When buying and selling assets on a cryptocurrency trading platform, the market price is directly affected by the relationship between supply and demand. In addition to price, important factors such as volume, market liquidity, and order type should also be considered. Subject to market conditions and the selected order type, transactions may not be completed at the ideal price.

As buyers and sellers come and go, price differences (ie, bid-ask price differences) will occur during the negotiation process. Depending on the trading volume and volatility of the asset, sliding spreads may also occur (more on this later). To avoid surprises, it helps to know the basics about a trading platform’s order book.

What is the bid-ask spread?

The bid-ask spread is the difference between the highest bid and the lowest ask in the order book. In traditional markets, spreads are typically initiated by market makers, brokers, or liquidity providers. In the cryptocurrency market, the spread is the result of the difference in limit orders between buyers and sellers.

If the buyer wants to buy immediately at the market price, he will accept the seller's lowest asking price. Conversely, if the seller wishes to sell immediately, the buyer's highest offer will also be accepted. For assets with excellent liquidity (such as foreign exchange), the bid-ask spread is relatively low, and buyers and sellers can execute orders without causing significant changes in asset prices. The reason behind this is that there are a large number of orders in the order book. When these large orders are closed, the bid-ask spread increases, causing large price swings.

Market makers and bid-ask spread

“Liquidity” is an important concept in financial markets . If you try to trade in a low-liquidity market, it's likely to be hours or even days before your order is matched with other traders.

Activating market liquidity is very important, but some markets cannot obtain sufficient liquidity through retail investors alone. For example: In traditional markets, brokers and market makers can earn arbitrage profits by providing liquidity.

Market makers only need to buy and sell the same asset to play with the bid-ask spread. By selling at a high price and buying at a low price, market makers can use the price difference to make arbitrage profits. Even if the price difference is small, as long as large-scale transactions are carried out around the clock, considerable profits can be created. High-demand assets have smaller spreads because market makers compete with each other to narrow the spread.

For example: a market maker can simultaneously buy Binance Coin at a unit price of $350 and sell Binance Coin at a unit price of $351, creating a price difference of $1. Anyone in the market who wishes to trade instantly will necessarily match their positions. Through the above buying and selling behavior, market makers can pocket the price difference as pure arbitrage income.

Depth Chart and Bid-Ask Spread

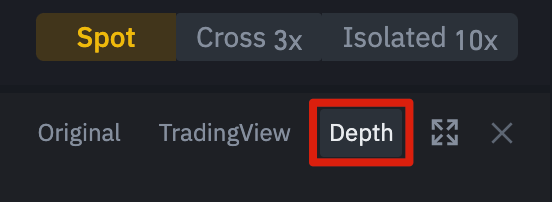

Let’s look at some real cryptocurrency examples, explore volume, The relationship between liquidity and bid-ask spreads. Open the Binance trading platform user interface and switch to the [Depth] chart view to easily view the bid-ask spread. The button is located in the upper right corner of the chart area.

Under the [Depth] option, the asset's order book is displayed graphically. The green color shows the buying quantity and the quotation, and the red color shows the selling quantity and the asking price. The difference between the red and green areas is the bid-ask spread. The specific value can be calculated by subtracting the green offer price from the red asking price.

As mentioned above, there is an implicit correlation between liquidity and lower bid-ask spreads. Trading volume is a commonly used liquidity indicator. The greater the trading volume, the smaller the proportion of the bid-ask spread to the asset price. Trading larger cryptocurrencies, stocks and other assets faces accumulation competition as traders seek to profit from bid-ask spreads.

Bid-ask spread ratio

In order to compare the bid-ask spread of different cryptocurrencies or assets, the bid-ask spread is evaluated in the form of a ratio. More intuitive. The calculation method is very simple:

(Ask price - Quotation price) / Asking price x 100 = Bid-ask spread rate

Let’s take the BIFI token as an example: At the time of writing this article, the asking price of BIFI is $907 and the quote is $901. In other words, the bid-ask spread is $6. Divide $6 by $907 and multiply by 100 to calculate the final bid-ask spread rate of approximately 0.66%.

Now, assume that the bid-ask spread of Bitcoin is $3. Although this value is only half of BIFI, if converted into ratio form, Bitcoin's bid-ask spread is only 0.0083%. BIFI's significantly lower trading volume just confirms our theory that bid-ask spreads are generally higher for illiquid assets.

We can also draw some conclusions from Bitcoin’s low price spread. Assets with low bid-ask spreads are likely to correspond to high liquidity. If you want a larger market order at the moment, there is usually less risk that the order price will not meet expectations.

What is a sliding spread?

Sliding spreads are often the product of severe market volatility or poor liquidity. A slippage occurs when a trade fails to settle at the expected or desired price.

For example: Suppose you want to issue a high market buy order at a unit price of $100, but there is insufficient market liquidity to complete the transaction at this price. In desperation, you can only accept further orders (unit price higher than 100 US dollars) until the final transaction is completed. This would push your average buying price to over $100, creating what's known as a "sliding spread."

In other words, when a user creates a market order, the trading platform automatically matches the buying and selling behavior with the limit order in the order book. The order book matches the best price for the user, and if the volume corresponding to the target price is insufficient, the order will continue to match higher prices in the order chain. This will result in the user's order being unable to be filled in the market at the expected price.

In the cryptocurrency space, sliding spreads often appear in the form of automated market makers and decentralized exchanges. For highly volatile or illiquid altcoins, the slippage can exceed the desired price by 10%.

Forward sliding spread

Sliding spread does not mean that your final transaction price will definitely be worse than expected . A positive slippage occurs if the price falls when you place a buy order, or rises when you place a sell order. Although positive sliding spreads are uncommon, they do occasionally occur in volatile markets.

Sliding spread tolerance

Some trading platforms allow manual setting of sliding spread tolerance levels to limit potential Sliding spread. Automated market makers generally have this option, such as Binance Smart Chain’s PancakeSwap and Ethereum’s Uniswap.

The amount setting of the sliding spread will also affect the order settlement time. If the sliding spread is set low, the order may take a long time to be filled, or may not be filled at all. If the setting is too high, the order will always be pending and other traders or robots will seize the opportunity to trade.

In this case, other traders only need to increase the gas fee to be the first to complete the transaction and buy the asset first. Afterwards, the front-running trader refers to the sliding spread tolerance, establishes another transaction at the highest expected price of the tolerance setter, and sells the asset back to the setter himself.

Try to avoid negative sliding spreads

Sliding spreads are difficult to avoid, but the impact can still be minimized through some trading strategies.

1. Try to "break large orders into parts". Keep a close eye on the order book and then spread out your orders to ensure the order total does not exceed market volume.

2. If you use a decentralized trading platform, don’t forget to consider transaction fees. To prevent sliding spreads, some networks charge high fees based on blockchain traffic, causing all gains to go down the drain.

3. If dealing with low-liquidity assets (such as small liquidity pools), trading activity will have a significant impact on asset prices. The sliding spread of a single transaction may be small, but the accumulation of a large number of small spreads will also affect the price of subsequent block transactions.

4. Use limit orders. Limit orders allow a trade to be filled at a desired price or better. Although the transaction speed is not as fast as market orders, any negative sliding spreads can be avoided.

Summary

When trading cryptocurrencies, don’t forget the bid-ask spread Or sliding spreads will affect the final transaction price. Both cannot be completely avoided, but they can provide valuable reference for trading decisions. For small transactions, the impact of both is minimal. However, if it is a large-scale order, the average unit price may be higher than expected.

For beginners who are exploring decentralized finance, understanding sliding spreads is an important part of learning the basics of trading. If you do not have basic knowledge, you will face a high risk of being taken advantage of by others, or the price slippage will be too large, eventually resulting in huge losses.

Forum

Forum Finance

Finance

Specials

Specials

On-chain Eco

On-chain Eco

Entry

Entry

Podcasts

Podcasts

Activities

Activities

OPRR

OPRR